Matrix and Mitosis collaboration: functionality, how it works, and development prospects

Introduction

As decentralized finance (DeFi) continues to evolve, the importance of effective liquidity management is becoming increasingly apparent. Protocols that offer innovative ways to integrate liquidity are changing the ecosystem and its dynamics. One such solution is Matrix Vaults from Mitosis. These vaults not only provide flexibility in providing liquidity, but also use programmable mechanisms to maximize the efficiency and resilience of the ecosystem. In this article, we will look at how Matrix Vaults work, their advantages, and opportunities for DeFi development.

1. Matrix Vaults: An innovative approach to liquidity

Matrix Vaults allow liquidity providers to interact with protocols more efficiently through flexible access mechanisms. Unlike traditional liquid vaults, which require assets to be frozen for a set period of time, Matrix Vaults offer the ability to withdraw funds at any time, subject to the forfeiture of accumulated fees. This creates a balance between flexibility and an incentive to hold assets for the long term.

2. Matrix Vaults functionality: Technologies and capabilities

Matrix Vaults uses tokenized positions - maAssets - to represent deposits. Each liquidity provider can choose the strategy that suits its needs:

- Flexibility and availability of liquidity: Users can withdraw their funds at any time, which increases the level of freedom in asset management.

- Programmable reward distribution: Protocols can customize rewards to reward those who support the system for a longer period of time.

- Ability to integrate with other protocols: It is implied that maAssets can be used in other DeFi strategies, which increases the potential of the capital.

3. New incentive model: from short-term to long-term relationships

Matrix Vaults is changing the strategy of incentivizing liquidity providers. Instead of simply distributing tokens based on activity, the system integrates more complex reward mechanisms that depend on users' contributions to the development of the protocol. This allows for a sustainable, long-term ecosystem development, where users who hold assets for longer periods of time receive more significant rewards.

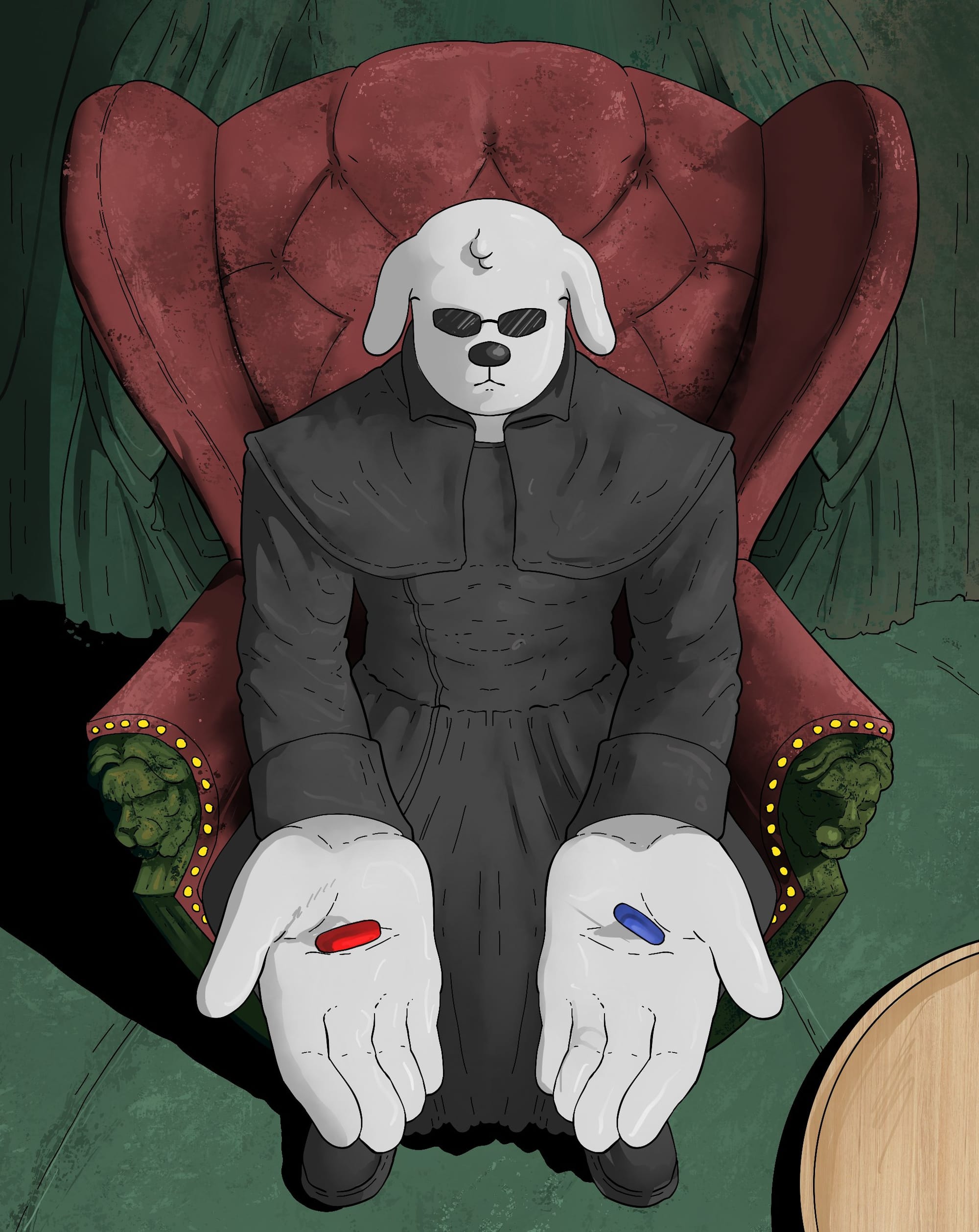

4. Anti-mercantilist mechanism: the fight against short-term capital

One of the biggest problems in the DeFi industry is the so-called “Mercenary capital”, when users quickly move their assets between protocols in search of the highest short-term profits. Matrix Vaults has a unique mechanism that filters out such users, making them lose rewards in case of early withdrawal. This helps to create sustainable liquidity where users with greater loyalty reap greater benefits.

5. Benefits for liquidity providers

Liquidity providers have a number of benefits from participating in Matrix Vaults:

- Flexibility without forced restrictions: The ability to withdraw funds at any time without penalties, which makes interaction with protocols more convenient.

- Loyalty is rewarded: Long-term participants receive a larger share of the rewards, which increases their interest in continued participation.

- Possibility to optimize profitability: Providers can combine different strategies to achieve better results based on their own preferences.

6. Benefits for protocols

Protocols also benefit from interaction with Matrix Vaults:

- Predictability of liquidity: Protocols can predict the level of liquidity available on a long-term basis.

- Reduced market pressure: A deferred fee mechanism reduces the risks associated with large asset withdrawals.

- Improved capital management: Protocols can focus on long-term goals and growth strategies instead of constantly rewarding users.

7. Transition from Expedition to Matrix Vaults: New horizons for DeFi

The shift from Expedition campaigns to Matrix Vaults reflects a shift in focus from short-term incentives to long-term relationships with liquidity providers. This development allows protocols to create more sustainable financial strategies that are not dependent on constant token inflation or changing liquidity conditions.

8. Programmable derivatives: opening up new opportunities for financial products

One of the promising opportunities for Matrix Vaults is the creation of programmable liquid derivatives. This will allow the creation of new financial instruments that combine the functions of traditional finance and DeFi. This may attract traditional financial institutions looking for opportunities to implement decentralized solutions in their portfolios.

Conclusion

Mitosis' Matrix Vaults are more than just a new tool for liquidity management. They offer flexibility, new incentive mechanisms, and foster sustainable relationships in DeFi. This is an important step towards creating a more stable and efficient financial ecosystem that combines DeFi innovation with traditional financial institutions. In the future, Matrix Vaults may become the main tool for many protocols, as their ability to increase efficiency and create new opportunities for DeFi participants is already revolutionary.

In the article I used pictures made by: Miserynads, shim_sing, ForsytheXBT and DabiriVahid

My Twitter account is https://x.com/Glodin9

Comments ()