MicroStrategy Bitcoin Acquisition Strategy: What Are the Possible Consequences, Investor Sentiment, Technical Analysis

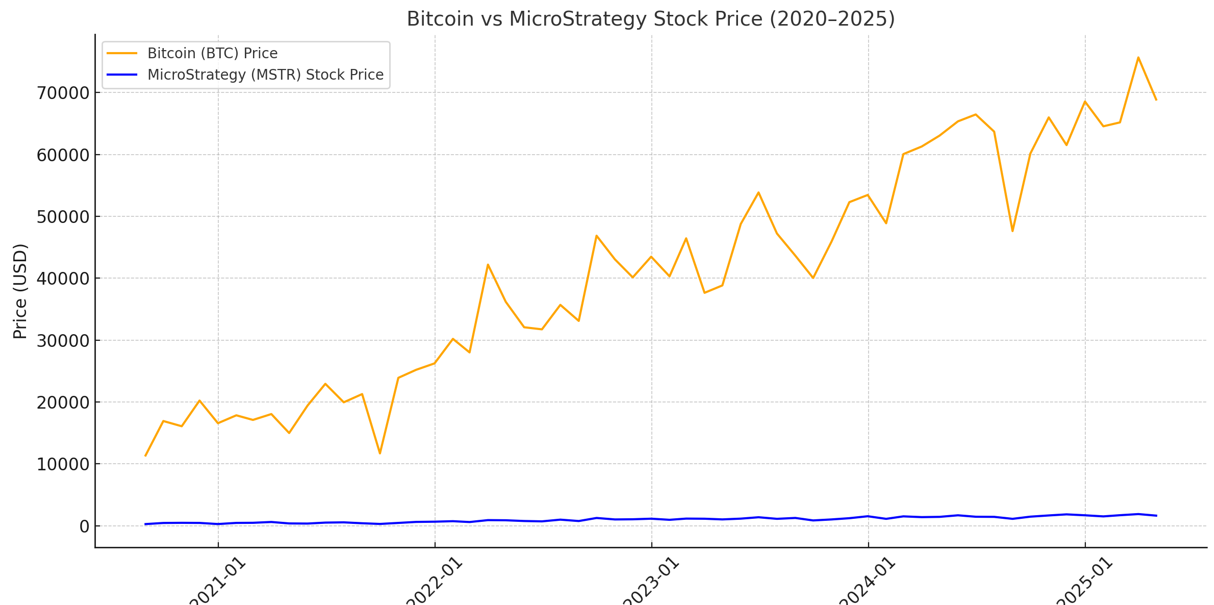

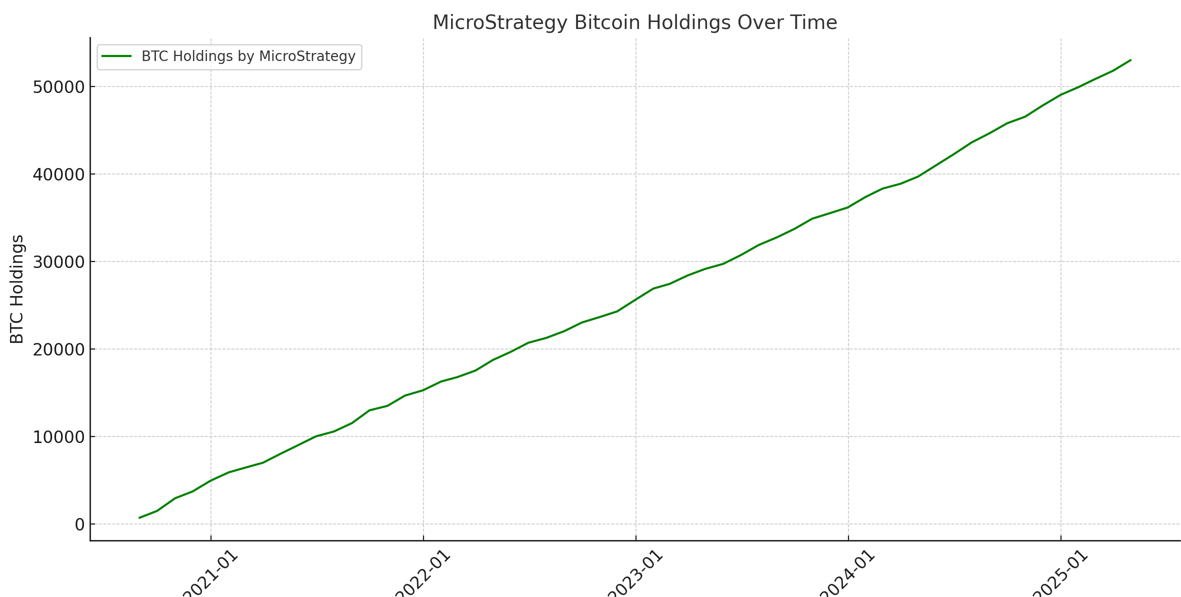

MicroStrategy has become a symbol of institutional interest in Bitcoin, having begun actively purchasing the digital asset back in 2020. Under the leadership of Michael Saylor, it has not only diversified its balance sheet, but also turned into the largest corporate holder of Bitcoin. As of May 2025, the company owns more than 214,000 BTC, purchased for over $7.5 billion. MicroStrategy's strategy is causing heated discussions in the market: from the delight of Bitcoin supporters to the concerns of traditional investors. Let's look at what such a strategy can lead to, how investors react and what technical analysis says.

MicroStrategy Strategy: What's the Bottom Line?

Since its first purchase in August 2020, MicroStrategy has consistently acquired Bitcoin using:

1) Free cash.

2) Convertible bond placement.

3) Direct equity issuance.

This approach makes Bitcoin not just part of an investment portfolio, but the company's core strategic asset, replacing traditional forms of reserves (such as the dollar or gold).

According to Saylor, Bitcoin is "digital gold" and its limited supply makes it the best form of long-term value storage in the face of inflationary pressures and monetary stimulus.

Potential implications of such a strategy

1. Vulnerability to volatility

Bitcoin is a highly volatile asset. A sharp drop in its price can instantly reduce the market value of the company's assets. For example, a decline in BTC from $70,000 to $50,000 could result in an unrealized loss of more than $4 billion.

2. Dependence on the crypto market

The fundamental value of MicroStrategy shares is increasingly correlated with the price of Bitcoin. This turns it from an IT company into an indirect Bitcoin ETF, which may scare off some institutional investors who want to avoid crypto risks.

3. Financing risks

The company actively used debt instruments to buy BTC. If conditions in the debt market change or the value of the asset falls, there may be a risk of default or dilution of shareholder shares.

MicroStrategy Bitcoin Acquisition Summary

|

Metric |

Value |

|

Total

BTC Held |

214,000

BTC |

|

Average

Purchase Price |

~$35,000

per BTC |

|

Total

Investment |

~$7.5

billion USD |

|

Current

Market Value (est.) |

~$14.5

billion USD (at $68k/BTC) |

|

Unrealized

Profit |

~$7

billion USD |

|

Funding

Sources |

Corporate

cash, equity, convertible debt |

|

BTC as

% of Total Assets |

Over

90% |

|

First

BTC Purchase Date |

August

11, 2020 |

|

CEO

& Strategist |

Michael

Saylor |

|

Company

Classification |

Public

BTC proxy / Business intelligence |

Investor sentiment: optimism or anxiety?

⚡ Bullish sentiment

Many retail and crypto-focused investors see MicroStrategy shares as a way to indirectly invest in BTC, especially in countries where access to crypto exchanges is limited. The growth of the BTC price traditionally raises MSTR shares.

⚠ Conservative criticism

Wall Street analysts have mixed opinions on Saylor's actions. Some call the strategy "an all-in game" and point to a violation of the principles of balanced corporate governance. There were periods when MSTR shares traded at a large discount to the BTC price due to concerns about the sustainability of the model.

📈 Long-term interest

Despite the fluctuations, the company's stability and consistency in implementing the strategy have strengthened the confidence of some institutional investors. Some funds view MicroStrategy as a public crypto-treasury company.

Technical analysis of MSTR stock and Bitcoin price

1. MicroStrategy shares (ticker: MSTR)

2. As of May 2025, the shares are trading in the $1,600-$1,800 range, updating the historical highs reached in 2021 and 2024.

3. Support is around $1,400 (50-day moving average area).

4. Resistance is $2,000 (psychological level and Fibonacci level).

5. RSI indicator on the daily chart is around 70, indicating overbought.

6. 🔍 Bitcoin (BTC/USD)

7. Steady above $65,000.

8. Nearest bullish target is $80,000 (estimated peak of the current cycle).

9. Support is $60,000 and 200-day MA.

MACD and OBV indicators indicate continuation of bullish momentum.

Technically, MicroStrategy may continue to grow along with BTC, but the risk of correction in the overheated market remains.

Conclusion

MicroStrategy strategy is a unique case of transformation of a traditional company into a crypto-oriented investment instrument. The consequences of such a policy could be either catastrophic or triumphant, depending on the dynamics of the crypto market. Today, MSTR acts as a proxy Bitcoin, and its success depends on the long-term legitimacy and growth of BTC.

Investors following MicroStrategy are essentially betting on the future of Bitcoin as a global asset. This makes the company a litmus test for the entire crypto market, both in periods of euphoria and in moments of panic.

Comments ()