Mitosis: Building the Modular Mesh for Interchain Liquidity

The evolution of decentralized finance (DeFi) has been marked by fragmentation across ecosystems, resulting in inefficiencies in liquidity, capital movement, and user experience. As the industry matures, the need for a seamless, interoperable financial layer has become paramount. Mitosis steps into this gap as a modular asset protocol engineered to unify fragmented liquidity across chains and offer composability, scalability, and security at its core.

In this article, we explore Mitosis’s modular architecture, how it leverages synthetic assets to establish liquidity bridges between blockchains, and its ambitious roadmap to become the connective tissue of interchain DeFi.

Why the Modular Interchain Layer Matters

In today’s multi-chain world, liquidity is fractured across Layer 1s and Layer 2s like Ethereum, Arbitrum, Cosmos, and others. This fragmentation leads to:

- Inefficient capital deployment

- Limited composability between DeFi apps

- High user friction in bridging assets

Mitosis is built with the conviction that liquidity should be modular, mobile, and multi-chain-native. Rather than competing with existing ecosystems, it integrates with them, creating a mesh network of interoperable liquidity rails.

The Architecture of Mitosis

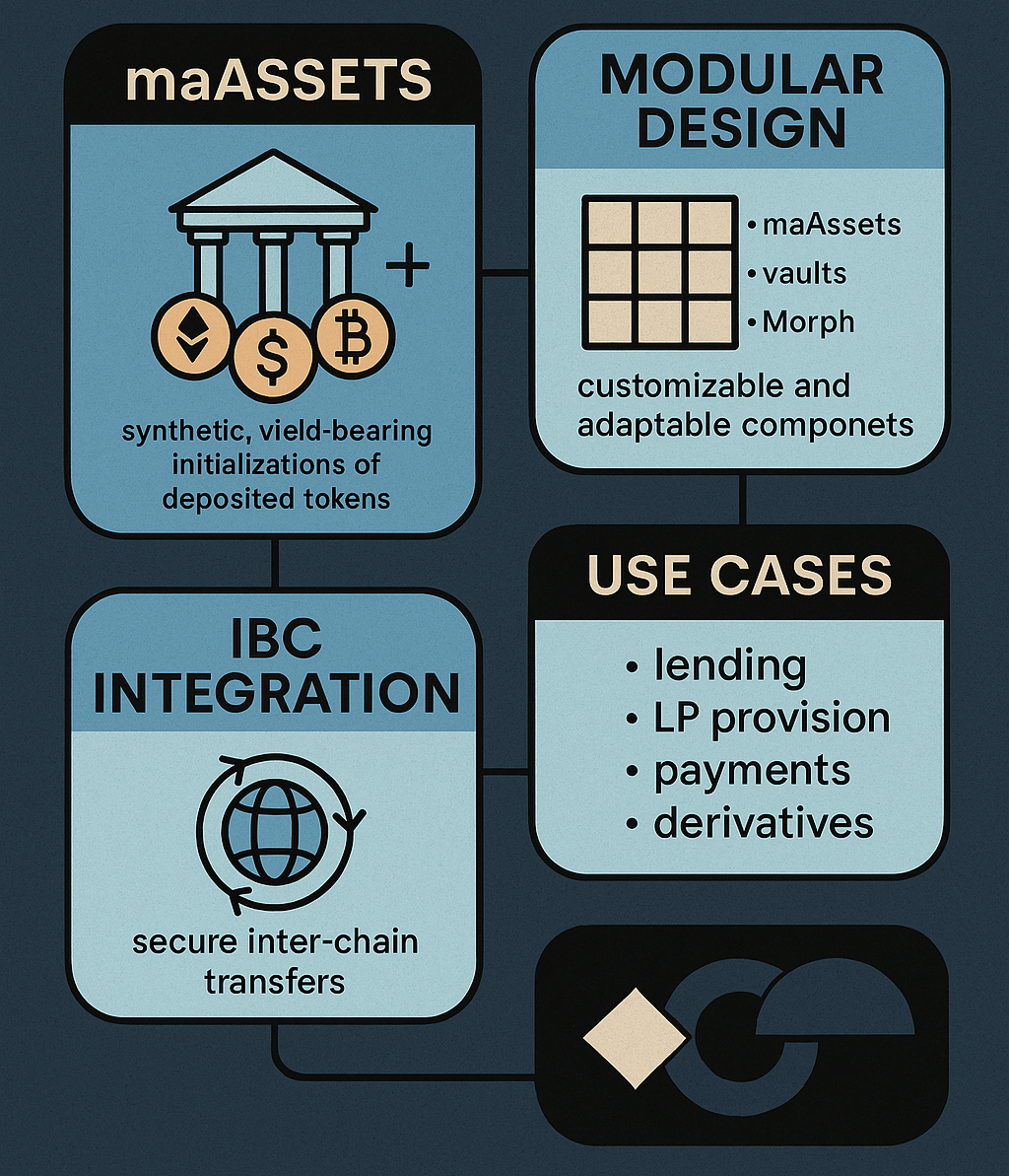

At the heart of Mitosis lies a modular design that empowers it to function as a flexible, scalable infrastructure across diverse blockchain ecosystems. This modularity enables seamless integration with both Layer 1 and Layer 2 networks, making Mitosis a robust interchain liquidity layer. The protocol is anchored by three primary components: maAssets, Vaults & Synth Modules, and Morph.

maASSETS: The Synthetic Fuel of the Mitosis Ecosystem: maAssets, short for Mitosis Assets—are synthetic, yield-bearing tokens designed to represent underlying base assets deposited into the Mitosis system. Far more than simple wrappers or derivatives, maAssets are engineered to be portable, interoperable, and composable, offering users a seamless and standardized interface to interact with decentralized finance (DeFi) protocols across multiple blockchain ecosystems.

Synthetic by Design: At their core, maAssets are minted when users deposit supported assets, such as ETH, USDC, WBTC, or other ERC-20/Cosmos-native tokens, into Mitosis smart contract vaults. These base assets are held in a non-custodial, secure manner while the system issues an equivalent amount of maAssets that synthetically reflect the value of the deposit. Unlike static tokens, maAssets are designed to accrue yield through various DeFi strategies, meaning their value proposition increases over time relative to their base assets.

Yield-Bearing Utility: Once in circulation, maAssets open doors to advanced yield opportunities. Users can lend them via Morph’s lending markets, stake them in governance or vault contracts, or swap them via cross-chain AMMs. This utility ensures that maAssets are not only passive reflections of value but active financial instruments that can generate returns, contribute to governance, and power liquidity provision.

Cross-Chain Interoperability: Thanks to Mitosis’s native integration with IBC (Inter-Blockchain Communication), maAssets can move fluidly between supported blockchains, enabling their holders to participate in DeFi applications on Cosmos, Ethereum, Arbitrum, and beyond without the need for traditional bridging. This drastically reduces fragmentation in user experience and capital efficiency while minimizing risks associated with third-party bridge infrastructure.

Composability at Its Core: maAssets are composable, meaning they can be integrated with multiple protocols simultaneously. For example, a user could:

- Mint maUSDC,

- Lend it on Morph,

- Stake the interest-bearing token,

- Earn Zoots, and

- Trade it on an AMM or deploy it as collateral—all within a single, composable transaction pipeline.

This layered approach to asset deployment empowers users to optimize yield while maintaining fluid asset control.

Unified Standard for Interchain Finance: Vaults and Synth Modules serve as the custodial layer and minting mechanism. Vaults accept native assets and issue corresponding maAssets, while Synth Modules manage collateralization, pricing, and real-time security. This design ensures that all maAssets are fully backed and transparent.

Morph is the decentralized finance (DeFi) powerhouse that fuels the broader Mitosis ecosystem. More than just an ancillary module, Morph serves as the economic core, where synthetic assets (maAssets) come to life through powerful yield-generation strategies and composable financial instruments. By integrating a suite of foundational DeFi primitives such as lending markets, automated market makers (AMMs), and staking protocols, Morph transforms maAssets from passive representations of value into active tools for maximizing capital efficiency.

Lending and Borrowing: Through Morph’s lending infrastructure, users can supply maAssets to liquidity pools and earn interest from borrowers. This mirrors the functionality of traditional DeFi platforms like Aave or Compound but is optimized for interchain compatibility and synthetic assets. Borrowers can also take out overcollateralized loans using maAssets, thereby gaining access to liquidity without the need to sell their holdings.

AMMs and Swaps: Morph’s built-in AMMs allow for seamless swaps between maAssets and other supported tokens within the Mitosis Matrix. The design focuses on low slippage and cross-chain operability, encouraging decentralized trading and arbitrage while maintaining deep liquidity. Users benefit from tight spreads and reliable pricing without depending on centralized exchanges.

Staking and Yield Farming: Morph also supports advanced staking mechanisms where users can lock maAssets to secure the protocol or participate in liquidity mining campaigns. These incentives are further gamified via Mitosis-native reward systems like Zoots (points earned through ecosystem engagement), ensuring that both casual users and professional yield farmers find value in participation.

A Composable Layer: What sets Morph apart is its composability. maAssets can be deposited in a lending pool, used as collateral, swapped through an AMM, and staked in governance or reward systems, all without leaving the Mitosis ecosystem. This enables a layered yield strategy, where users can stack returns from multiple sources simultaneously. For example, an individual could earn interest from lending, Zoots from ecosystem participation, and governance tokens from staking, all using a single maAsset.

Interchain Optimization: Morph is architected to work natively across multiple chains via the Inter-Blockchain Communication (IBC) protocol. This gives it a significant advantage over single-chain DeFi ecosystems by allowing users to deploy strategies and assets across various networks without bridging risks or added complexity.

In summary, Morph isn’t just a tool within Mitosis, it’s the economic engine that activates value, liquidity, and user engagement across the entire matrix. By abstracting complexity and maximizing yield potential, Morph empowers users to take full control of their digital assets in a modular, scalable, and highly interactive environment.

Together, these components form a modular, non-custodial ecosystem designed to standardize liquidity and create a seamless DeFi experience across chains.At the heart of Mitosis lies a modular design, which allows it to adapt and scale across various blockchain environments. It is structured around three core components:

1. maAssets (Mitosis Assets)

These are synthetic, yield-bearing representations of deposited tokens. When users deposit assets like USDC, ETH, or WBTC into Mitosis vaults, they receive maAssets in return.

- Interoperable: maAssets are IBC-compatible and move freely across supported chains.

- Composability-first: Can be used in DeFi strategies, AMMs, lending markets, and more.

- Backed 1:1: Each maAsset is fully collateralized by its base asset in smart contract vaults.

2. Vaults and Synth Modules

These vaults are chain-specific smart contracts that manage asset custody and minting of maAssets.

- Permissionless architecture

- Non-custodial with real-time audits

- Supports integrations with third-party protocols

3. Morph: Morph is the DeFi layer that enables users to deploy their maAssets in various financial primitives, lending, liquidity provision, synthetic trading, and more.

IBC Integration: Liquidity Without Bridges

One of Mitosis’s key innovations is its native IBC integration, allowing it to communicate seamlessly with Cosmos SDK chains. This eliminates the need for traditional bridges, which have been the source of some of the most catastrophic hacks in DeFi history.

By relying on Inter-Blockchain Communication (IBC), Mitosis ensures:

- Trustless transfers between chains

- Reduced bridge risk and downtime

- Greater developer interoperability across ecosystems

Mitosis essentially makes maAssets portable financial instruments, usable across ecosystems with minimal friction.

Use Cases of maAssets in the Interchain DeFi Stack

Once issued, maAssets unlock an entire universe of DeFi opportunities:

| Use Case | Description |

|---|---|

| Collateral in Lending Protocols | maAssets can be used in interchain money markets for borrowing/lending. |

| Liquidity Provision | Add maAssets to AMMs or stable pools across supported chains. |

| Farming and Incentives | Earn yield by staking maAssets in incentivized campaigns. |

| Cross-Chain Payments | Use maUSDC or maETH for seamless, low-cost value transfer across Cosmos chains. |

| Interchain Derivatives | Enable synthetic trading or options on top of maAssets. |

A Growing Ecosystem of Supported Assets

Mitosis continues to expand its asset support across ecosystems. Here’s a sample of key assets already integrated:

| Base Asset | maAsset | Chains Available |

|---|---|---|

| USDC | maUSDC | Ethereum, Arbitrum, Cosmos |

| ETH | maETH | Ethereum, Arbitrum |

| WBTC | maWBTC | Ethereum, Cosmos |

| USDT | maUSDT | Ethereum, Cosmos |

New integrations are constantly being added, especially with Cosmos-native tokens, L2 assets, and synthetic derivatives.

Security and Decentralization by Design

Mitosis’s approach to security is proactive and transparent:

- Open audits for all vaults and modules

- Immutable smart contracts once deployed

- Decentralized validator coordination for mint/burn transactions on IBC

Additionally, Mitosis leverages Cosmos-native consensus mechanisms for cross-chain integrity, enabling it to inherit the security guarantees of the chains it connects.

Roadmap Highlights

Mitosis is not just building for today, it’s charting a course for a fully modular interchain future.

| Milestone | ETA | Description |

|---|---|---|

| Zootosis Campaign Expansion | Q2 2025 | Further engagement layers for maAsset utility and user gamification |

| Cross-Chain Stablecoin Protocol | Q3 2025 | Launch of native maUSD using maAssets as collateral |

| ZK-Proof Vault Transparency | Q4 2025 | Real-time ZK-based audits for all vault positions |

| DAO Governance Launch | Q4 2025 | Mitosis token holders to control fees, assets, and integrations |

| L2 Deployment | Early 2026 | Full deployment on OP Stack, Base, and zkSync |

Comments ()