Mitosis and the Architecture of Cross-Chain Liquidity

Introduction

Liquidity fragmentation remains one of the most stubborn challenges in DeFi. With capital scattered across hundreds of chains and thousands of dApps, efficiency is diminished, and composability is compromised. Mitosis offers an architectural solution: a Layer 1 blockchain purpose-built to unify fragmented liquidity using innovations like Ecosystem Owned Liquidity (EOL), miAssets, and cross-chain vault architecture.

This article explores how Mitosis addresses capital inefficiency through a modular and composable design framework, and how its novel primitives enable a scalable and sustainable DeFi liquidity layer.

Fragmentation: The Core Problem

Existing liquidity solutions typically operate within isolated ecosystems or rely on brittle bridge protocols. This leads to:

- Redundant liquidity provisioning across multiple chains

- High costs for bridging and rebalancing

- Lower TVL utility due to capital inefficiency

Mitosis begins with a different design: cross-chain liquidity from the base layer.

Key Innovations

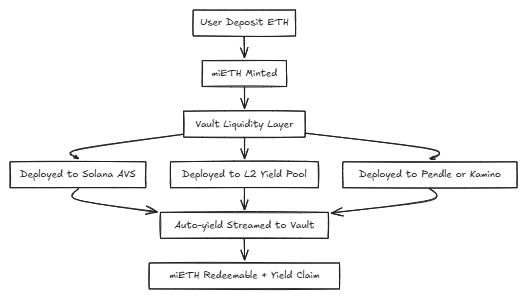

1. miAssets

Tokenized representations of assets that are natively interoperable across chains. Users deposit into Mitosis, receive miAssets (e.g. miETH, miUSDC), and those can be deployed across ecosystems with intent-based routing.

2. Vault System

Vaults act as liquidity sources for cross-chain execution. Assets deposited in vaults can be used across chains simultaneously.

3. EOL - Ecosystem Owned Liquidity

Instead of relying on mercenary capital, Mitosis builds protocol-owned liquidity. This model aligns incentives, reduces reliance on unsustainable yield farming, and improves capital stickiness.

Modular Liquidity Flow

Why This Matters

Mitosis isn’t simply another interoperability bridge. It’s a chain-level abstraction of liquidity movement:

- Improved capital efficiency: One deposit can serve multiple chains.

- Yield optimization: Solver engines (e.g., Morse) route assets to optimal strategies.

- Security model: MITO staking aligns incentives and secures the network.

Real-World Utility: A Yield Example

A user deposits ETH. It becomes miETH. This single asset can be:

- Restaked into EigenLayer AVSs on Ethereum

- Used as collateral on an L2 lending protocol

- Routed into Pendle for fixed yield

All from one intent. No manual bridging. No fragmentation.

Comments ()