Mitosis Blockchain: Leveraging NFTs for Proof of Liquidity

Abstract

This article explores how Mitosis, an Ecosystem-Owned Liquidity (EOL) Layer-1 blockchain, can leverage Proof of Liquidity (PoL) concept, recently brought up to date -with mixed results- by Berachain to "bolster both the application-layer and chain security".

Mitosis using Ethereum Proof of Stake (PoS) for security via EigenLayer, the purpose here is to focus on the application layer increasing liquidity with curated provenance from selected NFT collections.

This proposal is using the MORSE tokens created by Mitosis team as the flagship, utilizing ERC-404's hybrid fungible-non-fungible features as well as lock and mint bridge for selected top tier NFT collections on Ethereum to enhance DeFi liquidity, community engagement, and $MITO price stability.

In today's dynamic market environment, PoL emerges as strategy for revitalizing NFTs and advancing the Mitosis ecosystem.

Introduction and Literature Review

General Principles

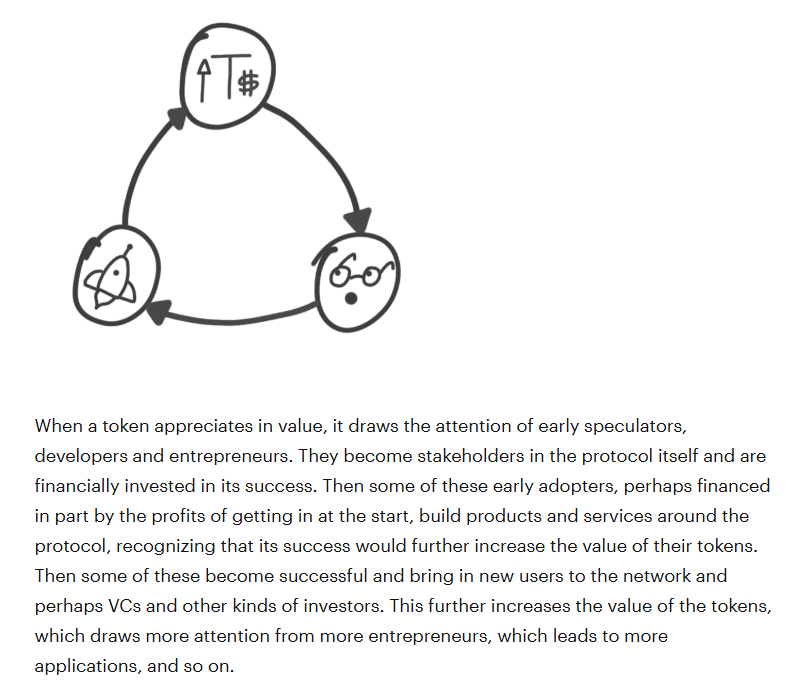

The Fat Protocol Thesis suggests value accrues to protocol tokens (like $BERA or $MITO), necessitating sustainable tokenomics (Monegro, 2016).

Most behavioral studies such as the famous Game Theory informs incentive structures for liquidity providers (Osborne, 2004).

Non-Fungible Tokens

Non-Fungible Tokens (NFTs), much like fungible cryptocurrency tokens, stand as a cornerstone of the digital asset industry. They pioneer the concept of unique crypto-objects, forming a vital pillar in the realization of a fully tokenized economy.

NFTs have integrated DeFi and Governance, notably with Uniswap V3’s NFT-based liquidity positions enabling tradeable stakes and vote-escrow NFTs (e.g., Velodrome’s veNFTs) facilitating governance flexibility.

Mitosis Blockchain

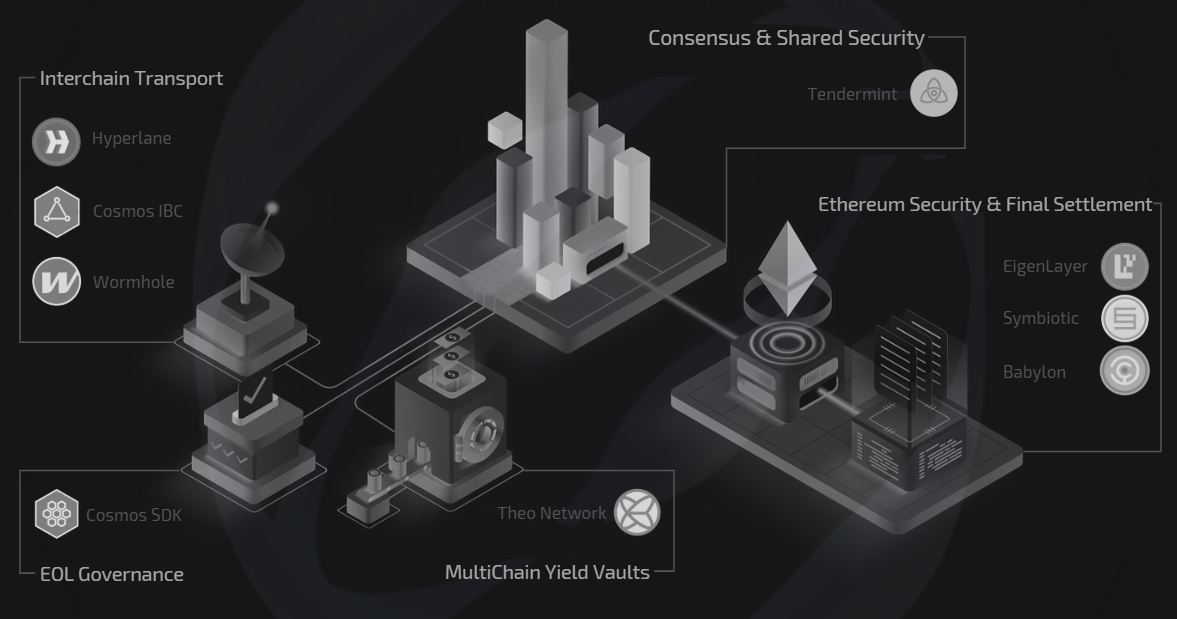

Mitosis is a Layer-1 (L1) blockchain built on the Cosmos SDK, designed to unify and tokenize liquidity across modular ecosystems, branded as the “Network for Programmable Liquidity.”

Employing Proof-of-Stake (PoS) consensus with Ethereum’s EigenLayer security, Mitosis uses its native token, $MITO, for gas, staking, and governance (Mitosis Docs).

Berachain

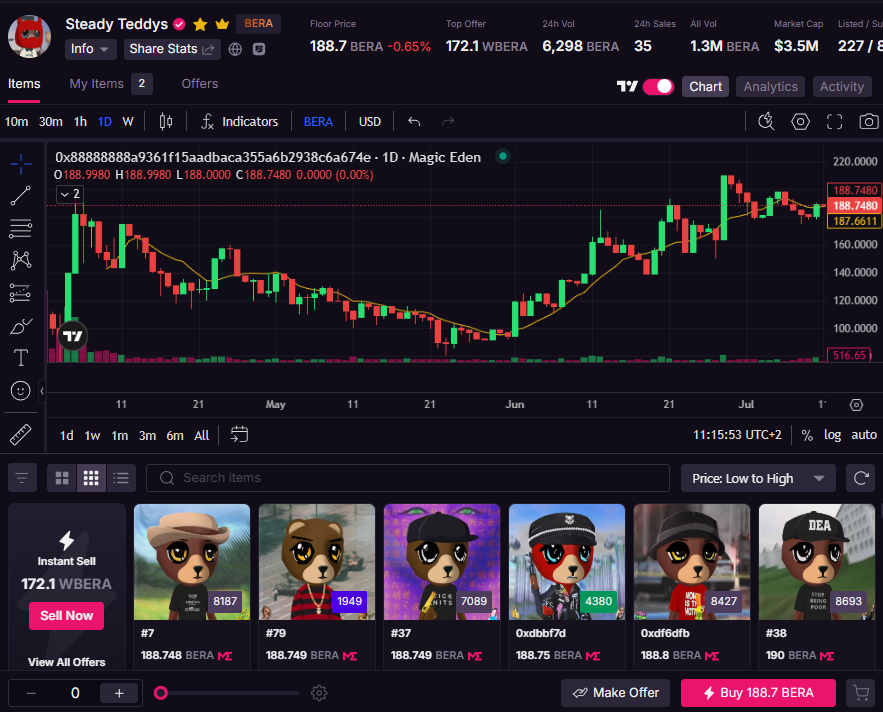

Berachain is referenced here for benchmark in terms of PoL infrastructure but also regarding the recent price action of $BERA, showing how inflation spirals can devastate fungible tokens while the USD value of prominent NFT collections like Steady Teddys are showing more resilience.

MORSE NFT Collection

MORSE NFT collection on Ethereum is using the ERC-404 standard, it has fostered a vibrant community and serves as a foundation for liquidity incentives. ERC-404's hybrid nature, combining fungible token mechanics (ERC-20) with non-fungible uniqueness (ERC-721), enables fractional ownership and liquidity, making it ideal for PoL (ERC-404, 2024).

Context and Content

$MITO is expected to launch with the Mitosis Mainnet in the coming weeks.

Berachain Mainnet has been live since February 2025, and, despite high community engagement -notably through NFT collections- and a successful testnet campaign, it has struggled with an 82% price decline in $BERA by mid-2025.

Therefore, the research problem is: How can Mitosis implement PoL for selected NFTs collections to drive liquidity without inflationary risks?

Using comparative analysis, tokenomics design, and blockchain interoperability principles, trying to build a robust model for Mitosis.

Berachain’s Inflation Risks and NFT Resilience

Berachain's downfall illustrates inflationary spiral risks in PoL systems.

PoL incentivizes liquidity provision for network security, with validators staking $BERA and managing pools to earn rewards, but $BERA’s price action reveals flaws:

- Tokenomics: A 10% inflation rate and 35% private allocation led to a 45% supply increase in Year 1 and 150% in Year 2, driving $BERA from $14 (Q1 2025) to $1.75 (June 2025), an 90% drop.

- Sentiment: Transparency issues (e.g., late investor staking disclosures) and insider selling eroded trust as well, ultimately reducing active users by 85% in June 2025, with TVL falling 72% from $1.6B to $0.5B (The Defiant, 2025).

- PoL Delays: Initial PoL absence left $BERA without utility, while its security reliance on $BERA’s value weakened as prices fell.

Fungible tokens bore the brunt, as emissions diluted value and fueled sell pressure. However, NFT collections like Steady Teddies demonstrated resilience, holding value and liquidity despite the spiral. As a 4,200-item Berachain NFT, Steady Teddies saw high volume (36k ETH in 7 days by June 2025) and strong community. Its scarcity and utility (e.g., IP, giveaways, staking, airdrop) insulated it from inflation, maintaining floor prices above ecosystem averages while $BERA crashed.

This shows NFTs can anchor liquidity in volatile PoL systems, a potential lesson for Mitosis.

Why and How PoL on Mitosis Could Be a Play for Selected NFT Collections

PoL on Mitosis could be a strategic play for selected NFT collections like MORSE by using ERC-404's hybrid features to blend fungible liquidity with non-fungible rarity.

ERC-404 allows fractional ownership (fungible ERC-20 tokens representing % of NFTs), enabling small holders to stake fractions for yields while preserving NFT uniqueness for rarity/value.

This creates composable liquidity: users stake NFTs/fractions in Matrix vaults for $MITO rewards, governance, or fees, turning collections into productive assets.

For MORSE, as flagship, PoL could reward early holders with airdrops and boosted yields, fostering loyalty, deploying staking contracts optimized to enhance liquidity provision and rewards. Full NFTs yield higher APY (e.g., 10%) than fractions (proportional), with dynamic locks (e.g. 90 days for additional APY).

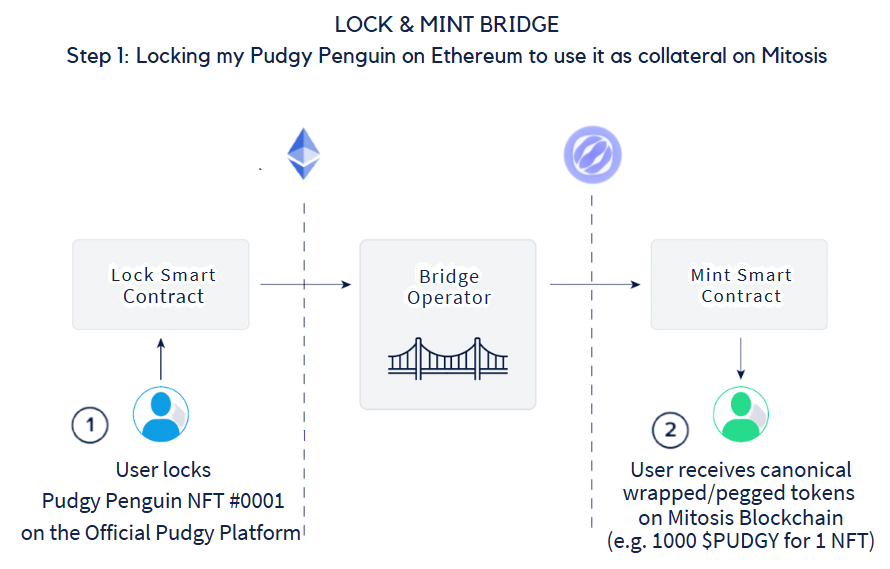

Selected collections (e.g., vetted for value/reputation/scarcity/utility), even without ERC-404 feature, could, through cross-chain smart contracts:

1. Freeze their NFTs on their native blockchain (e.g., Ethereum), using their official NFT staking platform using smart contracts and bridges to receive bridged fungible equivalent tokens (e.g., wrapped ERC-20) on Mitosis blockchain. (lock and mint)

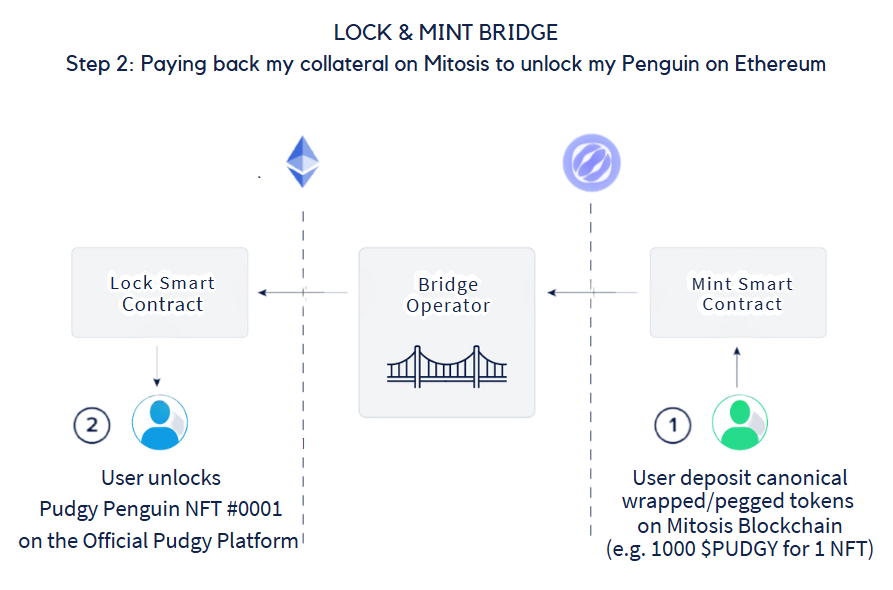

3. Swap, stake for yield, or use them as collateral for lending or trading perps on Mitosis blockchain DeFi protocols

4. Bridge back the same amount of equivalent tokens back to their NFT native blockchain - directly into the NFT staking platform to unfreeze their NFTs. (burn and release)

This process is only as reliable as the trust you put in the smart contracts and the minting authority of the NFT collections selected:

- Smart contracts should be audited (e.g., by PeckShield or Certik) to prevent vulnerabilities.

- A coefficient can be set for the reputation of the minting authority (collection owner or DAO) multiply it in real-time by the floor price of the collection to determine the collateral value of the NFTs on Mitosis.

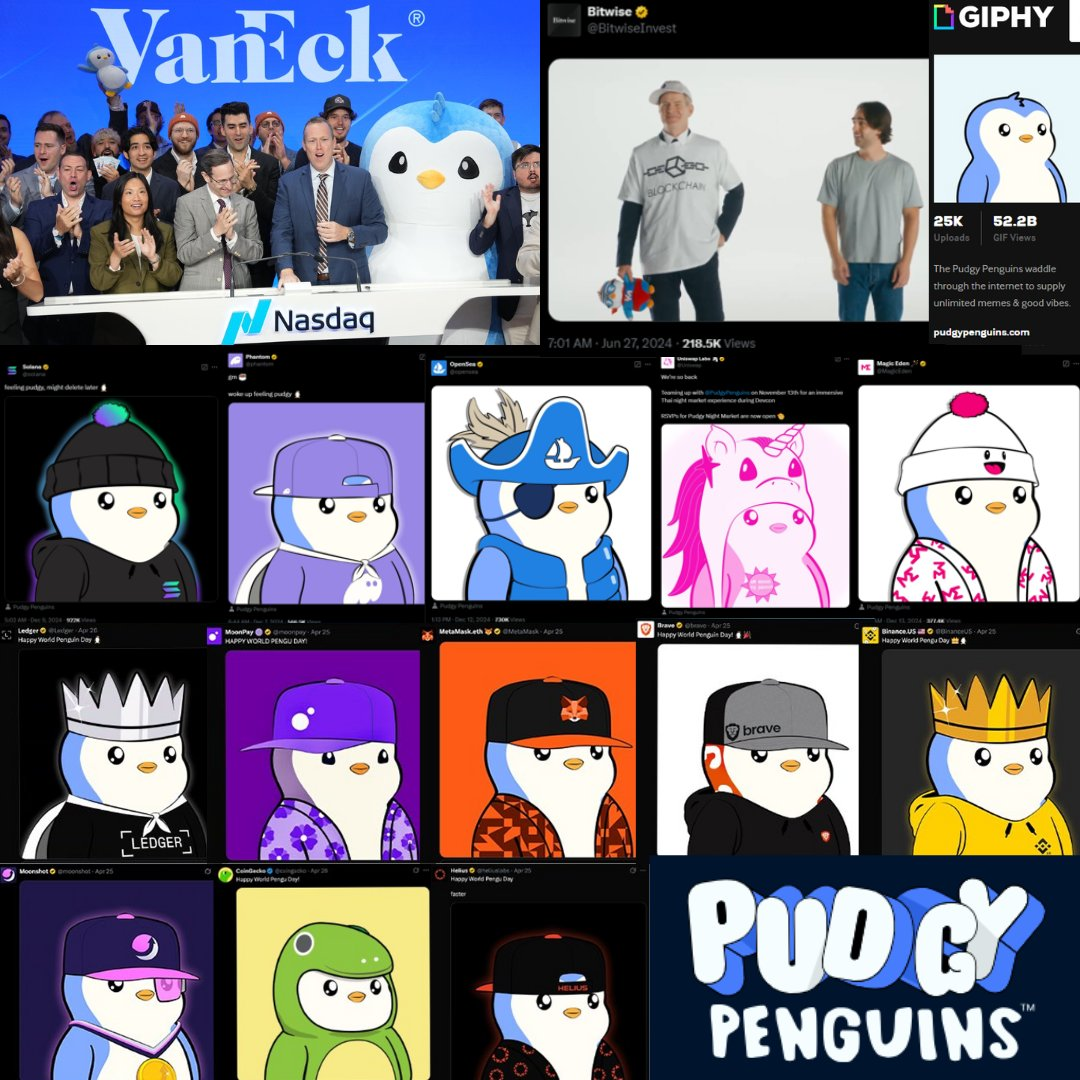

For instance, 50% of the floor price of Pudgy Penguins should be an acceptable risk for DeFi protocols on Mitosis, as it's a (very) conservative loan-to-value (LTV) ratio for volatile assets.

They could also weight the potential of on-boarding high-profile Ethereum wallets with extra rewards and perks, such as boosted yields, exclusive airdrops, or soulbound NFTs for VIP governance, to attract more TVL and, ultimately more demand for $MITO tokens.

Mitigating $MITO Price Action Risks

To avoid inflation-driven collapse similar to $BERA, Mitosis must balance token incentives with NFT-based value:

- Reduced Token Emissions: Allocate 50% of LP incentives as Liquidity NFT yields or bridged wrapped token rewards, capping $MITO inflation at 5%.

- NFT-Based Demand: Require MORSE or Liquidity NFT holdings to access governance rights or protocol revenue, increasing $MITO demand.

- Long-Term Alignment: Introduce soulbound Liquidity NFTs for long-term LPs and reward lock periods (e.g., 14–90 days) on staking.

These measures encourage sustainable $MITO demand and liquidity lock-up, while reinforcing MORSE and bridged NFT utility.

Recommendations and Best Practices

To implement an NFT-based PoL system to feed its DeFi Apps ecosystem, Mitosis would need:

- Bridge Infrastructure: Deploy an audited Ethereum-Mitosis bridge protocol using custom lock-and-mint logic compatible with ERC-404 and wrapped ERC-20 equivalents.

- Cross-Chain NFT Onboarding: Integrate major collections (e.g., CryptoPunks, Azuki) through their native staking contracts and mint wrapped equivalents on Mitosis.

- Community Integration: Reward top tier collection holders with $MITO airdrops and governance roles, extending MORSE’s community to major web3 players. Gamify Liquidity NFTs with leaderboards and badges.

- Liquidity NFTs: Mint Matrix Vault NFTs or wrapped tokens for staked assets. Offer tiered APYs (e.g., 8–12%) based on duration.

- Trust Coefficient: Assign reputation-based multipliers to collection floor prices to determine real-time collateralization metrics.

Conclusion

Mitosis can redefine interchain liquidity by attracting large NFT collections to freeze value on their origin chains and unlock productive assets on Mitosis via trust-minimized bridging.

Through ERC-404 native features (e.g., with bridged MORSE) and wrapped tokens from other chains, NFTs can become capital-efficient, yield-bearing assets.

This strategy avoids inflation, enhances protocol TVL, and builds composable DeFi infrastructure.

Future research should explore bridge standardization, wrapped NFT valuation models, and dynamic oracle integrations to manage risk and unlock DeFi-native NFT utility at scale.

Comments ()