Mitosis Phase 2 Launch: New Assets, Strategies, and Dual Rewards

The second phase of Mitosis delivers an evolved cross-chain liquidity experience with more assets, dual incentives, and programmable yield strategies.

Phase 2 Begins: Scaling the Mitosis Ecosystem

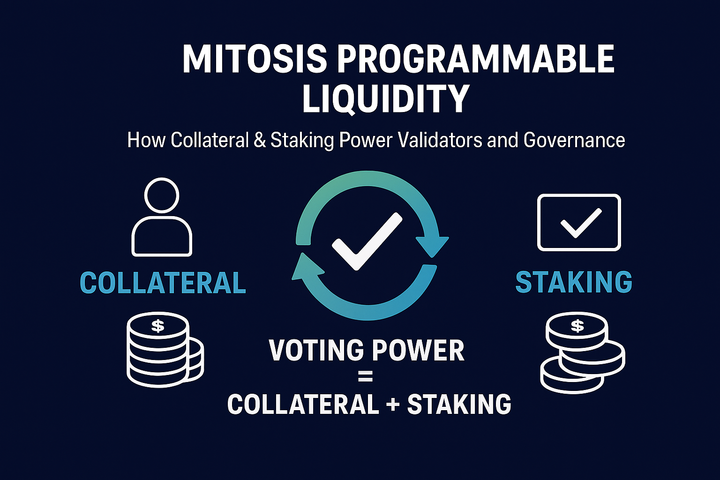

The Mitosis Protocol has officially entered Phase 2 — a significant upgrade designed to enhance modularity and liquidity efficiency across the DeFi space. Building on the foundation of Vanilla Assets, this phase introduces more supported tokens, cross-chain capabilities, and deeper DAO-integrated mechanics.

This expansion pushes the vision of programmable liquidity even further, empowering users to interact with DeFi not just as investors, but as strategy builders.

Expanded Vanilla Asset Support

Phase 2 introduces a wider selection of supported tokens including vUSDC, vETH, vDAI, and more. These vAssets are fully composable and can be transferred across chains without losing yield.

Users mint vAssets by depositing base assets into the Ecosystem-Owned Liquidity (EOL) pool — a shared community-managed capital base that powers yield strategies and ensures optimal liquidity routing.

The system now supports seamless cross-chain movement of vAssets, allowing liquidity to flow where it's most productive.

Dual Rewards Now Live on Morph

A major highlight of Phase 2 is the integration with Morph L2, offering users dual rewards. By providing liquidity with Mitosis on Morph, users can earn both base protocol yield and additional Morph incentives.

This incentive model is live through the Morph Dual Rewards Program, which strategically aligns both ecosystems for maximum user benefit.

Liquidity providers on Morph can now direct their vAssets into Mitosis Matrix-powered strategies while being auto-enrolled into Morph’s boosted reward pools.

Yield Strategy Layer: Mitosis Matrix

The Mitosis Matrix acts as a programmable strategy layer where users allocate their assets to custom or DAO-governed yield routes. Each strategy is implemented as a smart contract, and users can choose between:

- Manual allocation of their vAssets

- Auto-routing via DAO-approved strategies

Developers can also build and deploy their own strategies using the Matrix SDK, making the system highly extensible.

These contracts are governed and improved through Mitosis DAO, ensuring decentralization and transparent upgrades across strategies and assets.

Comments ()