Mitosis Matrix Vaults: The Programmable User Layer of Cross-Chain Liquidity

In the fast-growing world of decentralized finance (DeFi), new tools are always being built to help people earn, save, and move money in smarter ways. But let’s face it, many DeFi platforms are still confusing, rigid, or just too technical for the average user.

That’s where Mitosis Matrix Vaults come in.

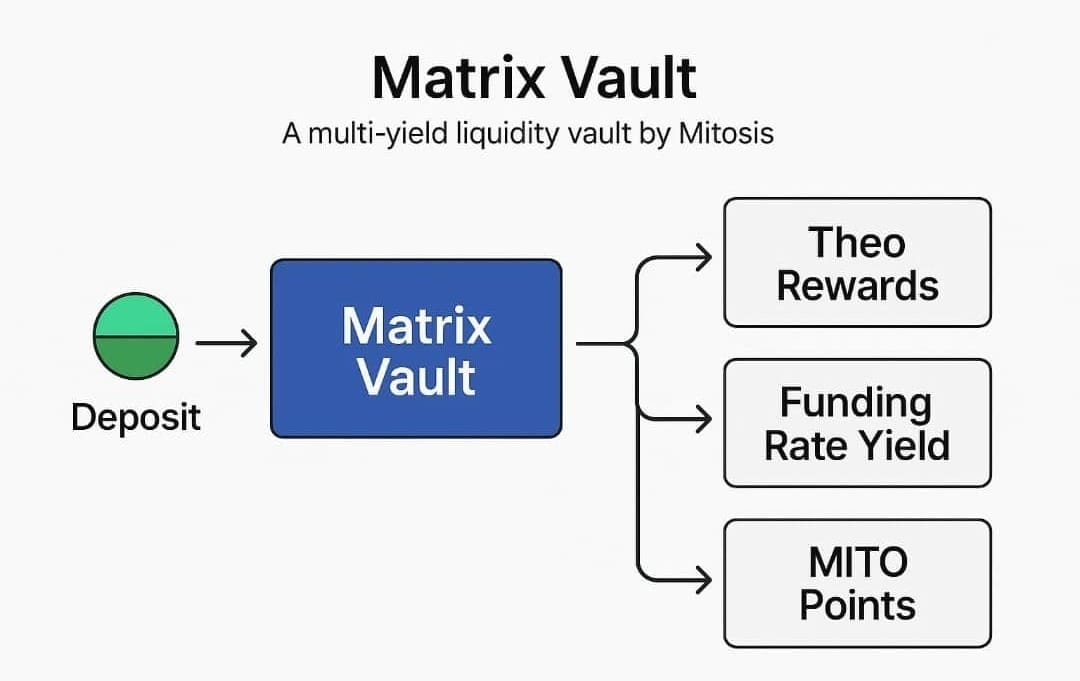

They’re designed to change the game by giving users flexible, cross-chain access to yield strategies and smart liquidity tools all in one place, without the usual friction. In simple words, Matrix Vaults are smart containers for your crypto that work across different blockchains and can be programmed to do more than just sit there.

Let’s dive into what they are, how they work, and why they matter so much for the future of DeFi.

What Are Matrix Vaults, Really?

At their core, Matrix Vaults are user-friendly DeFi tools built by the Mitosis protocol. You can think of them as programmable vaults that let you deposit crypto, earn yield, move across chains, and access new financial strategies, all without having to deal with complicated manual steps.

Most vaults in DeFi today are locked into one blockchain. You deposit, they run a strategy, and you hope to earn a return. But if you want to move your assets to another chain or change strategies, you usually have to exit the vault, bridge assets manually, and re-enter a new one elsewhere.

Matrix Vaults solve that. They are modular, cross-chain, and user-focused, giving you real control over your money without all the technical headaches.

The Problem With Traditional DeFi Vaults

Before we go deeper into Matrix Vaults, it’s important to understand what’s broken with current DeFi vaults:

- Siloed: Most vaults only work on one blockchain. If you want to move funds to another chain, you’re stuck doing it yourself.

- Yield-Locked: You can’t change strategies or switch to better returns easily. Your funds are tied to one approach until you exit.

- Rigid: There’s no flexibility. It’s a one-size-fits-all design that doesn’t evolve with your needs.

- Opaque: Users often have no idea where the yield is coming from or what strategies are being used behind the scenes.

These limitations create frustration. They reduce user freedom and limit the potential of DeFi to become a truly global, user-first financial system.

Enter Mitosis: A New Way to Think About Liquidity

Mitosis is building something different, a multi-chain liquidity layer that’s modular, programmable, and composable. Instead of locking liquidity into one spot, Mitosis lets liquidity flow across chains, strategies, and protocols seamlessly.

And at the heart of this system are Matrix Vaults.

They act as the user-facing interface for all of this complexity. You don’t need to understand how all the cross-chain routing or backend logic works. You just interact with Matrix Vaults, and the system handles the rest.

Why Matrix Vaults Matter

Let’s break down why Matrix Vaults are such a big deal:

1. Cross-Chain By Design

You’re no longer stuck on one chain. Deposit on Ethereum, earn yield on Arbitrum, and withdraw on Optimism if you want. It’s all handled under the hood by Mitosis’s cross-chain infrastructure.

2. Programmable Yield

Strategies are not fixed. Matrix Vaults support programmable yield which means the logic of how your assets earn can be customized and upgraded over time. Think of it like having a smart financial assistant that adapts to your goals.

3. Real User Control

You’re not just passively parking your funds. With Matrix Vaults, you stay in charge. You can choose strategies, rebalance, or even delegate control to automated agents, all while keeping transparency.

4. Easy to Use

All the complex stuff bridging, syncing, yield routing is hidden behind a clean, easy-to-use interface. You interact with a vault like any app, and the tech does the heavy lifting.

How Matrix Vaults Work (Without the Jargon)

Here’s a simplified breakdown of what happens when you use a Matrix Vault:

Step 1: You Deposit Assets

You choose a vault (e.g., ETH Matrix Vault) and deposit your crypto into it. That vault is connected to smart strategies across multiple chains.

Step 2: The Vault Puts Your Funds to Work

The vault automatically allocates your funds into high-performing strategies like liquid restaking, LRTs, or lending protocols across different blockchains.

Step 3: Assets Move Across Chains If Needed

If the best yield is on another chain, your funds can be bridged automatically and put to use there. You don’t have to manage that process, it’s built into the vault.

Step 4: You Earn Yield

You start earning rewards. Depending on the strategy, you might get ETH, stablecoins, or other tokens. Everything is tracked transparently.

Step 5: You Stay Liquid and Flexible

You can withdraw, switch strategies, or update your settings anytime. Matrix Vaults are built to adapt to your needs, not lock you in.

A Closer Look at the Technology Behind Matrix Vaults

Even though Matrix Vaults are simple to use, they’re powered by cutting-edge infrastructure under the hood:

- Mitosis Chain: This is the coordination layer that keeps things in sync across blockchains. It’s not a blockchain in the traditional sense, but more like a smart router for liquidity.

- Programmable Agents: These are like DeFi robots that can manage your assets, rebalance them, or execute strategies on your behalf.

- Chain-Agnostic Design: Matrix Vaults don’t care which blockchain your assets are on. They work across all chains Mitosis integrates with, and more will be added over time.

- Modular Architecture: Every part of the vault can be upgraded strategies, asset types, rewards mechanisms without disrupting users.

Use Cases: What Can You Do With Matrix Vaults?

1. Smart Yield Farming

Set a strategy that automatically finds the best yield across chains, without you having to jump around protocols.

2. Cross-Chain Liquidity

Deposit on one chain, use your funds on another, and withdraw somewhere else. It’s all handled seamlessly.

3. Passive + Programmable Income

Let your assets work passively or create custom logic to rebalance, take profits, or trigger strategies based on market conditions.

4. Build on Top

Developers can build new strategies, interfaces, or even games and apps that plug into Matrix Vaults. They’re not just vaults, they’re building blocks.

How This Benefits the Everyday User

For users, especially those who don’t want to deal with complex DeFi tools, Matrix Vaults are a breath of fresh air:

- No More Manual Bridging

- No More Juggling Protocols

- No More Guessing What’s Happening

- Just Deposit, Earn, and Move Freely

Everything works together to create a smoother, safer experience where users stay in control.

Security and Transparency

Security is a top priority for Mitosis and Matrix Vaults. Here’s what keeps your funds safe:

- Audited Contracts: Every smart contract is professionally audited to catch bugs or vulnerabilities.

- Transparent Strategy Tracking: You can see where your funds are, how they’re performing, and what yield you're earning.

- User Sovereignty: You always have control over your assets. Withdraw anytime, no lockups.

The Bigger Picture: Matrix Vaults and the Future of DeFi

Matrix Vaults are more than just a feature. They represent a shift in how we think about DeFi.

They remove barriers between chains, simplify user experience, and open the door to more powerful, personalized financial tools. In a world where liquidity is everything, Matrix Vaults turn every deposit into a gateway to a larger, smarter financial system.

This is DeFi for real people. Not just developers, whales, or power users but everyday users who want more control, better yield, and less hassle.

Why Builders Love Matrix Vaults Too

It’s not just end-users who benefit. Developers and DeFi builders can use Matrix Vaults as powerful infrastructure:

- Plug-and-Play Strategies

Create vaults for new yield strategies, restaking models, or cross-chain liquidity flows without reinventing the wheel. - Programmable Hooks

Add logic for when to move assets, change positions, or update parameters in real time. - Composable Architecture

Matrix Vaults can be combined with other protocols, dApps, and ecosystems to build new experiences.

Conclusion: Better Way to DeFi

Matrix Vaults show what DeFi can really become—fluid, flexible, and user-first. They bring the best of modern finance into a package that’s simple to use, powerful under the hood, and built for the cross-chain world ahead.

In short, Mitosis Matrix Vaults let you do more with your crypto, across more chains, with less friction and more freedom.

This isn’t just a vault, it’s a better interface to DeFi itself.

Comments ()