Mitosis - IBC Integration and Beyond

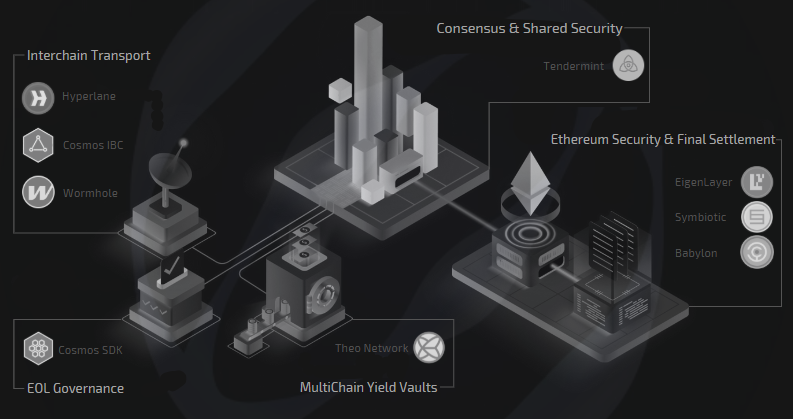

Introduction: Mitosis as a Multichain Liquidity Hub

Mitosis is not just another Layer 1 blockchain; it represents a fundamental shift in how liquidity is structured across decentralized finance (DeFi).

Built on CometBFT (a fork of Tendermint), it leverages multi-layer security through EigenLayer, Babylon, and Symbiotic while utilizing Hyperlane’s cross-chain messaging framework for interoperability.

However, Mitosis’ true innovation lies in its ability to transform liquidity provisioning through Ecosystem-Owned Liquidity (EOL)—a model where assets remain active across chains while continuously generating yield. Given its modular architecture, a natural next step is integrating Inter-Blockchain Communication (IBC), aligning with Cosmos' vision of trust-minimized interoperability.

I. Current Technical Architecture: A Foundation for Interoperability

Consensus and Security

Mitosis employs CometBFT as its consensus mechanism, ensuring fast finality and robust Byzantine Fault Tolerance (BFT). While Tendermint-based chains like Osmosis and Cosmos Hub rely on IBC for interoperability, Mitosis enhances its security stack by integrating Ethereum-native restaking solutions such as EigenLayer and Babylon.

These mechanisms allow Mitosis validators to inherit Ethereum’s security guarantees, reducing the risk of economic attacks on cross-chain transactions.

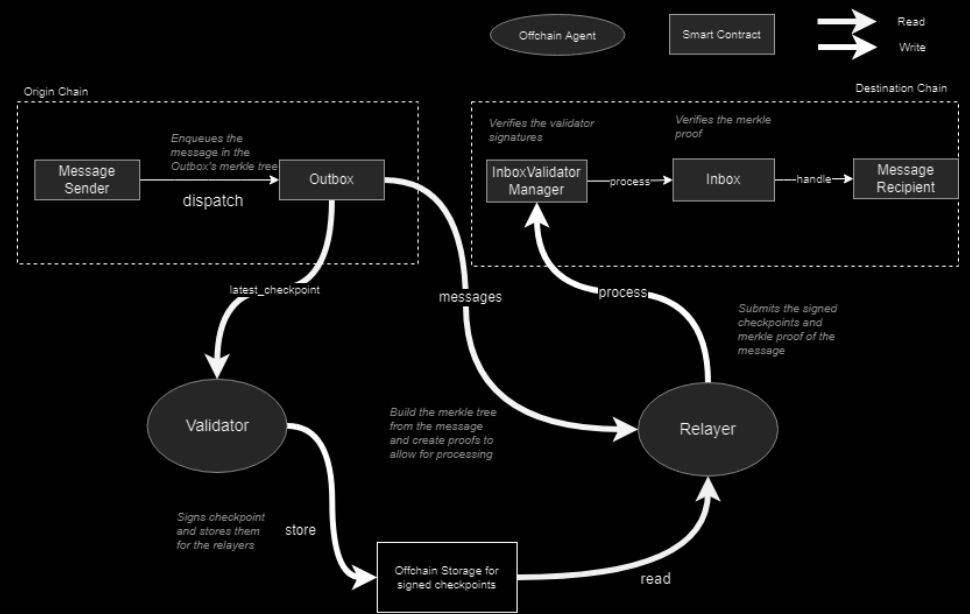

Cross-Chain Messaging with Hyperlane

Unlike traditional bridging solutions that rely on centralized multisigs (e.g., Multichain, LayerZero), Mitosis integrates Hyperlane, an intent-centric messaging framework. Hyperlane employs sovereign consensus, enabling validators to operate independently while verifying cross-chain messages.

This design significantly reduces attack vectors compared to legacy bridges.

In this regard, Mitosis' security model mirrors solutions such as Polymer Labs, which aims to bring IBC to Ethereum via a modular stack. However, Mitosis goes further by implementing yield-generating assets (miAssets) that retain usability across chains, ensuring superior capital efficiency.

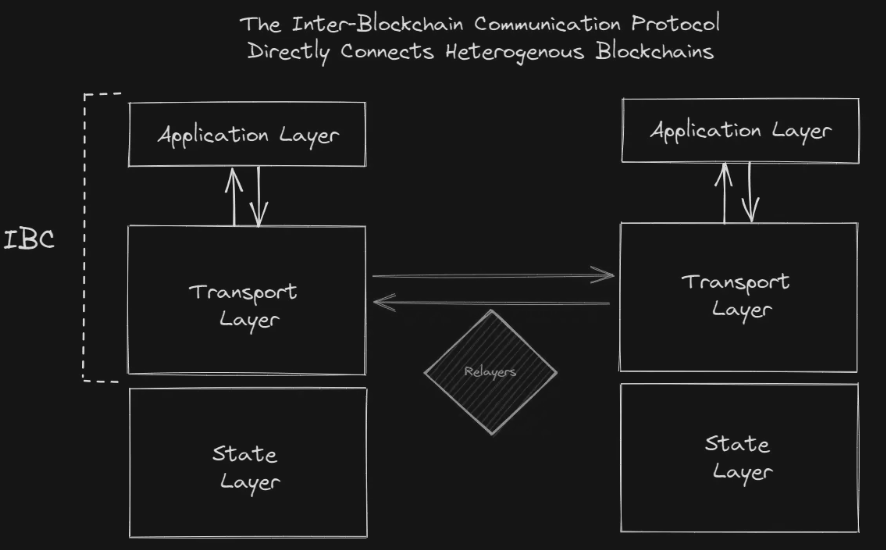

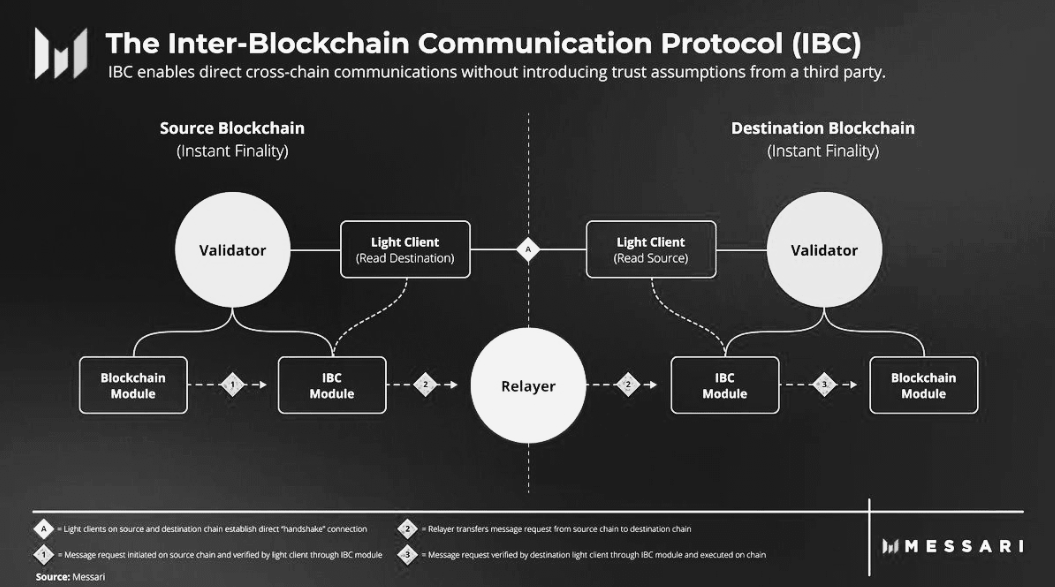

II. The Potential of IBC Integration

Enabling Trust-Minimized Cross-Chain Liquidity

While Mitosis currently relies on Hyperlane, enabling IBC compatibility could further its mission as a multichain liquidity hub.

IBC integration would:

- Provide a standardized cross-chain liquidity settlement layer without relying on wrapped assets.

- Reduce reliance on bridges like Axelar or Wormhole, minimizing counterparty risk.

- Enable Mitosis to connect with major Cosmos ecosystems such as Osmosis, Sei, and Injective.

- Facilitate seamless LP migration, allowing liquidity pools to span multiple ecosystems without fragmentation.

With IBC, Mitosis could function similarly to, for example, Thorchain or Osmosis, which provides native asset swaps without wrapped tokens.

However, while all IBC blockchains operate on a dedicated network of liquidity providers, Mitosis could leverage restaked Ethereum security for a hybrid approach that combines native execution with staked economic guarantees.

IV. Challenges and Considerations for IBC Activation

Smart Contract Adaptation

Unlike most Cosmos SDK-based chains, Mitosis is EVM-compatible. This means that existing IBC relayers would need modifications to interact with Ethereum-style smart contracts rather than Cosmos' built-in modules. Projects like Evmos have demonstrated that EVM and IBC can coexist, but Mitosis would need to ensure:

- Custom IBC relayers that support EVM smart contract calls.

- Asset tracking mechanisms to prevent double spending across chains.

- Adaptation of Mitosis Vaults to support IBC transfers instead of purely Hyperlane-based transactions.

Validator Incentives and Cross-Chain Security

To implement IBC, Mitosis may need to adjust validator incentives. Cosmos chains rely on native staking for security, but Mitosis primarily depends on EigenLayer and Babylon restaking. The challenge is ensuring that validators remain aligned with IBC settlement while maintaining their incentives in Ethereum and Bitcoin-native staking.

Potential solutions include:

- Dual staking mechanisms, where validators secure both Mitosis and an IBC settlement layer.

- EigenLayer restaked nodes acting as IBC validators, enhancing cross-chain finality.

- Selective IBC activation, where only high-value chains like Osmosis and Sei are prioritized initially.

V. Future Innovations: Beyond IBC

While IBC integration is a logical step, Mitosis has the potential to evolve further into a next-generation multichain liquidity engine. Here are some possible advancements:

1. Programmable Liquidity with Intent-Based Execution

Mitosis could integrate intent-based execution frameworks similar to Anoma or Skip Protocol, where users specify desired liquidity outcomes instead of individual transactions. This could enable:

- Automated yield optimization, where assets are dynamically reallocated across chains based on real-time APY changes.

- Gasless liquidity provision, where users sign intent-based transactions executed by Mitosis Vaults.

- MEV-resistant order flow, leveraging encrypted batch auctions to prevent front-running.

2. Native Bitcoin Integration via Babylon

Mitosis is already experimenting with uniBTC, a form of Bitcoin staking via Babylon. Instead of relying on wrapped BTC (like wBTC or renBTC), Mitosis could implement native BTC validation, mirroring initiatives like Nomic BTC or Babylon’s staking framework.

Benefits include:

- Direct BTC yield generation, without requiring Ethereum-based wrapping.

- BTC-native collateralization for DeFi applications.

- Integration with Lightning Network to support fast BTC transfers within Mitosis.

3. AI-Optimized Liquidity Management

Leveraging AI-driven liquidity routing, Mitosis could develop self-adjusting yield strategies, similar to GammaSwap or Brahma Finance:

- Predictive yield allocation: AI models forecast liquidity needs across chains, adjusting LP incentives dynamically.

- Automated arbitrage execution: Smart contracts execute inter-chain arbitrage, optimizing miAsset yield.

- Risk-adjusted staking models: AI-driven risk metrics prevent capital inefficiencies and optimize security.

Conclusion: Mitosis as a Defi Liquidity Powerhouse

Mitosis is positioned as a pioneering force in multichain liquidity. By integrating IBC, it can extend its Ethereum-aligned liquidity model to Cosmos, reducing reliance on centralized bridges while increasing TVL efficiency. However, the real innovation lies in Mitosis’ ability to evolve beyond IBC into a modular liquidity execution layer, powered by restaked security, AI-driven yield management, and cross-chain composability.

The next steps for Mitosis could include:

- Activating IBC compatibility, prioritizing Osmosis, Sei, and Injective.

- Expanding uniBTC capabilities for Bitcoin-native staking.

- Developing AI-powered liquidity optimization and intent-based execution.

As DeFi matures, projects like Mitosis will define the next era of permissionless, efficient, and secure multichain finance.

Comments ()