miAssets and Ecosystem Liquidity Design in Mitosis

Introduction

As cross-chain liquidity becomes the defining feature of next-generation DeFi, Mitosis introduces a new primitive to unify and mobilize liquidity: miAssets. These tokenized representations enable capital to move natively across chains, creating a liquidity layer that is both portable and composable.

In this article, we explore how miAssets work, their role in Mitosis' cross-chain architecture, and why they may become foundational to modular DeFi.

What Are miAssets?

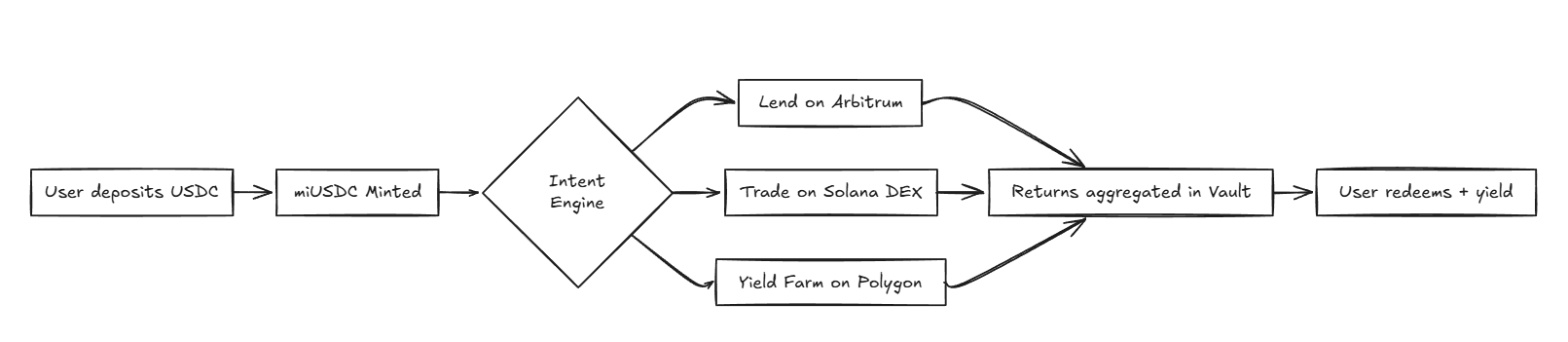

miAssets are tokenized representations of canonical assets (e.g., ETH, USDC) that retain cross-chain portability. When users deposit assets into Mitosis, they mint corresponding miAssets (e.g., miETH), which can then be used throughout the ecosystem.

Key characteristics:

- Composability-first: Designed for modular execution across chains

- Always backed: Redeemable 1:1 for underlying assets

- Intent-routable: Flow seamlessly across environments based on user-defined strategies

miAssets Lifecycle

Why miAssets Matter

1. Native Interoperability

Instead of bridging wrapped assets, miAssets are minted natively via vault logic and tracked on-chain.

2. Capital Efficiency

A single deposit of USDC can be deployed across multiple yield venues simultaneously.

3. Unified Liquidity Layer

miAssets create a liquid, on-demand infrastructure for developers and protocols to plug into.

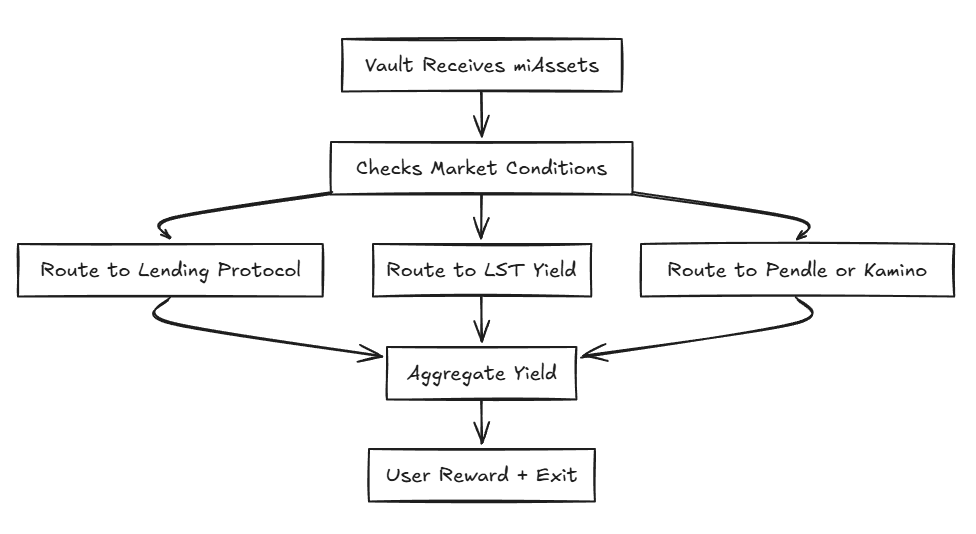

Vault Abstraction & Capital Routing

miAssets are integrated with Mitosis vaults, which act as execution hubs. These vaults:

- Automate yield routing across DeFi primitives

- Track TVL across all chains in a unified manner

- Allow partial redemption while funds remain deployed

Vault Interaction Model

Conclusion

miAssets represent more than a cross-chain token standard — they are a unifying layer for capital movement in modular DeFi. With Mitosis vaults, EOL, and solver engines, miAssets can abstract away complexity while optimizing yield and liquidity.

If Mitosis succeeds, miAssets will become the default abstraction layer for intent-based liquidity in crypto.

Comments ()