Mastering Crypto Investments: Build a Balanced and Profitable Portfolio

The cryptocurrency market is known not only for the high return opportunities it offers but also for its significant risks. Sudden price fluctuations, market manipulation, and regulatory news can put serious pressure on investors. Therefore, one of the fundamental conditions for success in crypto investing is creating a well-balanced and strategic portfolio.

While investing all your capital in a single asset may bring short-term gains, it can also lead to major losses in the long run. That’s why creating a diversified and balanced portfolio is essential for spreading risk and improving the overall stability of your investments.

In this article, we’ll cover the fundamental steps you need to build a solid crypto portfolio, important considerations, and example strategies to help you along the way.

What Is a Crypto Portfolio?

A crypto portfolio is the total collection of all digital assets held by an investor. These assets don’t consist solely of coins; they may also include tokens, NFTs, assets held in DeFi protocols, or even digital land/property within the metaverse.

Example:

Let’s consider an investor named Ali. He holds 1 BTC, 10 ETH, 1000 USDT, and some AAVE and SAND tokens. All of these together make up Ali’s crypto portfolio. If Ali only held BTC, his portfolio would be much riskier. Because if BTC dropped in value, his entire investment would be affected.

Why Are Asset Allocation and Diversification Important?

In the financial world, there’s an old rule: “Don’t put all your eggs in one basket.” This principle also applies directly to the crypto market. Every asset behaves differently, so spreading your investments across multiple projects helps reduce the impact of sudden price drops.

Example Scenario:

Imagine Bitcoin's price drops sharply. But your portfolio consists of 30% Bitcoin, 30% stablecoins (such as USDT), 20% DeFi tokens (such as UNI, AAVE), and 20% altcoins (such as SOL, LINK). In this case, only the Bitcoin portion is directly affected, while the others may remain stable or even increase in value.

This kind of diversification ensures your total portfolio maintains a more consistent performance.

Things to Consider When Balancing Your Crypto Portfolio

1. Identify Your Risk Profile

Every investor is different. Some are willing to take aggressive risks, while others prefer caution. Before building your portfolio, ask yourself:

- How much am I willing to lose?

- Do I panic during sharp market drops?

- Can I monitor the market on a daily basis?

If your risk tolerance is low, a portfolio heavy in Bitcoin and stablecoins may be suitable. If you can tolerate more risk, you can include a greater share of altcoins and DeFi tokens.

2. Include Different Asset Types

Your portfolio shouldn’t only consist of popular coins. The crypto ecosystem is vast. For example:

- Stablecoins: Maintain their value even during market crashes. Can be staked in DeFi for passive income.

- DeFi tokens: Platforms like Aave or Compound offer yield opportunities.

- NFT/metaverse tokens: Linked to gaming and virtual world projects (e.g., SAND, MANA).

This diversity helps both distribute risk and let you benefit from growing sectors.

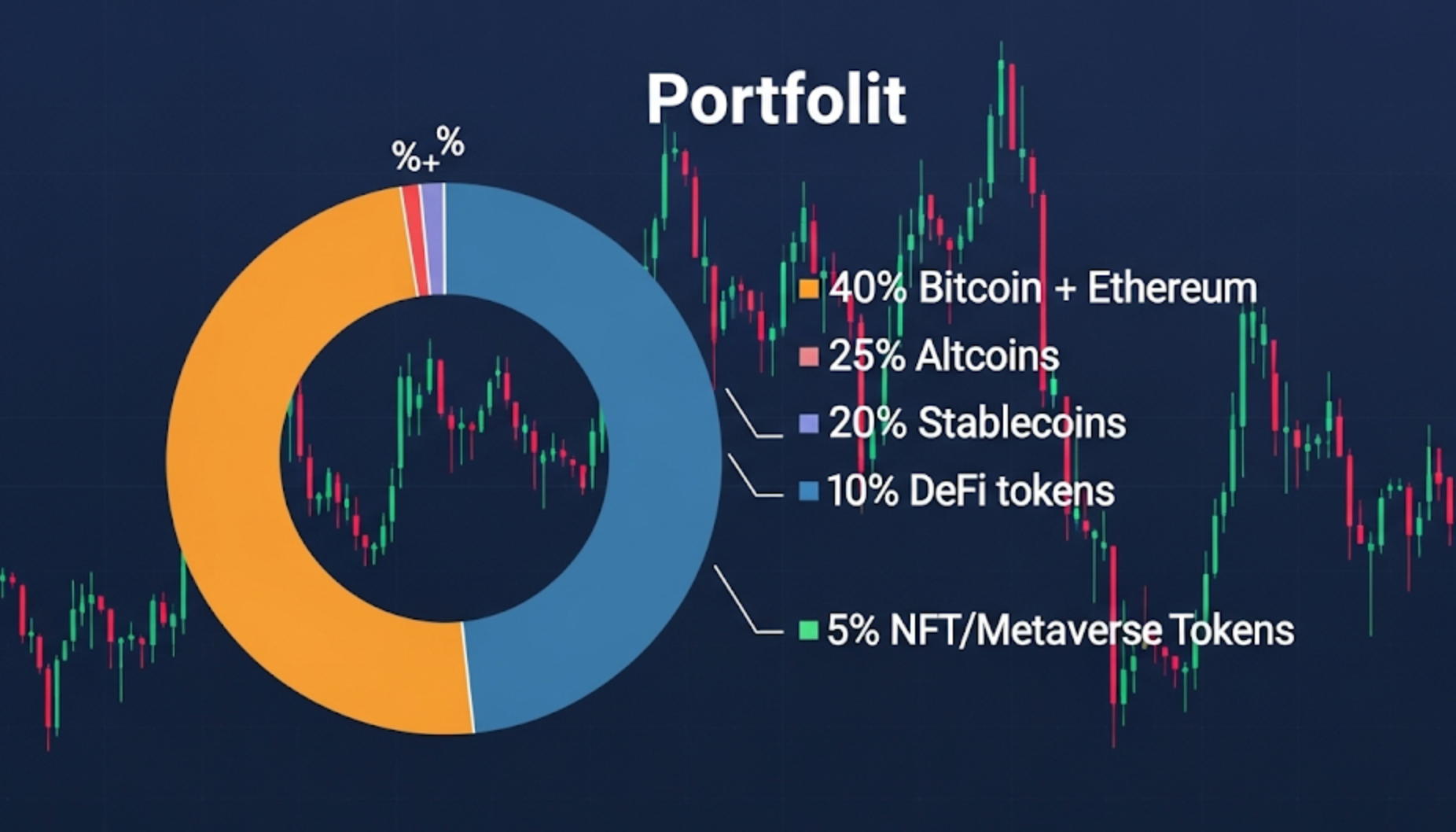

What Should Portfolio Allocation Look Like?

The ideal allocation varies depending on the investor. However, for a beginner, an example distribution might look like this:

- 40% Bitcoin + Ethereum: The strongest and most established projects.

- 25% Altcoins (e.g., ADA, SOL, ATOM): Higher potential, but more volatile.

- 20% Stablecoins (e.g., USDT, USDC): Offer breathing room in down markets.

- 10% DeFi tokens (e.g., AAVE, UNI): Can be staked for passive income.

- 5% NFT/metaverse tokens (e.g., MANA, SAND): Represent new-generation investments.

Real-Life Mini Example:

Ayşe keeps 25% of her portfolio in stablecoins. When the market drops suddenly, she doesn’t panic she has the cash to turn the dip into an opportunity. In addition, she earns passive income by staking those stablecoins on DeFi platforms for 5–10% interest.

Why Is It Important to Monitor Your Portfolio?

Once you’ve invested, you should regularly monitor your portfolio. The market moves quickly. A token can gain or lose value in a matter of days. That’s why performance analysis is crucial.

Tools You Can Use:

- CoinMarketCap Portfolio Tracker: Lets you see which assets are gaining or losing in real time.

- CoinGecko Portfolio: Useful for both mobile and desktop users.

- Delta or Blockfolio: Mobile apps that allow you to set alerts and do detailed analysis.

Strategies to Maintain Portfolio Balance

- Periodic Rebalancing: Re-adjust your portfolio regularly. For example, if BTC grows from 40% to 60% of your portfolio, it’s smart to sell some and redistribute to other assets.

- Keep Stablecoins Ready for Opportunities: You’ll need liquidity to join new projects or buy the dip. That’s why always holding some stablecoins is essential.

- Avoid FOMO: Don’t jump into trending projects without research, especially when prices are peaking. Be patient and evaluate before investing.

- Think Long-Term: Crypto isn’t a get-rich-quick scheme. Investors who are disciplined and think long-term usually come out ahead.

- Shape Your Portfolio Based on What You Know: Never invest in a project just because someone else recommends it. Make sure you understand what you’re buying.

Balanced Crypto Portfolio Example (Medium Risk Profile)

- 30% Bitcoin

- 25% Ethereum

- 20% Altcoins (SOL, INJ, ARB)

- 15% Stablecoins (USDC, DAI)

- 10% DeFi & NFT tokens (AAVE, MANA)

This structure allows you to invest in both safe havens and high-growth sectors.

Conclusion: Balanced Portfolio, Balanced Mind

Success in the crypto world is not just about picking the right coins it’s about applying the right strategy consistently. A well-balanced portfolio protects you during downturns and keeps you ready for new opportunities.

A balanced investor is prepared for every situation. They take profits during rallies and act strategically during corrections. Remember: The crypto journey is a marathon, not a sprint. The winner is not the fastest but the most patient and well-prepared

Comments ()