MicroStrategy’s Bitcoin Acquisition Strategy: Market Impact and Shifting Investor Sentiment – An In-Depth Analysis

MicroStrategy, one of the world's leading business intelligence companies, has made headlines for its strategic investments in Bitcoin. The company’s consistent Bitcoin acquisitions have had a profound impact on the market and sparked various debates among investors. This article explores MicroStrategy’s Bitcoin acquisition strategy, its current Bitcoin holdings, associated risks, and the potential future implications of this strategy.

What is MicroStrategy?

Founded in 1989 by Michael Saylor and Sanju Bansal, MicroStrategy is a business intelligence (BI) software provider. It helps organizations analyze and visualize data effectively. Over time, the company expanded its services to include data management, analytics, and cloud computing solutions. However, it has gained more prominence in recent years due to its Bitcoin investments. MicroStrategy’s Bitcoin strategy has significantly influenced the company's financial position and its market perception.

MicroStrategy’s Bitcoin Holdings: A Closer Look

As of now, MicroStrategy holds approximately 535,555 Bitcoins, valued at around $37.9 billion. The company's latest acquisition involved purchasing 15,355 Bitcoins for approximately $1.42 billion. With this strategy, MicroStrategy has become one of the largest institutional holders of Bitcoin globally.

The Shift in MicroStrategy’s Investment Strategy

MicroStrategy’s approach to Bitcoin has gone beyond a traditional financial investment. The company views Bitcoin not just as a hedge against inflation, but also as a long-term store of value. This strategy, initiated in August 2020, has resulted in continuous Bitcoin acquisitions since then.

Michael Saylor: The Man Behind MicroStrategy’s Bitcoin Strategy

Michael Saylor, the CEO and founder of MicroStrategy, is the central figure behind the company’s Bitcoin strategy. With an engineering background, Saylor’s growing interest in cryptocurrencies has led him to become a strong advocate for Bitcoin. He believes that Bitcoin could evolve into the currency of the future, considering it a reliable store of value.

How Michael Saylor Shaped MicroStrategy’s Bitcoin Strategy

Saylor adopted Bitcoin as a long-term investment tool and has since shaped the company’s Bitcoin strategy around this belief. He is also a proponent of Bitcoin revolutionizing the financial system, a vision that continues to drive MicroStrategy's commitment to increasing its Bitcoin reserves.

The Risks of MicroStrategy’s Bitcoin Strategy

Although MicroStrategy’s Bitcoin strategy has attracted attention, it comes with several potential risks:

1. Price Volatility

Bitcoin is known for its high price volatility. Short-term price fluctuations could significantly affect MicroStrategy’s financial health. As the company has invested heavily in Bitcoin, a sharp decline in its value could adversely impact the company’s financial position.

2. Regulatory Risks

The global regulatory environment for cryptocurrencies remains uncertain. New regulations targeting Bitcoin could pose a threat to MicroStrategy’s strategy. Particularly, stricter government regulations could force the company to reassess its Bitcoin investments.

3. Lack of Portfolio Diversification

MicroStrategy’s heavy reliance on Bitcoin limits its investment portfolio to a single asset class. This lack of diversification could lead to an increased risk profile, as the company’s financial performance becomes more dependent on Bitcoin’s price.

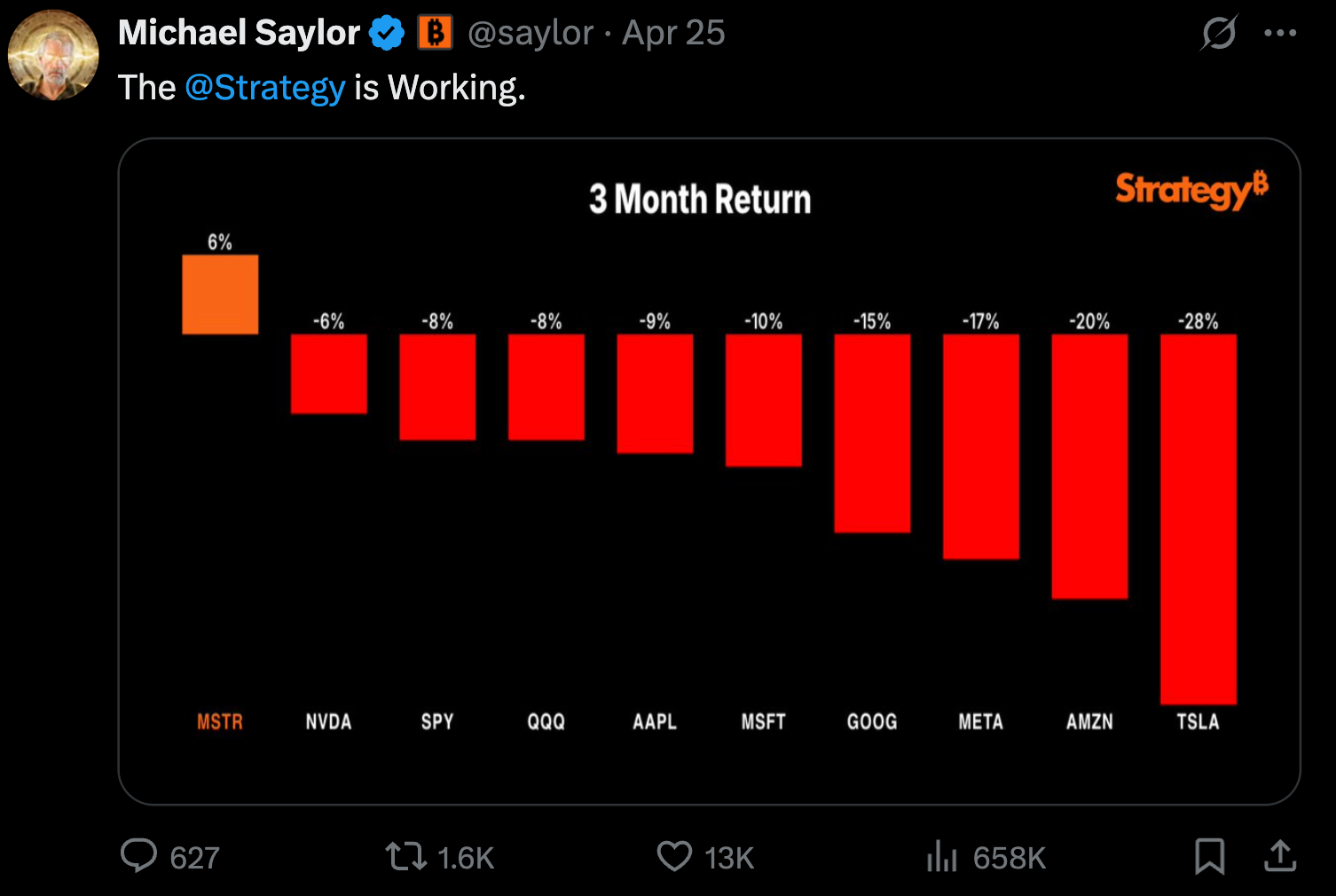

Market Impact of MicroStrategy’s Bitcoin Strategy

MicroStrategy’s Bitcoin acquisitions have not only affected the company but also had significant implications for the broader cryptocurrency market. These investments highlight growing institutional interest in Bitcoin, which has likely increased confidence in Bitcoin and other cryptocurrencies. MicroStrategy’s large-scale investments have also encouraged other institutional investors to consider Bitcoin as a viable investment.

The Future of Bitcoin and MicroStrategy’s Role

MicroStrategy’s Bitcoin strategy is not just a financial investment—it also serves as a strong endorsement of Bitcoin’s future value and security. Under Saylor’s leadership, the company’s Bitcoin investments could set an example for other firms. As MicroStrategy’s Bitcoin holdings grow, the company’s financial health may also see positive impacts.

The Long-Term Potential of Bitcoin as a Store of Value

While Bitcoin’s future remains uncertain, increasing institutional investments suggest that cryptocurrencies may increasingly be viewed as long-term stores of value. MicroStrategy is poised to remain a significant player in this evolution.

Conclusion: MicroStrategy and Bitcoin’s Future

MicroStrategy’s Bitcoin strategy has become an important factor in increasing institutional confidence in Bitcoin. The company’s substantial Bitcoin investments not only strengthen the value and security of Bitcoin but also significantly shape MicroStrategy’s financial structure. However, the strategy carries inherent risks, including market volatility and regulatory uncertainties.

Nonetheless, MicroStrategy’s Bitcoin investments are setting a model for other institutions and could play a key role in cementing Bitcoin’s place in the global financial system. This strategy represents a pivotal moment not just for MicroStrategy but for Bitcoin and other cryptocurrencies as well

Comments ()