Mitosis Mainnet Launch And the DeFi Protocols in its Ecosystem.

The Mitosis mainnet is just around the corner and the ecosystem is quietly but powerfully taking shape.

A new wave of DeFi applications are gearing up to go live on it - modular, composable, and more sophisticated than ever.

These protocols are not just launching alongside the mainnet - they’re built to thrive on it.

Let’s dive into what Mitosis is, why it matters, and which DeFi protocols are already building on this next-gen chain.

Why Mitosis?

Mitosis is DeFi’s answer to the persistent liquidity problem we face today.

Before now, many protocols struggle to bootstrap sustainable liquidity To operate and liquidity providers who actually deposit, have their funds locked, and often time they get the short end of the bread

Mitosis flip this script with programmability liquidity.

By turning liquidity positions into tradable assets, Mitosis introduces a system where liquidity is not just locked capital. It’s composable, flexible, and programmable, unlocking a whole new design space for DeFi primitives.

How Does It Work?

At the heart of Mitosis is the Mitosis Chain, a high-performance Layer 1 blockchain purpose-built to power its programmability and ecosystem of DeFi applications.

It acts as a coordination layer that makes liquidity usable wherever it’s needed, while maintaining high efficiency, low latency, and flexibility.

The mainnet launch is expected to go live in June, followed by the Token Generation Event (TGE) for $MITO, the native gas and governance token of the network.

And while the launch draws near, a growing number of DeFi protocols are already lining up to go live.

Mitosis DeFi Stack

Here’s a look at the protocols already building on Mitosis Ecosystem:

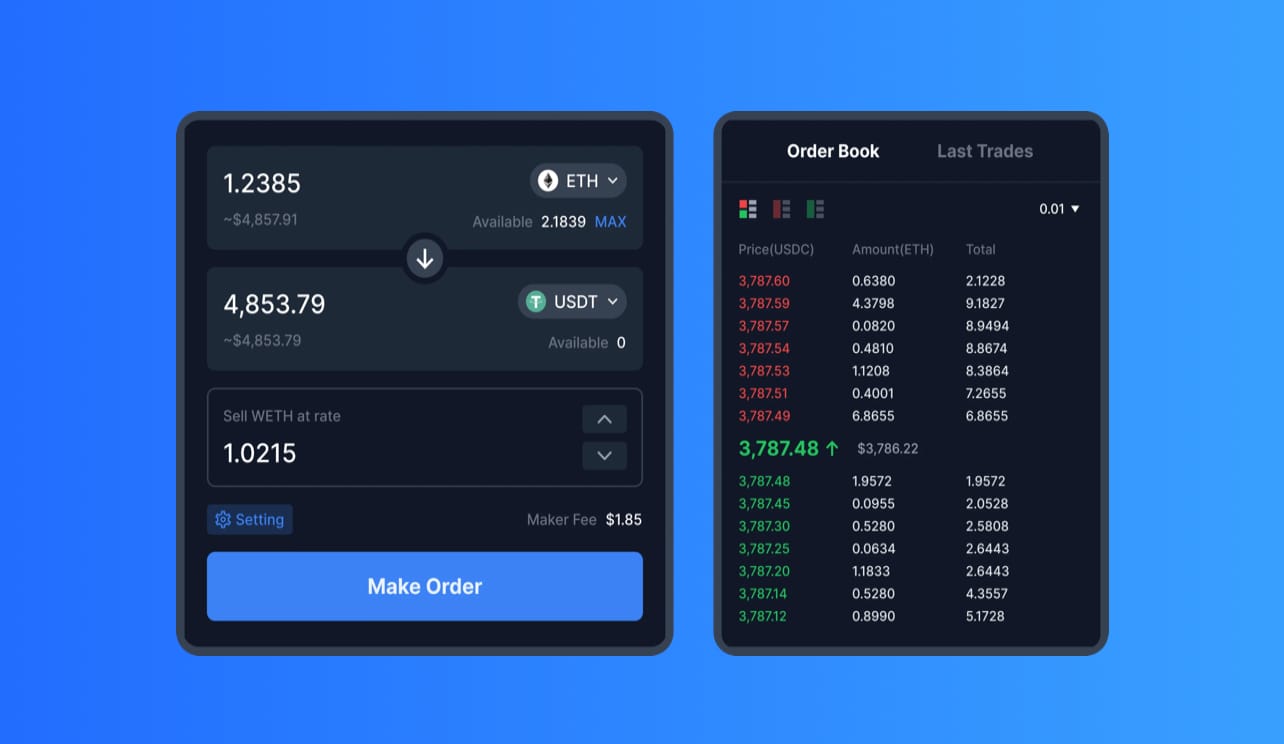

1/ CLOBER

A fully on-chain order book DEX that supports real-time limit and market orders in a trustless, decentralized way.

Clober is powered by LOBSTER, a next-gen segment tree architecture engine that matches orders efficiently, reduces latency, and minimizes fees.

It’s fully decentralized, transparent, and composable with defi protocols on Mitosis chain and beyond

Why it matters:

Order books are crucial for high-efficiency trading, especially in volatile or illiquid markets. Clober offers CEX-like performance on-chain without sacrificing decentralizatio.

2/ SPINDLE

Think of Spindle as the Pendle of Mitosis.

It‘s a yield trading protocol that splits yield-bearing assets into:

— PT (Principal Tokens)

— YT (Yield Tokens)

This separation gives users full control: lock in fixed yields or take on leveraged positions - your choice.

Spindle is built natively on Mitosis, inheriting its modularity, security, and cross-chain capabilities.

Why it matters:

Yield tokens like miAssets/maAssets becomes divisible, bringing flexivilify and more granular control for users and more building blocks for developers.

3/ CHROMO EXCHANGE

Chromo is the native liquidity hub on Mitosis, a modular AMM-based DEX that blends traditional liquidity design with concentrated liquidity pools.

Users can trade, swap, and deploy yield strategies with ease, backed by Ecosystem-Owned Liquidity (EOL) for deep, sustainable liquidity.

Chromo is built for flexibility, security, and seamless composability.

Why it matters:

Chromo isn’t just another swap. It’s designed to compose with Matrix Vaults, allowing protocol-owned strategies and user-owned yield to coexist.

4/ MILKY WAY

MilkyWay is a modular liquid staking and restaking platform that enables users to stake assets like (TIA, INIT, and BABY) to earn boosted yields while providing security to DeFi protocols.

MilkyWay is:

— Backed by top VCs like Binance Labs (@yzilabs), @Hack_VC, and @Polychain

— Trusted by 396k+ users

— Managing over $135.8M TVL

— Integrated with 50+ ecosystem partners

Why it matters:

MilkyWay brings security, yield, and composability to the staking layer, all while plugging into Mitosis’ liquidity ecosystem.

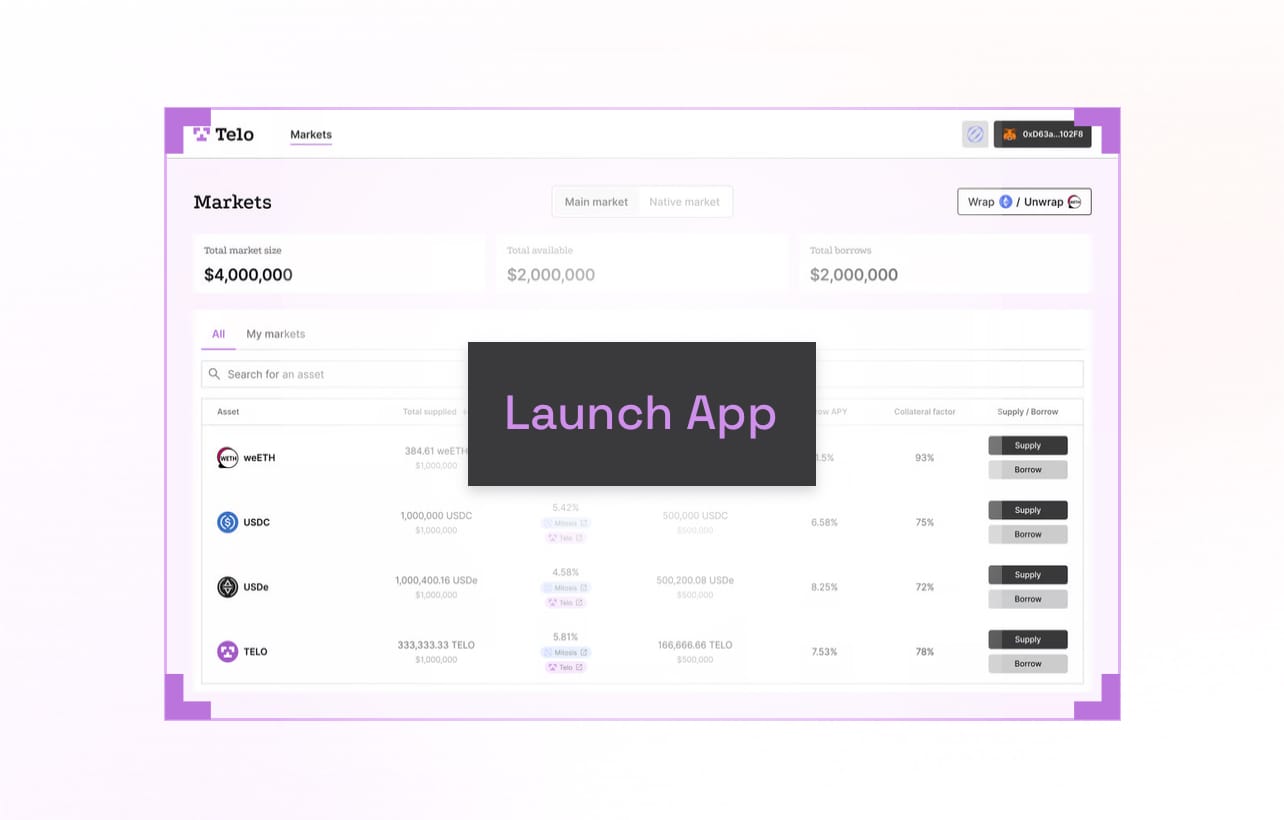

5/ TELO

Telo is the decentralized money market on Mitosis ecosystem.

A community-governed lending and borrowing platform that let you deposit and borrow against collateral permissionlessly.

Users can:

— Deposit assets to earn yield

— Borrow against their collateral

— Access capital in a fully decentralized manner.

Built with transparency and inclusivity at its core, Telo aims to make liquidity accessible to everyone.

Why it matters:

Lending is a DeFi’s core component. Telo modernizes it by making it modular, community-owned, and connected to a broader liquidity layer.

6/ ZYGO

Zygo is a decentralized perpetual trading exchange (Perp DEX) built on Mitosis.

It offers:

— Gasless trading

— High-performance leverage trading

— Support for multi-asset deposits, copy trading, and social trading features

Zygo is powered by Mitosis EOL and optimized for traders looking for speed, low cost, and full control.

Why it matters:

Gasless perps with social features can onboard new traders while maintaining performance. Zygo gives Mitosis a competitive edge in derivatives market.

More Than a Chain: A Modular Liquidity OS

What makes this ecosystem exciting isn’t just the individual protocols building on it - it’s how they work together.

— Matrix Vaults enable shared liquidity across Clober, Spindle, Chromo, and Telo

— Composable yield tokens from Spindle can be reused in Telo or Zygo

— Restaked assets from MilkyWay secure the ecosystem and earn yield simultaneously

— Ecosystem-Owned Liquidity (EOL) backs multiple layers, from trading to lending

This is a modular financial system, built to adapt, scale, and interconnect with other ecosystems.

In Conclusion

Mitosis ecosystem defi stack look strong and it’s only just getting started.

With the mainnet launch around the corner and modular liquidity becoming the new standard, these protocols are poised to unlock a new era of programmable, composable finance.

Are you ready for Mitosis?

Which protocol are you most excited to try?

Comments ()