MEV Supply Chains: The Real Battle for Blockspace Profits

In modern blockchains, blocks are more than just data containers, they're highly valuable real estate. And behind every block lies a quiet war: a race to capture, extract, and redistribute value. That war is shaped by a powerful but often misunderstood force: MEV, or Maximal Extractable Value. Today, MEV is no longer just a dark forest of bots sniping transactions, it's a full blown supply chain, with multiple actors vying for control over who gets to profit and how.

Let’s break down how the MEV economy works, who the players are, and what’s being done to decentralize its power.

What is MEV?

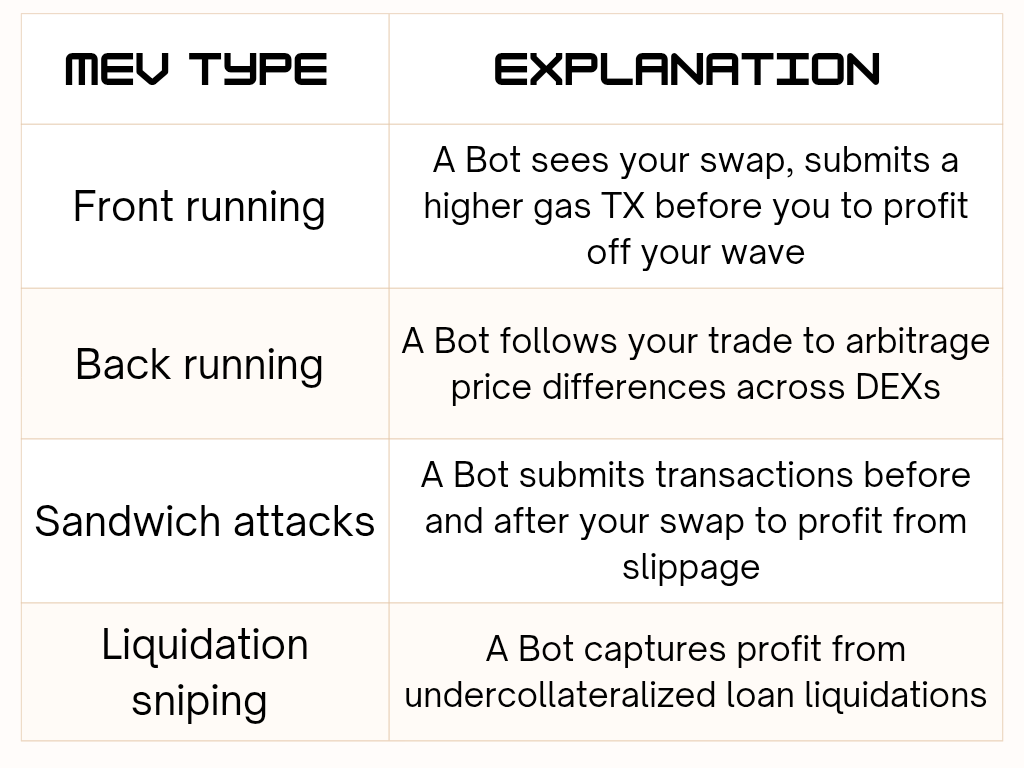

Maximal Extractable Value (MEV) is the extra value that can be captured by reordering, inserting, or censoring transactions within a block, beyond just the standard block reward and gas fees. Common Examples:

MEV started as an edge case in DeFi, but it now touches every Ethereum block, and it's reshaping how blockchains are built.

The MEV Supply Chain: Who’s in Control?

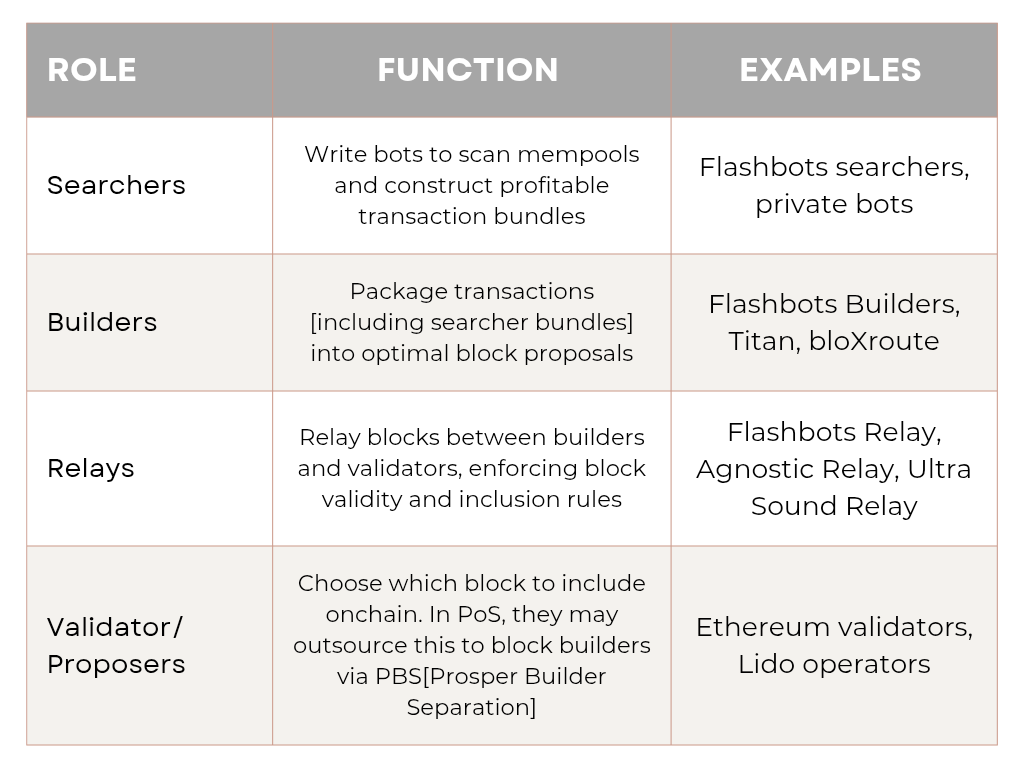

As Ethereum and other chains evolved, MEV moved from being purely opportunistic to institutionalized. The supply chain of MEV now involves multiple actors, each playing a strategic role. MEV Supply Chain Layers

This vertical stack creates a structured pipeline for MEV extraction, but it also concentrates power.

Flashbots: The MEV Kingmaker

In 2020, Flashbots changed MEV by introducing MEV Geth and later MEV Boost, tools that let Ethereum validators outsource block building to professional builders. Their goals:

• Prevent spam and network congestion caused by bot wars

• Make MEV extraction more transparent and efficient

• Introduce Proposer Builder Separation (PBS) for modular block production Today, Flashbots Relay and Flashbots Builders handle a large share of Ethereum blocks, but their dominance raises centralization concerns.

Problems With Centralized MEV

1. Censorship Risk: Relays can refuse to include certain transactions (e.g Tornado Cash sanctions). 2. Value Leakage: Validators and users may not share in the profits that builders and searchers extract. 3. Unclear Behavior: Many relays and builders operate with minimal transparency or accountability. 4. Lack of User Protection: MEV typically profits intermediaries, not the users whose trades are being exploited.

Toward Decentralized MEV: SUAVE, MEV Blocker & Beyond

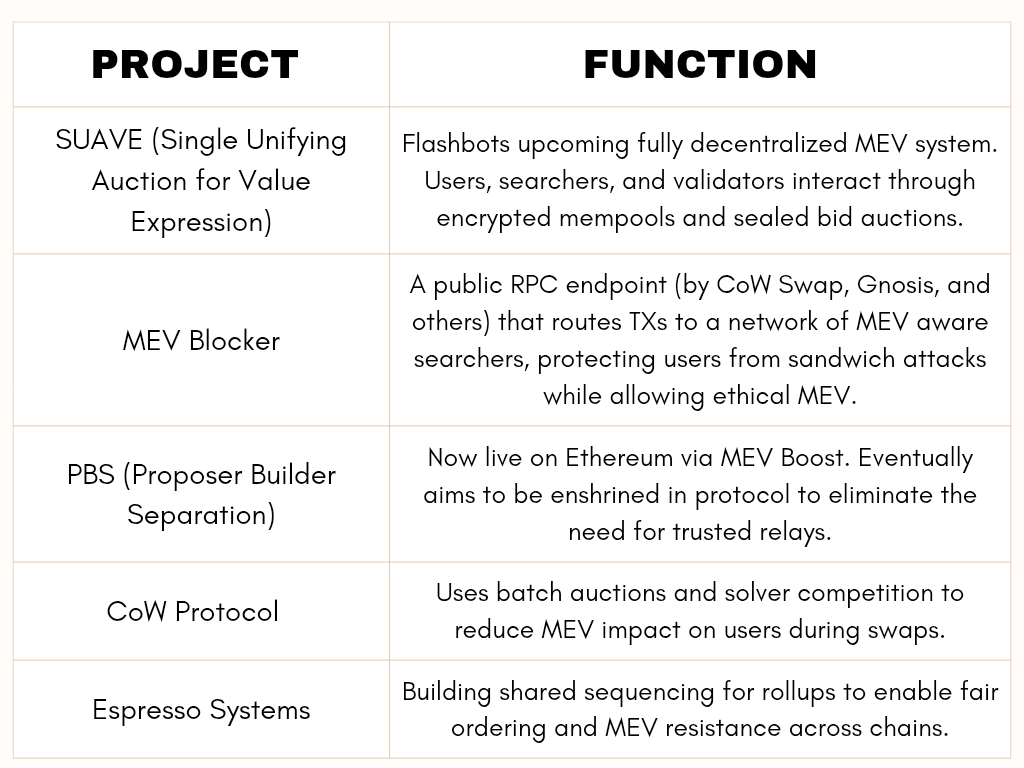

A growing wave of tools and protocols aim to democratize and decentralize MEV capture, giving more power to users and reducing systemic risks. Major Initiatives:

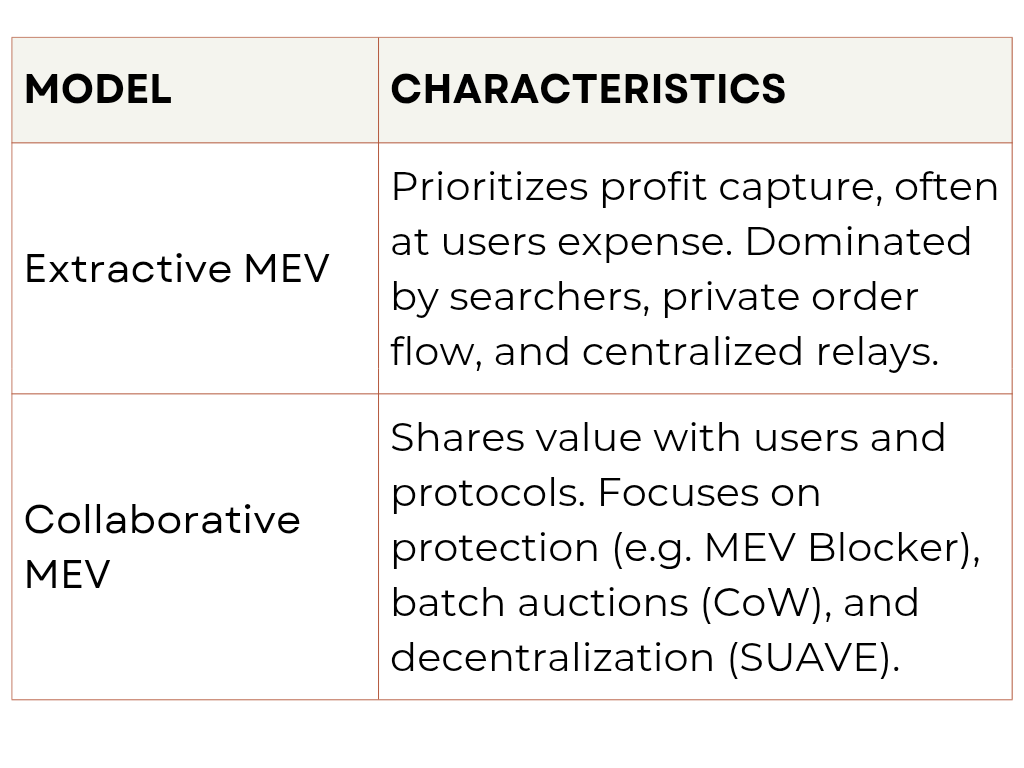

The Changing Landscape: Open vs Extractive MEV

There’s an ideological divide forming in the MEV world:

What Comes Next?

The battle for MEV profits is also a battle for control over Ethereum’s future UX: Will power stay with elite builders and searchers? Or will tools like SUAVE and MEV Blocker empower users and decentralize capture? As Layer 2s, modular chains, and rollups increases, the need for fair ordering and user protection becomes critical. Protocols, wallets, and infra providers will have to choose between extract or protect.

Final Thoughts

MEV is no longer a dark art, it’s a supply chain, and it's becoming the foundation of blockspace economics. Whether through SUAVE, MEV Blocker, or enshrined PBS, the next phase of Ethereum and beyond will be shaped by how we balance incentives, transparency, and user protection. The real battle for blockspace isn’t just technical, it’s political and economic. And it’s already underway.

Links to read more:

https://writings.flashbots.net/suave-introduction

Detailed introduction to SUAVE (Single Unifying Auction for Value Expression) by Flashbots, aiming to decentralize and privatize the MEV supply chain.

MEV Blocker Official Site https://www.mevblocker.io/

Ethereum's Introduction to MEV https://ethereum.org/en/developers/docs/mev/

Flashbots Research – MEV Supply Chains https://docs.flashbots.net/flashbots-auction/searchers/supply-chain

Explore Mitosis here: https://university.mitosis.org/

Comments ()