MITOSIS ECOSYSTEM PART 2 - vault partners

INTRODUCTION

The Mitosis ecosystem isn’t just about building its own infrastructure, it’s about empowering aligned partners who share the same vision of a programmable, multichain liquidity layer. Two of the most important partnerships in this mission are Morph and Theo Network, and their vault integrations Zootosis and Theo Straddle are setting a new standard for yield, flexibility, and alignment.

Let’s explore how these vault partners are reshaping the Mitosis landscape.

What is Morph?

Morph is an Ethereum L2 chain with a hybrid scaling design (optimistic + ZK rollup) backed by Bitget. It brings:

Near-instant finality

Low transaction costs

Decentralized sequencers

This infrastructure aligns perfectly with Mitosis’ vision: fast, secure, and user-friendly environments where vaults can thrive.

Zootosis Vaults – Built on Morph

Zootosis is the name of Mitosis' Matrix Vault integration on Morph.

Why Morph?

- Hybrid scaling (faster finality + zk security)

- Low fees, high throughput

- Modular design, optimized for liquidity strategies

What Makes Zootosis Special?

Stablecoin support: Users can deposit USDT, USDC, sUSDe, and more

No forced lockups: Withdraw anytime (early withdrawal reduces Zoots Points only)

Zoots Points: Earn loyalty points that may convert into MITO & Morph tokens

maAssets: Receive maAssets (Morph-native) upon deposit which will soon plug into the Mitosis ecosystem

Zootosis transforms vaults into a two-way street: yield for users, aligned liquidity for partners.

What is Theo Network?

Theo is a yield coordination layer and restaking strategy protocol. It complements Mitosis with:

Advanced yield optimization

LRT support (like weETH, stETH)

Composable vault strategies

Theo’s integration brings more complex, high-yield opportunities to Mitosis users who want to go beyond passive farming.

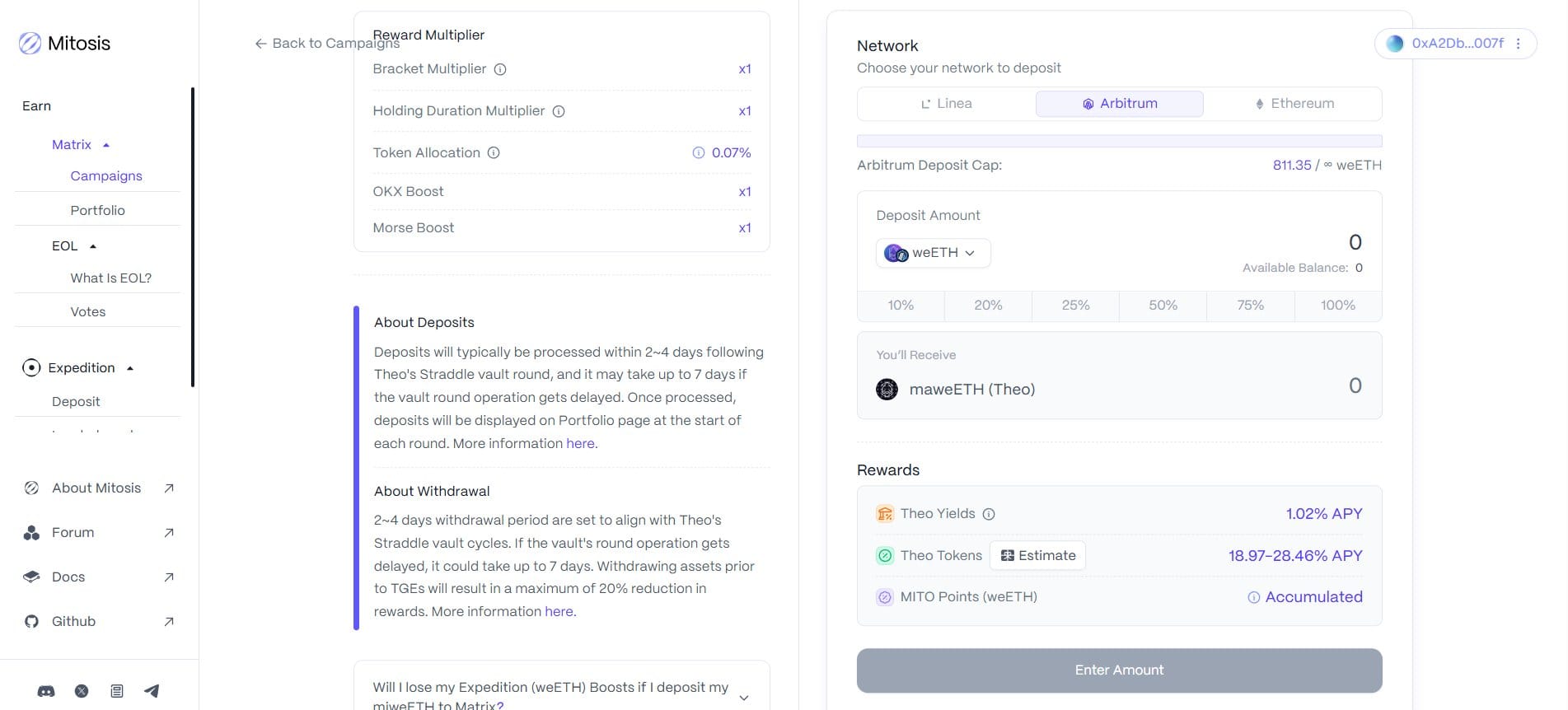

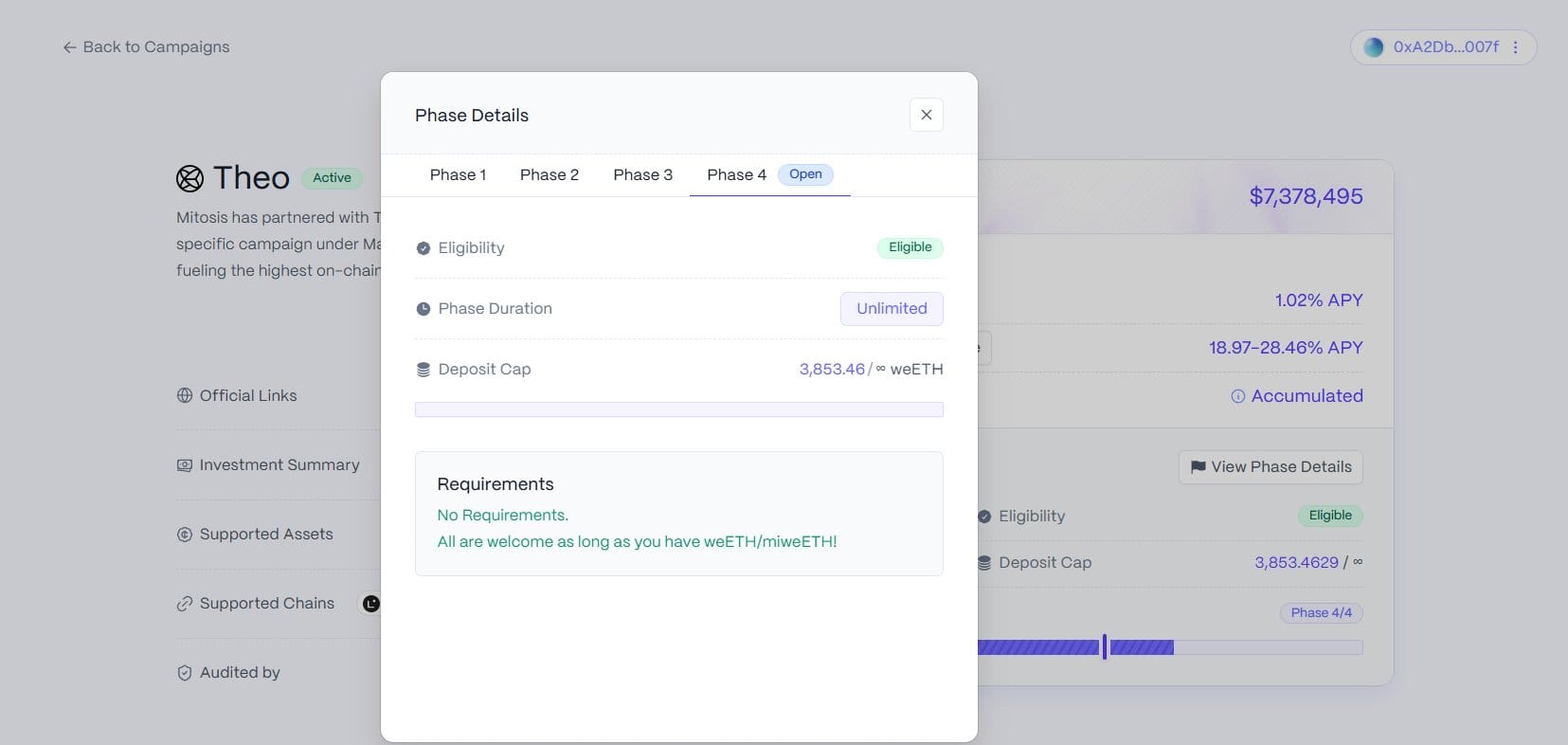

Theo Straddle Vaults – Multichain Vault Campaigns (in phase 4)

Theo’s Straddle Vaults are integrated Matrix Vaults across multiple chains, including:

Ethereum

Mantle

Linea

Scroll ETC...

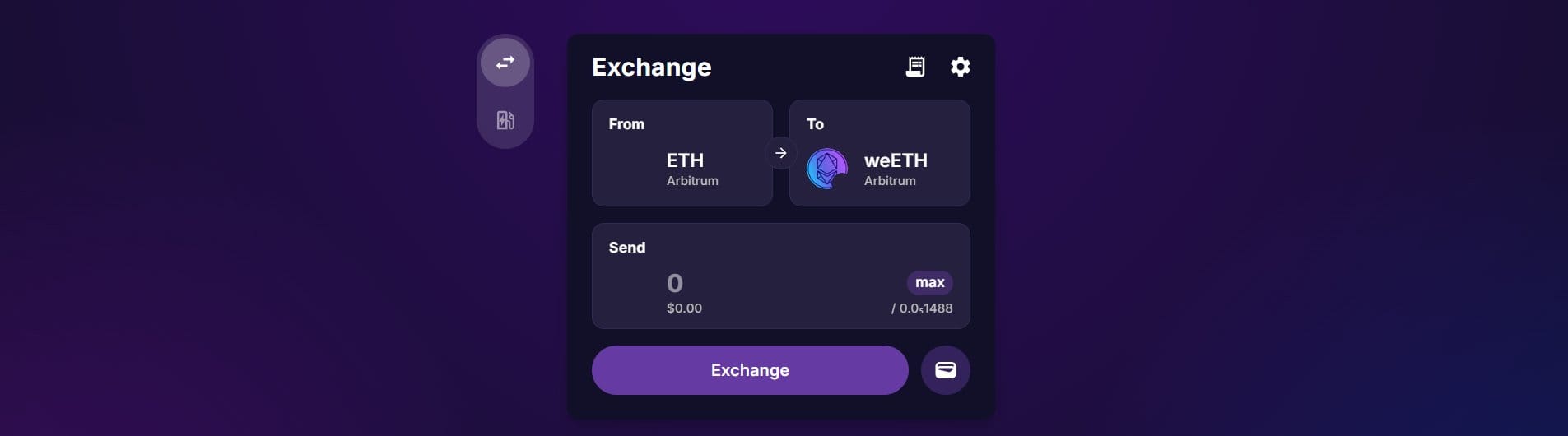

Users can deposit LRT assets like miweETH or weETH, and earn:

Theo token rewards

Straddle points (Theo’s vault campaign loyalty layer)

MITO Points as part of their Mitosis participation

This creates a double-yield flywheel, incentivizing long-term deposits and cross-chain participation.

How It Works:

Deposit LRTs into a supported vault (e.g. miweETH)

- Choose liquidity period (longer = more boost)

- Receive maAssets for that chain

- Earn multiple points and token allocations

Why Choose These Vaults Matter for Mitosis

Cross-chain alignment: Mitosis vaults don’t live in isolation, they live where liquidity is needed

Stablecoin yield: Zootosis makes vaults accessible for stable holders (a huge leap for DeFi inclusion)

Composable assets: All maAssets from vaults will be usable in Mitosis-native dApps once live

Loyalty-powered: Zoots and Theo Straddle points align incentives between users, vaults, and the broader ecosystem

Together, Morph and Theo show that Mitosis isn’t building a yield layer alone, it’s partnering with the future of DeFi.

CONCLUSION

Vaults are the foundation of yield in Mitosis. But with partners like Morph (Zootosis) and Theo (Straddle), they’re evolving into programmable engines of liquidity.

They don’t just farm, they align. They don’t just earn, they build loyalty.

As the Mitosis mainnet approaches, these vault integrations will play a pivotal role in onboarding the next generation of users and capital.

If you're holding stables or LRTs, you now have smarter, more composable ways to earn and help shape the future of multichain finance.

Stay aligned. Stay liquid. Say gMITO

Comments ()