Mitosis Long-term Growth Alliance Season 1: How MLGA Structures Its Growth Engine

DeFi is constantly evolving, but very few ecosystems are building with long-term sustainability in mind. The Mitosis Long-term Growth Alliance (MLGA) takes a fresh approach by aligning incentives across protocols, partners, and users.

The Season 1 of the Mitosis Long-term Growth Alliance (MLGA) is the first look at how Mitosis plans to grow liquidity in a way that actually lasts.

In this article, you’ll learn what MLGA is, how it works as a growth engine for Mitosis, the protocols and partners featured in Season 1, and why this model may redefine sustainable growth in Web3.

Introduction to MLGA

The Mitosis Long-Term Growth Alliance (MLGA) is more than just a liquidity incentive program, it’s a framework for sustainable DeFi growth. Unlike short-term campaigns that prioritize hype, MLGA focuses on longevity: building liquidity reserves, aligning partner ecosystems, and rewarding users who provide stable value over time.

At its core, MLGA aims to:

- Strengthen the Mitosis ecosystem by onboarding liquidity through strategic partners.

- Provide attractive, verifiable yields to early participants.

- Create a mutually beneficial loop where partner protocols gain liquidity while Mitosis grows adoption for its programmable liquidity framework.

The launch of MLGA reflects Mitosis’ broader mission, to transform liquidity into a programmable, composable asset layer that can flow seamlessly across chains.

How MLGA Operates: The Growth Engine

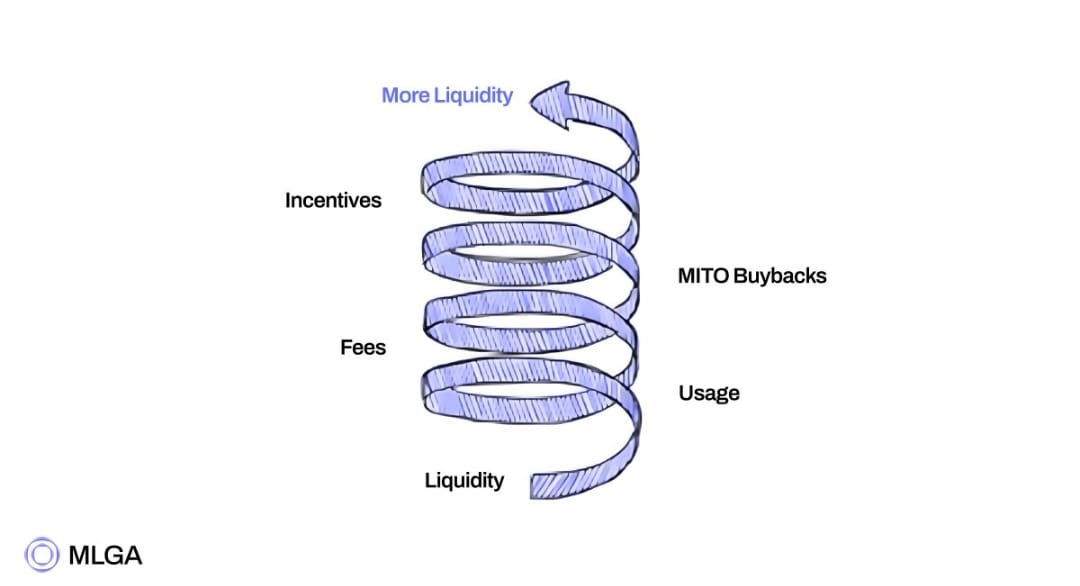

The MLGA operates as a growth engine for Mitosis by strategically aligning liquidity incentives with ecosystem expansion. At the heart of MLGA is a straightforward flywheel:

liquidity leads to usage; usage generates fees; fees power MITO buybacks; buybacks fund incentives; incentives attract more liquidity.

The elegance of this loop is obvious, but so is the classic obstacle: the circular dependency problem. You need activity to earn fees that pay incentives, yet you also need incentives to spark the activity. MLGA is designed to break that paradox through structure and collaboration.

Operationally, MLGA runs in quarterly seasons. Season 1 begins with a preparation period before Mitosis mainnet launch and then continues for a full quarter after activation. Each season features multiple protocols that plug into specific Vault Liquidity Frameworks (VLFs).

The Alliance also commits to a complete transparency framework before each season begins: it discloses the scale of allocated Mitosis token incentive subsidies, the previous quarter’s treasury revenues, the set of available VLF-based liquidity opportunities, and any exclusive benefits earmarked for Mitosis users. The stated objective is to attract sufficient liquidity that fee-generated MITO buybacks can replace ongoing subsidies, targeting zero token inflation for existing MITO holders.

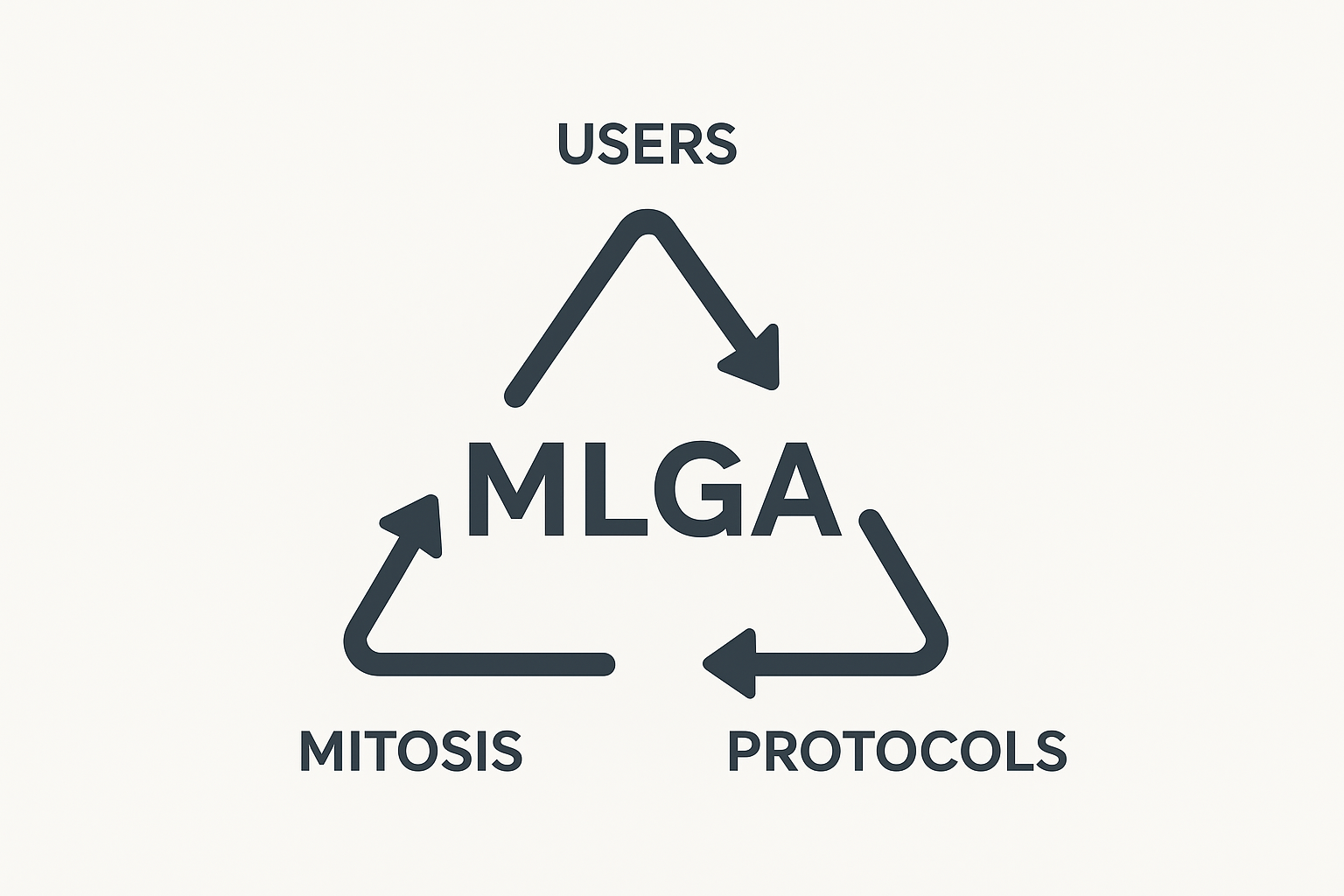

The Alliance itself is organized around three pillars that give the flywheel leverage:

- Featured Protocols: are curated partners that integrate with a designated VLF to present enhanced liquidity opportunities to users.

- Peripheral Protocols: benefit from the activity those features unlock and are asked to contribute incentives in upcoming seasons, aligning their growth with the Alliance’s success.

- Mitosis Foundation: oversees all of this as it coordinates allocations, incorporates community feedback, and carries the operational responsibility for managing the Alliance.

By staging growth in seasons, publishing clear inputs, and aligning participants under one roof, MLGA gives the flywheel its crucial first push while keeping the mechanics legible to users.

Here’s how it works

- Deposits enter Mitosis Vaults: Users deposit supported assets into Mitosis Vaults (such as EOL Vaults or Matrix Vaults), which issue yield-bearing assets in return. These assets are designed to be composable and usable across multiple DeFi applications.

- Incentives fuel adoption: To attract liquidity, MLGA partners offer incentives in the form of yield boosts, exclusive rewards (like MITO distributions), or ecosystem-native benefits.

- Protocols gain liquidity depth: The liquidity doesn’t just sit idle, it’s directed toward protocols within the alliance, amplifying their usability, market depth, and adoption.

- Users benefit from both yield and growth: Participants earn competitive APYs alongside exposure to the upside of ecosystem growth, creating a win-win dynamic between liquidity providers and protocols.

This engine ensures that liquidity growth isn’t a temporary influx but rather part of a sustainable cycle, reinforcing the Mitosis network and its partners.

MLGA Featured Protocol and Partner

YO (Yield Optimizer)

Season 1’s Featured Protocol is YO, integrated under Mitosis’ EOL (Ecosystem-Owned Liquidity) Vault Liquidity Framework. YO positions itself as “the last vault you’ll ever need,” acting as a unified layer that continuously reallocates deposits across DeFi to pursue the best risk-adjusted yields.

Built by the exponential.fi team and backed by investors including Paradigm, Haun, Hack VC, Solana, and Circle, YO is engineered to simplify sophisticated yield strategies into a single, composable deposit experience. Its currently available vaults include yoETH, which accepts ETH or wETH on Base, and yoUSD, which accepts USDC on Base.

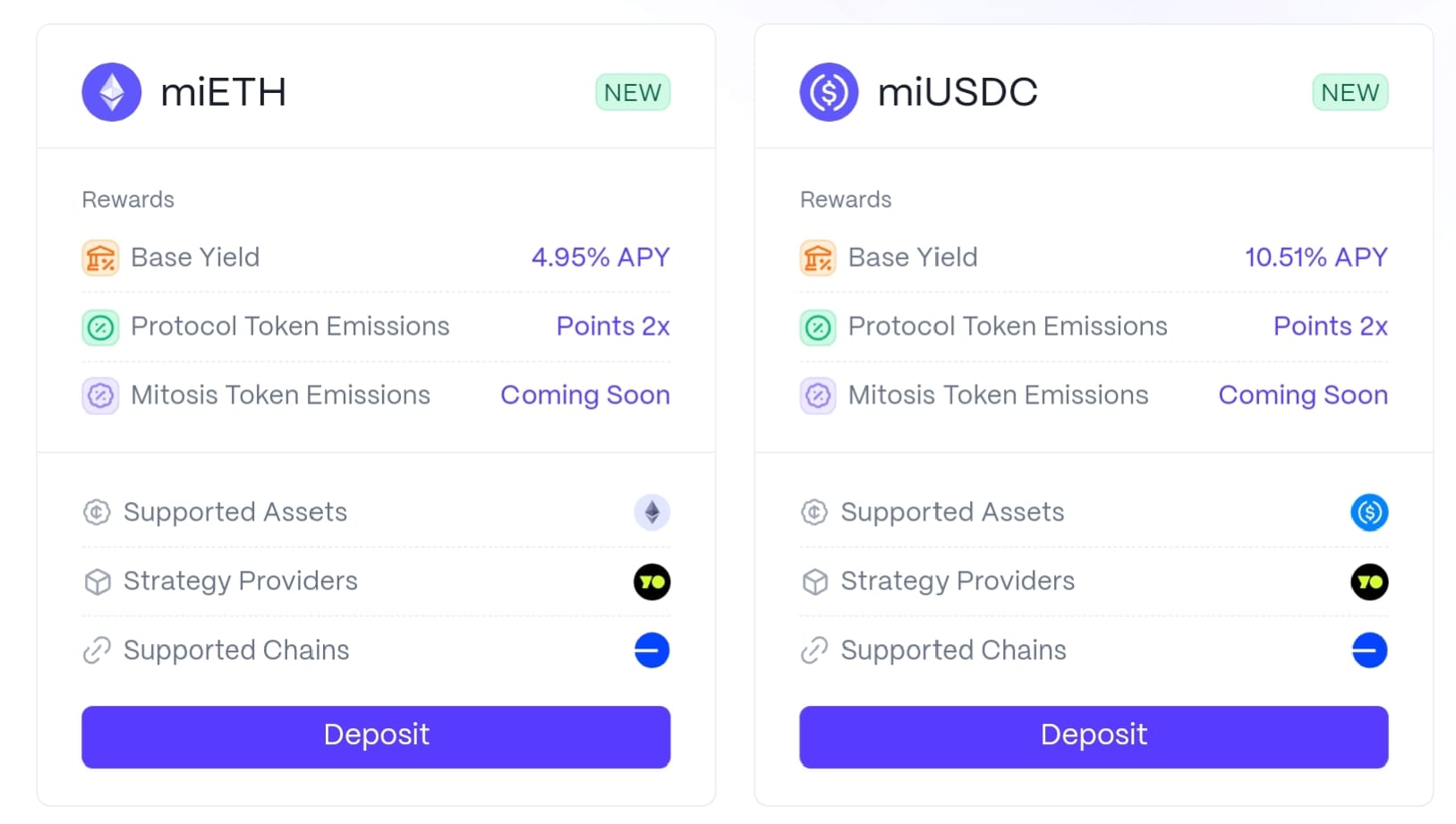

In line with MLGA’s composability goals, receipt tokens for YO positions (miETH and miUSDC) will be available on the Mitosis mainnet following launch so that positions remain liquid and can be integrated across the ecosystem as it expands. YO has reported a seven-day average APY of 5.9% for ETH and 10.9% for USDC, reflecting the optimizer’s dynamic allocation across underlying protocols.

YO’s role inside MLGA is to provide a reliable yield engine that converts user deposits into sustained on-chain activity; activity that feeds the flywheel of usage, fees, and MITO buybacks that fund future incentives.

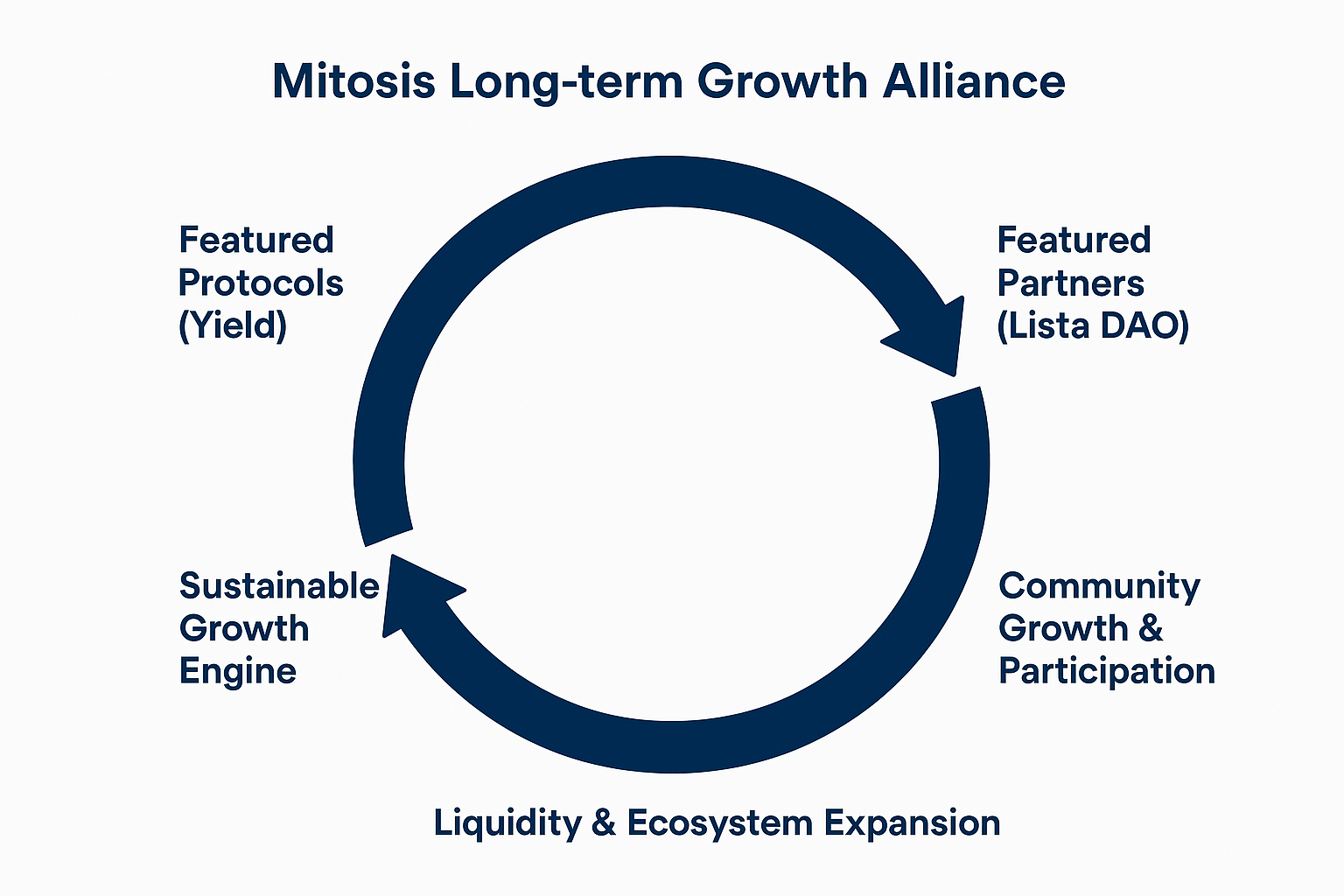

Lista DAO

Season 1’s Featured Partner is Lista DAO, the collaborator powering the Binance-integrated campaign and aligning MLGA with the BNB ecosystem. Lista is built to redefine BNB through liquid staking and strategy-driven yield, making it a natural fit for Mitosis’ programmable liquidity layer.

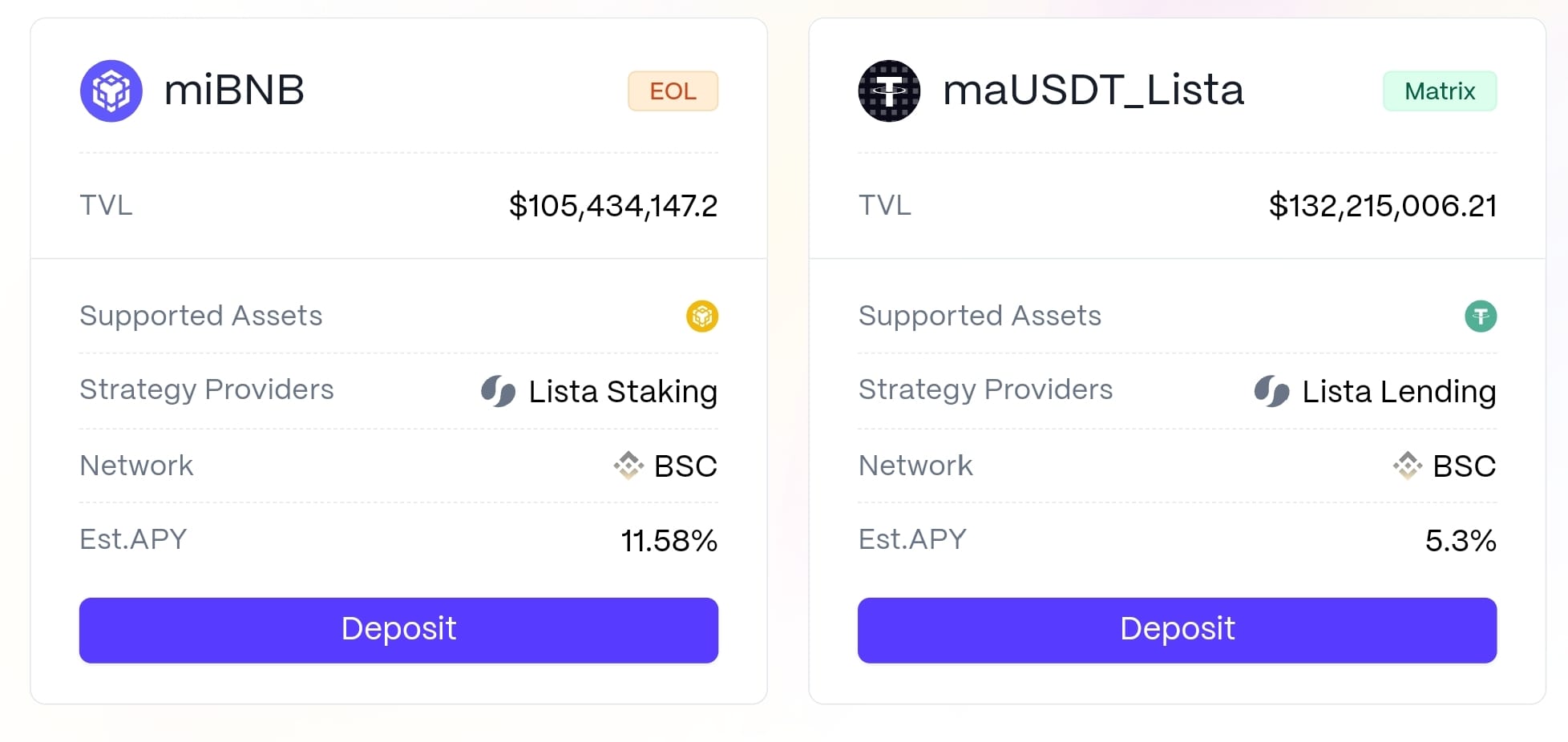

In practice, users participate via the Binance Wallet app’s Simple Yield flow by depositing BNB or USDT on BSC; those deposits are routed into Mitosis vaults that mint yield-bearing, composable assets on BSC. BNB deposits go to the EOL Vault and issue miBNB, while USDT deposits use the Matrix Vault implemented with Lista strategies and issue maUSDT.

This arrangement turns Binance Wallet into a mainstream on-ramp for MLGA while Lista supplies the strategy layer that deploys stablecoin liquidity productively. Mitosis has highlighted headline campaign APYs of roughly 117.91% for BNB and 115.94% for USDT at announcement, with eligibility limited to deposits made through the Binance Wallet app and rewards subject to a project-defined lock-up.

All relevant contracts for onward utilization have been audited by Zellic, reinforcing the SAFU-first stance. Lista’s partnership demonstrates how MLGA couples distribution and strategy: Binance Wallet brings users, Lista routes and optimizes the liquidity, and Mitosis converts the resulting activity into a sustainable incentives loop via fee-driven MITO buybacks.

Conclusion

Season 1 shows that MLGA isn’t a one-off campaign but a blueprint. The Alliance acknowledges DeFi’s fragmentation and the well-known death spiral of incentives, then counters with a coordinated, seasonal program that ties rewards to real activity. Its flywheel is explicit (liquidity to usage to fees to MITO buybacks to incentives and back to liquidity) and its governance structure makes the loop credible by disclosing inputs before each season.

With YO as the first Featured Protocol and Lista DAO the first partner, MLGA anchors both sides of the equation: a best-in-class yield layer and a mainstream path for deposits to enter composable vaults, all under an audited, SAFU-first umbrella.

So the question becomes: if an alliance can turn early participation into a self-funding engine that reduces reliance on ongoing subsidies, could this model become the default way ecosystems bootstrap and sustain growth?

One season won’t decide the future of DeFi incentives, but Season 1 of MLGA sets a high bar: connect distribution to strategy, convert usage into buybacks, and let the system reward the people who help power it, again and again.

Comments ()