Mitosis’ $MITO Token: Powering Community Governance in DeFi

Introduction

Decentralized Finance (DeFi) thrives on the promise of empowerment, no banks, no bosses, just code and community. Yet, for all its openness, most DeFi protocols leave retail users on the sidelines, watching whales and insiders call the shots. Mitosis, a Layer 1 blockchain protocol, is flipping that narrative with its native token, $MITO. Set to launch with its mainnet, $MITO isn’t just a reward, it’s a key to community governance, putting Liquidity Providers (LP) in the driver’s seat. With $7 million raised in 2024 and a bold vision, Mitosis is betting that true decentralization starts with who holds the power.

Governance: DeFi’s Missing Piece

In today’s DeFi, liquidity providers stake their assets and hope for the best. Where that liquidity goes high-yield farms, new protocols, or cross-chain ventures, is often decided by developers or big investors behind closed doors. It’s efficient, sure, but hardly democratic. Mitosis’ Ecosystem-Owned Liquidity (EOL) model changes that, and $MITO is the linchpin.

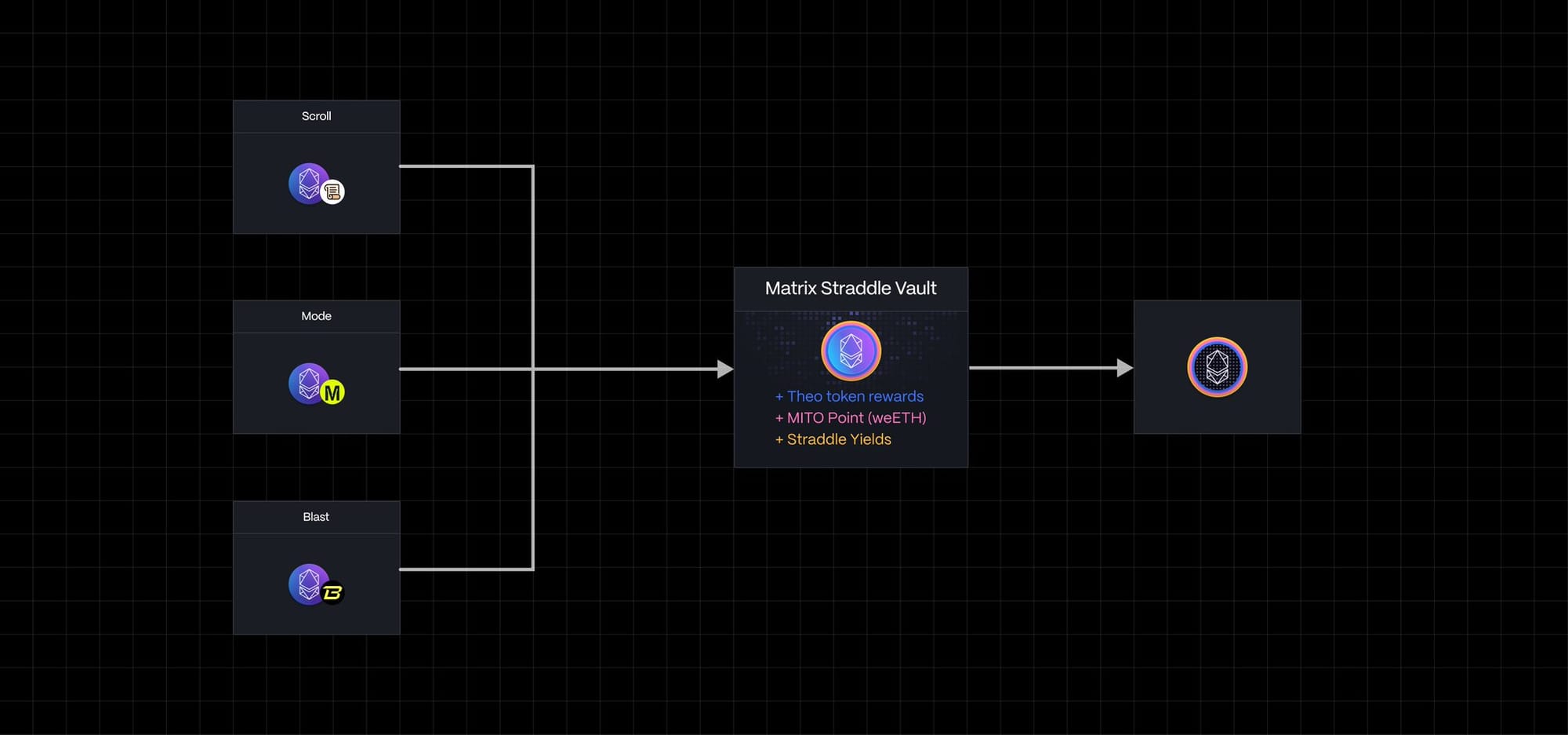

Born from campaigns like the 2024 “Expedition Testnet” (where users earned MORSE tokens as a teaser), $MITO is designed to let LPs govern the ecosystem. Deposit assets into Mitosis Vaults, earn tokenized stakes (like “miAssets”), and use $MITO to vote on what happens next. Should liquidity flow to a promising L2? Boost rewards for liquid restaking tokens (LRTs)? The community decides, not a boardroom.

More to come in details from this article, as we’ll be looking at:

🎯 How $MITO work

🎯 Why it is a big deal

🎯 The catch from it

🎯 How it is a new DeFi blueprint

Let’s dive right into it 🚀

How $MITO Works

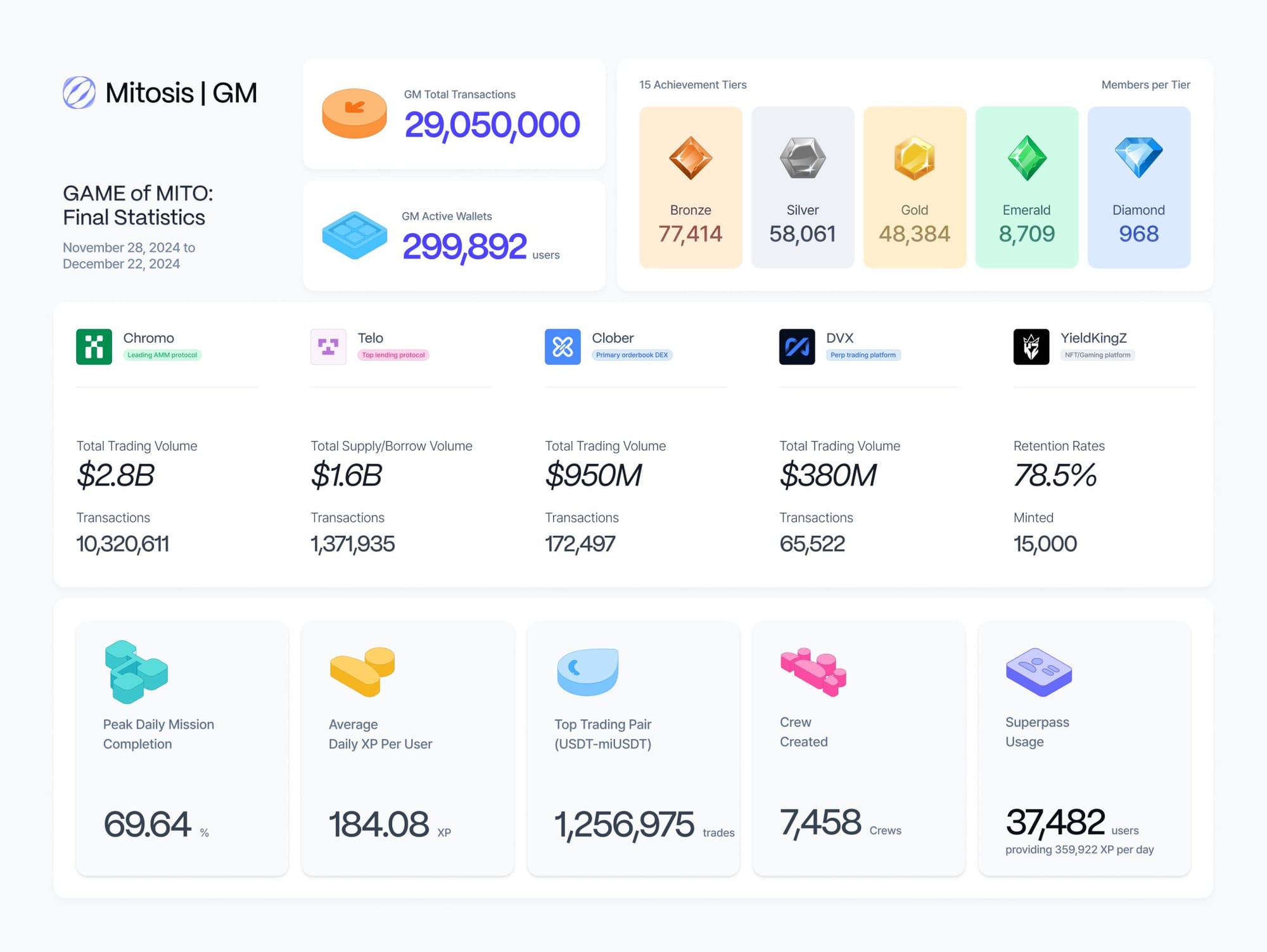

Think of $MITO as your ballot and your stake. Holding it gives you a say in Matrix, Mitosis’ curated yield platform, where LPs pick the best opportunities, short-term plays or locked-in strategies. It’s not just about yields; $MITO holders shape the protocol’s direction, from cross-chain expansions to partnerships. During the “Game of Mito” campaign, Mitosis hinted at this power, tying points and rewards to future governance roles.

This isn’t tokenomics for show. Mitosis aims to solve real DeFi problems, like the “cold start” trap for new chains, by letting LPs allocate liquidity where it’s needed most. It’s a self-regulating system: speculative dumpers lose out, while committed holders steer the ship. With $7 million from backers like Amber Group and Foresight Ventures, the infrastructure’s there to make it stick.

Why It’s a Big Deal

DeFi’s governance experiments like Decentralized Autonomous Organizations(DAOs) often fizzle into apathy or whale domination. $MITO could buck that trend. By tying voting power to liquidity provision, it rewards those who fuel the ecosystem, not just those with the fattest wallets. X(Twitter) posts from the community buzz with excitement over this shiftless “VC playground,” more “LP democracy.”

It’s practical, too. Cross-chain liquidity, a Mitosis hallmark, gets a boost when LPs can vote to bridge assets where yields peak. Transparency’s baked in every decision’s on-chain, trackable via tools like Routescan. And with security partners like Ethos, Mitosis is guarding against the hacks that plague DeFi governance.

The Catch

Power comes with pitfalls. Governance can be messy, too many cooks, not enough consensus. $MITO’s value might swing with market whims, and lockups in Matrix Vaults could test patience. Still, Mitosis’ testnet success and clear roadmap suggest they’re ready to iterate. The real test comes post-mainnet: can $MITO holders turn votes into value?

A New DeFi Blueprint

Mitosis isn’t just launching a token, it’s sparking a governance revolution. $MITO hands Liquidity Providers(LPs) the reins, making liquidity a collective asset, not a private fiefdom. As DeFi grows, this could set a precedent: protocols that thrive don’t just decentralize tech, they decentralize control.

For users, $MITO is a chance to shape DeFi’s future, one vote at a time. For Mitosis, it’s the heartbeat of a community driven ecosystem. The mainnet’s coming, and with it, a question: when LPs hold the power, how far can they take it? Mitosis and $MITO are about to find out.

And that brings us to the end of this article, follow Mitosis on their official websites to stay tuned for more: Website | X | Discord | Telegram

Comments ()