Mitosis: Morph the Powerhouse of Zootosis

The decentralized finance (DeFi) space is undergoing continuous evolution, and at the frontier of this transformation stands Mitosis, a modular asset layer empowering interchain liquidity. Within this robust infrastructure, Morph emerges not merely as another DeFi protocol but as the operational engine powering one of Mitosis’s most ambitious programs: Zootosis.

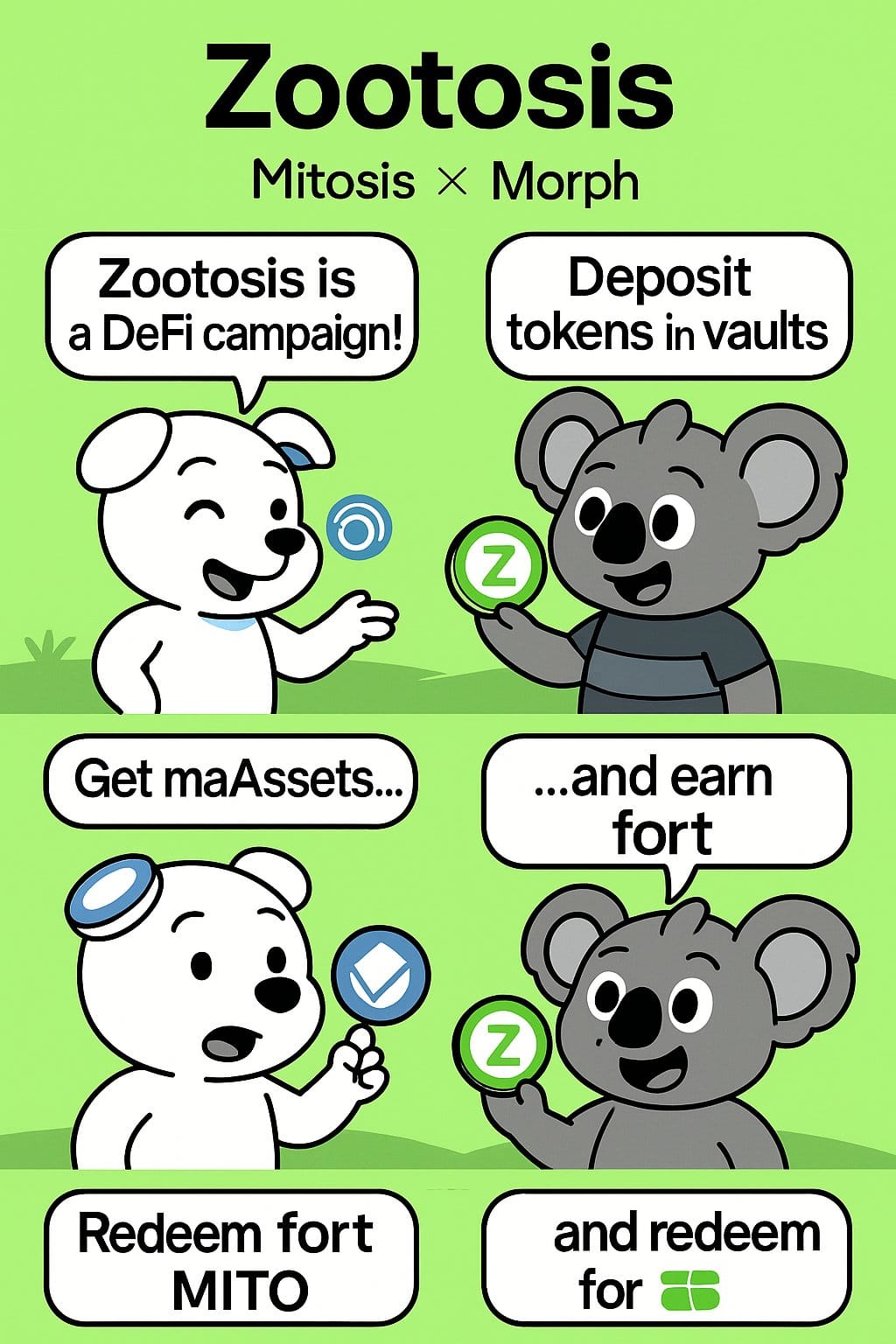

Zootosis is a gamified yield expedition that aims to redefine user engagement and liquidity aggregation in DeFi. Through a combination of smart contract vaults, synthetic asset creation, and incentivized participation, Zootosis leverages Morph’s capabilities to attract liquidity across chains and boost utility across the Mitosis Matrix.

In this article, we explore how Morph powers Zootosis, the architecture underpinning its vault and reward mechanisms, and why it is poised to lead a new wave of innovation in multi-chain finance.

Morph as the DeFi Hub

Morph acts as the operational layer within the Mitosis Matrix. It provides the necessary DeFi infrastructure, vaults, lending markets, AMMs, and liquidity incentives, that serve as the foundational environment where synthetic assets like maAssets are issued and utilized.

Key attributes of Morph:

- Multi-Asset Support: Supports a wide array of assets that can be converted into maAssets (Mitosis assets).

- Security and Speed: Built for scalability and efficient asset handling with a focus on non-custodial architecture.

- Interchain Operability: Seamlessly interacts with Cosmos SDK and IBC-based chains for fluid asset mobility.

Zootosis: The Yield Expedition on Morph

Zootosis is described in Mitosis documentation as a “yield expedition”. It’s designed to draw users into active participation by depositing assets into curated vaults and receiving tokenized receipts maAssets that accrue rewards over time. These rewards come in the form of Zoots, a gamified point system that can later be redeemed for tokens in the Mitosis ecosystem.

This process transforms passive DeFi participation into an engaging, interactive experience where users can maximize yield while contributing to ecosystem growth.

A Two-Phase Participation Model

- Phase 1 - Vault Deposits:

- Users deposit supported assets into smart contract vaults.

- These assets are instantly converted into maAssets.

- Users begin to accumulate Zoots proportional to their holdings and the time of deposit.

- Phase 2 - Advanced DeFi Deployment:

- Participants can choose to deploy their maAssets into Morph’s lending markets or AMMs.

- This opens opportunities for multiplicative yield generation, adding a second layer of strategy.

Non-Custodial and Flexible Architecture

Unlike traditional vault mechanisms, Zootosis offers a non-custodial experience where users maintain control over their assets. Vaults can be exited at any time without penalty, and maAssets can be transferred, staked, or even re-deposited in different parts of the Morph ecosystem.

This creates a permissionless and composable financial ecosystem where users are not bound by strict protocols or locking mechanisms.

Updated Table of Supported Assets

The official Zootosis documentation lists more than 10 supported assets on launch, with maAssets acting as yield-bearing synthetic representations of these base assets. Here's an updated table:

| Asset | maAsset | Function | Contract Address |

|---|---|---|---|

| WETH | maWETH | Main Asset | 0x5300000000000000000000000000000000000011 |

| USDT | maUSDT | Main Asset | 0xc7D67A9cBB121b3b0b9c053DD9f469523243379A |

| USDC | maUSDC | Main Asset | 0xe34c91815d7fc18A9e2148bcD4241d0a5848b693 |

| WBTC | maWBTC | Main Asset | 0x803DcE4D3f4Ae2e17AF6C51343040dEe320C149D |

Additional assets including ETH and BTC derivatives are expected to be supported as Zootosis expands.

How to Participate in Zootosis

Participation in Zootosis is designed to be intuitive, enabling both DeFi veterans and newcomers to engage:

- Connect Wallet: Use a compatible Web3 wallet connected to supported chains (Ethereum, Arbitrum, Cosmos, etc.).

- Deposit Tokens: Select supported assets and deposit them into the Zootosis smart contract vaults.

- Receive maAssets: Upon deposit, receive synthetic maAssets representing your position.

- Earn Zoots: Your wallet accumulates Zoots based on the asset deposited, duration, and any additional actions like staking.

- Strategy Layer: Deploy your maAssets into Morph’s DeFi stack to increase yield.

- Redeem: Upon TGE or milestone events, use Zoots to claim ecosystem rewards, including token drops or NFTs.

Gamification and Reward Mechanics

Zootosis doesn’t just reward financial participation, it makes it fun. Key features:

- Zoot Boosters: Time-sensitive campaigns where users can earn bonus Zoots.

- NFT Integration: Users can unlock themed NFTs for holding specific asset combos.

- Leaderboard Tiers: Top contributors may access exclusive ecosystem governance rights.

Zootosis vs Other DeFi Yield Strategies

| Feature | Zootosis (via Morph) | Convex | Aave |

| Gamified Points System | Yes | No | No |

| Multi-Chain Liquidity | Yes | Limited | Moderate |

| Synthetic Asset Support | Yes (maAssets) | No | No |

| Composable Strategy Layer | Yes | Moderate | Yes |

| NFT & Community Engagement | Yes | No | No |

Zootosis clearly distinguishes itself with gamification, composability, and interchain liquidity.

Roadmap and Future Outlook

As the Zootosis campaign continues, the Mitosis team plans to:

- Introduce Zoots Marketplace: A swap-based platform to trade or redeem Zoots.

- Launch Governance Utility: Zoots could unlock DAO voting rights.

- Expand Supported Assets: Including native Cosmos tokens and L2 assets.

- Zoot Seasonal Events: Quarterly reward events with boosted rewards and ecosystem NFT drops.

With Morph as the engine and Zootosis as the expedition, Mitosis presents a cohesive, scalable, and innovative framework for DeFi in a multi-chain world. As the vaults fill, Zoots accumulate, and strategies evolve, Morph solidifies its role as the powerhouse that energizes the Zootosis adventure.

Together, they form a feedback loop of utility and incentive that may very well define the next frontier of interchain liquidity and user-centric DeFi. The future is composable, gamified, and interchain, and Mitosis is leading the charge.

Conclusion: A Perfect Symbiosis

In Zootosis, we see a thriving application that leverages Morph not as a backend utility, but as a strategic enabler. This symbiotic relationship, where infrastructure serves application needs rather than the reverse is the essence of the Mitosis vision. By building on Morph, Zootosis is not only scaling its game, it’s scaling possibility. And as the ecosystem evolves, more developers will look to Morph as the powerhouse capable of transforming bold ideas into performant, scalable, decentralized realities.

Comments ()