Matrix Liquidity Framework: The Hidden Engine of Cross Chain Yield

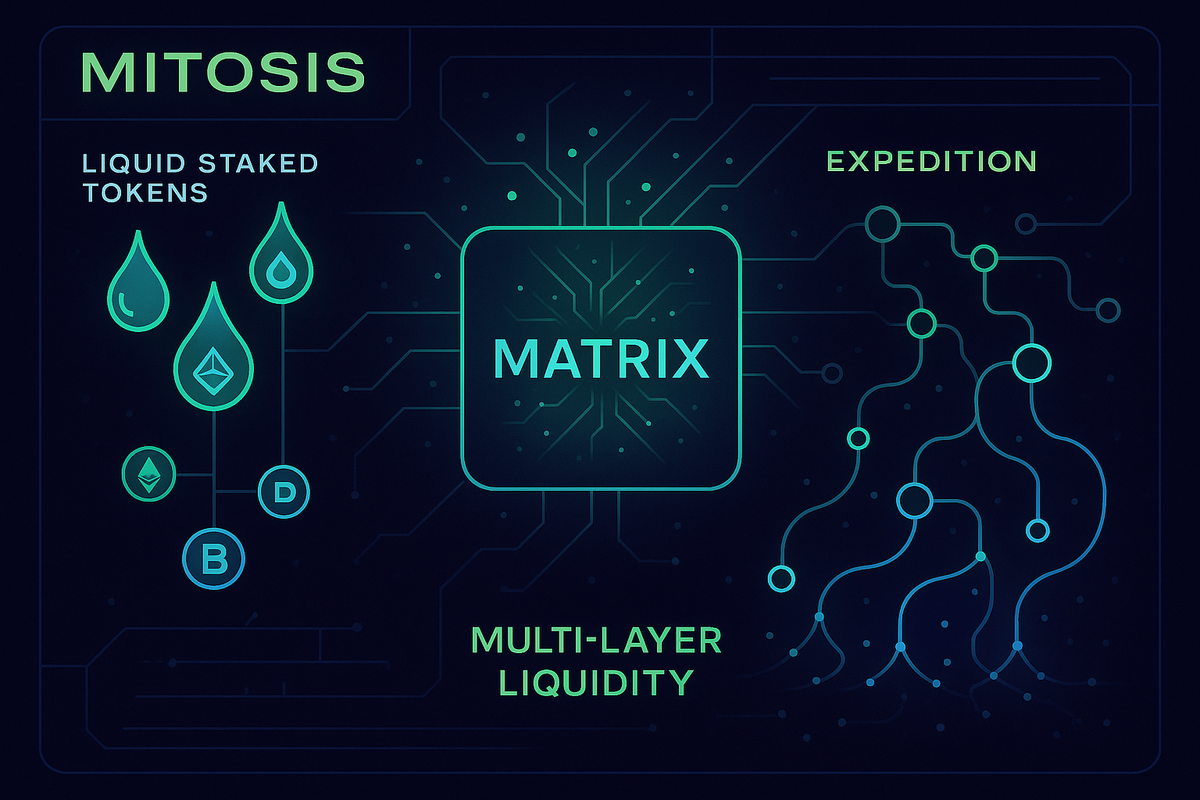

Apart from routing liquidity, Minting synthetic assets Mitosis also funnels capital into high impact ecosystems with surgical precision through something called the Matrix Liquidity Framework (MLF). You won’t find this in any traditional yield aggregator. Let’s explore why.

What Is an MLF?

A Matrix Liquidity Framework is a vault like module deployed on destination chains. It accepts maAssets, and from there: • Allocates them into local protocols (AMMs, LRTs, lending markets, etc.) • Adjusts exposure based on signal (TVL demand, emissions, volatility, depth) • Sends real time performance data back to the SynthCell. So while SynthCells mint and teleport capital, MLFs are where it goes to work.

What Makes MLFs Different?

Traditional vaults are passive. You deposit and hope for the best. MLFs are autonomous routing units connected to a global capital brain (Matrix Framework). That means: • Capital isn’t static it moves between destinations • Performance is optimized across multiple chains, not just one • MLF are EOL native, meaning protocols can plug into them directly. This unlocks a new initiative: Programmatic protocol integrations.

How Protocols Integrate via EOL

Most protocols rent liquidity via incentives. Mitosis lets them own it through the EOL program. Here's how it works:

1. A protocol integrates with a local MLF 2. The MLF allocates maAssets into that protocol (e.g., LP, staking, or lending) 3. That protocol receives: -Liquidity flow -MITO Point exposure -On chain data from Matrix routing 4. Over time, it can accrue ownership stake in Mitosis itself via MITO Point alignment This means the more aligned the protocol is with Mitosis, the more liquidity it gets and the more governance power it earns. No farming games, No rent extraction. Just reciprocal capital alignment.

MLFs Are Modular Fundamentals

Each MLF is built for a specific environment: • One for ETH L2s? Custom routing weights based on gas fees and LRT incentives. • One for Solana? Optimized for high frequency settlement and SOL native assets. • One for Cosmos? Permissionless integration into IBC yield sources. Every funnel can be tuned, forked, and governed independently. This is DeFi native capital infrastructure.

The Bigger Picture

Mitosis isn’t just solving where should this liquidity go? It’s solving: How liquidity moves, who controls it, how protocols earn it. MLFs make that possible by giving Mitosis a deployment layer that’s intelligent, adaptive, and co owned. And when protocols stop renting capital and start owning the rails? That’s when DeFi becomes regenerative.

Official links

Mitosis University Explore Mitosis Now Mitosis Documentation blog Join the Mitosis Discord Community Follow Mitosis on Twitter (X)

Comments ()