Mitosis and Theo collaboration: the exclusive liquidity opportunity

Introduction:

Mitosis, a decentralized finance (DeFi) platform specializing in programmable liquidity, has partnered with Theo Network to enhance its Matrix Vaults system. Matrix Vaults are designed to provide liquidity providers with curated, high-yield opportunities across multiple blockchain networks.

Theo Network is Mitosis’s first selected partner to integrate with Matrix Vaults, aiming to offer exclusive liquidity opportunities with enhanced rewards and a transparent structure.

Why Theo:

Theo Network is a custom built to enable protocols and end users to access every venue and margin, across DeFi, Theo is built with straddle which is a strategy that runs a basis trade but allows end users to borrow cash, deposit and mint stables from the Theo network's system with the alliance of big lending markets. And if all are connected as a decentralized system, that is both safe, secure and efficient. Theo is also building a custom validator set which will serve as their own internal oracle margin system risk engine.

Yields can be increased for end users who deposit in the Theo network's vault with the custom strategy like straddle on this infrastructure which can help to access higher yields than any other protocol in the space.

Why Mitosis alliance

Mitosis have the vision to professionalize the market and basically bring it away from shadow deals and underhanded tactics and actually give retail the power to access all types of institutional deals, private and angel investors are getting which is the vision of crypto. The whole point is to democratize finance in DeFI

What Theo is building is exactly what mitosis is building as well, a built infrastructure in form of a network where transparency is prioritized, Mitosis has the same scale or even more scale than some of these private TVL deals, private TVL dealmakers or institutions, but it's fully transparent, and it allows theonetwork to directly talk to the community so theo can actually work with the Mitosis community rather than just one big firm. And so you know, not only do the team achieve high TVL, but they get to grow their community genuinely.

Also retails are given access to same quality deals that big institutions get but in fully transparent way that's in public, this is the way that retails can actually make bigger than institutions

Read about maAssset here

Benefits of the Matrix alliance

- Incentives: basically there is a liquid token incentive or the fixed token incentive that mitosis offers with other protocols, So, there's a fixed token incentive that's given out per dollar of TVL that's deposited in Theo's system. depositors will be able to earn Theo tokens and straddle yield and Mito points.

- Security: Theo actually spent much time prioritizing security, over everything else. There is no single point of failure within Theo's system. All of the funds are kept within, within either the vaults that are controlled by decentralized validators set with multiple validators running independently or an accounts that are controlled by a multisig structure with the keys constantly being rotated within a trusted execution environment outside of our control

- it's physically impossible for them to get a hold of those keys because they're being rotated within isolated environments that are fully encrypted. And so and being rotated, it's then being controlled by multiple signers that are also fully encrypted. Theo does their absolute best to ensure that there's multiple fallbacks and that there's very low chance of any type of hack happening, especially even if multiple end signers or controllers of that even validators or or, private keys are compromised because these keys are held within encrypted environments that are fully isolated from our systems that are not controlled directly by us, we're able to ensure that, yeah, the funds are safe.

- Withdrawals mechanism: unlike other traditional lockup periods that have a long lock-up period, the matrix vault actually have a shorter lockup time of 2 days just to give time for trade exit without incurring significant execution costs, it's a low latency infrastructure built for high frequency trading, so the protocol can be able to get the best possible execution on chain and off chain, so mitosis users are never trapped, the withdrawal period is expected to be set for 3 days

- Composability: Depositors receive maAssets, tokenized representations of their deposited assets, which can be utilized across various DeFi applications. This feature enables users to engage in multiple investment strategies simultaneously, enhancing capital efficiency.

Participation eligibility

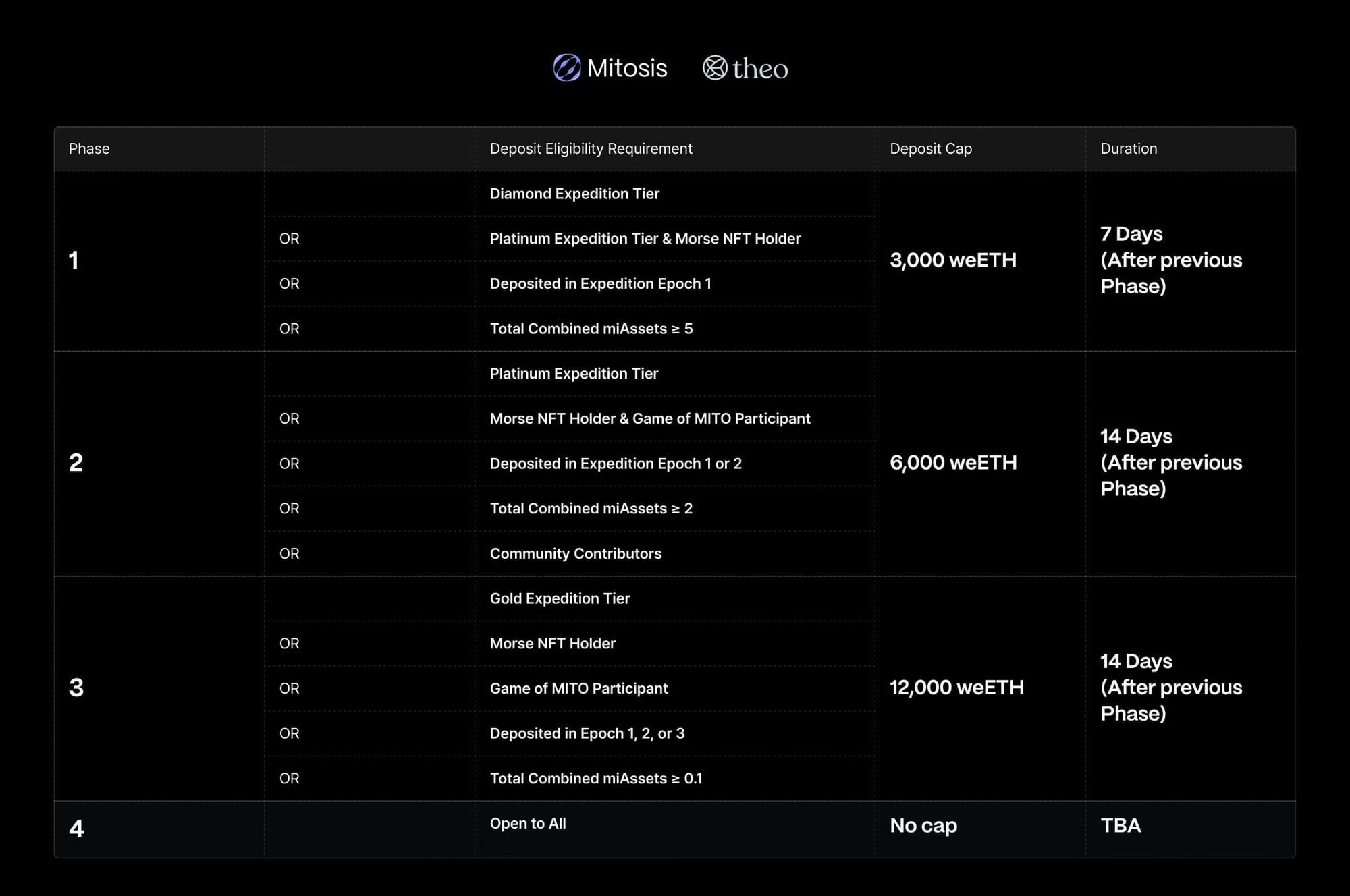

Participation for the matrix campaign of 4 distinct Phases, each with its own deposit cap.

A Phase concludes when it reaches its deposit limit or the set duration ends.

Participants from earlier Phases are also eligible to join all future Phases.

The “&” symbol signifies that both conditions must be fulfilled to qualify for a given Phase (e.g., “Platinum Expedition Tier & Morse NFT Holder” means the user must be both an Expedition Platinum Tier member and a Morse NFT Holder). details link

Eligible assets:

《》MiweETH

《》weETH

Supported chains:

《》Ethereum

《》Arbitrum

《》Linea Details

Conclusion

The collaboration between Mitosis and Theo Network on Matrix Vaults represents a significant advancement in DeFi liquidity solutions. By introducing a structured and flexible approach to liquidity provision, this partnership benefits both liquidity providers and protocols. Participants gain access to diversified, cross-chain yield opportunities while maintaining liquidity through tokenized maAssets. Meanwhile, protocols receive more stable and predictable liquidity, reducing the need for continuous incentive programs.

Overall, the Matrix Vault initiative enhances capital efficiency, mitigates risks through diversification, and expands opportunities for users and projects alike. This collaboration sets the stage for more sustainable and scalable liquidity frameworks in the evolving DeFi landscape.

Useful links

The matrix vault: https://university.mitosis.org/glossary/matrix-vaults/

The Inaugural Matrix vault: https://blog.mitosis.org/blog/introducing-straddle-supply-opportunity-with-mitosis

Comments ()