Matrix Vaults: A Deep Dive into Mitosis’ Curated Liquidity Framework

Unlocking Exclusive DeFi Opportunities with Programmable Liquidity

Introduction: The Need for Curated Liquidity

In the fast-paced world of DeFi, liquidity providers (LPs) often face a dilemma: chase high yields across fragmented protocols or settle for suboptimal returns. Matrix Vaults by Mitosis solve this by offering curated, high-yield opportunities with transparent terms and flexible participation. This article dives into the technical details of Matrix Vaults, exploring how they work, their unique mechanisms, and their potential to reshape DeFi liquidity.

maAssets: The Building Blocks of Curated Liquidity

The core innovation behind Matrix Vaults is the use of programmable liquidity tokens (miAssets) and tokenized assets for multi-asset pools (maAssets). These tokens are designed to represent users’ positions in a highly transparent manner, allowing for flexible participation while maintaining control over their capital.

Key Features

- Tokenization of Liquidity Positions:

- miAssets: Represent programmed liquidity positions, offering users the ability to trade, lock up, or withdraw their shares.

- maAssets: Represent multi-asset positions, enabling users to deploy assets across multiple DeFi protocols while maintaining ownership and control.

2. Curated Campaigns:

- Users can choose from predefined campaigns with specific lock-up periods and return targets (e.g., a 60-day campaign offering 8% annual percentage yield (APY)).

- Each campaign is carefully vetted to ensure quality, reducing the risk of suboptimal returns.

3. Flexible Participation:

- Early withdrawals forfeit rewards but maintain liquidity.

Full lock-ups ensure rewards without risk, aligning with users’ objectives for stability or higher yields.

How Matrix Vaults Work: A Technical Breakdown

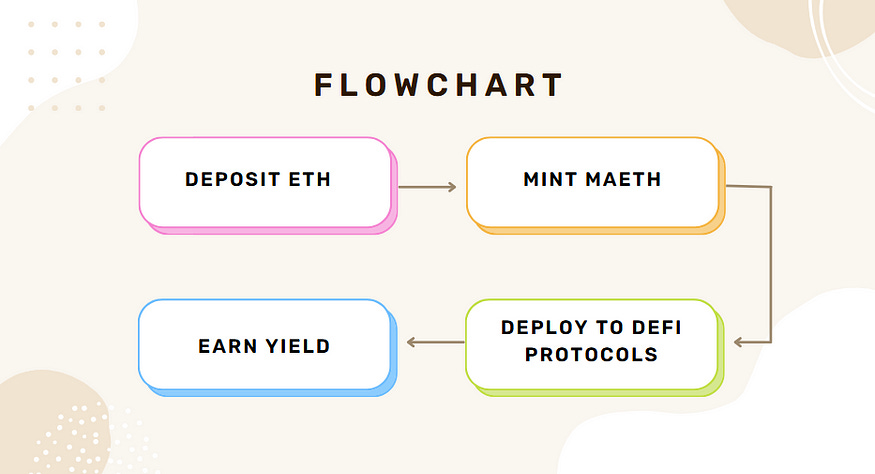

The Deposit Process

1. User Actions: Users initiate the process by depositing assets into Mitosis Vaults on supported chains (e.g., Ethereum, Solana, or Cosmos).

2. System Mechanism: The system mints miAssets or maAssets based on predefined rules:

- Single-asset positions are represented as miAssets.

- Multi-asset positions are tokenized as maAssets.

3. Redistribution of Forfeited Rewards:

- Early withdrawals forfeit rewards, but these rewards are redistributed to loyal participants within the same campaign chain.

- This mechanism incentivizes users to participate proactively while maintaining protocol stability.

Flow Diagram:

Protocol Deployment

miAssets and maAssets as Investments:

- miAssets: Deployed as single-asset investments across DeFi platforms (e.g., lending markets or AMMs).

- miAssets and maAssets can be rebalanced based on market conditions, enabling users to optimize their returns through dynamic portfolio management.

maAssets: Deployed as multi-asset investments, allowing users to benefit from diverse protocols while maintaining control over their positions.

Dynamic Allocation:

- miAssets and maAssets can be rebalanced based on market conditions, enabling users to optimize their returns through dynamic portfolio management.

Reward Structure

Real Yield

- Source: Generated from protocol fees, trading revenue, and other organic sources.

- Example: If maETH is deployed to a lending protocol like Aave, the interest earned on loans constitutes real yield.

Native Token Rewards

- Source: Additional rewards are distributed to participants via Mitosis’ ecosystem tokens (e.g., $MITO).

- Purpose: These tokens incentivize LPs and encourage protocol development through tokenomics.

Combined Returns

- Users receive both real yield from the protocol’s operations and rewards tied to their participation in liquidity campaigns.

- Example: 10 ETH → 10 maETH → Deploy to a lending protocol for 8% APY, plus native $MITO tokens for loyalty.

Example:

- Deposit 10 ETH → Receive 10 maETH.

- Earn 8% APY from Aave (real yield) + 5% APY in Mitosis tokens (native rewards).

Anti-Mercenary Capital Mechanisms

The Problem: Mercenary Capital

- Mercenary capital refers to illiquid, short-term LPs chasing high yields without long-term commitment.

- This practice destabilizes protocols and undermines the broader DeFi ecosystem.

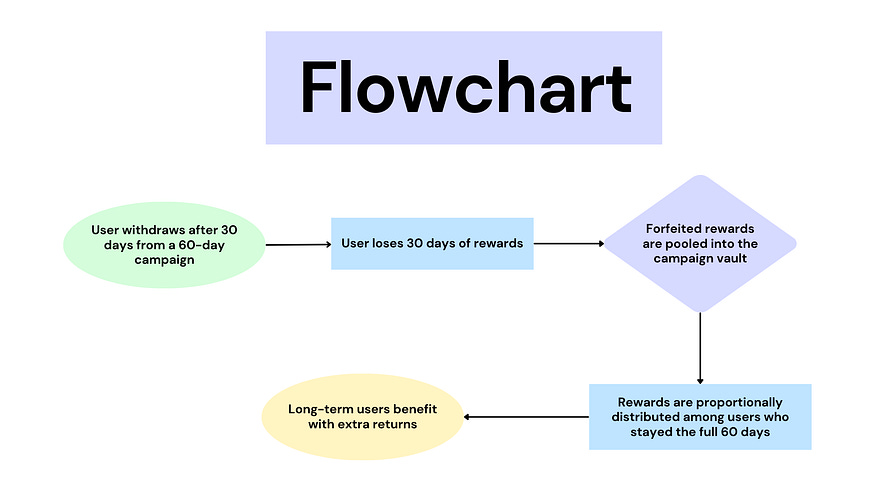

Matrix’s Solution: Reward Forfeiture

- Early Withdrawal Penalty: Users who withdraw liquidity before completing the lock-up period forfeit a portion of their rewards.

- Example: A user withdrawing after 30 days from a 60-day campaign loses 50% of their earned rewards, with the remaining distributed to loyal participants.

2. Rewards Redistribution: Forfeited rewards are redistributed proportionally among active participants, ensuring that long-term users benefit from short-term exits.

- Example: If a user withdraws early from a campaign, the forfeited rewards are re-invested into the vault for other users who maintained their deposits until expiration.

Example:

- A user withdraws after 30 days from a 60-day campaign → Loses 30 days of rewards.

- These rewards boost returns for users who stay the full 60 days.

Flowchart:

Programmable Yield Strategies

Matrix Vaults enable users to optimize their yields through strategic asset allocation and portfolio management:

Multi-Asset Lending

Deposited assets can be split across multiple chains (e.g., Ethereum, Solana) using the same maAssets.

Yield Optimization

- Auto-Rebalancing: Assets are dynamically allocated to high-yield opportunities.

- Multi-Step Strategies: Combine lending, staking, and trading for maximum returns.

- Example: A user’s maAssets are reallocated to a lending protocol offering higher yields if market conditions change.

Stablecoin Collateralization

Users can secure their maAssets by providing collateral in the form of stablecoins, enabling them to borrow additional liquidity without exiting their positions.

- Example: Withdrawing ETH from a Matrix Vault allows users to mint maUSD (a stablecoin) and use it as collateral for borrowing on DeFi platforms.

Deposit ETH → Mint maETH → Deploy to Aave → Earn Interest

Cross-Chain Liquidity Deployment

How It Works

Matrix Vaults facilitate efficient resource allocation across multiple blockchain networks:

- Inter-Blockchain Chain Messaging: A messaging system ensures seamless asset transfer between supported chains.

- Example: Deploying maETH from Ethereum to a lending protocol on Solana involves transferring the assets directly, without requiring additional collateral.

2. Dynamic Reallocation: The system automatically adjusts liquidity distribution based on market demand and protocol performance.

- Example: If a lending protocol on Chain A performs poorly, its liquidity is reallocated toChain B where yields are more attractive.

Benefits

- Efficient Capital Allocation: Liquidity flows to where it’s most needed.

- Enhanced Yields: Access high-yield opportunities across chains.

Deposit ETH (Ethereum) → Mint maETH → Deploy to Solana Lending Protocol

Benefits for All Stakeholders

For Liquidity Providers

- Flexibility: Withdraw anytime (though early exits forfeit rewards).

- Composability: Use maAssets across DeFi applications.

- Real Yield: High returns through protocol fees and trading revenue.

For Protocols

- Predictable Liquidity: Long-term LPs reduce market volatility.

- Sustainable Growth: Focused on product development rather than constant incentives.

- Cross-Chain Integration: Efficient allocation of resources across multiple networks.

For the DeFi Ecosystem

- Efficient Capital Allocation: Resources flow to high-impact protocols without abrupt exits.

- Reduced Market Manipulation: Predictable liquidity levels stabilize token prices.

- Diversified Opportunities: Cross-chain liquidity deployment enhances market stability and growth.

The Road Ahead: Matrix’s Vision for DeFi

Expanding Cross-Chain Support

Matrix Vaults aim to integrate with Layer 1 and Layer 2 networks, enabling broader liquidity deployment across the blockchain ecosystem. This will enhance efficiency and reduce transaction costs for users.

Introducing Yield Derivatives

Future developments may allow users to trade future yield streams as financial instruments, creating new investment opportunities.

Attracting Institutional Players

Matrix’s structured approach and predictability make it an attractive option for traditional institutions entering the DeFi space. This could expand market depth and liquidity stability.

Conclusion: Building a Resilient DeFi Future

Matrix Vaults address DeFi’s most persistent challenges — volatile liquidity, misaligned incentives, and capital inefficiency — by prioritizing flexibility and strategic alignment. By rewarding loyalty and enabling cross-chain composability, Mitosis is crafting a future where protocols and users thrive together.

Explore Matrix Vaults: Mitosis Website

Read about Mitosis Litepaper here: mitosis-litepaper-6e8de95ce2bb14f8c2d2ffc8c272b9f3.pdf

Comments ()