MicroStrategy to Raise $84 Billion for Bitcoin Purchases: Michael Saylor’s Strategy

Led by Michael Saylor, MicroStrategy is set to increase its Bitcoin holdings through a bold move—raising up to $84 billion via stock sales. This investment push highlights the company's commitment to expanding its Bitcoin strategy, and it is drawing attention from investors and crypto enthusiasts alike.

MicroStrategy’s Bitcoin Strategy and Goals

MicroStrategy has doubled its capital plan to $84 billion in order to ramp up Bitcoin purchases. The company plans to raise this amount through equity and fixed-income options. MicroStrategy’s Bitcoin investments gained significant momentum towards the end of 2023, with the company regularly purchasing Bitcoin on a weekly basis, a trend that continued into 2025.

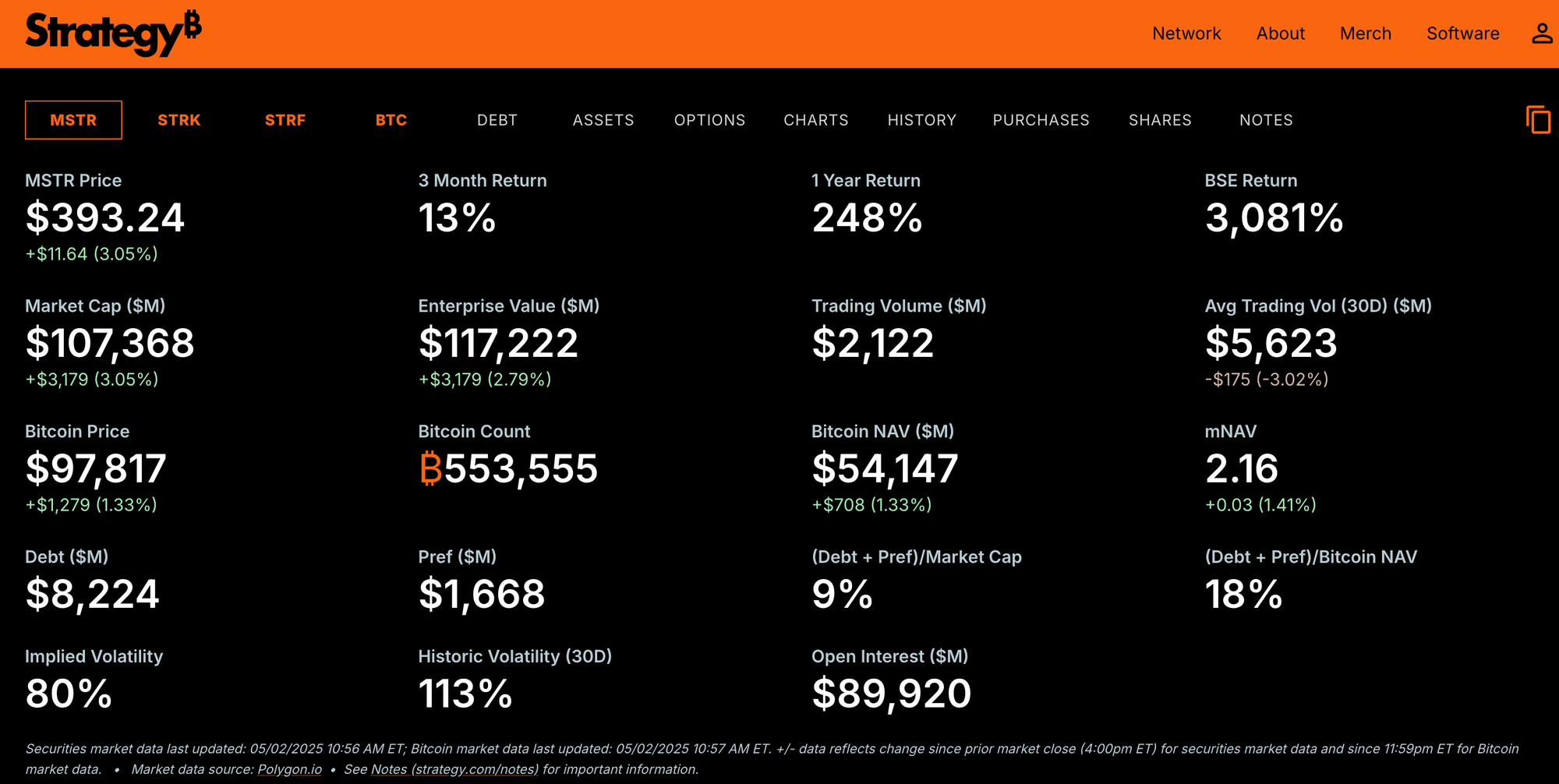

Currently, the company holds 553,555 BTC, with a total investment cost of $37.9 billion, averaging a purchase price of $68,459 per Bitcoin. As a result, MicroStrategy has become the largest public company in terms of Bitcoin holdings. The company now owns more than 2% of the total circulating supply of Bitcoin.

Significant Gains from Bitcoin Investments

MicroStrategy has seen notable gains from its Bitcoin investments. The company is targeting a 25% Bitcoin yield for 2025, with a projected increase in Bitcoin gains from $10 billion to $15 billion. Currently, MicroStrategy has a BTC yield of 13.7%, and its year-to-date (YTD) gains have amounted to $5.8 billion.

MicroStrategy's New Capital Raise and Stock Offering

As part of the $84 billion capital raise, MicroStrategy has announced a new $21 billion at-the-market (ATM) common stock offering. The company has already raised about $6.6 billion through the issuance and sale of Class A common stock. This capital raise is expected to further bolster MicroStrategy's ability to acquire more Bitcoin.

BlackRock and MicroStrategy: The Largest Institutional Bitcoin Holders

MicroStrategy’s Bitcoin holdings place it as the largest institutional holder of Bitcoin, owning over 2% of the total supply. The company’s Bitcoin strategy has been a major success, and it now holds the largest Bitcoin position among public companies. BlackRock, with around 570,000 BTC under its management, remains the only other institutional investor ahead of MicroStrategy in terms of Bitcoin holdings.

Conclusion: MicroStrategy’s Bitcoin Investment Strategy

Michael Saylor's leadership continues to shape MicroStrategy’s Bitcoin investment strategy, and the company’s move to raise $84 billion for further acquisitions signals a growing commitment to the digital asset. MicroStrategy’s example is setting the standard for corporate Bitcoin adoption, and with this bold strategy, it is likely to maintain its leadership in the Bitcoin space. As institutional interest in Bitcoin continues to rise, MicroStrategy's influence in the market will likely grow even further

Comments ()