Mitosis Litepaper - An In-Depth Exploration of Programmable Liquidity

Decentralized Finance (DeFi) has grown rapidly since Bitcoin demonstrated how to establish trust without centralized intermediaries using BRC-20[1]. Ethereum then added smart contracts and permissionless applications [2], opening the door to an entire ecosystem of on-chain financial products. Despite these milestones, one fundamental component of DeFi lending remains inefficient, unstable, and often obscure. In many cases, liquidity providers (LPs) lock assets into pools with little clarity about true market pricing or long-term sustainability. Meanwhile, protocols struggle with “mercenary” liquidity that arrives solely to capture short-term rewards and disappears when a better yield appears elsewhere.

Mitosis aims to tackle these issues head-on. By transforming traditional liquidity positions into programmable liquidity, it provides new ways for both small and large participants to access fair yields, manage risks, and strengthen the overall DeFi ecosystem. This article reviews the ideas behind Mitosis, exploring how it works, why it matters, and where it could lead the future of decentralized finance.

The Liquidity Conundrum

From its earliest days, DeFi has been propelled by two major breakthroughs: Bitcoin’s demonstration of decentralized consensus and Ethereum’s introduction of programmable smart contracts [1][2]. Yet, while these innovations solved trust and programmability, they left unanswered questions about liquidity management. In DeFi, liquidity often involves LPs depositing tokens into a protocol in exchange for rewards. Without a clear market reference, yields and agreements can be opaque:

- Lack of Fair Price Discovery: Most DeFi protocols don’t publish standardized, transparent benchmarks for liquidity needs or costs. Large LPs sometimes negotiate private, above-market yield deals, creating information asymmetry.

- Capital Inefficiency: When a token is locked in a single DeFi pool, you generally cannot use it for other yield strategies or collateralization. This fragmentation reduces overall capital efficiency.

- Unstable TVL: Many protocols rely on short-term incentives to attract total value locked (TVL). Once these incentives expire or shift, liquidity rapidly moves on, disrupting protocol stability.

These patterns form a loop of suboptimal capital allocation and volatile TVL, hurting both protocols and smaller participants [3]. Mitosis begins by recognizing that DeFi liquidity isn’t just a “deposit and forget” resource but rather a crucial piece of financial infrastructure—one that should be tradeable, manageable, and priced transparently.

The Mitosis Vision

Mitosis treats providing liquidity as a true lending arrangement, where participants supply capital to protocols under specified terms, duration, and expected returns [3]. The platform then works to tokenize these liquidity positions, providing three core innovations:

- Democratized Access to Preferential Yields

Collective bargaining power allows Mitosis to obtain higher yields once reserved for large private deals. By pooling many smaller LPs together, it can unlock yield opportunities typically hidden from public markets. - Liquid LP Positions

Mitosis introduces two token types—miAssets and maAssets—that represent liquidity positions on the Mitosis Chain. These tokens can be transferred, traded, or combined with other DeFi strategies, greatly enhancing capital efficiency. - A Specialized Liquidity Capital Market

The Mitosis Chain itself is built to host advanced financial applications centered on these tokenized positions. This “programmable liquidity” framework enables new levels of risk management, complex yield products, and integrated DeFi functionalities not easily achievable in standard yield-farming contracts.

How It Works: Deposit, Supply, Utilize

The Mitosis protocol is built around three core processes—Deposit, Supply, and Utilize—each backed by a Vault infrastructure that interacts with supported blockchains. These processes seamlessly move user assets into (and out of) Mitosis, while enabling a new level of programmability once those assets are tokenized.

Deposit

Users begin by sending tokens (e.g., ETH) to a Mitosis Vault on a chosen chain (Ethereum, BSC, or another). The Vault secures those assets and then sends a message to Mitosis’s Asset Manager, which mints a 1:1 Vanilla Asset (e.g., Vanilla ETH) on the Mitosis Chain [4].

- If you want your original ETH back, you burn your Vanilla ETH on Mitosis, and the Vault releases the real ETH.

- This system effectively bridges your deposit, letting you hold a fully backed representation on the Mitosis Chain.

By separating the real deposit from its tokenized equivalent, Mitosis transforms the notion of a locked LP position into something more flexible—you can now use these Vanilla Assets across the Mitosis network.

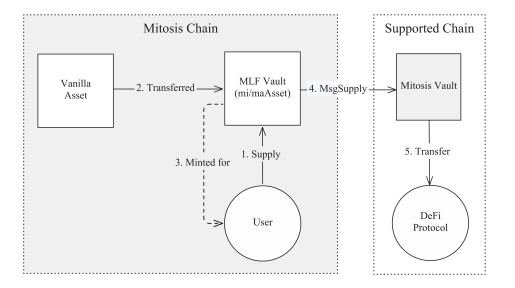

Supply

Once users have Vanilla Assets, they can deploy them into yield strategies under Mitosis Liquidity Frameworks (MLFs). Mitosis currently supports two primary frameworks:

- Ecosystem-Owned Liquidity (EOL)

- Matrix (Time-Bound Liquidity Campaigns)

Under each framework, the user’s Vanilla Assets are deposited into the chosen pool or campaign, and in return, the user receives MLF Assets that track the position’s principal and any accrued interest. The Mitosis protocol initially offers:

- miAssets (for EOL),

- maAssets (for Matrix).

Both follow the ERC-4626 standard [4], ensuring they are composable across DeFi.

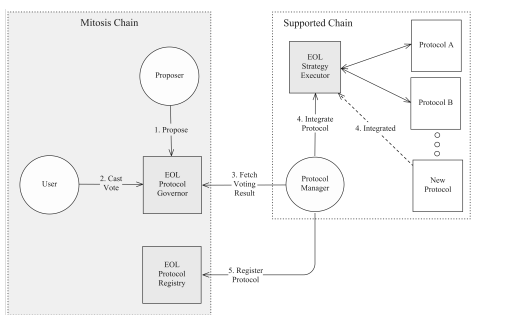

EOL: Ecosystem-Owned Liquidity

EOL takes a governance-driven approach, pooling user assets (Vanilla Assets) and giving participants miAssets that reflect both ownership and voting power. Through EOL:

- Initiation Votes: New DeFi protocols apply to be included in the EOL pool, explaining how they’ll use the liquidity and what returns they offer.

- Gauge Votes: miAsset holders periodically decide how much capital each approved protocol should receive.

A “Settlement” system periodically mints or burns Vanilla Assets to match actual yields or losses realized by the EOL strategies [5]. This process ensures miAsset pricing remains accurate and transparent. Extra rewards, such as protocol governance tokens, are also distributed to miAsset holders in a fair and on-chain manner.

Matrix: Curated Liquidity Campaigns

Unlike the community-based approach of EOL, Matrix focuses on fixed-time commitments. Protocols create campaigns offering higher yields if you lock assets for a set period (e.g., 30, 60, or 90 days). In this model:

- You exchange your Vanilla Assets for maAssets, effectively locking capital until the campaign ends.

- When the lock period expires, you redeem your maAssets for the original deposit plus any promised yield.

This direct arrangement can be ideal for protocols seeking consistent, short-term liquidity and for users who prefer clear timeframes and defined returns.

Putting Liquidity to Work: The Utilize Process

The real magic happens once you hold miAssets or maAssets on the Mitosis Chain. These tokenized positions aren’t just idle placeholders:

- They can be used as collateral in lending markets,

- Traded or pooled in automated market makers (AMMs),

- Split into principal and interest components for yield tokenization,

- Integrated into more advanced DeFi structures such as yield-bearing stablecoins or liquidity indices [7][8][9][10].

Mitosis envisions a fully programmable liquidity capital market where each LP token can be repurposed, combined, or hedged—much like how sophisticated traders deal with bonds, derivatives, or structured financial products in traditional finance.

Architecture of the Mitosis Chain

To support this level of flexibility, Mitosis runs on a custom blockchain built with the Cosmos SDK and CometBFT. It offers:

- Modular Blockchain: Execution (EVM-compatible) is separated from consensus, allowing future upgrades (e.g., adopting alternative consensus models or restaking solutions) without breaking existing functionality [5][6].

- Seamless Ethereum Integration: The Mitosis Chain is EVM-equivalent, meaning DeFi developers can port or build dApps that interact with miAssets and maAssets without major rewrites.

- Cross-Chain Bridges: Mitosis Vaults manage deposits on various chains, so your assets can originate on Ethereum, BSC, or others. The Mitosis Chain orchestrates these cross-chain flows, ensuring that the total supply of each token remains consistent.

Key Developments and Future Challenges

Multi-Asset Liquidity

Currently, many DeFi protocols require token pairs (like ETH/USDC). Mitosis must extend beyond single-asset approaches to accommodate multi-token AMMs and more complex pool structures.

Cross-Chain Liquidity Management

As users deposit on one chain but withdraw on another, the system must stay balanced. Mitosis research includes dynamic mechanisms for automatically shifting liquidity where it’s needed most.

EOL Governance Optimization

While EOL governance is an improvement over opaque private deals, not every user has time or expertise for active voting. Delegation systems could be introduced so smaller holders can trust specialized delegates, ensuring more balanced decision-making.

The M.O.R.S.E Program

To encourage early participation, Mitosis created the M.O.R.S.E (Mitosis Operations and Rewards for Strategic Engagement) program. It provides $MITO token incentives to protocols that launch liquidity campaigns via Matrix. This effectively lowers the cost of acquiring liquidity while still offering attractive yields to Mitosis LPs. Over time, as the network effects grow and more users hold miAssets or maAssets, these incentives can gradually scale down—shifting toward a sustainable, demand-driven marketplace [4].

What did we learned?

Mitosis aims to rewrite how DeFi liquidity is deployed, valued, and governed. By tokenizing positions into liquid assets (miAssets, maAssets), opening them up to advanced DeFi strategies, and anchoring everything on a specialized blockchain, Mitosis envisions a future where the liquidity pool is neither static nor easily manipulated by a few big players. Instead, it becomes a shared, transparent resource governed by those who provide it, with flexible options to manage risks, seize yield opportunities, and build more sophisticated financial products.

If Mitosis succeeds, it could help DeFi evolve beyond quick-hit farming schemes into a more mature, stable, and democratic ecosystem. Capital would no longer be locked away and illiquid but instead roam freely—constantly finding its best use and redistributing risks and rewards to those who actively govern and contribute. In a sector still racing to define its long-term models, Mitosis offers an ambitious blueprint for turning liquidity from a short-term commodity into a foundational layer of the decentralized economy.

I hope you guys enjoyed this thread about Mitosis. If you have any feedback feel free to hit me a dm on https://x.com/FarmingLegendX

References

- Nakamoto, S. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. [Online]. Available: https://bitcoin.org/bitcoin.pdf

- Buterin, V. (2014). A Next Generation Smart Contract and Decentralized Application Platform. [Online]. Available: https://ethereum.org/en/whitepaper/

- Leshner, R. & Hayes, G. (2019). Compound: The Money Market Protocol. [Online]. Available: https://compound.finance/documents/Compound.Whitepaper.pdf

- Wagner, W. et al. (2022). EIP-4626: Tokenized Vault Standard. Ethereum Improvement Proposals. [Online]. Available: https://eips.ethereum.org/EIPS/eip-4626

- Kwon, J., Buchman, E., & Milosevic, Z. (2019). Cosmos: A Network of Distributed Ledgers. [Online]. Available: https://v1.cosmos.network/resources/whitepaper

- Buchman, E., Kwon, J., & Milosevic, Z. (2023). CometBFT: Byzantine Fault Tolerance for Fast Finality. [Online]. Available: https://cometbft.com/

- Adams, H. et al. (2021). Uniswap v3 Core. [Online]. Available: https://uniswap.org/whitepaper-v3.pdf

- Pendle Finance. A study on AMMs for trading fixed yield and Pendle V2’s Principal Trading AMM. [Online]. Available: https://github.com/pendle-finance/pendle-v2-resources/blob/main/whitepapers/V2_AMM.pdf

- DeFi Saver. What is sDAI? [Online]. Available: https://help.defisaver.com/protocols/spark/what-is-sdai

- Index Coop. DeFi Pulse Index. [Online]. Available: https://indexcoop.com/products/defi-pulse-index

Comments ()