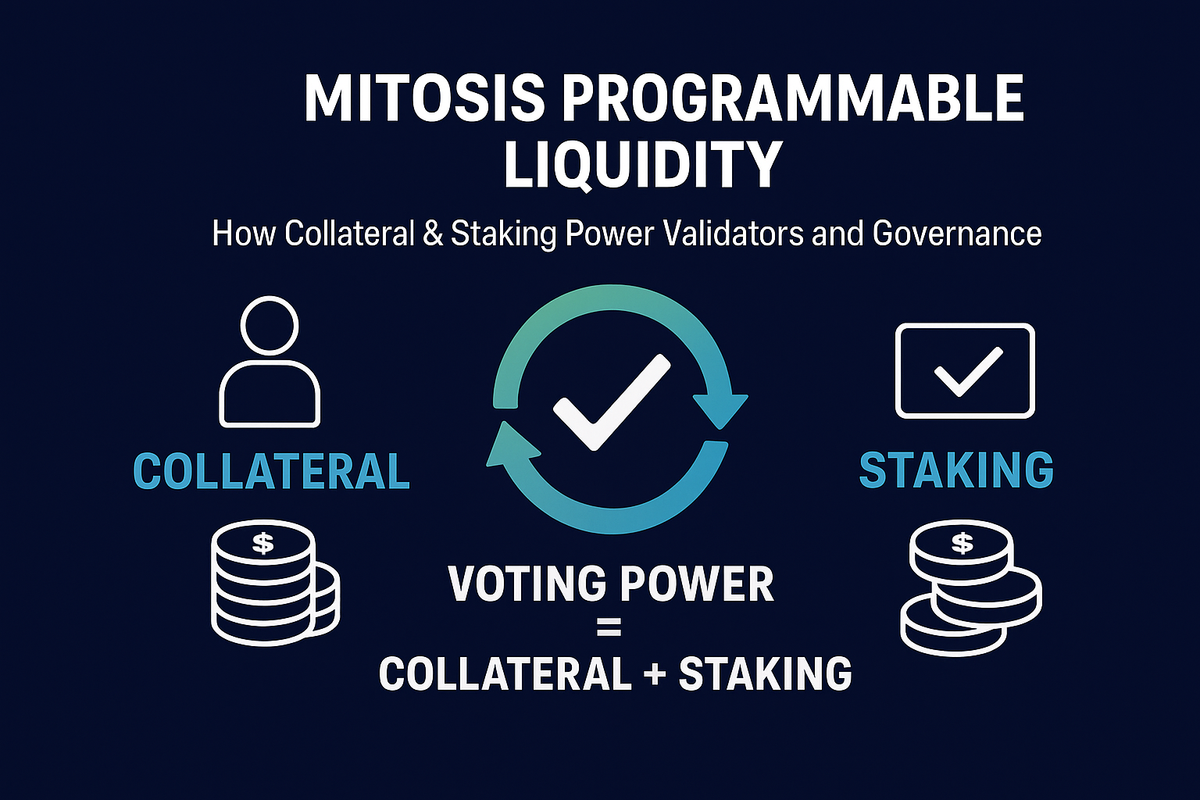

Mitosis Programmable Liquidity: How Collateral & Staking Power Validators and Governance

Mitosis introduces a revolutionary approach to blockchain validation through its programmable liquidity system. By creating a smart separation between collateral and staking, the protocol balances validator accountability with user protection while establishing a governance framework that rewards genuine network participation.

In this article, you'll discover how Mitosis's innovative dual-token system protects your investments while maximizing rewards. You'll understand the strategic differences between collateral and staking, learn how validator economics work, and see how the protocol's governance model ensures only committed participants shape its future. Whether you're considering becoming a validator or looking to stake tokens safely, this guide provides the insights you need to navigate Mitosis's unique ecosystem effectively.

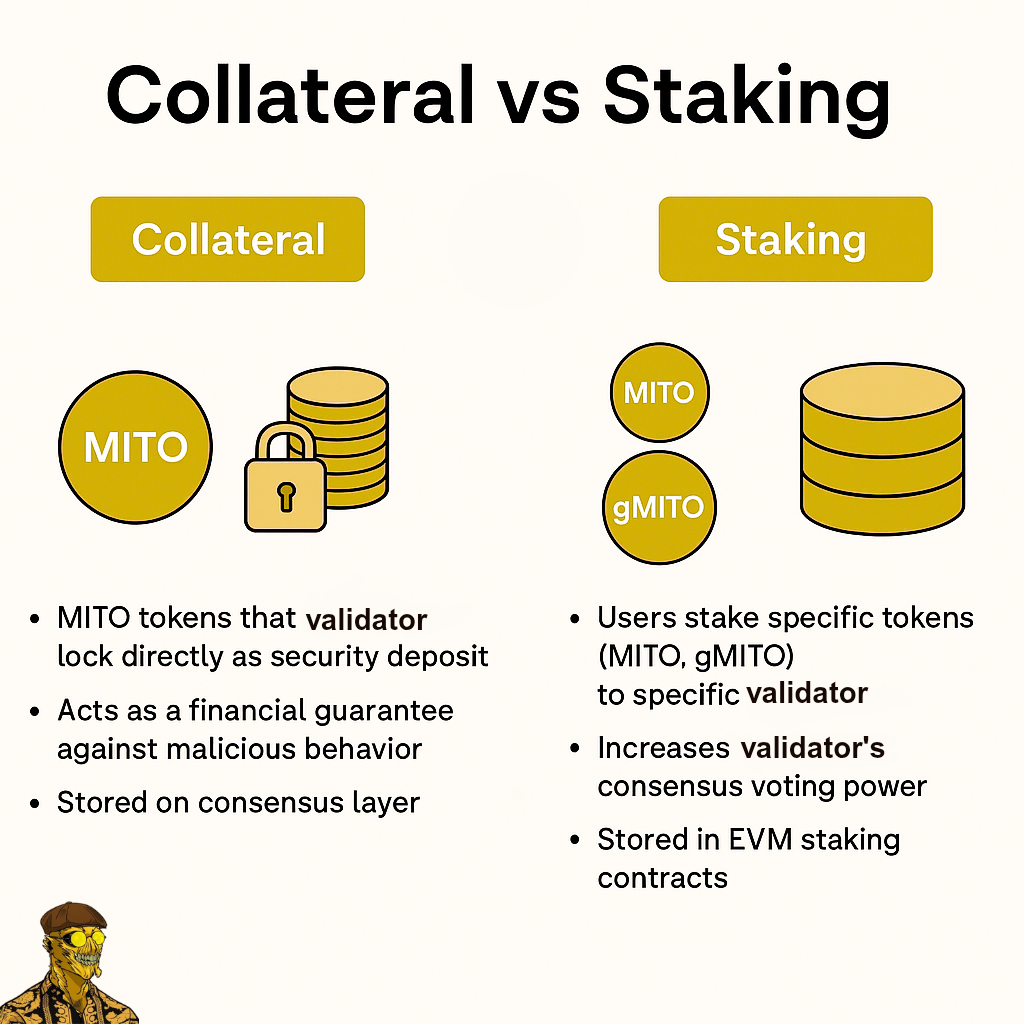

Understanding the Collateral vs Staking Distinction

Collateral: The Validator's Skin in the Game

Collateral represents MITO tokens that validators must lock as a security deposit on the consensus layer. This serves as their financial guarantee to the network, a commitment that can be slashed if they behave maliciously. Think of it as the validator's own money at risk, ensuring they have a genuine incentive to act honestly.

Staking: User Participation Without Risk

Staking allows users to delegate MITO or gMITO tokens to validators through EVM staking contracts. Unlike collateral, staked tokens are completely protected from slashing. Users can support network security and earn rewards without risking their principal, regardless of validator behavior.

This separation creates a win-win scenario: validators demonstrate commitment through their own capital while users can participate safely in network consensus.

How Voting Power Works

A validator's consensus voting power determines their influence in block production and network decisions. The calculation follows a simple but powerful formula:

Voting Power = Validator's Collateral + Delegated Stake (up to leverage cap)

The system implements a leverage ratio (typically 10x) that caps total voting power. For example, a validator with 100 MITO collateral can achieve a maximum voting power of 1,000 MITO, even if users stake more than 900 additional MITO.

This design prevents excessive concentration while rewarding validators who maintain substantial collateral relative to their staked amounts. Users benefit by choosing validators with better collateral-to-stake ratios, as these validators can more effectively utilize staked tokens for reward generation.

The Economics of Validator Rewards

Rewards flow through a sophisticated system that prioritizes collateral contributions:

- Collateral rewards go directly to the validator's reward manager

- Staking rewards are distributed to users after the validator takes a commission

- Total rewards are proportional to the validator's actual contribution to block production

When leverage limits are reached, stakers receive reduced rewards because excess staked tokens don't contribute to voting power. This creates natural incentives for users to seek validators with sufficient collateral backing.

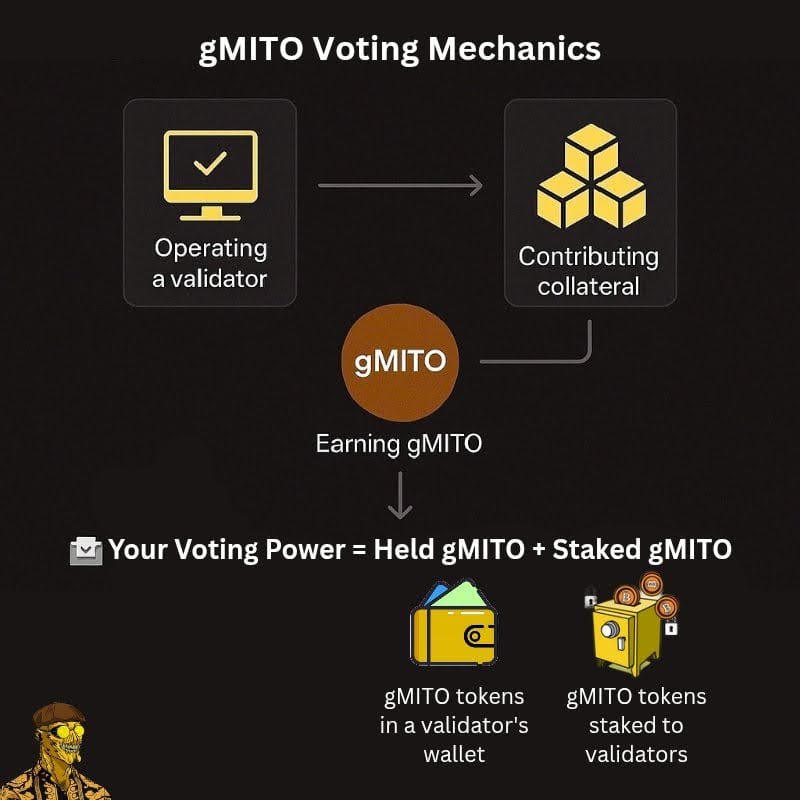

Governance Through Earned Participation

Mitosis governance operates on a fundamental principle: voting power must be earned, not bought. The gMITO governance token is non-transferable, ensuring authentic participation.

How Validators Earn Governance Power

Running a validator node generates gMITO rewards through:

- Validator operations and block production

- Collateral contributions to network security

- Commission from staking services

Voting Power Calculation

Your total governance influence equals:

Voting Power = Held gMITO + Staked gMITO

This means validators who earn gMITO through network contribution automatically gain voting rights on protocol parameters, upgrades, and cross-chain operations. There's no artificial separation between "validators" and "users"; anyone who earns gMITO can participate in governance.

Strategic Implications for Network Participants

For Validators:

- Higher collateral attracts more stakers seeking better rewards

- Consistent performance maximizes gMITO earnings and governance influence

- Operational excellence directly translates to network voting power

For Stakers:

- Choose validators with strong collateral-to-stake ratios for optimal returns

- Stake gMITO to maintain governance participation while earning rewards

- No slashing risk allows focus on validator performance rather than security concerns

For the Network:

- Prevents centralization by limiting individual validator influence

- Encourages new validator entry through economic incentives

- Aligns governance power with actual network contribution

Building a Decentralized Future

Mitosis programmable liquidity represents more than technical innovation - it's a blueprint for sustainable blockchain governance. By requiring validators to have a genuine economic stake while protecting user participation, the system creates robust incentives for network health.

The governance model ensures that those who shape the protocol's future have earned their influence through meaningful contributions. This merit-based approach prevents wealthy actors from simply purchasing control while rewarding long-term commitment to network success.

Through this comprehensive framework, Mitosis establishes a new standard for how blockchain networks can balance security, decentralization, and user protection. The result is a system where validators are accountable, users are protected, and governance reflects genuine network participation rather than financial speculation.

Conclusion

Mitosis's programmable liquidity system represents a paradigm shift in blockchain validation and governance. The smart separation between collateral and staking creates a robust framework where validators demonstrate genuine commitment through their own capital while users participate safely without slashing risk. This dual approach ensures network security while protecting participant investments.

The governance model built around earned gMITO tokens establishes authentic democratic participation. Unlike traditional systems, where wealth can purchase influence, Mitosis requires actual network contribution to gain voting power. This merit-based approach strengthens decentralization and ensures that those shaping the protocol's future have a genuine stake in its success.

The economic incentives align all participants toward network health. Validators with higher collateral attract more stakers and earn greater rewards, while users benefit from choosing well-capitalized validators. The leverage caps prevent excessive concentration, creating space for new validators to enter and compete effectively.

As blockchain networks evolve toward greater sophistication, will other protocols adopt similar models that balance accountability with user protection while ensuring governance reflects genuine contribution rather than financial speculation?

Mitosis programmable liquidity doesn't just solve today's validation challenges - it establishes a foundation for sustainable, decentralized networks that reward commitment and protect participants while maintaining the democratic ideals that make blockchain technology transformative.

Comments ()