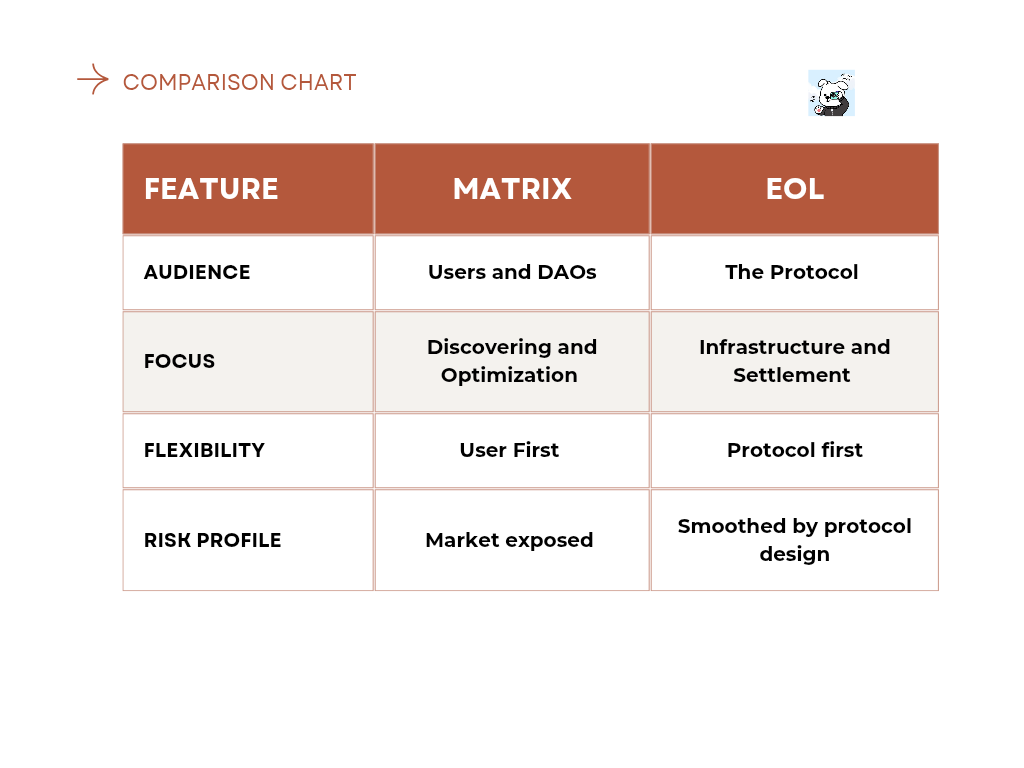

MATRIX VAULTS vs. ECOSYSTEM-OWNED LIQUIDITY (EOL): Two Sides of the Mitosis Engine.

Mitosis is building a programmable liquidity layer for DeFi but it’s doing so with two core strategies:

1. Matrix Vaults – a curated platform for users to discover and interact with optimized DeFi opportunities. 2. EOL (Ecosystem-Owned Liquidity) – a decentralized liquidity layer owned and governed by the Mitosis. Though both are part of the same system, they serve very different purposes. Here's how they compare:

——

1. Purpose & Role Matrix Vaults User-facing interface -Helps users explore, filter, and enter opportunities (like LRT vaults, restaking strategies, etc.) -Think of it as a frontend for intelligent liquidity decisions. EOL Protocol-owned backend -Provides cross-chain, programmable liquidity as infrastructure. -Designed to stabilize the system, reduce reliance on mercenary capital, and enable better settlement.

2.Who Owns the Liquidity? Matrix Vaults Liquidity comes from individual users They deposit into curated vaults and retain ownership of their funds EOL Liquidity is owned by the protocol, not users Built over time via incentives, MITO Points, and protocol revenue This liquidity becomes Mitosis’ foundation for things like fast settlement and yield routing.

3. Capital Flow Matrix Vaults >Capital is flexible and user-directed >Enter and exit freely, pursue the best yields and campaigns >Ideal for retail, degens, and DAOs optimizing capital allocation. EOL >Capital is sticky and programmable >Acts more like a liquidity engine routing funds, supporting cross-chain operations, and backing protocol-level commitments. >Ideal for protocol partnerships and long-term security.

4.Yield & Value Accrual Matrix Vaults -->Yield goes mostly to users, minus a small fee to Mitosis. -->Highly competitive, yield-chasing design. EOL -->Yield flows back to the protocol. -->Used to fund development, reward MITO stakers, and grow the Mitosis treasury. -->Creates a flywheel of sustainability and ecosystem reinvestment.

5. Strategic Role

Conclusion Matrix Vaults is the "what" and "where" of liquidity. EOL is the "how" and "why" behind it. Matrix vaults empowers users to interact with DeFi smarter. EOL ensures that Mitosis has the infrastructure to make those interactions seamless, secure, and scalable across chains. Together, they form a complete liquidity engine: user-optimized on the surface, protocol-secure underneath.

Learn more about Mitosis

● Explore details on the official website: https://www.mitosis.org/ ● Follow announcements on Twitter: https://twitter.com/MitosisOrg ● Participate in discussions on Discord: https://discord.com/invite/mitosis ● Read articles and updates on Medium: https://medium.com/mitosisorg ● Blog: https://blog.mitosis.org/

Comments ()