Mitosis in comparison with competitors in the field of restaking: How Matrix will help become better than the rest

Introduction

Restaking is a key mechanism in the field of decentralised finance (DeFi) that allows users to generate additional income by reusing already staked assets. This approach provides deeper liquidity, increases network security, and opens up new opportunities for asset capitalisation. Restaking not only maximises profits but also contributes to a more efficient use of capital in different DeFi protocols.

However, traditional restaking solutions have numerous limitations. Liquidity often remains blocked, asset management can be difficult, and the centralisation of certain platforms creates additional risks. For users seeking to maximise the value of their investment, this can be a significant obstacle.

Mitosis offers an innovative approach that addresses these challenges through the integration of Matrix, a revolutionary technology that optimises liquidity utilisation and minimises risk. Unlike its competitors, Mitosis provides an efficient, transparent and decentralised restaking process that opens up new opportunities for users.

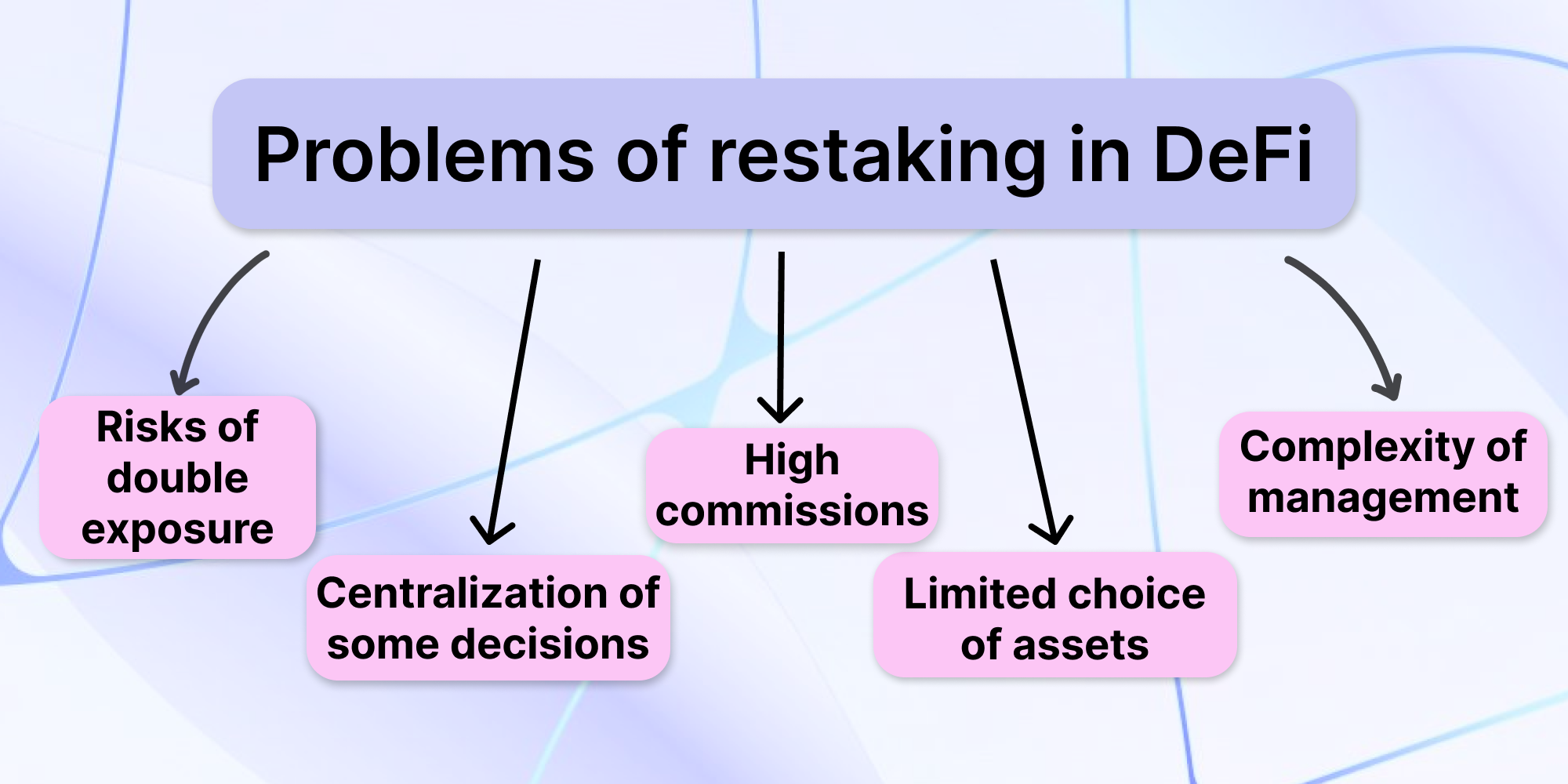

Problems of restaking in DeFi

Restaking allows staked assets to be reused in additional protocols, increasing profitability. This opens up access to new liquidity mechanisms and increases the efficiency of capital use. However, existing restaking mechanisms often face a number of challenges:

- Double exposure risks: Users may suffer losses if assets participate in multiple protocols at the same time. This increases the likelihood of misuse or technical failures, which can lead to significant financial losses.

- Centralisation of some decisions: Most platforms are controlled by a limited number of validators, which poses threats to decentralisation and independence. This can lead to abuse of power or manipulation of assets, which carries additional risks for users.

- Limited choice of assets: Not all staked assets support restaking mechanisms, which narrows the options for users. This can limit their ability to diversify and reduce returns, as users cannot use all of their assets in different protocols

- High fees: Restaking operations can involve significant transaction costs, which reduces the overall revenue of users and makes them less interested in using such solutions. This can create barriers for new market entrants.

- Complexity of management: Many platforms require in-depth technical knowledge to use effectively, which creates barriers for new users. This can limit the popularity of platforms and lead to their inefficient use.

These problems limit the effectiveness of traditional solutions and create barriers to the mass use of resteking.

Overview of competitors and their features

Among the leading restaking platforms are EigenLayer, Lido, Rocket Pool, Frax ETH, Etherfi and Symbiotic. Each of these platforms has its own unique features, but also limitations.

- EigenLayer is a pioneer in the field of restaking, allowing users to use already staked assets to secure other protocols. However, this creates a risk of double exposure, reducing the security of the assets. This can be a serious obstacle for users seeking to minimise risk.

- Lido provides liquid staking, which allows users to receive liquid tokens for staked assets. However, restaking opportunities are limited and focused only on certain networks. This may limit the profitability for users as not all assets are available for staking.

- Rocket Pool offers a more decentralised approach, but has a complex governance model and requires considerable technical knowledge. This can deter new users and limit its popularity, as many people do not have enough technical experience to use the platform effectively.

- Frax ETH combines staking mechanisms with its own stablecoin, which creates some flexibility but limits the ecosystem to Frax Finance products. This may limit users' ability to choose assets for restaking.

- Etherfi focuses on decentralised staking management, offering users the ability to control their assets without having to rely on third-party validators. This reduces risk and increases security.

- Symbiotic aims to combine the different aspects of DeFi and NFT, giving users the opportunity to earn money by staking assets within a cross-protocol ecosystem. This allows for liquidity from NFTs, which makes the platform unique.

Traditional solutions have their limitations: centralisation, lack of cross-chain support, low level of automation and increased exposure risks.

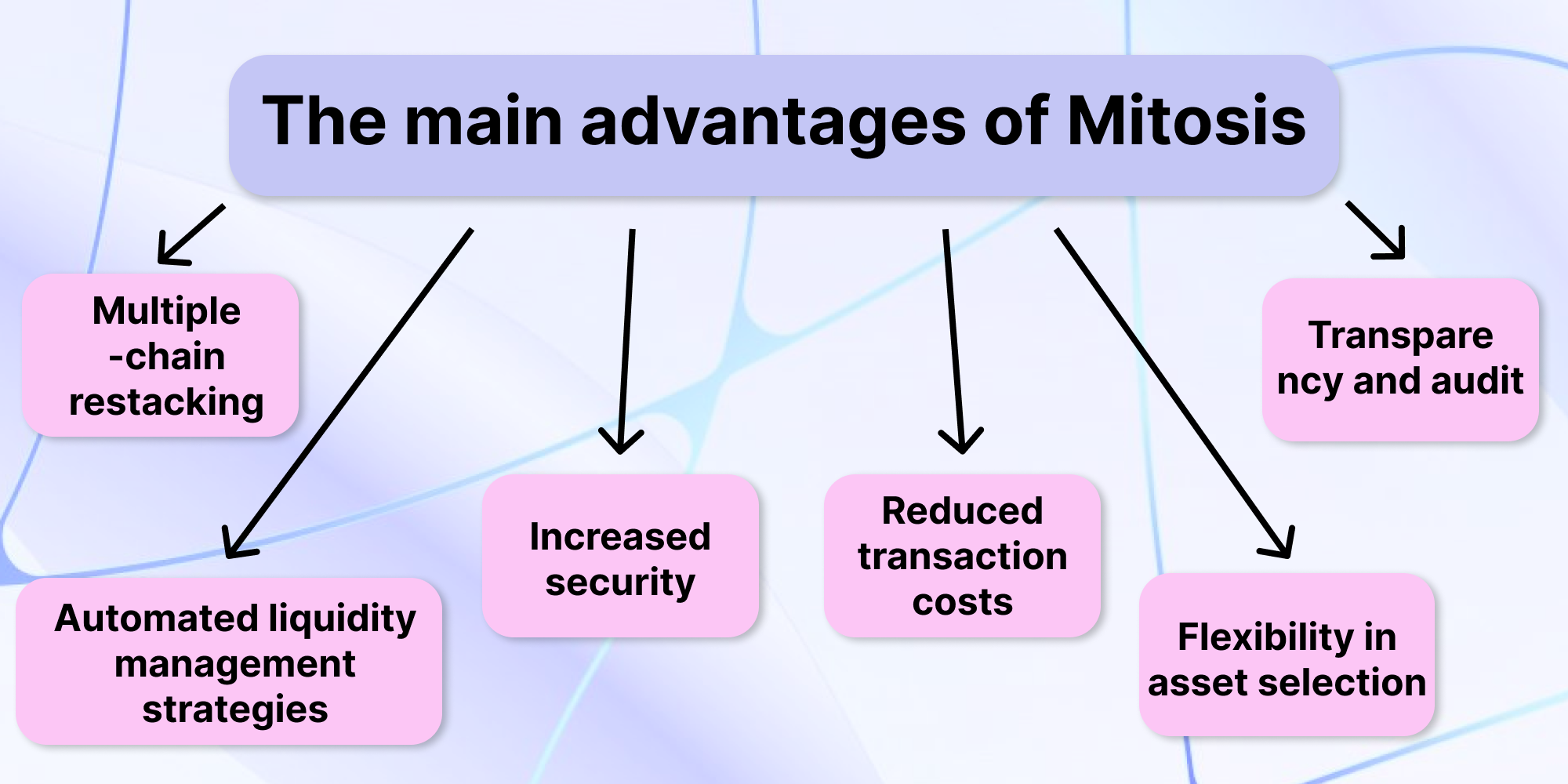

The benefits of Mitosis: a new era of restaking

Matrix is Mitosis' main engine that solves key liquidity problems. With global liquidity, automatic asset rebalancing, and high security, Matrix ensures efficient resource allocation across different networks. This allows users to generate maximum revenue with minimum risk.

The main advantages of Mitosis:

- Multi-chain restaking: Unlike most competitors, Mitosis allows users to participate in restaking across multiple blockchain ecosystems without being limited to a single network. This opens up access to more liquid assets and capitalisation opportunities.

- Automated liquidity management strategies: The Matrix system uses algorithms to automatically balance liquidity across assets and platforms, optimising users' profitability. This eliminates manual management and reduces the risk of errors.

- Reduced transaction costs: The use of efficient technology reduces gas costs and fees, making Mitosis more attractive to a wider range of users. This keeps more profit for users and encourages them to make more frequent transactions.

- Flexibility in the choice of assets: Users can restake different assets, receiving liquid tokens that can be used in other DeFi applications. This provides more opportunities for profitability and asset diversification.

- Increased security: A distributed liquidity management model reduces the risks of fraud associated with centralised platforms. This provides greater user confidence and reduces the risk of loss.

- Transparency and audit: Mitosis guarantees transparency of all transactions and operations, which increases user confidence in the platform. Regular audits of the system provide additional security and stability.

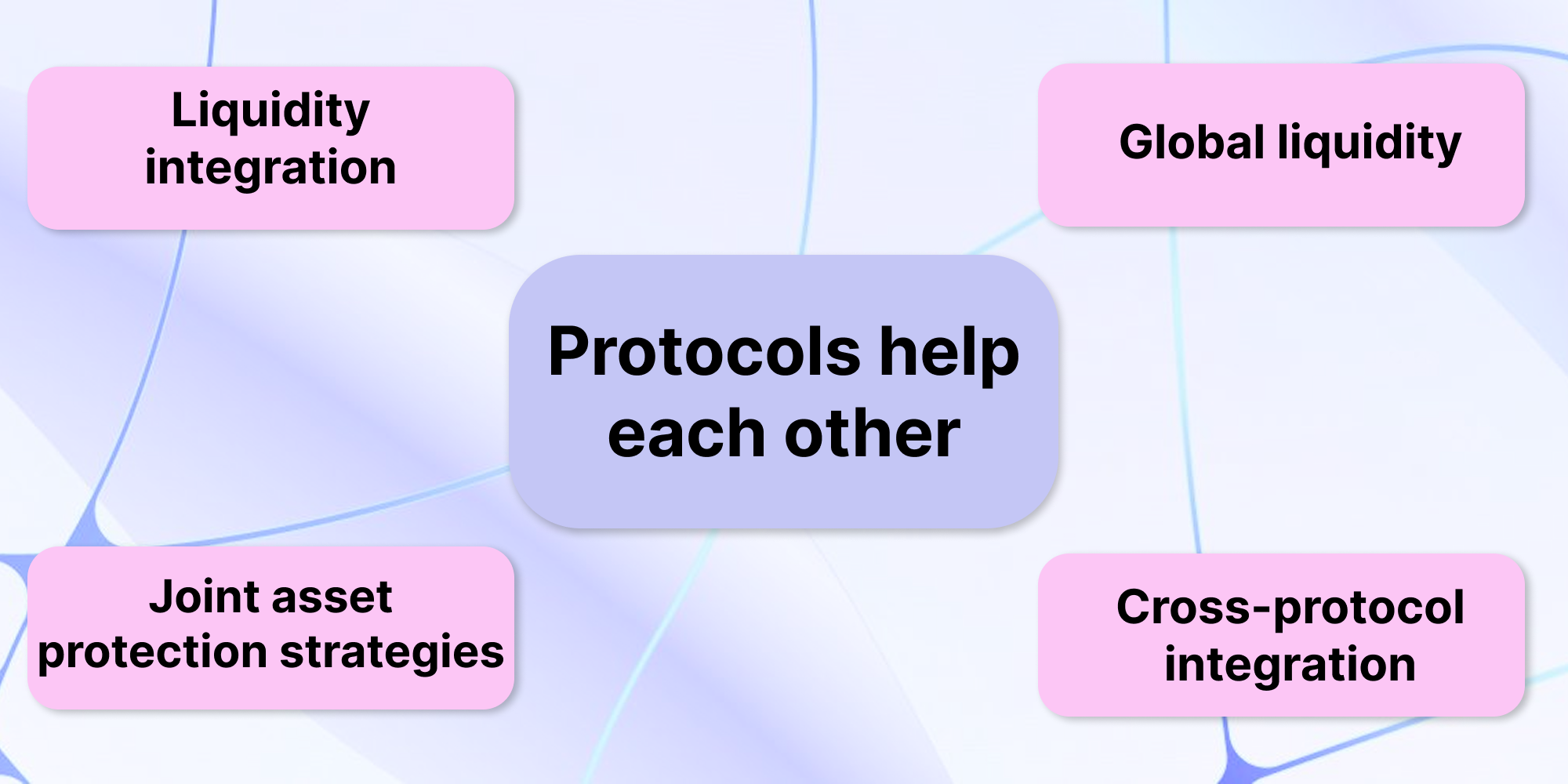

How can protocols help each other?

While a competitive environment drives development, collaboration between protocols can create additional value. For example:

- Liquidity integration: The ability to exchange liquidity between different platforms will reduce asset shortage risks and improve user profitability. It can also reduce market volatility and increase overall system stability.

- Shared asset protection strategies: The use of multiple security and audit mechanisms can improve user trust across platforms. This allows for a safer environment for trading and asset management.

- Cross-protocol integration: The ability for different systems to interoperate will allow for the creation of more efficient financial products. This could include shared tokens that can be used across different protocols or new strategies to maximise returns.

- Global liquidity: Through the collaboration of different platforms, an efficient liquidity market can be created without geographical or technological limitations. This can significantly increase the availability of liquidity to users.

Conclusion

Mitosis offers a new, revolutionary approach to liquidity in DeFi, solving numerous problems of traditional restaking. With Matrix, users receive not only global liquidity, but also automated asset management, which greatly simplifies the restaking process. The platform provides transparency and a high level of security, which inspires trust among users. Mitosis provides access to a variety of mechanisms that allow you to get the most out of your staked assets without the need for deep technical knowledge.

The cooperation between protocols supported by Mitosis opens up new horizons for market development. This can lead to the creation of more efficient financial products that connect different ecosystems and provide users with more opportunities for profitability. Thanks to its innovative technology, Mitosis is well positioned to become a leader in this field, setting new standards in liquidity. In light of all these factors, Mitosis not only competes with existing platforms, but also contributes to the development of decentralised finance in the future, opening up new opportunities for users.

My Twitter account is https://x.com/Glodin9

Comments ()