miAssets vs. maAssets: Understanding the Role of Matrix in DeFi Liquidity And Mitosis Tokenized Liquidity Models

Introduction: The Evolution of DeFi Liquidity

Liquidity in decentralized finance (DeFi) is considered its lifeblood, fueling lending, borrowing, trading, staking, and so forth. Over time, liquidity provisioning models have evolved to become more efficient, flexible, and rewarding for participators. Two innovations that stand out in this regard are miAssets and maAssets, both of which fit into the Mitosis Matrix framework.

Decentralized Finance (DeFi) has essentially reformed traditional financial mechanisms that provided open or permissionless access to financial services. Though this has grown rapidly, liquidity remains fundamentally inefficient in DeFi. For one, Liquidity Provision for providers (LPs) have encountered a few challenges including capital inefficiency, limited moveability of liquidity, and relatively low yield opportunities.

➽ miAssets: Cross-chain liquidity representations, allowing for efficient transferring of capital across ecosystems.

➽ maAssets: Liquid representations of staked assets within the Matrix framework, allowing for additional composability.

Liquidity providers' positions can be transformed into tradable, composable, and yield-augmenting financial tools using this novel programmable liquidity in Mitosis. Two innovations of the protocol: miAssets and maAssets enable new levels of liquidity provisioning, thus enhancing the efficiency of capital allocation, generation of sustainable yields, and liquidity of the secondary market.

Understanding how these asset types interact within Matrix is key to optimizing liquidity strategies in DeFi. This article provides an in-depth exploration of the issues solved by Mitosis, the workings of miAssets and maAssets, and their conversion of DeFi liquidity into structured financial assets like bonds and debt instruments.

What is Matrix, and How Does it Benefit DeFi Participants?

Matrix is a structured liquidity system that offers predictable, timeframe-bound liquidity to DeFi protocols as an opportunity for high-yielding, flexible avenues to liquidity suppliers. The way Matrix works is to link the providers and the protocols, thereby ensuring that the optimum availability of capital.

Why Mitosis and Tokenized Liquidity?

The Problems in Current DeFi Liquidity Models:

While decentralization has made the access of financial services to users ubiquitous, the management of liquidity per se has a few issues:

Capital Inefficiency: Liquidity providers are needed to lock assets in pools, thereby inadequately adding those funds to any other productive use.

Illiquid LP Positions: LP positions are generally not tradeable or collateralizable and so leave LPs, other than the ones passively yield farming, with few options.

Bad Yield Optimization: Most protocols cannot dynamically allocate liquidity, which means capital gets allocated sub-optimally.

Short-Term Liququidity Migration: Most DeFi incentive schemes rely on temporary rewards, creating situations where liquidity moves back and forth between protocols.

Limited Institutional Participation: Due to poor price discovery and fragmented liquidity management, institutional investors largely steer clear of DeFi.

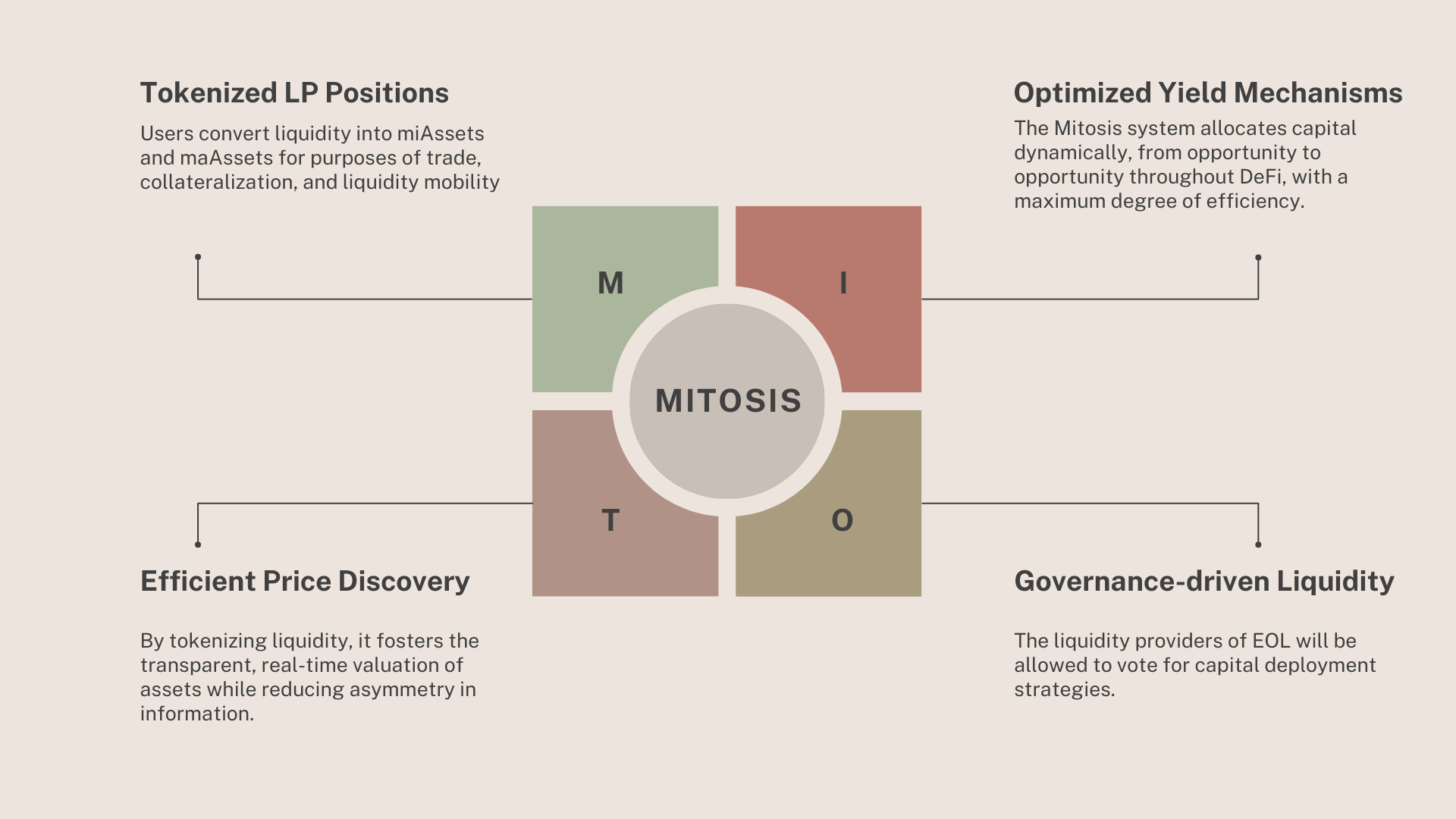

The Mitosis Solution: A New Paradigm for Liquidity!

Mitosis opens a whole new world of possibilities with Programmable Liquidity.

Tokenized LP Positions: Users convert liquidity into miAssets and maAssets for purposes of trade, collateralization, and liquidity mobility.

Optimized Yield Mechanisms: The Mitosis system allocates capital dynamically, from opportunity to opportunity throughout DeFi, with a maximum degree of efficiency.

Efficient Price Discovery: By tokenizing liquidity, it fosters the transparent, real-time valuation of assets while reducing asymmetry in information.

Governance-driven Liquidity: The liquidity providers of EOL will be allowed to vote for capital deployment strategies.

Key Takeaway: Mitosis makes DeFi applications operationally efficient, liquid, and structured so that LPs get maximum benefit out of their assetsKey Benefits:

For liquidity providers: Higher-intermediate yield and other incentives through maAssets.

For protocols: Stable and structured liquidity without dependence on unpredictable LP incentives.

For the ecosystem: Improved capital efficiency and increased liquidity composability.

Understanding Vanilla Assets: The Foundation of Mitosis Liquidity

Before conversing about miAssets and maAssets, it is necessary to discuss Vanilla Assets, which are the building blocks of Mitosis' liquidity framework.

Unlike traditional bridges, Mitosis uses a non-bridging liquidity model where:

- Users deposit ETH or other assets into Mitosis Vaults on supported chains (e.g., Ethereum, Mantle).

- Vanilla Assets (e.g., Vanilla ETH, Vanilla USDC) are automatically minted 1:1 on the Mitosis.

- Vanilla Assets can then be used within Mitosis' liquidity frameworks (EOL and Matrix) to generate miAssets or maAssets.

Key Takeaway: Vanilla Assets are not equal to miAssets, whereas they represent something in between the original deposits and allocation into yield strategies.

What Are miAssets? (EOL Liquidity)

miAssets like miETH and miUSDC are liquidity positions deposited on the Ecosystem-Owned Liquidity (EOL), which is Mitosis' governance-driven liquidity pool.

How miAssets Work:

- Users deposit Vanilla Assets into EOL.

- They mint miAssets in return (for example, miETH).

- EOL puts liquidity to various DeFi strategies to earn yields.

- miAsset holders earn yield + governance rights to vote for the allocation of EOL liquidity.

EOL Withdrawals: Immediate?

- Withdrawals are instant if there is enough liquidity in the EOL vault.

- If assets are locked into strategies, then liquidity is rebalanced for the vault.

- Tradeability of miAssets on secondary markets allows users to exit their position earlier.

- In extreme cases where liquidity is strongly constrained, an auctioning mechanism can ensue for the general fair access to the withdrawals.

Key Takeaways About miAssets:

- Governance Power: miAsset holders vote on liquidity deployment strategies.

- Yielding Returns: income from protocol rewards + yield strategies.

- Redeemable for Vanilla Assets: Depending on liquidity available in EOL.

- Flexible and Tradeable: Unlike traditional LP tokens, miAssets may be sold, collateralized, or leveraged in DeFi Lending markets.

What Are maAssets? (Matrix Liquidity Campaigns)

maAssets (e.g. maETH, maUSDC) are minted through Matrix Liquidity Campaigns, and participants lock liquidity in return for higher yield over a fixed time.

How maAssets Work:

- Vanilla Assets are deposited by users into a Matrix liquidity campaign

- They receive maAssets (e.g., maETH) representing their locked position.

- Liquidity is locked for a pre-set duration in specific DeFi protocols.

- Once the lock-up period expires, users redeem maETH for Vanilla ETH + accrued yield.

miAssets vs. maAssets: A Technical Breakdown!

miAssets: Governance-Driven Liquidity!

miAssets (e.g., miETH, miUSDC) are minted when users deposit Vanilla Assets into EOL, Mitosis’ decentralized liquidity pool. Key features:

- Governance Rights: miAsset holders vote on protocol integrations and liquidity allocation.

- Yield Accrual: Rewards are distributed as additional Vanilla Assets, dynamically adjusting miAsset value.

- Liquidity: miAssets can be traded on secondary markets, even if underlying assets are locked in strategies.

maAssets: Fixed-Term Yield Opportunities!

maAssets (e.g., maETH, maUSDC) represent locked liquidity in Matrix campaigns. Key features:

- Time-Bound Commitments: Users lock assets for predefined periods (e.g., 45–90 days) in exchange for higher APYs.

- Composability: maAssets remain liquid—usable as collateral, tradable, or staked elsewhere.

- Predictable Returns: Fixed-term agreements ensure stable yields for LPs and reliable liquidity for protocols.

| Feature | miAssets (Governance-Driven Liquidity) | maAssets (Fixed-Term Yield) |

|---|

| Definition | Liquidity tokens with governance rights | Locked yield-bearing tokens |

| Liquidity | Tradeable, flexible, and cross-chain | Locked but usable in DeFi |

| Use Case | Cross-chain liquidity, governance voting | High-yield staking with fixed terms |

| Governance | Holders vote on EOL strategies | No governance rights |

| Yield | Earns from EOL vault strategies | Earns fixed APY from Matrix campaigns |

| Flexibility | Tradable, collateralizable, stakable | Tradable but locked until maturity |

| Composability | Used in lending, AMMs, staking | Used as collateral or in yield strategies |

| Redemption | Redeemable anytime if liquidity is available | Redeemable after the lock-up period |

| Best For | Users seeking liquid, governance-backed yield | Users preferring fixed, predictable returns |

DeFi Liquidity as a Debt Market: The Financialization of LP Positions!

In traditional finance, bonds and debt instruments serve as structured financial products that allow institutions to raise and allocate capital efficiently. Mitosis applies this principle to DeFi by turning LP positions into structured financial assets, similar to bonds.

- miAssets behave like liquid bonds, where their value fluctuates based on governance decisions and yield expectations.

- maAssets function more like fixed-income securities, as they are locked for a period and generate predictable returns.

- Both assets can be traded, used as collateral, or bundled into liquidity-backed derivatives, paving the way for structured DeFi credit markets.

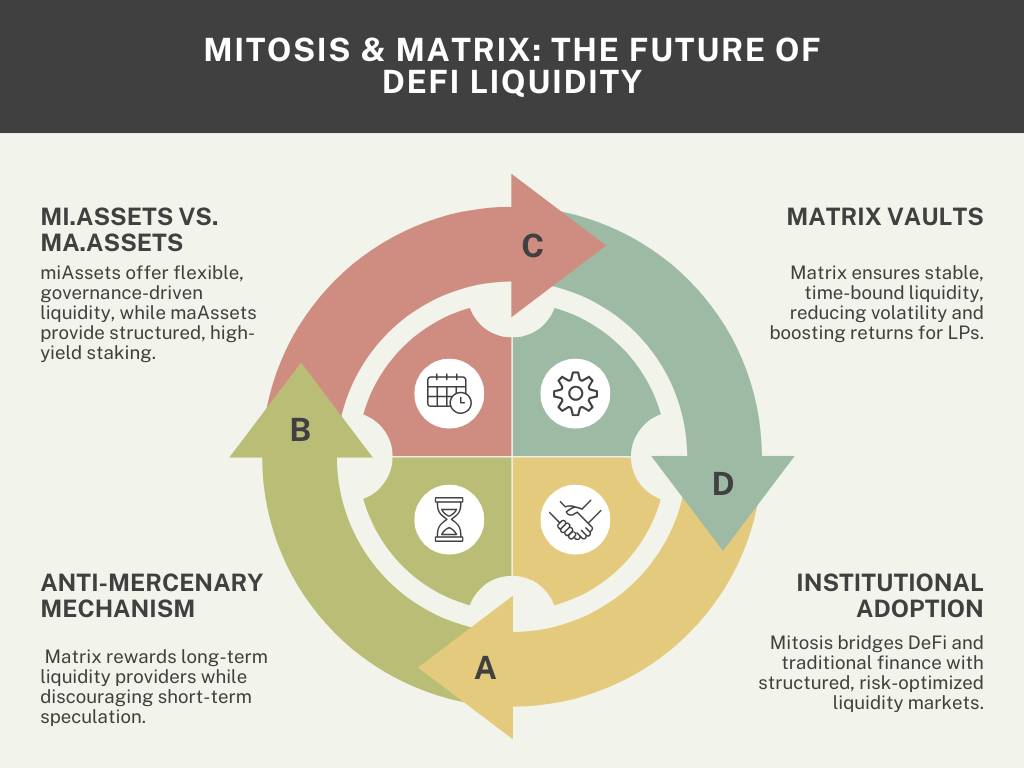

What is Matrix, and how does it benefit Mitosis suppliers and protocols?

In the fast-evolving world of decentralized finance (DeFi), Liquidity Provision is a critical component that determines the success and sustainability of protocols. The introduction of Matrix presents a novel solution that aligns incentives for both liquidity suppliers and DeFi protocols.

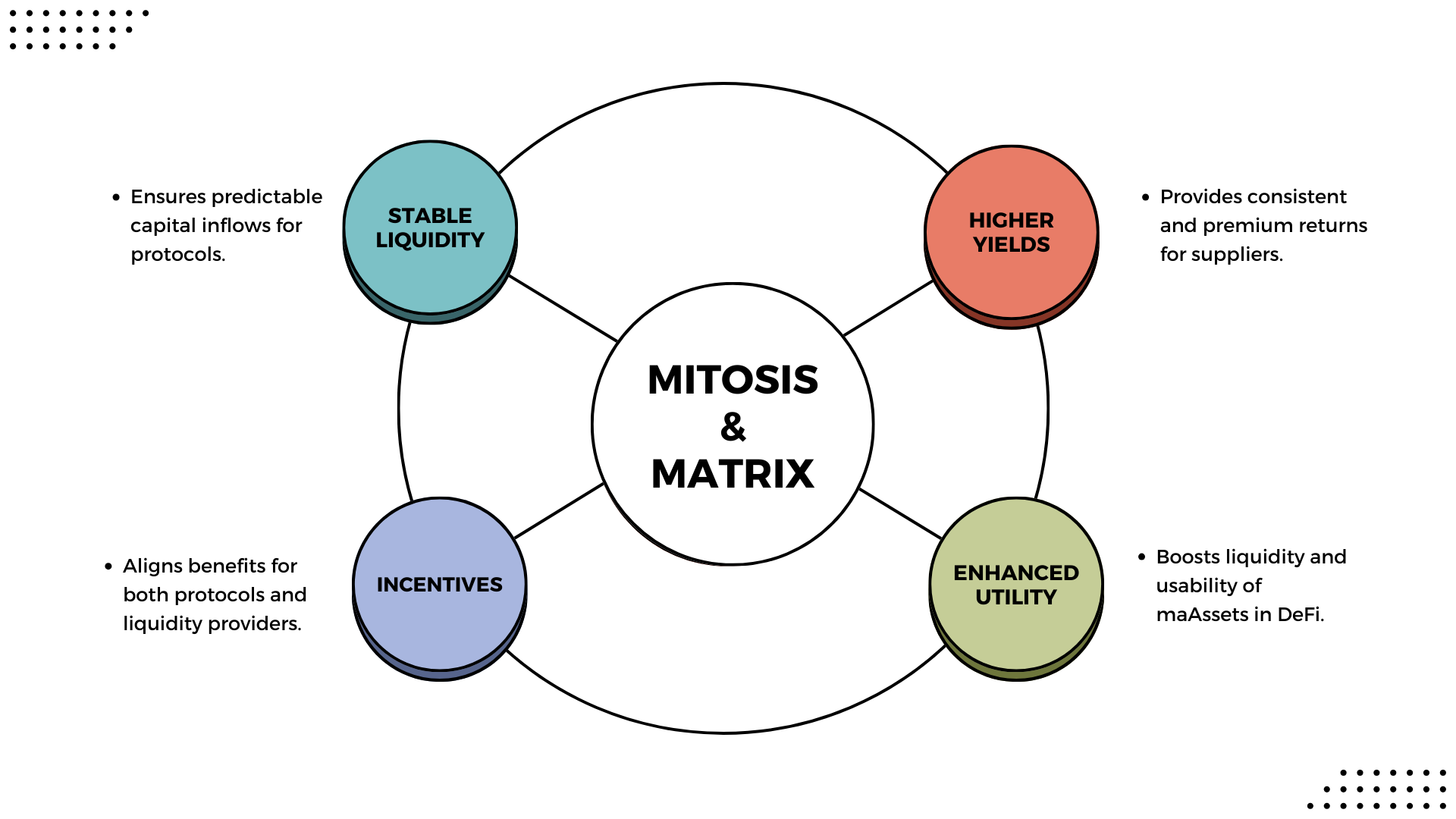

Matrix is a framework that allows DeFi protocols to offer time-bound, high-yield opportunities to liquidity suppliers. This creates a direct relationship between suppliers and protocols, ensuring a win-win situation for both parties:

- Protocols get stable and predictable liquidity.

- Liquidity providers (LPs) or miAsset holders gain access to premium, predictable yields with additional incentives.

Understanding Matrix: A New Paradigm for DeFi Liquidity Provisioning!

Traditional DeFi liquidity incentives have often been volatile, leading to uncertain yields for LPs and unstable liquidity for protocols. Matrix addresses this by establishing a structured, time-bound yield model, ensuring:

- Stable liquidity for protocols → predictable capital inflows.

- Higher and consistent yields for liquidity suppliers → enhanced returns and incentives.

- Utility and liquidity of maAssets → enabling further DeFi use cases.

How Matrix Works?

Matrix functions by allowing miAsset holders (e.g., those holding maETH, maUSDC, etc.) to choose from various DeFi protocol opportunities based on incentive duration, APY, and extra rewards.

For instance, let's examine how three DeFi protocols leverage Matrix to bootstrap liquidity:

| Protocol | Term | APY | Extra Rewards |

|---|---|---|---|

| Protocol A | 60 days | 15% | 5% governance |

| Protocol B | 45 days | 18% | 3% tokens |

| Protocol C | 90 days | 20% | 1% yield boost |

Each protocol offers unique yield opportunities, allowing liquidity suppliers to select the option that best aligns with their risk and reward preferences.

Key Benefits of This Approach:

- Flexible staking options: Suppliers can choose based on their liquidity needs.

- Diverse yield structures: Options range from shorter, moderate-yield periods to longer, high-yield commitments.

- Extra incentives: Protocols offer additional rewards in governance tokens, increasing total returns for suppliers.

- Stable Liquidity for Protocols: Fixed-term commitments reduce capital flight.

- Higher Yields for LPs: Campaigns offer premium APYs compared to traditional pools.

- Liquidity via maAssets: Unlike locked staking, maAssets enable composability (e.g., collateralization).

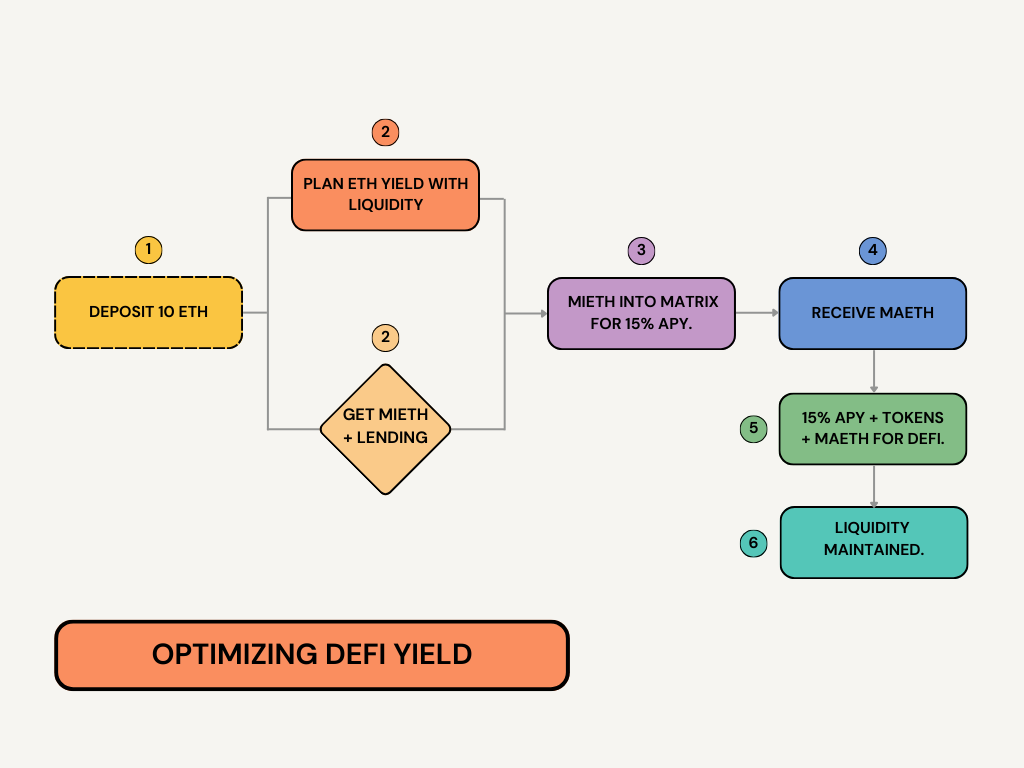

Use Case Example: Combining miAssets and maAssets for Maximum Efficiency!

Scenario: Alice Optimizes Her DeFi Yield

Let's say, Alice holds 10 ETH and wants to earn yield while maintaining liquidity. Using Mitosis, she can maximize her returns through the following strategy:

- Cross-Chain Liquidity with miAssets:

- Alice deposits 10 ETH into Mitosis and receives miETH, allowing her to move capital across chains efficiently.

- She deploys miETH into a lending protocol on a different chain for additional yield.

- Earning Yield with Matrix and maAssets:

- Alice deposits her miETH into Matrix, selecting a 60-day, 15% APY option.

- In return, she receives maETH, which she can use elsewhere in DeFi (e.g., collateral for Stablecoin minting).

- Final Outcome:

- After 60 days, Alice earns 15% APY on her staked assets.

- She also benefits from additional governance token rewards.

- Her maETH remained liquid, allowing her to leverage additional DeFi opportunities.

Why This Matters

- Alice effectively combines cross-chain mobility (miAssets) with yield-bearing liquidity (maAssets).

- She optimizes her capital efficiency without compromising liquidity.

- Her participation in Matrix ensures she earns premium DeFi yields with structured risk management.

The Role of Mitosis in Matrix: Enhancing DeFi Liquidity Networks!

Mitosis is a Layer 1 ecosystem that integrates Matrix as a core liquidity framework. The primary role of Mitosis in Matrix includes:

- Providing Infrastructure: Supporting seamless integration of maAssets within the Mitosis L1 ecosystem.

- Facilitating Liquidity Composability: Enabling DeFi applications to utilize maAssets for borrowIing, trading, and staking. maAssets interact with Mitosis-native AMMs, lending markets, and yield tokenization protocols.

- Optimizing Yield Strategies: Empowering miAsset holders with automated yield optimization strategies.

How Matrix Strengthens the Mitosis Ecosystem!

Encouraging Cross-Protocol Liquidity

- Matrix facilitates liquidity sharing across multiple DeFi protocols, ensuring deep, stable pools.

- Liquidity is less fragmented, increasing efficiency in trading, lending, and yield farming.

Enhancing Capital Efficiency

- Unlike traditional staking models, Matrix allows liquidity suppliers to retain flexibility via maAssets.

- Suppliers can leverage their positions while earning additional rewards.

Reducing Impermanent Loss Risks

- Many liquidity providers fear impermanent loss when participating in DeFi pools.

- Matrix mitigates this by focusing on single-sided staking opportunities with fixed APY options.

Comparing Matrix with Traditional DeFi Liquidity Models!

| Feature | Traditional DeFi | Matrix |

| Yield Stability | Fluctuates with market | Predictable, fixed-term |

| Liquidity | Locked | Liquid via maAssets |

| Flexibility | Limited options | Multiple campaign choices |

| Protocol Stability | High volatility | Structured, long-term |

Matrix introduces a reliable, structured, and optimized staking mechanism, reducing volatility and enhancing incentives for all participants.

How Matrix Vaults Address Mercenary Capital

Matrix introduces anti-mercenary mechanisms by redistributing forfeited rewards from early withdrawals to long-term participants. This approach:

- Naturally filters short-term profit seekers without artificial restrictions.

- Encourages sustainable liquidity provisioning.

- Reduces sell pressure on protocol tokens.

Why Matrix is a Game-Changer for DeFi Yield Farming!

1. Multi-Layered Yield Optimization

Matrix combines base yields, protocol incentives, and additional DeFi opportunities, enabling higher APYs for suppliers.

2. Liquidity Remains Unlocked

Unlike traditional staking, Matrix ensures LPs can still use their assets via maAssets, increasing capital efficiency.

3. Reduced Volatility for Protocols

Protocols get stable liquidity, reducing dependency on volatile LP inflows, which enhances sustainability.

4. New DeFi Use Cases with maAssets

maAssets introduce composability, allowing cross-protocol strategies, such as:

- Using maAssets as collateral for stablecoin minting.

- Liquidity provisioning in Mitosis-native AMMs.

5. Sustainable Growth Model

By aligning supplier incentives with protocol liquidity needs, Matrix fosters long-term stability in DeFi.

Conclusion: The Future of DeFi Liquidity with Mitosis and Matrix

The evolution of DeFi liquidity provisioning has taken a significant leap forward with Mitosis and its Matrix framework. By introducing miAssets and maAssets, Mitosis has transformed traditional liquidity models into programmable, composable, and structured financial instruments. This innovation allows liquidity providers to maximize returns, protocols to secure long-term liquidity, and the entire DeFi ecosystem to achieve greater efficiency, predictability, and sustainability.

Key Takeaways

- miAssets vs. maAssets – While miAssets provide governance-driven liquidity with cross-chain flexibility, maAssets enable structured, time-bound yield generation with added liquidity composability.

- Matrix Vaults Create a Sustainable DeFi Yield Model – By allowing protocols to offer fixed-term yield campaigns, Matrix ensures stable capital inflows, higher LP rewards, and liquidity composability via maAssets.

- Programmable Liquidity Optimizes Capital Efficiency – Unlike traditional DeFi staking models, Matrix reduces impermanent loss risks, enables cross-protocol strategies, and discourages mercenary capital through incentive alignment mechanisms.

- Institutional Adoption and Future Growth – The structured financial nature of Mitosis' liquidity models mirrors traditional debt markets, paving the way for institutional investors to participate in DeFi.

What’s Next for Mitosis and Matrix?

- How will Matrix evolve to support new structured financial products?

- Can DeFi liquidity instruments like miAssets and maAssets create a standardized global liquidity market?

- As institutional players enter DeFi, will structured liquidity models like Matrix become the foundation for large-scale financial adoption?

Final Thought

Mitosis and Matrix are not just incremental improvements—they represent a fundamental shift in how liquidity is created, distributed, and optimized in decentralized finance. By bridging liquidity mobility with structured financial incentives, Mitosis is setting the stage for a more efficient, resilient, and scalable DeFi ecosystem. Whether you're a yield farmer, a protocol developer, or an institutional investor, Matrix offers the tools to unlock the full potential of DeFi liquidity.

Join Mitosis Today: Mitosis X

Follow Me on X: raysonsio

Sources & References:

- Mitosis Litepaper: Official Document

- Matrix Vaults By Mitosis: Matrix Vaults

- Study Mitosis: Matrix Thread

- Ethereum Improvement Proposals (EIP-4626): EIP-4626 Standard

- Cosmos SDK Documentation: Cosmos Network

- DeFi Market Data & Protocol Comparisons: DefiLlama Analytics

- Uniswap v3 Whitepaper: Automated Market Making

Comments ()