miAssets: Unlocking Cross-Chain DeFi with Mitosis

Introduction

As liquidity fragments across hundreds of blockchains, DeFi becomes inefficient — capital is siloed, bridging is risky, and yield opportunities are lost.

Mitosis introduces miAssets — cross-chain liquidity primitives designed to solve these problems at the protocol level.

In this article, we unpack how miAssets transform fragmented liquidity into a unified, composable foundation for the next generation of DeFi.

The Liquidity Fragmentation Problem

DeFi today suffers from:

- Isolated token liquidity on each chain

- Inefficient capital movement via bridges

- Increased exposure to fragmented risks

- Lost yield due to underutilized assets

miAssets solve this by enabling seamless, secure liquidity across ecosystems — without sacrificing decentralization or custody.

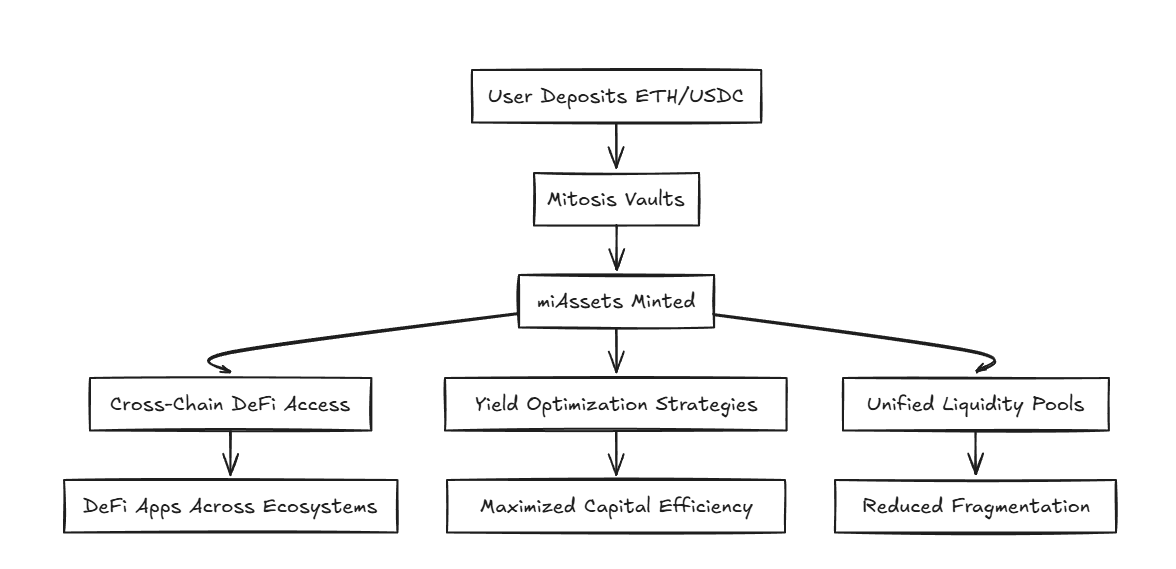

What Are miAssets?

miAssets are tokenized representations of underlying assets deposited into the Mitosis liquidity network. For example:

- ETH → miETH

- USDC → miUSDC

Once minted, miAssets unlock:

✅ Composable DeFi utility across chains

✅ Unified liquidity layer without bridging friction

✅ Participation in Mitosis yield optimization

✅ Redeemability back to native assets at any time

How miAssets Power Cross-Chain Liquidity

Benefits of miAssets for Users and Developers

For Users:

- Access DeFi yield across chains without manual bridging

- Maintain full ownership and redeemability of assets

- Participate in protocol-owned liquidity growth

For Developers:

- Build composable DeFi apps with unified liquidity

- Integrate cross-chain assets without fragmented risks

- Leverage Mitosis’s zkVM for programmable liquidity behavior

Real-World Example: Using miAssets

A user deposits ETH into Mitosis:

- Receives miETH as a cross-chain liquidity token

- Uses miETH as collateral on a lending protocol on Avalanche

- Simultaneously earns Mitosis yield and participates in DeFi

- Redeems miETH for native ETH at any time

Result: Frictionless DeFi participation, maximized capital utility, minimized fragmentation.

Why miAssets Matter for DeFi

miAssets are a core primitive of the Mitosis ecosystem, enabling:

✅ True cross-chain liquidity mobility

✅ Reduced reliance on risky bridges

✅ Sustainable yield through ecosystem-owned liquidity

✅ Composable DeFi across multiple chains

They shift DeFi from fragmented, chain-specific liquidity to a unified, scalable foundation — powered by programmable assets.

Comments ()