Matrix Vault: Programmable Liquidity in Action

Matrix Vault: How Programmable Liquidity Solves DeFi Problems

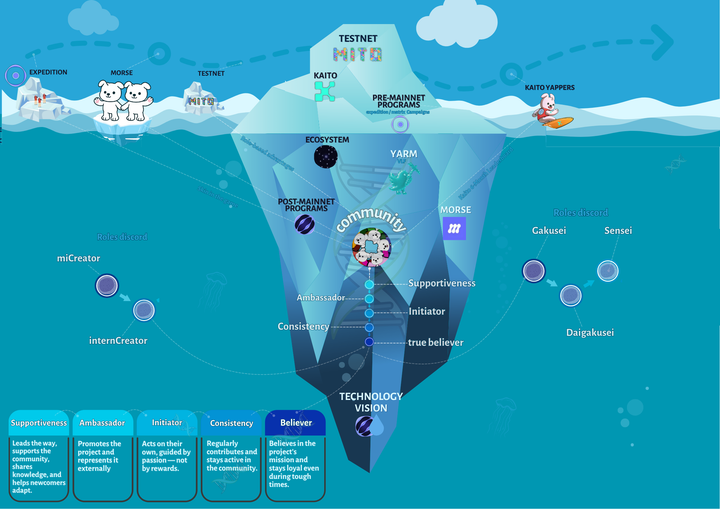

When I first encountered Matrix Vault from Mitosis, I was struck by how elegantly this tool solves DeFi's main problem — the opacity and inaccessibility of the best opportunities for regular users. Instead of chasing yields across different protocols or settling for hidden whale deals, Matrix offers a structured approach to accessing premium yields.

Matrix is Mitosis' flagship product that curates premium DeFi opportunities with transparent terms and complete control over assets. Essentially, it's a system that transforms chaotic yield hunting into an organized process with predictable results.

How the Matrix Mechanism Works

Matrix operates on the concept of programmable liquidity. When I deposit assets into Matrix Vault, the system issues maAssets — tokenized representations of my position. These tokens aren't just deposit receipts but full-fledged instruments usable in other DeFi protocols.

The process works like this:

- I evaluate available Matrix campaigns, reviewing reward details, supported networks, and asset types.

- I commit funds, allowing Mitosis to deploy my assets into selected DeFi protocols.

- In return, I receive maAssets and access to multiple rewards.

The system functions as a vault-based structure for asset participation with liquidity routing and reward control. Matrix Vault connects to Mitosis' broader cross-chain functionality, enabling unified liquidity deployment via programmable primitives.

For example, depositing 10 ETH mints 10 maETH. Unlike traditional liquidity pools with rigid terms, Matrix prioritizes flexibility.

Triple Yield and Redistribution Mechanism

Matrix addresses the mercenary capital problem — short-term LPs who destabilize protocols — through a reward forfeiture mechanism. Users can withdraw liquidity anytime, but early withdrawals forfeit part of the rewards, which are redistributed to long-term participants.

The triple yield structure includes:

- Base protocol yield

- Partner project tokens

- MITO Points for participation

maAssets accrue value over time via protocol fees, lending interest, or trading revenue across platforms like Aave or Uniswap. Since maAssets are composable, they can be used in other DeFi strategies (lending, staking, collateralizing) without exiting the vault.

Layer 2 Integration and Cross-Chain Capabilities

Matrix integrates with Layer 2 solutions and supports seamless cross-chain liquidity deployment. LPs don’t need to manage manual bridging or chain-specific setups.

Key features:

- Inter-blockchain messaging transfers assets directly (e.g., ETH from Ethereum to Solana lending protocol)

- Dynamic reallocation based on market conditions

- Auto-rebalancing to shift assets where APYs are higher

Users deposit once and Matrix handles the strategy allocation, constantly optimizing for the best yield.

Practical Use Cases

Straddle Strategy with Theo

Theo focuses on connecting disparate liquidity venues via a decentralized system. It employs custom validators, internal oracles, and risk engines to enhance yields.

The Straddle Strategy is delta-neutral and adjusts between two modes:

- Basis Trade Strategy: weETH collateral is deposited in Aave, USDC is borrowed and used for shorting on Hyperliquid to capture funding rates.

- Leveraged ETH Strategy: unwinds basis trade when yields fall below 10%, shifting to a looped ETH strategy.

The deployment is cyclical, adjusting to yield environments, offering stability and adaptability.

Users can also collateralize maAssets using stablecoins, minting assets like maUSD for borrowing without exiting the vault.

Benefits for Different Participants

For liquidity providers:

- Flexible withdrawals

- Composable maAssets

- Transparent and real yields

For protocols:

- Predictable long-term liquidity

- Sustainable growth

- Diversified exposure

For the DeFi ecosystem:

- Efficient capital allocation

- Reduced volatility

- Seamless cross-chain access

Matrix Vault abstracts technical complexity. Users interact once, and Matrix handles cross-chain deployments, yield optimization, and asset utility within Mitosis’ ecosystem.

Conclusion

Matrix Vault offers a practical, transparent, and programmable solution to DeFi participation. Instead of chaotic yield hunting, it delivers structured opportunities with aligned incentives, full composability, and user-first capital management. It transforms liquidity from a passive asset into a dynamic financial tool with full control in the user's hands.

🔗 Stay Connected with Mitosis:

- Explore the project: mitosis.org

- Follow for updates: X (formerly Twitter)

- Join the community: Discord Server

- Get announcements first: Telegram Channel

Comments ()