Low‑Cap Value Plays: Subs $1 Altcoins in Focus

Introduction

After a long winter of caution, crypto markets are warming up again—and with that comes a renewed appetite for risk. But this time, it’s not just about chasing meme coins or aping into hype. A growing segment of investors is turning their attention to low-cap, sub-$1 altcoins with solid fundamentals, real-world traction, and asymmetric upside potential.

These aren't just pennies-in-the-wind plays. Many sub-$1 tokens are early-stage infrastructure, layer-1 challengers, or DeFi enablers still flying under the radar. As liquidity creeps back into the ecosystem, savvy retail traders and opportunistic funds alike are asking: What if the next 50x isn’t in the blue chips, but in the forgotten corners of the market?

Let’s explore what’s driving the renewed focus on low-priced altcoins, the traits investors are hunting for, and which sectors are showing promising signs of undervalued strength.

Why the Sub-$1 Narrative Resonates

There’s a simple psychological reason: price optics matter. Retail investors, in particular, are naturally drawn to cheaper tokens. It feels more possible to own “1,000 tokens” of something under $1 than “0.01 ETH”—even when market cap matters far more than unit price.

But this time, the trend is maturing. Instead of blind speculation, investors are searching for:

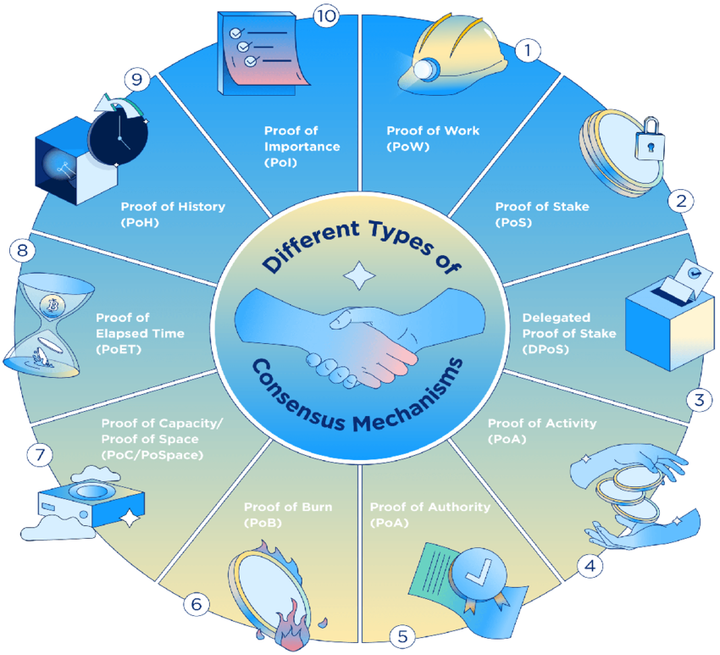

- Undervalued layer-1s with unique consensus or modular architecture

- Niche DeFi protocols solving specific pain points (e.g., intent-based routing, self-repaying loans)

- AI-integrated networks promising real-world utility beyond buzzwords

- Chain infrastructure tokens (indexing, oracles, modular DA layers) tied to long-term blockchain scalability

In other words: sub-$1 tokens that actually do something, or stand to become critical infrastructure as the next wave of dApps scales up.

The Institutional Shift: Small Caps, Big Theses

It’s not just retail. Small crypto funds and boutique VCs are quietly scooping up low-market-cap assets with strategic potential. Why? Three key reasons:

- Liquidity Cycles Favor Small Caps Late-Stage

During the early stages of a bull cycle, blue chips (BTC, ETH, SOL) typically dominate inflows. But as gains compound and confidence returns, capital rotates into mid- and small-cap plays offering higher beta—i.e., greater price swings (and profits) in a rising market. - Longer Time Horizons Mean Better Conviction Bets

Funds can afford to sit on small caps with a 12–24 month thesis. If a project solves a hard problem—say, data availability or decentralized AI inference—its market cap doesn’t need to explode tomorrow. It just needs to survive, ship, and grow in relevance. - Early Governance Power Is Cheap

Sub-$1 tokens with active DAOs offer institutional players outsized governance influence at relatively low cost. That means shaping protocol direction, pushing upgrades, or securing validator seats early.

Traits of High-Conviction Sub-$1 Projects

Not all cheap tokens are hidden gems. Many are cheap because they’ve stalled, lost user traction, or simply lack product-market fit. But the smart money is filtering for a few strong signals:

- Active GitHub or codebase commits

A sleeping price with a shipping team is often a bullish divergence. - Unique tech or use case

If the project isn’t just another L1 or swap DEX, that’s a plus. - Small but sticky community

Organic Telegram/Discord growth—even slow—can signal long-term believers. - Recently announced testnets or mainnets

Fresh milestones tend to precede narrative lift. - Backed by real builders, not influencers

Teams with prior exits, academic cred, or protocol contributions draw quiet confidence.

Tokens like these—if priced under $1 and under $200M market cap—represent asymmetric opportunities for patient investors willing to sit through market chop.

Sectors Worth Watching

Some themes are recurring across the best sub-$1 plays today:

1. Modular Blockchain Infrastructure

Projects like Dymension, Avail, or 0G are building the backbone for scalable dApp execution. Their tokens may still be cheap due to early phase launches, but their upside grows as rollups and app-chains multiply.

2. Intent-Centric Protocols

Networks like Anoma and Namada introduce new models of transaction design—where users express intents and protocols find the optimal execution path. Still early, still inexpensive, but foundationally novel.

3. DePIN and AI x Crypto

Protocols in decentralized physical infrastructure (like peaq) or inference-driven tooling (e.g., io.net) are making noise. The markets haven’t priced in how big these categories could get.

4. Undervalued DeFi Protocols with Revenue

Some DeFi protocols quietly post real on-chain revenue (see Token Terminal), but their tokens remain flat. Projects with sticky TVL and non-inflationary tokenomics are gaining renewed attention.

Final Thoughts: Filtering Hype from Value

Yes, many sub-$1 tokens will never reach $2—let alone $10 or $100. Price ≠ potential. But in early bull phases, narrative meets rotation, and undervalued assets with strong execution teams tend to catch up fast once sentiment flips.

For traders, this is about momentum and timing. For long-term holders, it’s about finding assets that the market hasn’t fully appreciated yet—then sitting tight.

So whether you're a curious retail investor or a fund with a risk window, the sub-$1 arena is worth watching. Some of tomorrow’s giants may still be trading in cents today.

Just remember: cheap is not always undervalued, and fundamentals always win the long game.

Internal Mitosis Links & Glossary References

- Bitcoin

- Blockchain

- Cryptocurrency

- Mitosis Core: https://university.mitosis.org/mitosis-core

- Governance: https://university.mitosis.org/governance

- Glossary: https://university.mitosis.org/glossary/

- Ecosystem Connections: https://university.mitosis.org/ecosystem-connections

Comments ()