MATRIX VAULTS: Curated liquidity access for the next-gen DeFi users.

DeFi is full of opportunities but navigating them is chaotic. Yield options are scattered across chains, protocols vary in quality, and users often face unclear risks. Mitosis Matrix vault changes that. It's a curated liquidity access layer that connects users with high-quality campaigns with full transparency and full control.

What is Matrix Vaults? Matrix vault is Mitosis' leading architecture for sourcing DeFi yields. It allows users to browse, evaluate, and participate in vetted, premium liquidity campaigns, while maintaining custody of their funds. Through Matrix Vaults, protocols offer competitive yields, and users get receipt tokens (maAssets) that represent their positions.

How It Works Matrix vault works in two key stages: Before Mitosis Mainnet Matrix Vaults are deployed on external chains (e.g., Ethereum, Arbitrum) Users deposit assets into campaign-specific vaults They receive maAssets as proof of deposit Rewards accumulate on the network where assets were deposited After Mitosis Mainnet Assets flow into the Mitosis L1 mainnet Users deposit assets on supported chains and receive Vanilla Assets on Mitosis These Vanilla Assets are then committed to Matrix vault campaigns Users receive maAssets on Mitosis L1, enabling unified rewards and programmability.

Why Matrix Vault Matters Matrix Vaults solves three major DeFi problems: 1. Broken Yield Opportunities: Matrix-vaults aggregates the best opportunities across chains. 2. Capital Inefficiency: Users can hold, move, or even trade maAssets making liquidity fluid. 3. Risk Transparency: Every campaign is detailed reward structure, asset type, and network clearly stated.

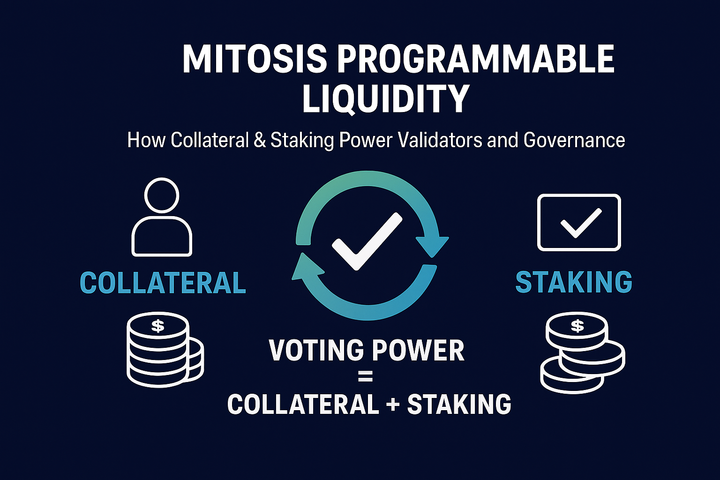

MaAssets: Programmable Liquidity Receipts MaAssets aren't just claim tokens they're programmable financial primitives. Over time, they will support: -->Trading in secondary markets -->Use as DeFi collateral -->Yield splitting and structured products -->Reward aggregation across campaigns Matrix Vaults turns simple yield farming into an advanced capital allocation layer.

Empowering Both Sides Protocols gain access to long term, stable liquidity by offering exclusive terms Users get premium yields, governance free participation, and chain-agnostic access This creates a symbiotic relationship between capital seekers and providers, optimized by Mitosis infrastructure.

In Summary Matrix Vaults isn’t just another yield platform it’s a modular liquidity marketplace designed for the future of multichain DeFi. As it evolves alongside the Mitosis, it will become the go to layer for programmable, and high performance liquidity deployment.

Check out this official links

• Mitosis University • Explore Mitosis Now • Mitosis Documentation blog • Join the Mitosis Discord Community

Comments ()