Matrix by Mitosis: Empowering Liquidity Providers in DeFi

Introduction

"Matrix by Mitosis: Empowering Liquidity Providers in DeFi". This focuses on Mitosis’ flagship product, Matrix, and how it gives liquidity providers (LPs) unprecedented control and rewards in the DeFi landscape. It’s a deep dive into a specific part of the Mitosis ecosystem that’s both user-centric and innovative. Below is what the topic entails 👇

🎯 The Liquidity Providers (LPs) Struggle

🎯 How Matrix Works

🎯 Reward That Stick

🎯 Why LPs Is A Big Deal

🎯 The Risks And Rewards Involved

🎯 A New Era For LP

Let’s dive in 🚀

In the wild world of Decentralized Finance (DeFi), liquidity providers (LPs) are the unsung heroes. They fuel the pools that keep swaps, loans, and yields flowing, yet too often, they’re left with rigid options and middling returns. Mitosis, a Layer 1 blockchain protocol shaking up DeFi, has a fix: Matrix. Far from just another vault system, Matrix is a game changer that hands LPs the reins, blending flexibility, curated rewards, and community power into one sleek package. With a $7 million seed round in 2024 and a mainnet on the horizon, Mitosis is betting big on Matrix and LPs stand to win.

The Liquidity Providers(LP) Struggle

If you’ve ever been an LP, you know the drill. You lock your assets into a protocol, let’s say, Uniswap or Curve for example, and earn fees or tokens. It’s simple, but it’s limiting. Want to shift your funds to a hotter opportunity? You’re stuck waiting out lockups or paying to exit. Meanwhile, the best deals often go to whales or insiders who snag private incentives. For the average user, it’s a passive gig with little say in the game.

Matrix flips that script. Built by Mitosis, it’s a platform that turns liquidity provision into an active, rewarding experience. It’s not about locking and forgetting, it’s about curating and controlling, all while tapping into DeFi’s juiciest opportunities.

How Matrix Works

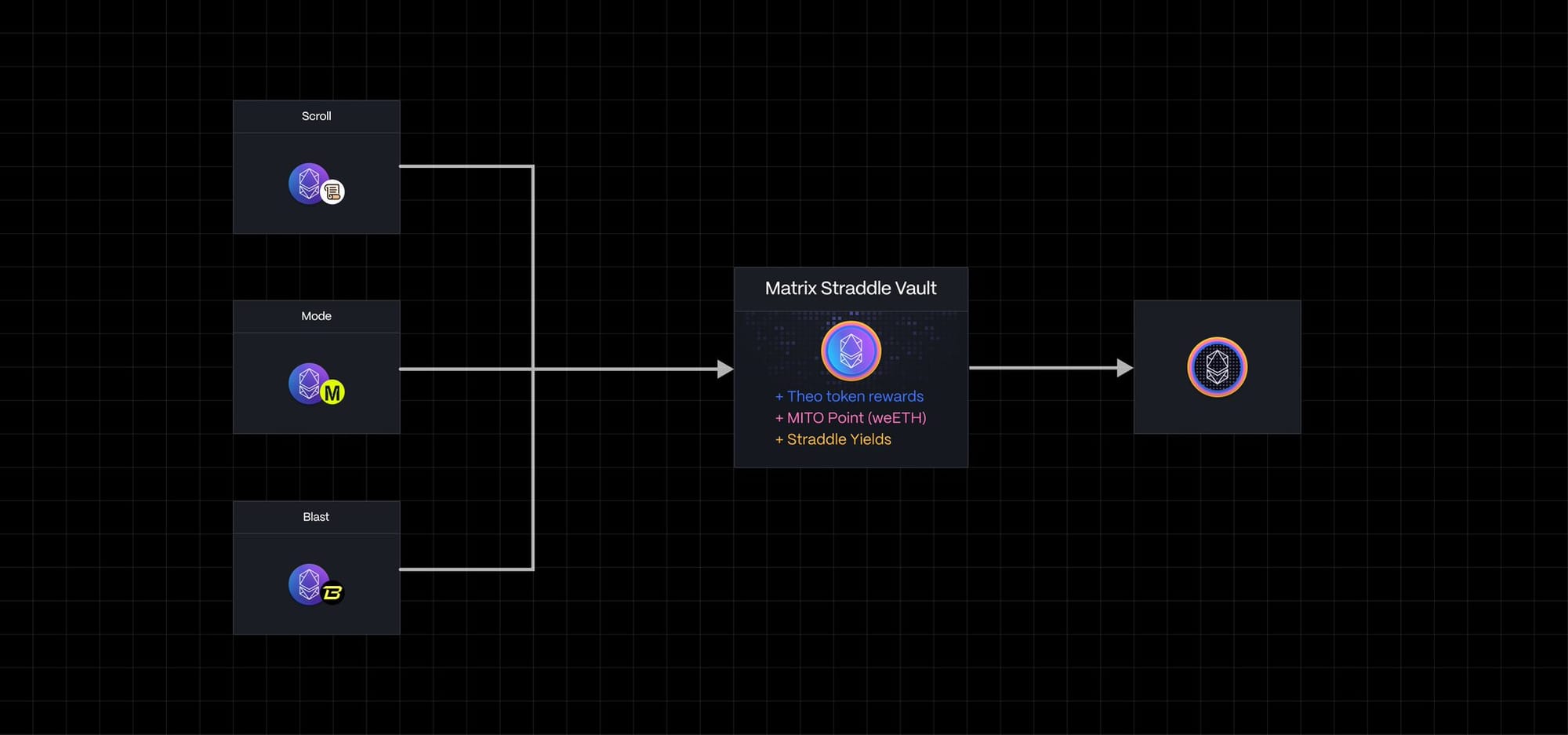

Matrix Vaults are the heart of the system. Deposit your assets, like ETH, stablecoins, or even liquid restaking tokens (LRTs) and you get “maAssets,” tokenized receipts tied to specific campaigns. These aren’t static, they’re your ticket to enhanced yields and ecosystem influence. Each vault is a structured opportunity and some offer early withdrawal (with a penalty), others reward long-term commitment with bigger payouts. It’s a “choose your own adventure” for LPs, tailored to risk and goals.

What sets Matrix apart is curation. Mitosis doesn’t just throw your assets into a generic pool, they scout premium DeFi strategies across chains, from high-yield farms to emerging protocols needing a liquidity boost. Think of it like a sommelier picking the best wines, except here, it’s yields, and you’re the taster. Plus, Matrix ties into Mitosis’ Ecosystem-Owned Liquidity (EOL) model, letting LPs vote on where their collective liquidity flows next. More control, better rewards, it’s a power shift.

Rewards That Stick

Mitosis isn’t shy about incentivizing users. Their 2024 “Expedition Testnet” let early adopters test Matrix Vaults and earn MORSE tokens, a prelude to the $MITO token set to anchor the ecosystem. Matrix builds on that momentum with a self-reinforcing design, short-term speculators who dip out early lose some upside, while dedicated LPs rake in the real gains. It’s a loyalty play that aligns incentives stick around, and the system works harder for you.

Cross-chain support sweetens the deal. Matrix Vaults aren’t tethered to one blockchain; they span networks like Ethereum and L2s, letting your assets chase the best yields wherever they pop up. For LPs, that means less hassle bridging funds and more time earning.

Why It’s a Big Deal

DeFi’s LP model has been due for an upgrade. Matrix delivers by making liquidity provision active, not passive. It’s backed by Mitosis’ $7 million raise from heavy hitters like Amber Group and Foresight Ventures, signaling trust in its vision. The “Game of Mito” campaign hinted at the fun side, but Matrix is the substance, a tool that could redefine how LPs engage with DeFi.

It’s not just about profits (though those are nice). Matrix empowers users to shape the ecosystem. Voting on liquidity allocation via EOL isn’t a gimmick, it’s a stake in DeFi’s future. For new protocols, it’s a lifeline and for LPs, it’s leverage. Add in transparency (all on-chain, trackable via explorers like Routescan) and security focus (think Ethos partnerships), and you’ve got a system built to last.

Risks and Rewards

Nothing’s perfect. Smart contract bugs could bite, market dips could shrink yields, and Matrix’s lockup options might not suit the impatient. But Mitosis is playing the long game, Matrix rewards commitment, not churn. As DeFi matures, that could be the edge LPs need to thrive, not just survive.

Conclusion: A New Era for LPs

Matrix by Mitosis isn’t just a product, it’s a promise. LPs aren’t second-class citizens anymore. With curated vaults, cross-chain reach, and community governance, it’s handing power back to the people who keep DeFi alive. As Mitosis gears up for its mainnet launch, Matrix stands out as a beacon for anyone who’s ever wanted more from their liquidity. In a space obsessed with innovation, this might be the upgrade LPs have been waiting for.

Stay updated on more exciting features on Mitosis by following their official pages at: Website | X | Discord | Telegram

Comments ()