Mitosis for Builders: Programmable Liquidity Infrastructure

Introduction

As DeFi evolves beyond isolated chains, the demand grows for unified, composable liquidity layers. Mitosis provides exactly that — a programmable liquidity network that empowers builders to deploy scalable DeFi infrastructure without fragmented capital or mercenary incentives.

This article explores how Mitosis enables developers to integrate, customize, and scale liquidity primitives across ecosystems.

The Problem: Fragmented Liquidity Slows Development

Building sustainable DeFi protocols today is hindered by:

- Isolated liquidity pools per chain

- Inefficient bridging processes

- Capital inefficiency and high dependency on temporary incentives

Mitosis solves this by introducing liquidity as programmable infrastructure, abstracting away fragmentation at the base layer.

Key Innovations for Builders

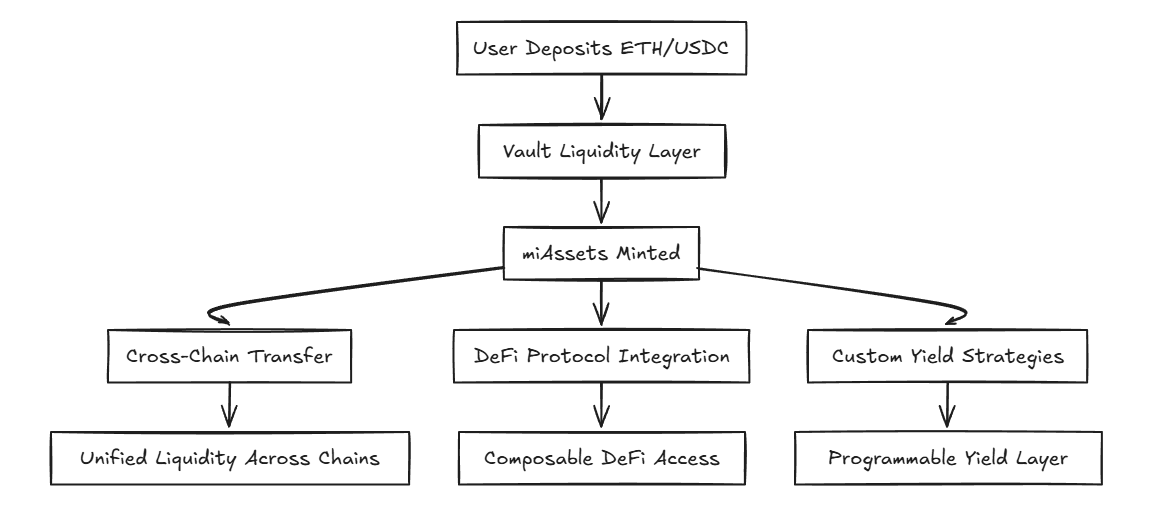

1. miAssets: Cross-Chain Liquidity Tokens

Assets deposited into Mitosis vaults are converted to standardized miAssets (e.g., miETH, miUSDC), unlocking frictionless liquidity across chains and protocols.

2. Vault Infrastructure with Intent Routing

Mitosis vaults manage unified liquidity pools, routing assets based on user intents to maximize yield or protocol utility across supported ecosystems.

3. Ecosystem-Owned Liquidity (EOL)

Mitosis implements protocol-owned liquidity at scale — ensuring sticky, sustainable capital that grows with the ecosystem, not with short-term incentives.

4. Nexus zkVM: Verifiable, Programmable Liquidity

Mitosis's zkVM layer enables builders to deploy customizable, auditable logic for liquidity behavior — programmable yield strategies, staking modules, or DeFi integrations.

Mitosis Programmable Liquidity Stack

Why Programmable Liquidity Matters

Mitosis provides:

✅ Unified liquidity infrastructure for builders

✅ Portable, composable DeFi assets

✅ zkVM-powered, verifiable liquidity logic

✅ Reduced capital fragmentation and friction

✅ Sustainable, protocol-owned liquidity through EOL

Instead of competing for fragmented capital, developers build on Mitosis — leveraging modular liquidity layers that scale with the ecosystem.

Case Study: Deploying DeFi with Mitosis

A new DeFi protocol integrates Mitosis by:

- Minting miAssets for unified liquidity access

- Leveraging intent routing for yield optimization

- Deploying zkVM modules to define custom liquidity behavior

- Accessing liquidity across chains without manual bridging

Outcome: Frictionless, scalable DeFi utility — powered by composable, programmable liquidity infrastructure.

Comments ()