Mitosis: A New Paradigm for Liquidity in Modular DeFi

Mitosis is pioneering a new approach to decentralized liquidity, tailored for the evolving modular blockchain landscape. While university.mitosis.org outlines foundational concepts, this article dives into emerging trends, technology architecture, and ecosystem developments shaping Mitosis’s broader role in DeFi.

🧬 What Is Mitosis?

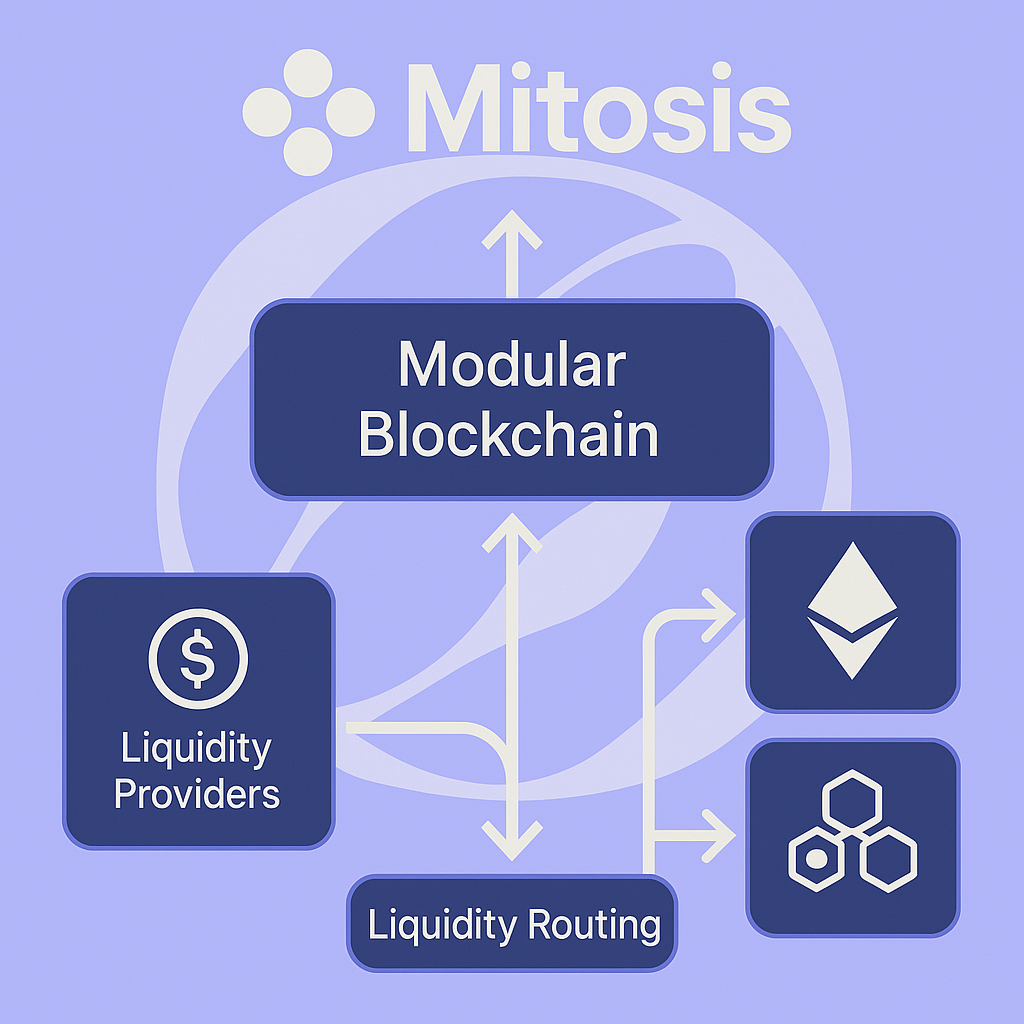

Mitosis is a next-gen DeFi appchain designed to optimize liquidity distribution across blockchain networks. Its standout innovation is the Ecosystem-Owned Liquidity (EOL) model, a mechanism that aggregates liquidity from users and redistributes it strategically across chains and protocols.

Figure: A digital graphic representing the modular nature of Mitosis and its liquidity routing system.

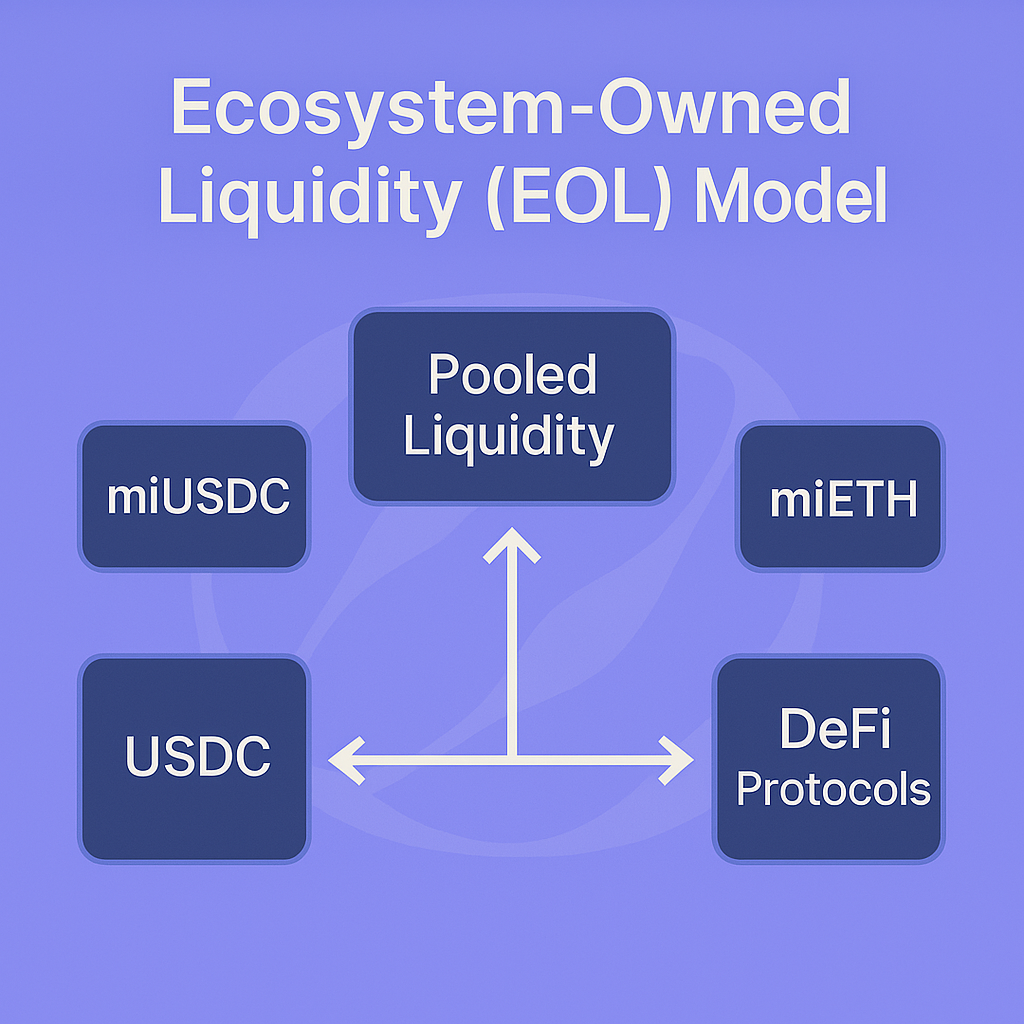

🔁 Ecosystem-Owned Liquidity (EOL): A Collective Advantage

Unlike traditional liquidity mining, which isolates LP rewards per protocol, Mitosis's EOL model pools assets at scale. This shared liquidity earns collective rewards and governance rights. Here's how it works:

- Users deposit native assets (e.g., ETH, USDC)

- Receive miAssets (e.g., miUSDC) as liquid staking tokens

- Mitosis DAO allocates pooled liquidity to vetted protocols

- Rewards accrue and are distributed among LPs

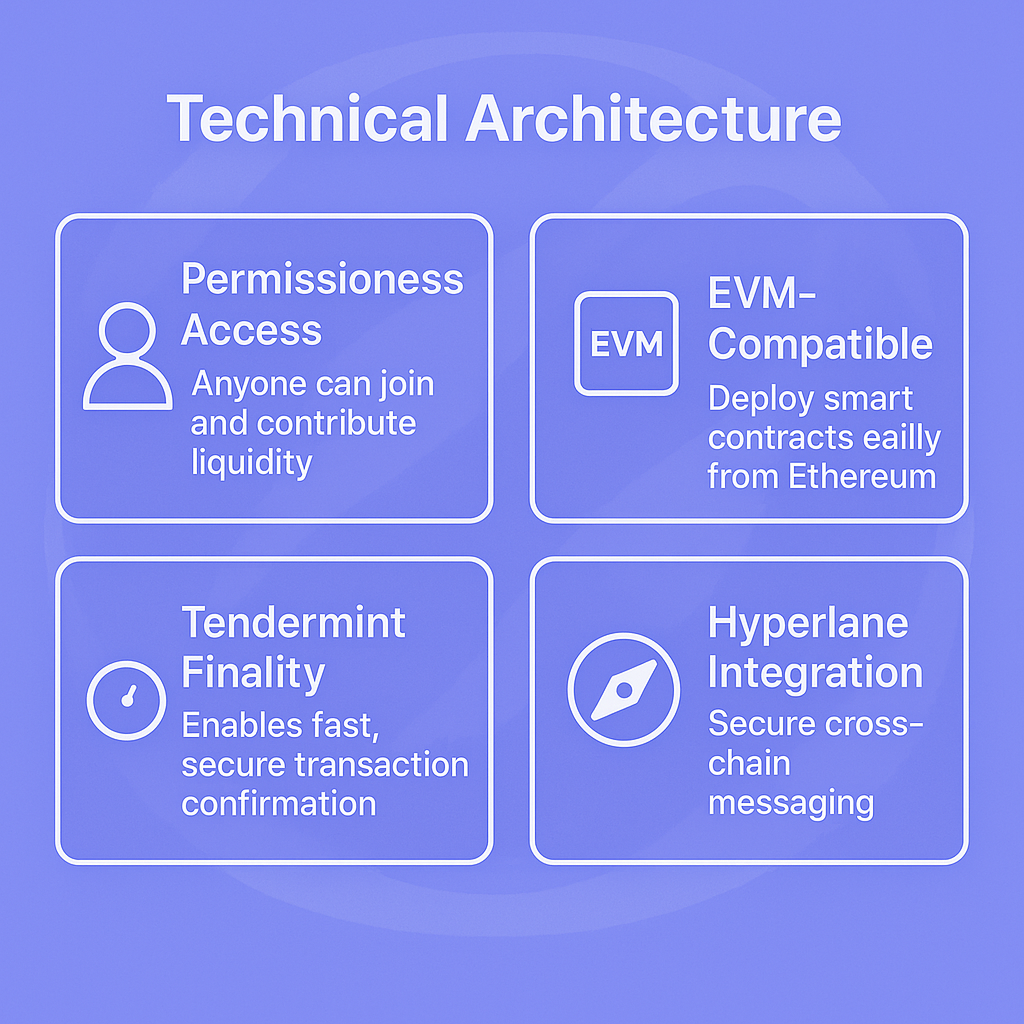

⚙️ Technical Architecture

Mitosis is purpose-built to serve as the liquidity layer for modular blockchains like Celestia, Monad, and Cosmos chains. Key design elements include:

| Feature | Description |

|---|---|

| 🔓 Permissionless Access | Anyone can join and contribute liquidity |

| 🔄 EVM-Compatible | Deploy smart contracts easily from Ethereum |

| ⚡ Tendermint Finality | Enables fast, secure transaction confirmation |

| 🌐 Hyperlane Integration | Secure cross-chain messaging |

💡 Learn more in TokenMetrics Review

🌍 Strategic Developments

Since its stealth debut in late 2023, Mitosis has rapidly gained traction:

- 💸 $7M Seed Round led by Amber Group & Foresight Ventures (Source)

- 🚀 Testnet Launch (March 2024): Thousands of users joined Expedition Testnet

- 📈 $100M+ in TVL by mid-2024 (Proof)

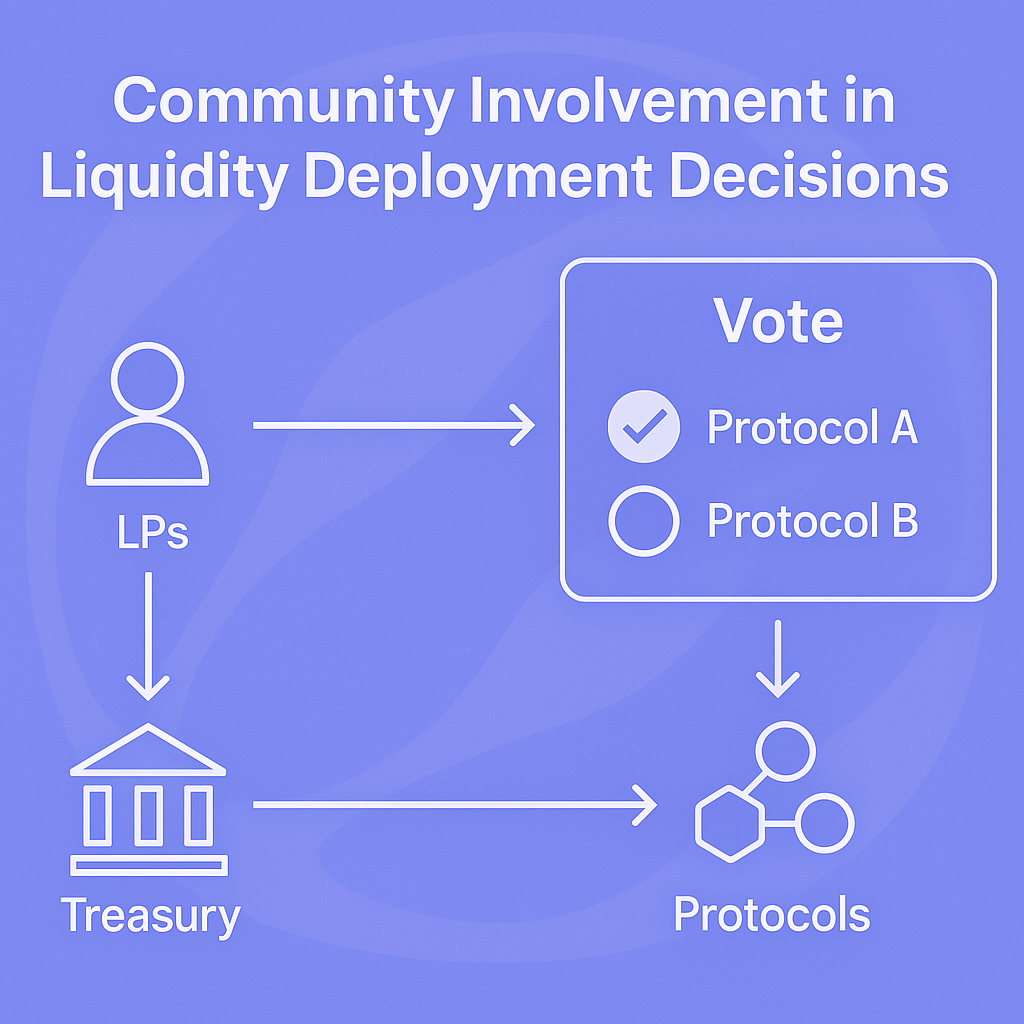

🧑🤝🧑 Community-Governed Liquidity

LPs aren’t passive – they vote on which chains/protocols receive liquidity and how rewards are distributed. This makes Mitosis a collaborative liquidity DAO rather than just an allocator.

Image: Community involvement in liquidity deployment decisions.

🔭 What's Next for Mitosis?

Looking forward, Mitosis is preparing for:

- Mainnet Launch with modular security primitives

- Multi-chain support: Linea, Scroll, Celestia, Monad, and more

- Matrix Vault Campaign: A program to test liquidity routing efficiency and reward users (📌 Follow @MitosisOrg)

🧠 Why It Matters

Mitosis is redefining what it means to be a liquidity provider in 2025. Rather than chasing APYs across bridges and farms, LPs now get access to:

✅ Cross-chain exposure

✅ Governance influence

✅ Real yield from multiple protocols

✅ Liquid staking via miAssets

Comments ()