Mitosis Hub and Spoke Architecture: Revolutionizing Cross-Chain DeFi

The decentralized finance landscape faces a fundamental challenge: liquidity fragmentation across multiple blockchain networks, which creates inefficiencies and limits opportunities for users and protocols. Mitosis addresses this challenge through an innovative hub-and-spoke architecture that establishes unified coordination while maintaining the benefits of multi-chain operations. This architectural approach transforms how DeFi protocols manage cross-chain assets, enabling sophisticated liquidity optimization strategies that were previously impossible.

In this article, you'll discover how Mitosis transforms fragmented DeFi liquidity through its innovative hub-and-spoke architecture. We'll explore the three core concepts that make this system work: the centralized coordination hub (Mitosis Chain), distributed execution through branch chains (the spokes), and the sophisticated cross-chain communication system (this ties everything together). By the end, you'll understand how this architecture enables unprecedented liquidity optimization and unified asset management across multiple blockchain networks.

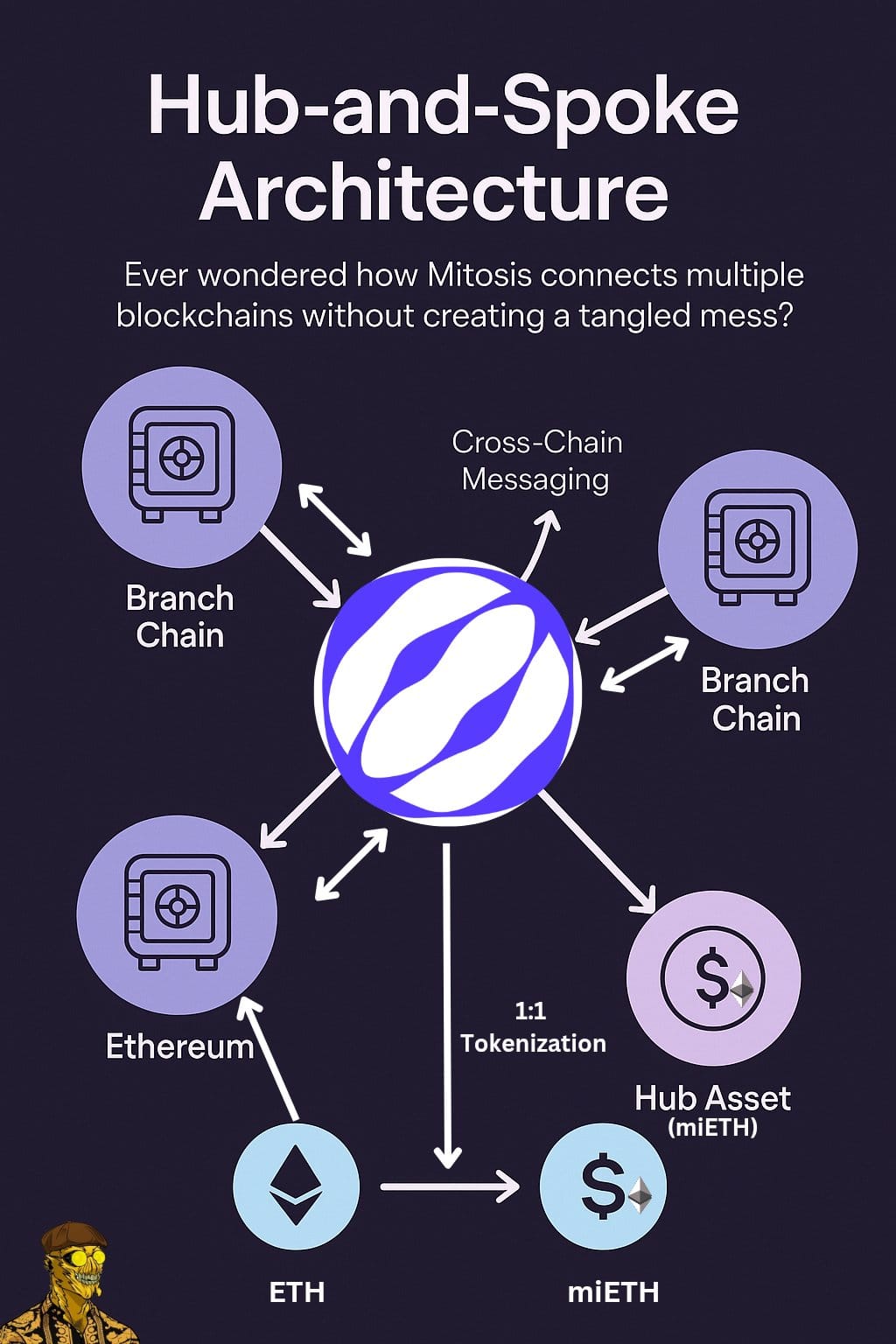

Centralized Coordination Through Mitosis Chain (The Hub)

At the heart of Mitosis's architecture lies Mitosis Chain, a purpose-built Layer 1 blockchain that serves as the central coordination hub for all cross-chain operations. Just like how a major airport hub simplifies travel by providing one central point for connections, Mitosis Chain eliminates the exponential complexity of direct chain-to-chain connections by centralizing coordination through a single, sophisticated control center.

The technical foundation of this hub employs a modular design that separates execution and consensus layers, providing both EVM compatibility and the performance benefits of modern consensus mechanisms. The execution layer provides complete EVM compatibility by utilizing unmodified Ethereum execution clients, while the consensus layer is built on the Cosmos SDK and utilizes CometBFT for consensus, delivering instant finality and fast block times. The two layers communicate through the Engine API, with the consensus layer utilizing the x/evmengine module for seamless integration.

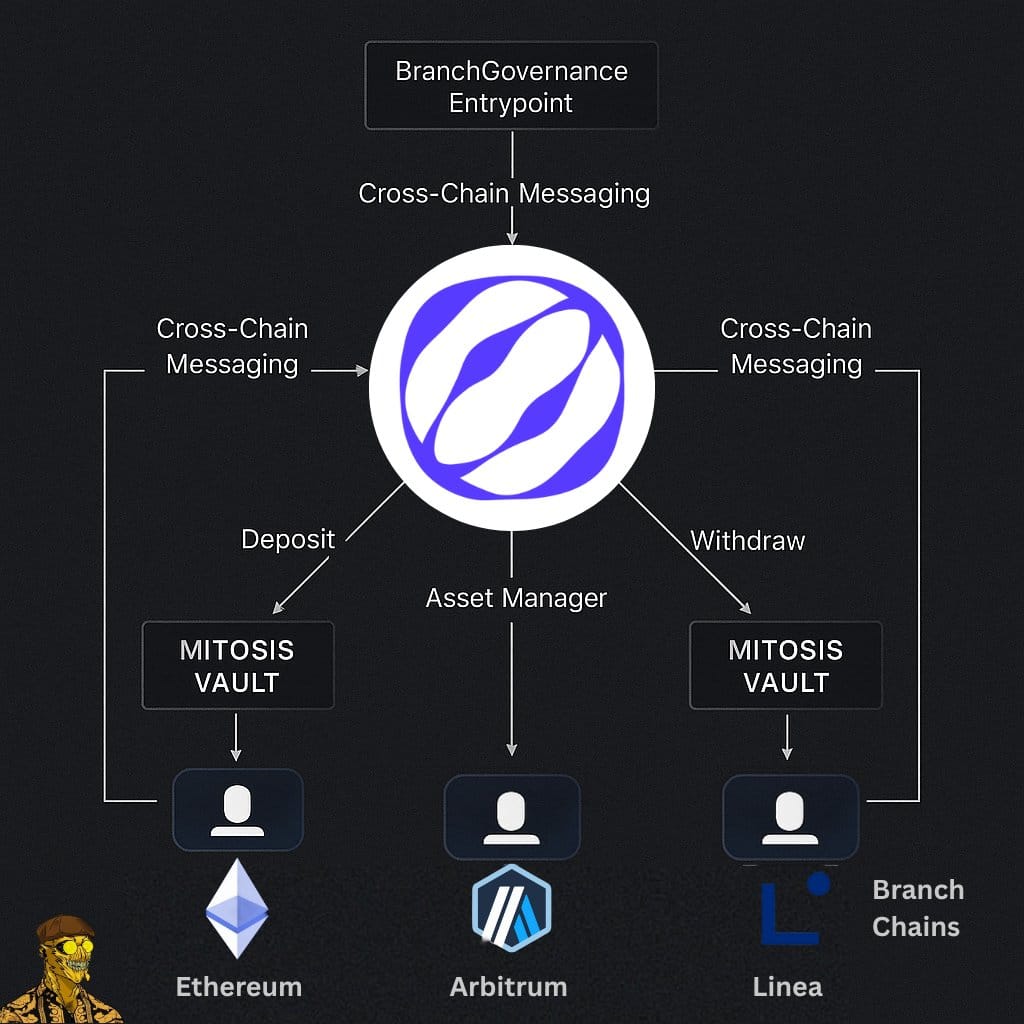

What makes this hub particularly powerful is its unified governance system built on OpenZeppelin v5's governance framework. The system enables gMITO token holders to control protocol parameters and cross-chain operations across three distinct areas:

- Mitosis Chain contracts: through direct control via the Timelock system.

- Branch chain contracts: through cross-chain governance via BranchGovernanceEntrypoint.

- Consensus layer modules: through direct governance via ConsensusGovernanceEntrypoint and the x/evmgov module.

This architecture offers significant advantages, including simplified coordination through one central point managing all connections, scalability by easily adding new branch chains, and unified liquidity management where all deposits route through the hub for optimal allocation.

Instead of using traditional Cosmos SDK modules, Mitosis implements most validator and governance logic as smart contracts in the EVM execution layer. Users stake MITO tokens to validators on EVM, operators create and manage validators on EVM, and staking rewards are distributed on EVM, with contracts serving as the source of truth and information flowing to the consensus layer through EVM logs processed by custom modules.

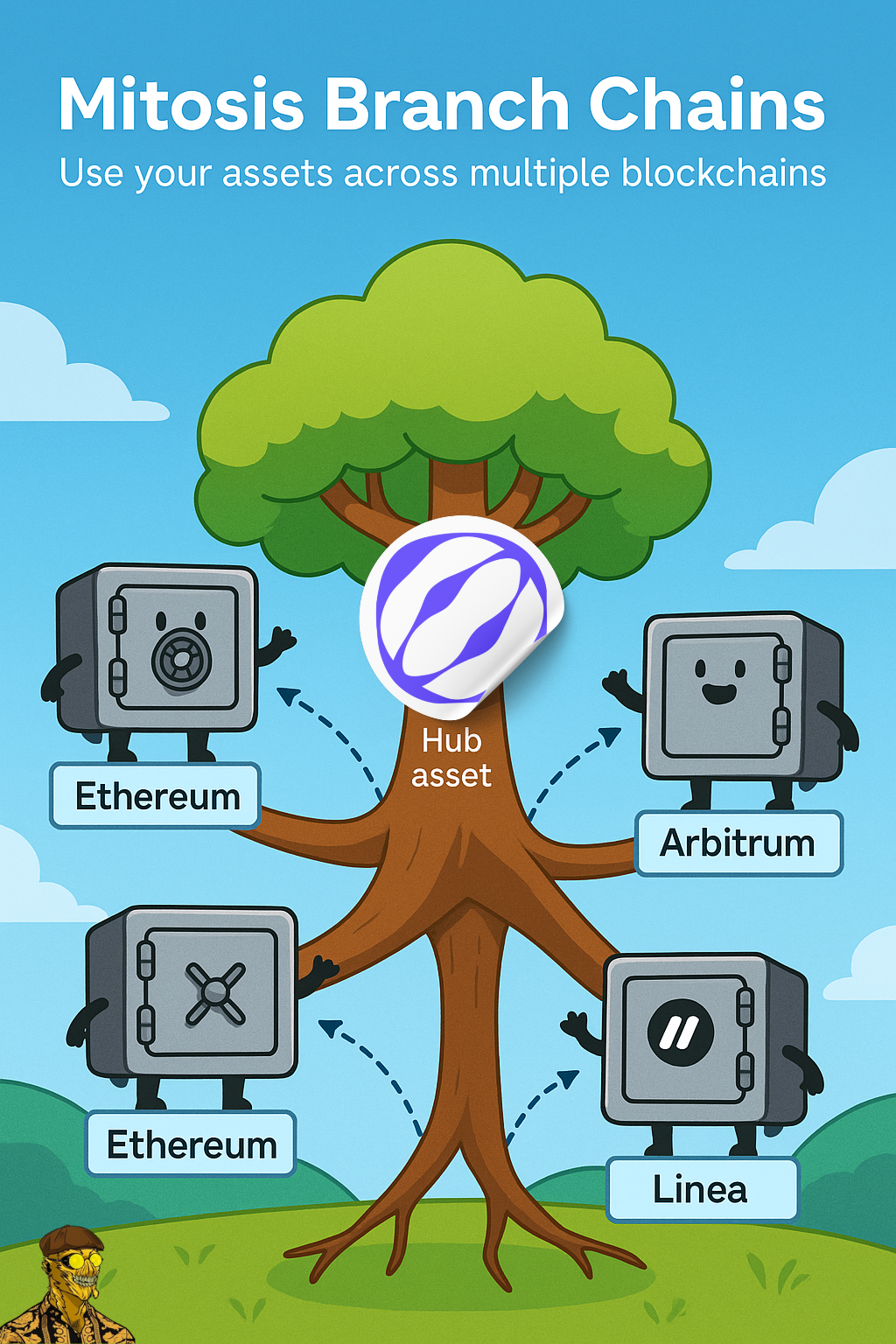

Distributed Execution Through Branch Chains (Spokes)

If you're tired of juggling wallets, bridges, and risky transfers just to earn yield across chains, Mitosis Branch Chains provides your all-in-one solution for a multichain DeFi experience. The philosophy is simple: "Deposit once, stay on your preferred chain, and let your assets earn across the ecosystem." Branch chains are external blockchains like Ethereum, Arbitrum, and Linea, where Mitosis Vaults are deployed and DeFi strategies executed, turning multi-chain chaos into coordinated capital.

With Branch Chains, you can deposit assets like ETH or weETH directly on networks where they naturally belong. Your assets stay safe on their native chain, while Mitosis creates a 1:1 Hub Asset on its core chain. That Hub Asset lets your funds tap into yield opportunities across multiple chains, without bridging or wrapping. When you deposit ETH on Ethereum, that information is securely transmitted to Mitosis Chain through cross-chain messaging, and your ETH becomes a hub asset on Mitosis Chain, ready for strategy deployment. If you want to withdraw on Arbitrum instead, the Asset Manager on Mitosis Chain handles that cross-chain coordination, ensuring your request is fulfilled without friction.

Branch chains serve as the execution environment for Vault Liquidity Frameworks (VLFs), which establish structured relationships between Mitosis LPs and DeFi protocols. The system supports:

- Ecosystem-Owned Liquidity (EOL): that enables democratic governance of pooled assets with collective decision-making.

- Matrix: that allows direct participation in curated liquidity campaigns.

Both frameworks issue specialized tokens (miAssets for EOL and maAssets) for Matrix, which represent users' positions and function as programmable building blocks for sophisticated financial engineering.

The Asset Manager on Mitosis Chain maintains comprehensive ledgers tracking both allocated and idle liquidity across all branch chains. The strategist, responsible for controlling liquidity allocation decisions, analyzes available opportunities and determines optimal allocation across different branch chains. The VLF handles everything behind the scenes: earning, reallocating, and optimizing deposits for the best returns, allowing users to earn yield across different blockchains, withdraw from any supported network, and avoid bridges or extra steps. This turns fragmented DeFi into a unified, user-friendly experience where liquidity works smarter.

Cross-Chain Communication and Settlement System

The third pillar of Mitosis's architecture is its robust cross-chain communication and settlement system that ensures seamless coordination between the hub and all spokes. This system handles everything from basic deposit and withdrawal operations to complex yield settlement and reward distribution, maintaining synchronization between activities across supported networks and the Mitosis Chain.

Secure communication between hub and spokes relies on sophisticated cross-chain messaging protocols that ensure message integrity through cryptographic verification, support atomic operations across multiple chains, and provide robust failure recovery mechanisms. This infrastructure enables real-time coordination of liquidity states and ensures accurate asset tracking across the entire network.

The deposit process involves cross-chain coordination where users deposit assets into Mitosis Vaults on branch chains, deposit information is relayed to the Asset Manager on Mitosis Chain via cross-chain messaging, and the Asset Manager mints equivalent Hub Assets to the user. The withdrawal process reverses this flow, with users requesting withdrawals from the Asset Manager, hub assets being burned, and withdrawal information being relayed to Mitosis Vaults for asset transfer.

The VLF Settlement system represents one of Mitosis's most sophisticated features, periodically calculating VLF strategy performance and synchronizing asset states across all supported networks. The system operates through three distinct settlement types that ensure transparent, accurate tracking of VLF performance while providing flexible distribution mechanisms for different types of rewards.

- Yield Settlement: occurs when VLF strategies generate rewards of the same type as underlying assets. The system calculates the total balance of underlying assets managed by VLF Strategy Executor, compares it to the last settled balance, and mints equivalent hub assets to increase VLF asset value when positive performance is detected.

- Loss Settlement: handles situations where strategies experience losses by burning hub assets from VLF Vaults to decrease VLF asset value proportionally, maintaining accurate representation of strategy performance.

- Extra Rewards Settlement: manages rewards in different tokens than underlying assets by transferring reward tokens to Mitosis Vaults, minting corresponding hub assets, storing them in Treasury, and distributing them to users through sophisticated mechanisms, often utilizing merkle proof-based distribution systems.

Conclusion

Mitosis's hub-and-spoke architecture represents a fundamental advancement in cross-chain DeFi infrastructure, successfully addressing the fragmentation challenges facing modern decentralized finance while enabling unprecedented levels of liquidity optimization and user control. The architecture's three core concepts work in harmony:

Mitosis Chain provides centralized coordination through its innovative modular design and unified governance system, branch chains enable distributed execution of sophisticated yield strategies through VLFs, and the cross-chain communication system ensures seamless settlement and asset synchronization across the entire network.

As the DeFi landscape continues to evolve toward greater multi-chain integration, how might Mitosis's hub-and-spoke architecture influence the development of future cross-chain protocols and reshape the way we think about liquidity management in decentralized finance?

Through this comprehensive architectural approach, Mitosis creates a foundation for a more connected, efficient, and user-friendly decentralized finance ecosystem, positioning itself at the forefront of the next generation of cross-chain DeFi infrastructure.

Comments ()