Mitosis as Middleware: Liquidity Infrastructure in the Modular Rollup World

Introduction

As Ethereum and other ecosystems shift toward modularity, the need for middleware infrastructure becomes clear. While rollups provide scalability and execution, they lack unified liquidity layers. Without native interoperability, capital becomes siloed. This is where Mitosis emerges—not as a bridge, not as a DEX, but as liquidity middleware that serves the intent-driven, cross-chain modular future.

In this article, we explore how Mitosis acts as connective tissue between fragmented rollups, enabling liquidity flow, yield strategies, and composability across execution environments.

Why Rollups Need Middleware

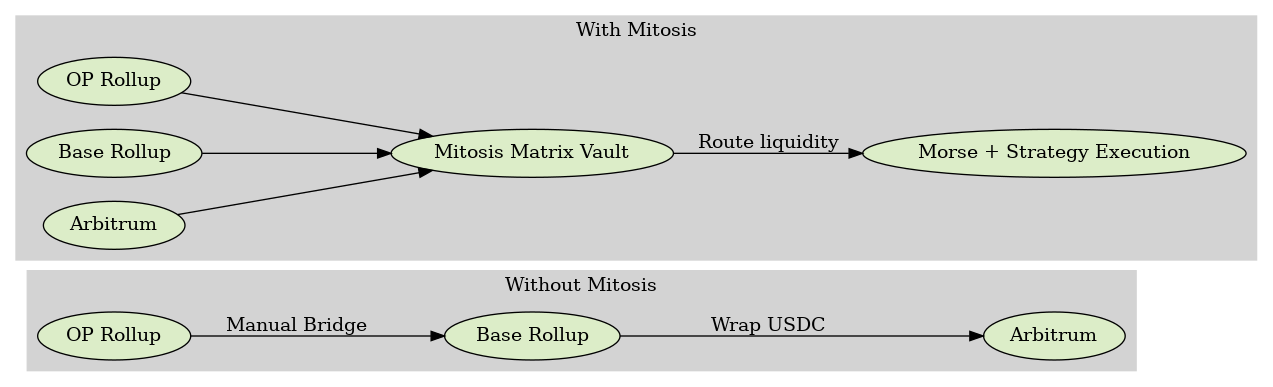

Rollups like Optimism, Arbitrum, and Base solve for throughput. But their isolation leads to:

- Fragmented asset liquidity

- Redundant bridging or wrapping

- Poor UX for multichain users

Middleware protocols are emerging to solve this problem, abstracting asset routing, liquidity sync, and execution intents. Mitosis fits squarely into this new category.

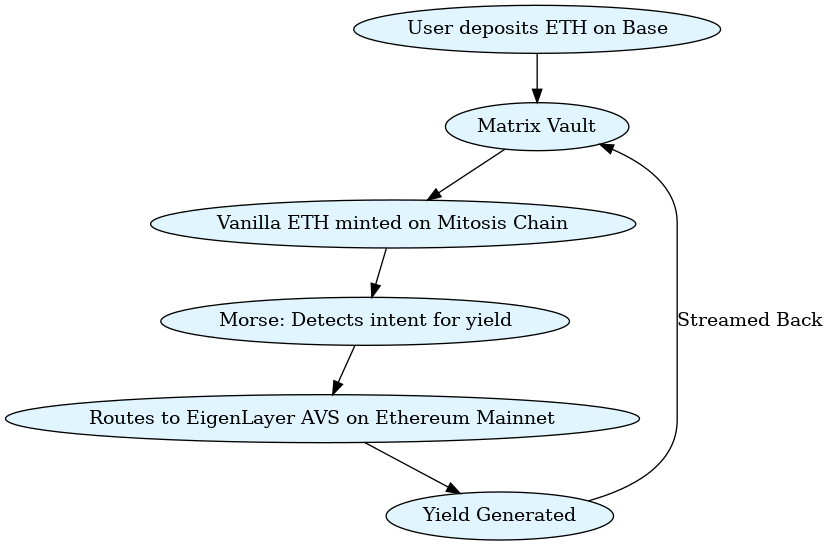

Mitosis Architecture Recap

Mitosis consists of several key primitives:

- Matrix Vaults: Accept deposits and mint 1:1 Vanilla Assets on the Mitosis chain

- Vanilla Assets: Unwrapped representations of user capital that can be routed

- Morse: An intent-routing engine that connects user intents to available yield strategies

- Cross-Chain Execution Layer: Powered by integrations like Hyperlane for secure message-passing

These primitives allow Mitosis to sit between user capital and multichain execution environments.

Mitosis as Shared Liquidity Layer

Middleware is only useful if it is both composable and scalable. Mitosis achieves this by:

- Being rollup-agnostic: It can serve L2s, appchains, and alt-L1s

- Using Vanilla Assets: No wrapping, no bridge risk

- Enabling modular yield routing: Morse routes capital based on user intents and strategy availability

This positions Mitosis as a shared liquidity fabric under the modular blockchain stack.

Rollup Liquidity Without Mitosis vs With Mitosis

Composability & Interop

The endgame of modularity isn’t just scalability—it’s composability across chains. Mitosis enables this by:

- Making liquidity chain-abstracted

- Enabling gasless, intent-based UX

- Providing a platform for unified strategy access (AVS, RWA, LRT)

Mitosis doesn’t replace rollups—it amplifies them.

Conclusion

As rollups proliferate, middleware becomes essential. Mitosis offers the liquidity layer missing from today’s fragmented multichain reality. Through Matrix Vaults, Morse routing, and chain-agnostic vanilla assets, it creates a unified layer for capital efficiency.

In the modular blockchain world of 2025, Mitosis doesn’t compete with rollups. It completes them.

Comments ()