MITOSIS ECOSYSTEM PART 1 -DeFi apps

INTRODUCTION

The Mitosis ecosystem is not just a single protocol but an evolving liquidity infrastructure made up of coordinated dApps and visionary builders. These contributors form the foundation of what’s known as the Mitosis Alignment Circle. Each team brings unique strengths to the table, collectively powering the future of programmable, cross-chain liquidity.

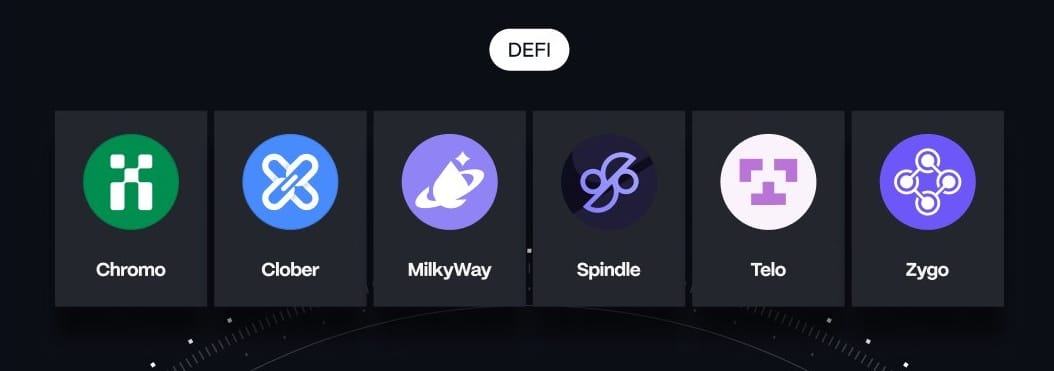

Let’s break down the core 6 DEFI APPS within the Mitosis universe and understand the role each one plays

Chromo Exchange – The Native DEX for Mitosis

Chromo is the first fully integrated decentralized exchange built specifically for Mitosis. Unlike traditional DEXs that rely on simple swap mechanisms, Chromo is tailored for:

Vanilla Assets (vAssets): Mitosis-wrapped assets like vETH or vUSDC

miAssets and maAssets: Vault-based token representations for yield strategies

Chromo provides low-slippage, high-efficiency swaps optimized for the Mitosis chain. As a router for replicated liquidity, it eliminates the need for bridges and complex cross-chain relays, enabling native-like trading across integrated chains.

This makes Chromo not just a tool for swapping but a cornerstone of liquidity access within the Mitosis environment.

Clober – Advanced Order Book Trading Infrastructure

Clober brings a new dimension to Mitosis: decentralized order books. Unlike AMMs, order books allow precise execution, limit orders, and strategic liquidity placement.

Clober is instrumental for:

Supporting advanced DeFi products (options, derivatives)

Powering future on-chain liquidity auctions

Enhancing market depth across vaults and vault campaigns

By enabling real-time, gas-efficient trading logic, Clober upgrades Mitosis from basic swap functions to a dynamic financial playground.

MilkyWay – LRT Strategy Layer

MilkyWay is focused on optimizing Liquid Restaking Tokens (LRTs) within Mitosis. As restaking becomes a vital DeFi primitive, MilkyWay ensures that:

LRTs like stETH, weETH, mphETH can be efficiently deployed

Matrix Vaults incorporate diverse restaking strategies

Users earn the maximum from aligned LRT campaigns

MilkyWay essentially acts as a smart strategy layer, managing LRT positions for both vault designers and yield seekers.

Zygo – The Engine of Matrix Vaults

Zygo powers the backend smart contract infrastructure for Mitosis’ yield layer:

Manages the deployment and lifecycle of Matrix Vaults

Automates reward mechanisms and time-based logic

Enables vault creators to launch new campaigns without coding from scratch

As the vault factory and logic layer, Zygo ensures that Mitosis’ yield engine stays flexible, composable, and up-to-date.

Telo – Analytics, Liquidity Routing, and Optimization

Telo brings clarity to the complex liquidity flows in Mitosis. It focuses on:

Tracking yield flows across Matrix Vaults

Analyzing DNA scores, vault participation, and Zoots point activity

Informing future routing decisions and on-chain optimizations

With Telo, users and strategists alike can see where capital is most productive, turning Mitosis into a transparent and data-driven ecosystem.

Spindle – Governance & Loyalty Infrastructure

Spindle is the governance brain of Mitosis. It orchestrates the alignment layer through:

gMITO allocation and proposal voting logic

lMITO (Loyalty token) scoring, reward systems, and on-chain actions

Integration with roles, Discord participation, and user incentives

It ensures the community has power over the ecosystem not just whales or insiders. Spindle is how DeFi governance matures in Mitosis.

Why These dApps Matter Together And Work so Perfectly

Chromo handles native liquidity and swap flows

Clober introduces precision trading and options

MilkyWay optimizes staked restaking capital

Zygo enables vault creation and modular campaigns

Telo makes sense of the liquidity data and vault metrics

Spindle binds it all with governance and behavioral rewards

Together, they make Mitosis not just a DeFi platform, but a living, programmable liquidity fabric.

CONCLUSION

Mitosis is orchestrating an ecosystem.

The DEFI Apps in its Alignment Circle aren’t side projects, they’re key components of the next evolution in DeFi: one where liquidity is fluid, capital earns everywhere, and users hold the power to move ecosystems with their actions.

As mainnet nears, these builders will help turn Mitosis from a protocol into an economy. If you're reading this, YOU’RE EARLY.

Comments ()