Magic Newton: Projects Enabling AI-Driven Transactions Through Prompts

As AI agents begin replacing traditional interfaces and apps, the question becomes not just if, but how they’ll interact with money, contracts, and decentralized finance. Enter Magic Newton — a new infrastructure layer enabling AI-driven, prompt-based financial transactions that are verifiable, secure, and built for the next era of autonomous systems.

What is Magic Newton?

Magic Newton is the trust layer for autonomous finance — a protocol designed to let AI agents execute on-chain transactions within strict, user-defined boundaries. It’s built on a core thesis: if AI is going to manage our finances, we need to control it with code, not hope.

Instead of handing private keys or smart contracts directly to AI agents, Newton introduces a governance layer: users set legal-style “prompts” or operational boundaries. AI agents can then operate freely, but not blindly — always within rules that are cryptographically enforced.

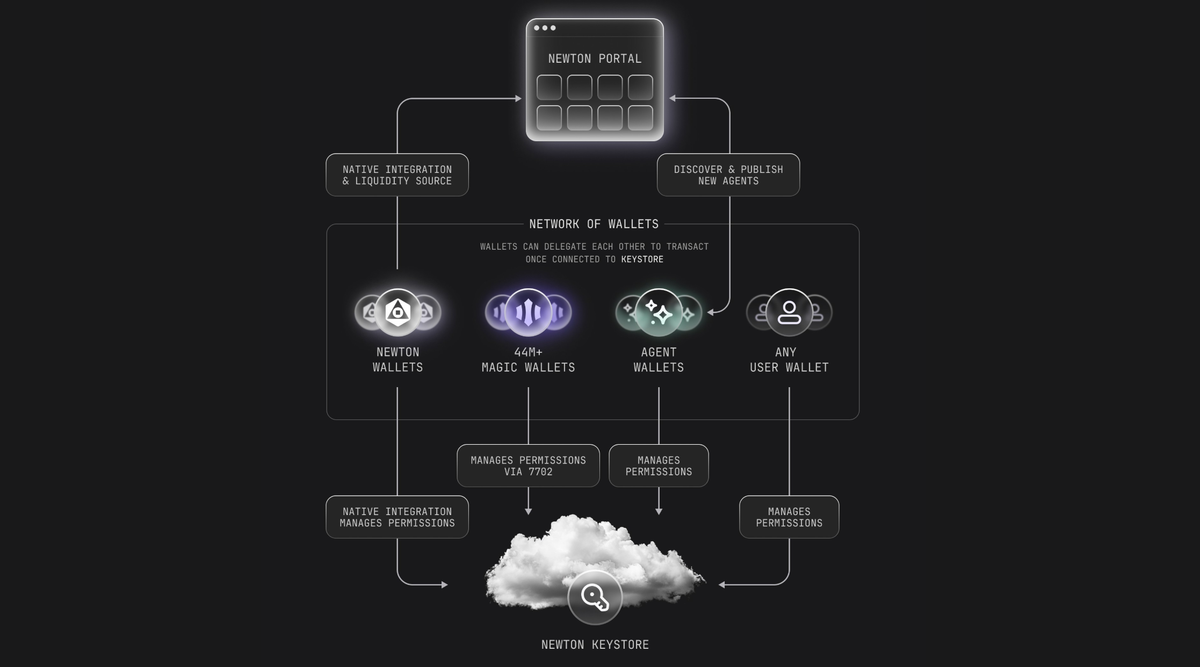

This is achieved through the Newton Keystore Protocol, an architecture that authorizes AI agents without giving up full asset custody. Users create “permission sets” via natural language prompts, which the Newton system parses and enforces.

Why It Matters

AI’s financial potential is massive. But if agents can’t be trusted with keys or unchecked permissions, their utility is limited. Newton solves this by:

- Creating verifiable constraints for agents.

- Allowing prompt-based execution (similar to ChatGPT prompts) tied to financial actions.

- Offering full transparency and security, even in autonomous environments.

It’s not just theoretical. Early products include:

- MagicSweeper — a daily engagement game tied to Newton tasks.

- An active Airdrop system, incentivizing early adopters to interact with Newton’s portal and ecosystem.

And recently, Newton announced a 0.75% token allocation to top contributors on KaitoAI, rewarding those generating quality prompts and interactions.

Comparison with Mitosis

While Magic Newton focuses on AI-to-protocol interaction, Mitosis is focused on programmable liquidity and unlocking more efficient capital markets.

Both, however, share key philosophical similarities:

|

Feature |

Magic Newton |

Mitosis |

|---|---|---|

|

Core Focus |

Trust layer for AI financial actions |

Liquidity as a programmable primitive |

|

User Role |

Set rules (prompts) for AI agents |

Provide liquidity, earn tokenized yield |

|

Key Mechanism |

Prompt-based guardrails via keystore |

Tokenized LP positions (miAssets, maAssets) |

|

Execution Layer |

Autonomous agents w/ rules |

Smart contracts + Cosmos-based infra |

|

Value Unlock |

Autonomous transactions with security |

Yield optimization + DeFi capital markets |

In essence, Mitosis turns liquidity into structured, tokenized building blocks, while Newton does the same for agent-driven actions — defining what agents can and can’t do in a programmable way.

Why You Should Pay Attention

Projects like Newton and Mitosis signal the next shift in DeFi: from users to agents, from apps to prompts, and from click-to-transact to auto-execute-with-constraints.

Magic Newton is still early. But for anyone building in AI x crypto — this is one of the few projects not just playing with hype, but solving real problems in trust, security, and autonomy.

And if you’re farming KaitoAI tasks or airdrops — Newton’s leaderboard just might change your portfolio.

Useful Mitosis Links

- Mitosis Litepaper — Learn the vision behind Mitosis, modular rollups, and their economic design:👉 https://docs.mitosis.org/docs/learn/litepaper

- Mitosis Blog — Explore updates, ecosystem news, technical breakdowns, and RaaS strategies:👉 https://blog.mitosis.org/

- Mitosis Link3 Profile — Quick access to Mitosis socials, campaigns, and ecosystem touchpoints:👉 https://link3.to/mitosisorg

Comments ()