Mitosis: Powering Programmable Liquidity with EVM-Cosmos Hybrid Architecture

Abstract

This article investigates the foundational role of blockchain consensus mechanisms and data availability (DA) solutions in enabling scalable and modular systems such as the Mitosis protocol. It addresses key challenges in decentralized finance (DeFi). By analyzing Proof-of-Work (PoW), Proof-of-Stake (PoS), and alternative consensus models, alongside modern DA layers like Celestia, and EigenDA, we uncover the trade-offs impacting blockchain scalability and security. Mitosis’s hybrid and modular architecture melding Ethereum’s programmability with Cosmos’s high-performance consensus tackles liquidity fragmentation by transforming static liquidity into programmable assets. This analysis highlights the crucial role of modular design in creating a seamless, cross-chain DeFi ecosystem, offering insights into the future of interoperable blockchains.

The Modular Blockchain Vision

The blockchain ecosystem is shifting from monolithic, all-in-one chains to modular architectures that separate execution, consensus, and data availability for enhanced efficiency and scalability. This article provides a comprehensive analysis of blockchain consensus mechanisms, the data availability problem, and the Mitosis protocol’s innovative approach to cross-chain liquidity. Its central thesis is that Mitosis’s modular design, combining an Ethereum Virtual Machine (EVM)-compatible execution layer with a Cosmos-based consensus engine, creates a programmable, cross-chain liquidity layer that addresses persistent DeFi challenges, such as fragmented liquidity and scalability bottlenecks.

Targeted at protocol researchers, developers, and investment analysts with a foundational grasp of blockchain systems, this article takes an analytical and comparative approach. It progresses from core concepts to a focused case study on Mitosis, integrating technical architecture with strategic intent to contextualize its role within the modular blockchain landscape.

Consensus Mechanisms: The Foundation of Trust

The Consensus Problem: Solving Decentralized Agreement

At the heart of every blockchain lies the consensus problem: ensuring multiple nodes in a decentralized network agree on a single, consistent state without a central authority, even when some nodes are malicious or unreliable (Visa). This is akin to a group of strangers agreeing on a shared record without a leader, despite potential deceit. A blockchain’s consensus mechanism is the set of rules enabling this agreement, ensuring security and functionality by preventing issues like double-spending, where a user spends the same digital asset twice (Investopedia). These mechanisms replace trusted third parties, enabling a shared, immutable ledger across a peer-to-peer network.

Proof-of-Work: Computational Security and Trade-offs

Mechanism: Proof-of-Work (PoW), used by Bitcoin, relies on miners solving complex computational puzzles to validate transactions and create new blocks (Investopedia). The first miner to solve the puzzle broadcasts the block, which other nodes verify and add to the chain. Security stems from the difficulty of controlling over 50% of the network’s computational power—a costly “51% attack” requiring vast hardware and energy resources (Heddera)

Advantages:

- Proven Security: Bitcoin’s PoW, operational since 2009, is the most battle-tested consensus mechanism, demonstrating resilience against attacks (Fidelity).

- Decentralization: Influence is tied to computational power, not coin ownership, making it harder to monopolize control.

Disadvantages:

- Energy Consumption: PoW’s computational race consumes massive electricity, raising environmental concerns (Visa).

- Scalability Limits: Bitcoin’s 10-minute block time limits transaction throughput (Investopedia).

- Centralization Risk: Specialized hardware and cheap electricity have led to mining pools dominating, concentrating power (Fidelity).

Proof-of-Stake: Economic Security and Slashing

Mechanism: Proof-of-Stake (PoS) replaces computational mining with economic staking, where validators lock up cryptocurrency as collateral to validate transactions and propose blocks (Coinbase). Selection is often lottery-based, proportional to stake size (e.g., a 5% stake yields a 5% chance of block proposal) (Fidelity). Malicious behavior triggers “slashing,” where a portion of the stake is destroyed, aligning validators’ incentives with network security (Coinbase). This is like betting your savings on honest behavior, with penalties for cheating.

Advantages:

- Energy Efficiency: PoS consumes a fraction of PoW’s energy, as seen in Ethereum’s 2022 PoS transition.

- Scalability: Faster block times (e.g., Ethereum’s 12 seconds) enable higher throughput.

- Accessibility: Participation requires capital, not specialized hardware, broadening access via staking pools (Coinbase).

Disadvantages:

- Centralization Risk: Wealthy validators can dominate, creating a “rich get richer” dynamic.

- Less Battle-Tested: PoS is newer than PoW, with unproven long-term resilience compared to Bitcoin’s track record (Heddera).

Philosophical Shift: PoW relies on external resources (hardware, energy) for security, while PoS internalizes it through staked assets, reflecting different approaches to the blockchain trilemma of decentralization, security, and scalability (Fidelity). PoW prioritizes security and decentralization but sacrifices scalability, while PoS enhances scalability and efficiency at potential decentralization costs.

Feature | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

|---|---|---|

Mechanism | Competitive mining to solve complex computational puzzles. | Validators are chosen to create blocks based on the amount of cryptocurrency they stake as collateral. |

Security Model | Based on computational power (hashrate). An attack requires controlling >50% of the network’s hashrate, which is prohibitively expensive in terms of hardware and energy. | Based on economic stake. An attack requires a significant amount of the network’s native currency. Malicious behavior is punished by slashing the validator’s stake. |

Energy Efficiency | Extremely high energy consumption due to computational race. | Highly energy-efficient, eliminating the need for intensive computations. |

Table 1: Comparing PoW and PoS consensus mechanisms.

Alternative Models: Beyond PoW and PoS

- Proof of Capacity (PoC): Used by Signum and Chia, PoC leverages storage space. Miners pre-compute puzzle solutions (“plots”) stored on hard drives, with larger storage increasing block creation chances. PoC is energy-efficient and uses standard hardware (GeekstorGeeks).

- Proof of Activity (PoA): A hybrid of PoW and PoS, PoA starts with miners competing for block headers, followed by a PoS phase where validators sign the block. Used by Decred, it requires both hashrate and stake for attacks, enhancing security (Investopedia).

- Proof of Burn (PoB): Participants burn cryptocurrency by sending it to an unspendable address, earning block creation rights proportional to the burned amount. PoB is energy-efficient, replacing computational costs with economic loss (GeekstorGeeks).

These alternatives address specific PoW and PoS limitations but are less widely adopted, reflecting the dominance of PoW and PoS in major networks (Rapid Innovation).

The Data Availability Bottleneck

Defining Data Availability: Beyond Retrievability

Data Availability (DA) ensures all nodes can access a block’s full data to verify its validity, a cornerstone of blockchain’s trustless nature (Celestia). Unlike simple retrievability (requesting data), DA guarantees transaction data is published and accessible, preventing malicious producers from withholding data to hide fraudulent transactions, such as double-spending (Nervous Network). Think of DA as ensuring every page of a public ledger is visible to all, not just a cover page.

Role in Modular Blockchains: Light Clients and Rollups

DA is critical for modular blockchains, particularly for:

- Light Clients: These nodes download only block headers, relying on DA to ensure underlying data is available. Without DA, malicious producers could publish valid headers but withhold data, deceiving light clients (Ledger). It’s like trusting a book’s table of contents without seeing the chapters.

- Rollups: Layer 2 (L2) solutions like Optimistic and Zero-Knowledge (ZK) Rollups process transactions off-chain but post summaries to Layer 1 (L1) for security. Optimistic Rollups need DA for fraud proofs to challenge invalid transactions, while ZK-Rollups require it to reconstruct states.

Ethereum’s Monolithic Challenge: Calldata and Gas Fees

In monolithic blockchains like Ethereum, execution, consensus, and DA are handled by the same nodes, creating a scalability bottleneck (Simplicity Group). Larger blocks increase throughput but raise hardware and bandwidth requirements, centralizing node operation. Rollups exacerbate this by posting large calldata volumes, increasing gas fees and slowing transactions.

Modern Data Availability Solutions

The DA bottleneck has spurred innovative solutions, each balancing scalability, security, and decentralization.

Ethereum’s EIP-4844: Proto-Danksharding

Mechanism: Ethereum’s EIP-4844 (Proto-Danksharding), part of the Dencun upgrade, introduces “blobs,” temporary data packets separate from calldata, priced under a distinct fee market. Blobs are pruned after weeks, reducing costs for rollups (Symbolic Capital).

Consensus and Finality: Operating under Ethereum’s PoS (GHOST + Casper), blocks are produced every 12 seconds, but economic finality takes 12-15 minutes, delaying rollup settlement.

Limitations: Proto-Danksharding lacks Data Availability Sampling (DAS), requiring full nodes to download all blob data, limiting scalability. Full Danksharding with DAS remains in development (Symbolic Capital).

Encoding and Security: KZG commitments ensure correct data encoding but add computational overhead. Light clients rely on an honest majority assumption for DA.

Celestia: Purpose-Built Modular DA Network

Mechanism: Celestia specializes in transaction ordering and DA, outsourcing execution to rollups, offering a scalable, sovereign DA layer (Celestia).

Consensus and Finality: Built with the Cosmos SDK and CometBFT, Celestia uses Byzantine Fault Tolerance (BFT), tolerating up to one-third malicious nodes for robust consensus (DAIC Capital). Its single-slot finality, where blocks are instantly final once validators agree, achieves ~15-second finality, far faster than Ethereum (CometBFT).

Key Feature (DAS): Data Availability Sampling allows light nodes to verify data by sampling small chunks, like checking a few puzzle pieces to confirm the whole puzzle is present. This enables scalability without heavy hardware demands, with more light nodes increasing security as block sizes grow.

Encoding and Security: Celestia uses fraud proofs, less computationally intensive but requiring a challenge period, introducing slight latency. Its PoS validator set is smaller than Ethereum’s, with lower economic stake.

EigenDA: Restaked Security

Mechanism: EigenDA leverages Ethereum’s restaked ETH for security, offering a sovereign DA service for rollups. It uses a committee-based model for verification(Medium).

Consensus and Finality: The committee-based model balances security and sovereignty but lacks DAS, limiting scalability compared to Celestia (Medium).

Comparison Table:

Feature | Ethereum (EIP-4844) | Celestia | EigenDA |

|---|---|---|---|

Mechanism | Blob-based data storage, temporary and low-cost. | Specialized DA layer with DAS. | Restaked ETH security with committee-based verification. |

Consensus | PoS (GHOST + Casper), 12-15 min finality. | CometBFT with BFT, ~15 sec finality. | Committee-based. |

Scalability | Limited by lack of DAS; full nodes download all blobs. | High via DAS; light nodes sample data. | Moderate, committee-based. |

Security | High economic security via Ethereum’s stake. | Moderate; smaller PoS validator set. | Leverages Ethereum’s stake. |

Table 2: Comparison of Data Availability Layers.

Strategic Trade-offs:

- Ethereum: Prioritizes security but sacrifices speed and scalability (Symbolic Capital).

- Celestia: Emphasizes scalability and sovereignty with fast finality but less economic security (Celestia).

- EigenDA: Balances security and sovereignty via restaked ETH but limits decentralization due to committee-based verification (Medium).

Projects choose DA layers based on priorities: high-value DeFi may favor Ethereum’s security, while gaming apps may prefer Celestia’s throughput. A potential bar chart comparing finality times (Ethereum: 12-15 min, Celestia: ~15 sec, EigenDA: committee-based).

Mitosis: A Programmable Liquidity Layer

Ecosystem-Owned Liquidity and miAssets

Mitosis addresses liquidity fragmentation in DeFi, where liquidity on one chain is siloed, by transforming static liquidity provider (LP) positions into programmable, cross-chain assets called miAssets (Mitosis Docs). Users deposit assets (e.g., ETH, stablecoins) into Mitosis Vaults across supported chains, receiving 1:1-backed miAssets on the Mitosis Chain. These tokens are liquid, tradable, and usable in DeFi protocols (e.g., as collateral in lending) while earning yield from cross-chain LP activities. This creates Ecosystem-Owned Liquidity (EOL), empowering small LPs with institutional-scale benefits.

miAssets in Action

Consider a user depositing USDC into a Mitosis Vault on Polygon. They receive miUSDC on the Mitosis Chain, which they use as collateral in a lending protocol, earning yield from Polygon’s liquidity pool. Later, they swap miUSDC for miETH on a Mitosis-based DEX, all in few transaction, avoiding slow, risky bridges (Mitosis Docs). This illustrates Mitosis’s capital efficiency and seamless cross-chain experience.

Note that, there is an underlying bridge in the whole architecture: (powered by hyperlane) but it has been abstracted away from the user.

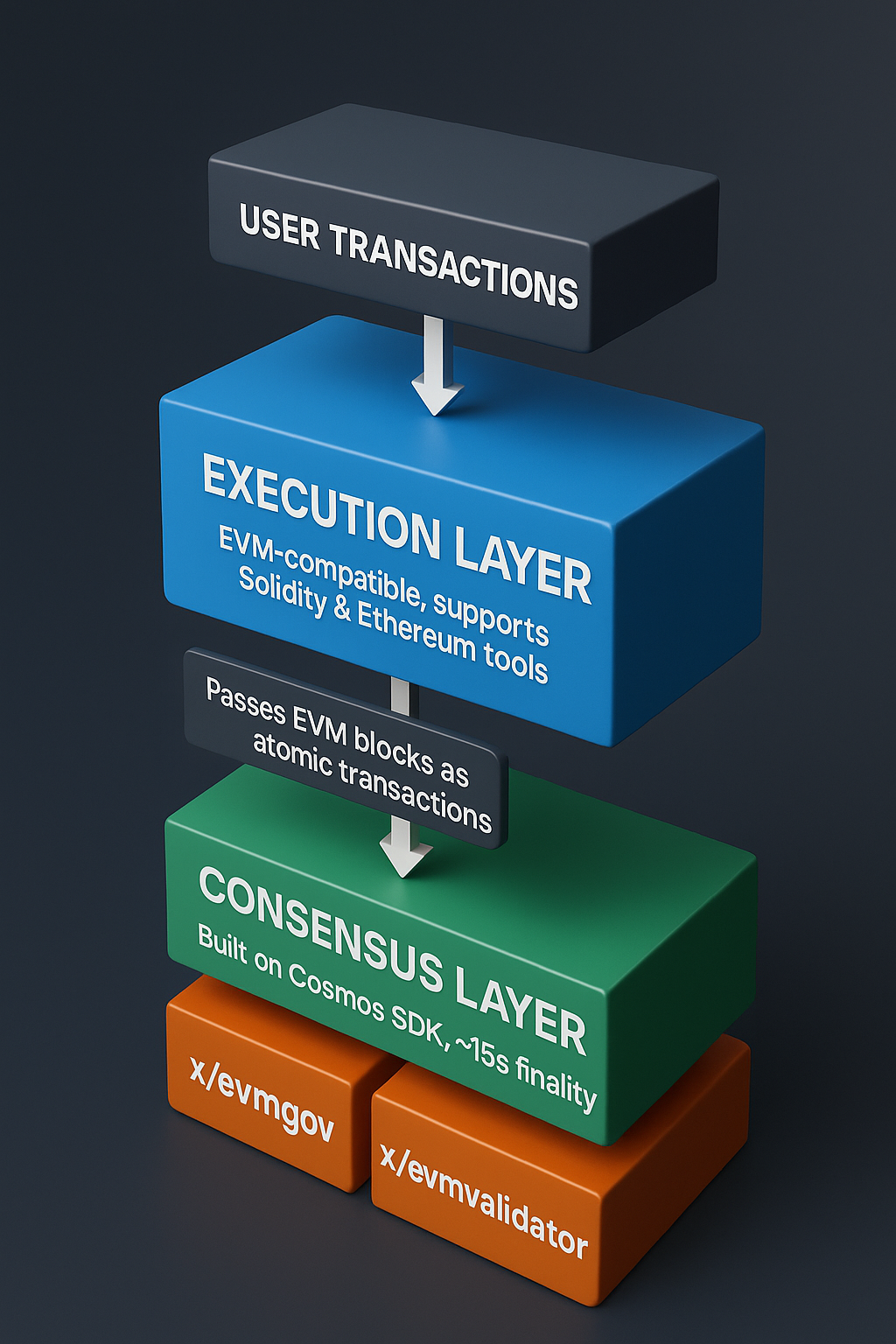

Architecture: EVM and Cosmos SDK Integration

Mitosis employs a modular architecture, separating execution and consensus for efficiency. Imagine a flowchart where user transactions enter the EVM execution layer, are processed into a block, passed via the Octane API to the CometBFT consensus layer, and finalized by validators. This structure optimizes each layer independently:

- Execution Layer: Fully EVM-compatible, enabling Solidity smart contracts and Ethereum tools (e.g., MetaMask, Hardhat) to lower developer barriers and bootstrap DeFi ecosystems (Gate.com).

- Consensus Layer: Built with Cosmos SDK and CometBFT, providing ~15-second single-slot finality for fast, secure settlement (CometBFT).

- Engine API (Octane): Connects layers, treating EVM blocks as atomic transactions for consensus.

Uniquely, Mitosis implements validator and governance logic as EVM smart contracts, allowing users to stake $MITO and vote via Ethereum wallets, enhancing composability. EVM logs are parsed by Cosmos SDK modules (x/evmvalidator, x/evmgov) to update validator sets and governance decisions (GitHub).

Layer | Function | Technology |

|---|---|---|

Execution | Processes transactions and smart contracts. | EVM-compatible environment. |

Consensus | Orders and finalizes blocks. | Cosmos SDK with CometBFT. |

Interface | Connects execution and consensus layers. | Octane (Engine API). |

Table 3: Mitosis Architecture Layers.

Data Availability Strategy: Sovereign L1 Approach

Mitosis operates as its own DA layer, with CometBFT validators ensuring block data availability (Nansen). EVM blocks are finalized by a two-thirds validator majority, securing data without external DA providers like Celestia. Cross-chain messaging uses Hyperlane’s permissionless model (Mitosis Docs).

Strategic Synthesis

Navigating the Blockchain Trilemma

Mitosis’s modular design navigates the blockchain trilemma (decentralization, security, scalability) by combining Ethereum’s programmability with Cosmos’s performance. Unlike monolithic chains like Ethereum (sorry, but much respect), which struggle with slow finality and high costs, or Solana, which prioritizes throughput over decentralization, Mitosis balances scalability (via CometBFT’s fast finality) and programmability (via EVM). However, its sovereign security model requires robust $MITO staking to ensure decentralization, a challenge for new L1s (Nansen).

Hybrid Advantage: Ethereum and Cosmos Synergy

Mitosis leverages Ethereum’s developer ecosystem through EVM compatibility, enabling rapid deployment of audited smart contracts, while CometBFT’s ~15-second finality and high throughput address Ethereum’s 12-15 minute finality and high costs (CometBFT). This makes Mitosis ideal for a cross-chain liquidity hub requiring fast, irreversible settlement.

Programmable Assets: Unlocking Liquidity with miAssets

Mitosis’s miAssets enable seamless cross-chain transactions. Swapping assets across chains becomes a single, atomic transaction on a Mitosis DEX, leveraging CometBFT’s instant finality for security and efficiency. This unlocks billions in locked liquidity, enhancing DeFi capital efficiency. A line chart comparing Mitosis’s transaction throughput to Ethereum L1 could illustrate this, but source data lacks specific metrics (Mitosis Docs).

Strengths, Weaknesses, and Challenges

Strengths:

- Capital Efficiency: Tokenizing LP positions unlocks inert capital for DeFi use (Mitosis Docs).

- User Experience: EVM compatibility enhance accessibility.

- Performance: CometBFT’s fast finality supports high-frequency transactions (CometBFT).

Challenges:

- Economic Security: As a sovereign L1, Mitosis must bootstrap $MITO value and validator decentralization.

- Architectural Complexity: The Engine API introduces potential vulnerabilities.

Conclusion: Driving Modular Finance

Mitosis exemplifies the modular blockchain vision, favoring a network of specialized, interoperable chains over a monolithic architecture. Its hybrid design directly tackles liquidity fragmentation, establishing Mitosis as a key infrastructure layer for DeFi.

References

- Celestia. The data availability problem. https://celestia.org/glossary/the-data-availability-problem/

- Coinbase. What is proof of work or proof of stake? https://www.coinbase.com/learn/crypto-basics/what-is-proof-of-work-or-proof-of-stake

- CometBFT. What is CometBFT? https://docs.cometbft.com/v0.37/introduction/what-is-cometbft

- DAIC Capital. CometBFT: BFT Consensus Explained. https://daic.capital/blog/comet-bft

- Fidelity. Proof of stake vs proof of work: What you need to know. https://www.fidelity.com/learning-center/trading-investing/proof-of-work-vs-proof-of-stake

- GeekstorGeeks. Proof of Capacity. https://www.geekstorgeeks.org/blogs/proof-of-capacity/

- GeekstorGeeks. Proof of Burn (PoB) Consensus Algorithm in Blockchain. https://www.geekstorgeeks.org/artificial-intelligence/proof-of-burn-consensus-algorithm-in-blockchain/

- GitHub. mitosis-org/chain: Mitosis Chain. https://github.com/mitosis-org/chain

- Heddera. Proof of Stake (POS) vs. Proof of Work (POW). https://hedera.com/learning/consensus-algorithms/proof-of-stake-vs-proof-of-work

- Investopedia. What Are Consensus Mechanisms in Blockchain and Cryptocurrency? https://www.investopedia.com/terms/c/consensus-mechanism-cryptocurrency.asp

- Investopedia. Proof of Activity (PoA). https://www.investopedia.com/terms/p/proof-activity-cryptocurrency.asp

- Ledger. Data Availability Meaning. https://www.ledger.com/academy/glossary/data-availability

- Medium. Introducing Mitosis: The Modular Liquidity Protocol. https://medium.com/mitosisorg/introducing-mitosis-the-modular-liquidity-protocol-bfa421273b80

- Mitosis Docs. What is Mitosis? https://docs.mitosis.org/

- Nansen. What Is Mitosis? Guide to EOL & Cross-Chain Liquidity. https://www.nansen.ai/post/what-is-mitosis-guide-to-eol-cross-chain-liquidity

- Nervos Network. What is Data Availability in Blockchain? https://www.nervos.org/knowledge-base/what-is-data-availability-in-blockchain

- Simplicity Group. Ethereum’s Data Availability Problem. https://www.simplicitygroup.xyz/blog/data-availability

- Symbolic Capital. A Deep Dive into Data Availability: The Promises and Challenges of Scaling Web3. https://www.symbolic.capital/writing/a-deep-dive-into-data-availability-the-promises-and-challenges-of-scaling-web3

- Visa. What are Consensus Mechanisms? https://usa.visa.com/solutions/crypto/consensus-mechanisms.html

Comments ()