MITOSIS DAPPS: SpindleAG

What Is Spindle?

In the DeFi space, one of the most interesting tools being built for Mitosis is Spindle; a native yield-splitting mechanism. Instead of leaving your vault deposits locked and passive, Spindle lets you split them into two separate parts: your principal (PT) and your future yield (YT).

This approach doesn’t just add complexity, it fundamentally changes what you can do with your capital while it’s staked

HOW IT ACTUALLY WORKS

Let’s say you join a vault in Matrix or EOL, the campaign-based and community-governed vaults in the Mitosis ecosystem. When you deposit, you get back a tokenized vault position like maweETH if you deposit ETH.

With Spindle, you can now split maweETH into:

PT (Principal Token): this represents your original capital. At the end of the vault’s term, you can redeem the PT for your staked amount (subject to vault performance).

YT (Yield Token): this is your claim on all the future upside: rewards, partner tokens, protocol incentives → anything the vault is set to distribute. This split doesn’t happen automatically, it’s something you choose to do when you want more flexibility.

WHY SPLIT YOUR POSITION?

In most DeFi vaults, your position is completely bundled: your principal and yield are locked together until maturity. That means your capital is stuck, and you can’t respond to changing market conditions.

By splitting, you unlock a lot of new strategies:

Hedge: If you’re not bullish on the vault’s rewards, sell your YT immediately. You hold onto the PT, which still matures later.

Speculate: If you do believe the vault’s upside will be huge, buy more YTs at a discount to increase your exposure.

Unlock liquidity: Selling the YT now gives you immediate liquidity, while your PT still guarantees the principal payout later.

Earn fees: You can also LP PT and YT tokens on Chromo, the native liquidity hub, to earn trading fees from other users

In short, Spindle lets you respond to market sentiment instead of waiting and hoping

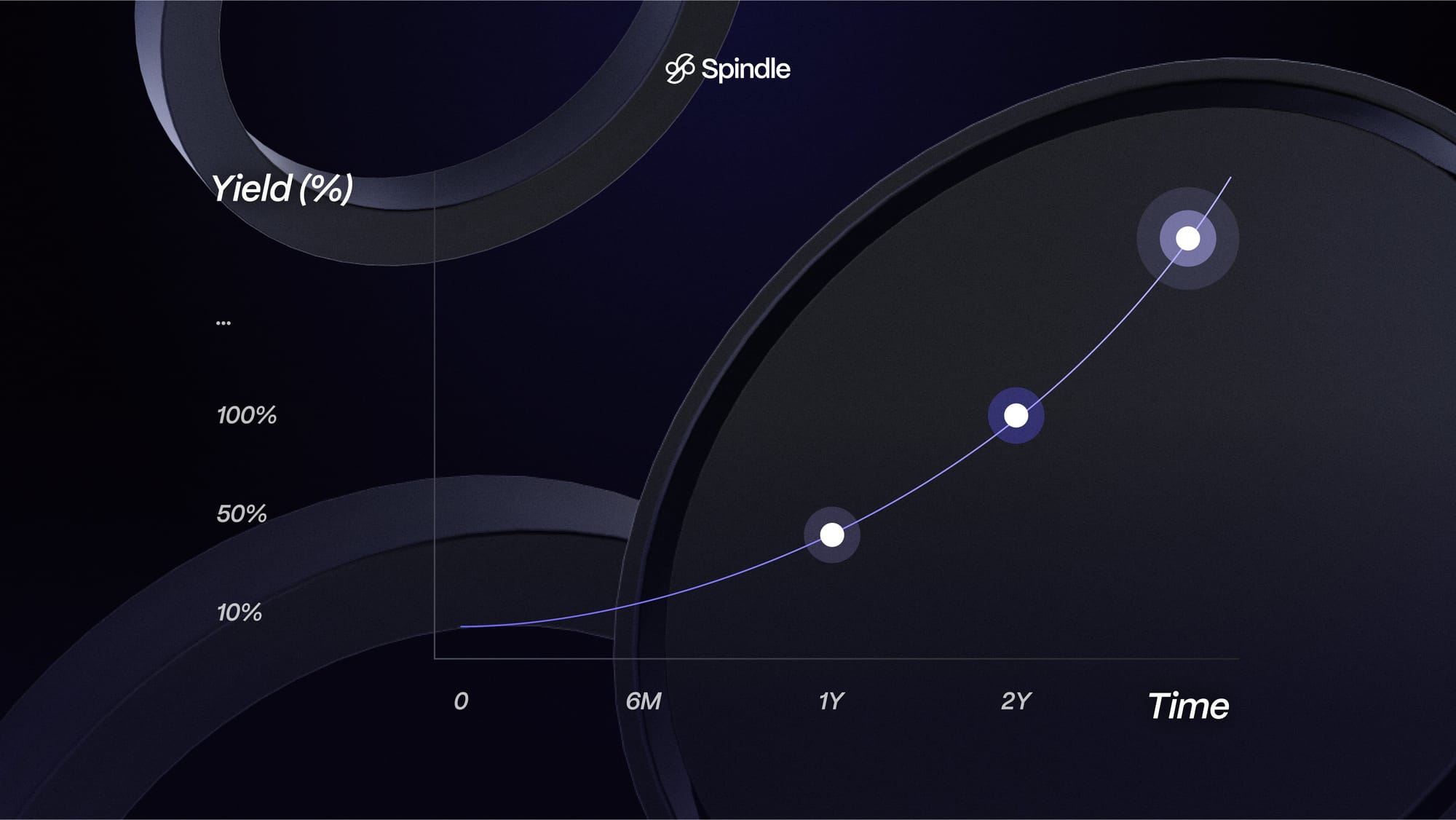

YIELD TOKEN PRICES TELL A STORY

One of the most interesting parts of Spindle is that YT prices become a live, market-driven signal of what traders think about the vault’s future rewards.

If YT prices are rising, the market is bullish: people believe those rewards are going to be valuable. If prices drop, sentiment turns bearish, the rewards seem less attractive.

This isn’t just speculation: it gives vault governance and liquidity providers a real-time pricing oracle for yield that hasn’t even been distributed yet. It’s crowdsourced valuation for future upside.

SPINDLE INSIDE MITOSIS

Spindle doesn’t exist on its own, it’s deeply integrated into the Mitosis ecosystem: Matrix & EOL produce the vault tokens (like maweETH) that can be split.

Chromo provides liquidity pools where you can trade PT and YT tokens, or provide LP to earn fees.

Telo lets you use PTs (and eventually YTs) as collateral in lending markets.

This isn’t a bolt-on product; it’s a core part of how Mitosis turns passive LP positions into programmable, composable building blocks.

A REAL EXAMPLE

Imagine you join a 30-day Matrix campaign partnered with Theo Network. You get back maweETH representing your stake.

With Spindle, you split it into:

PT-maweETH: your principal, redeemable after 30 days.

YT-maweETH: your right to all the $THEO tokens and partner rewards the vault will distribute.

If you think $THEO won’t do well, you can sell YT-maweETH right now and keep your principal safe. If you’re bullish, you can buy more YTs to increase your exposure

WHY IT MATTERS FOR DEFI

Spindle is part of a bigger idea: making DeFi smarter and more flexible. Instead of just staking and waiting, LPs can now:

Build custom strategies

Respond to market sentiment

Unlock liquidity earlier Use live YT pricing as a signal for project health

By splitting LP tokens into PT & YT, Spindle adds an entirely new layer of capital efficiency and composability.

THE BIG PICTURE

As of June/early July 2025, Spindle isn’t live yet, it will launch alongside Mitosis mainnet. But when it does, it’s designed to be: A native, integrated yield-splitting mechanism A real-time marketplace for pricing future rewards A tool that transforms passive DeFi into programmable liquidity All of this makes Spindle much more than just a trading tool: it’s a way to rethink how DeFi capital works

TL;DR:

Split your vault tokens into PT & YT

Hedge or sell speculative upside

Unlock liquidity or speculate more

Use live YT pricing to track sentiment

All fully native inside Mitosis Spindle is built to turn yield itself into something liquid, tradable, and programmable, and that could change how DeFi really works.

Comments ()