Mitosis: Revolutionising DeFi with Programmable and Cross-Chain Liquidity

Introduction

Decentralised Finance (DeFi) has transformed finance, but liquidity inefficiencies still limit its full potential. Mitosis is a network designed to make liquidity programmable, tradable, and optimised for efficiency.

Mitosis provides an open, fair, and transparent way for all users—retail and institutional—to participate in liquidity markets.

This article breaks down the Mitosis ecosystem in a simplified way:

✔️ The biggest liquidity problems in DeFi today

✔️ How Mitosis solves them with EOL and Matrix Vaults

✔️ The benefits of tokenised liquidity positions (miAssets & maAssets)

✔️ Why Mitosis is different from other DeFi protocols

1. The Problem with DeFi Liquidity

Despite its potential, DeFi has some major liquidity issues:

1️⃣ Liquidity is locked and unusable → Once users deposit funds into liquidity pools, they often cannot access or use those assets elsewhere.

2️⃣ Unfair yield access → Large investors (whales) get exclusive high-yield opportunities, while smaller users have fewer ways to earn rewards.

3️⃣ Liquidity is fragmented across chains → Assets are often trapped on different blockchains, making them difficult to move and use efficiently.

These problems make it hard for DeFi protocols to maintain stable liquidity and for users to maximise their returns.

2. How Mitosis Works

Mitosis transforms liquidity into a flexible and tradeable financial asset through three key innovations:

✅ Collective Bargaining Power → Users pool liquidity to access higher-yield opportunities.

✅ Tokenised Liquidity Positions → Mitosis introduces miAssets and maAssets, making liquidity usable after depositing.

✅ Cross-Chain Liquidity Management → Mitosis enhances cross-chain liquidity by enabling strategic allocation across networks, though some assets may remain locked on their original chain until withdrawal.

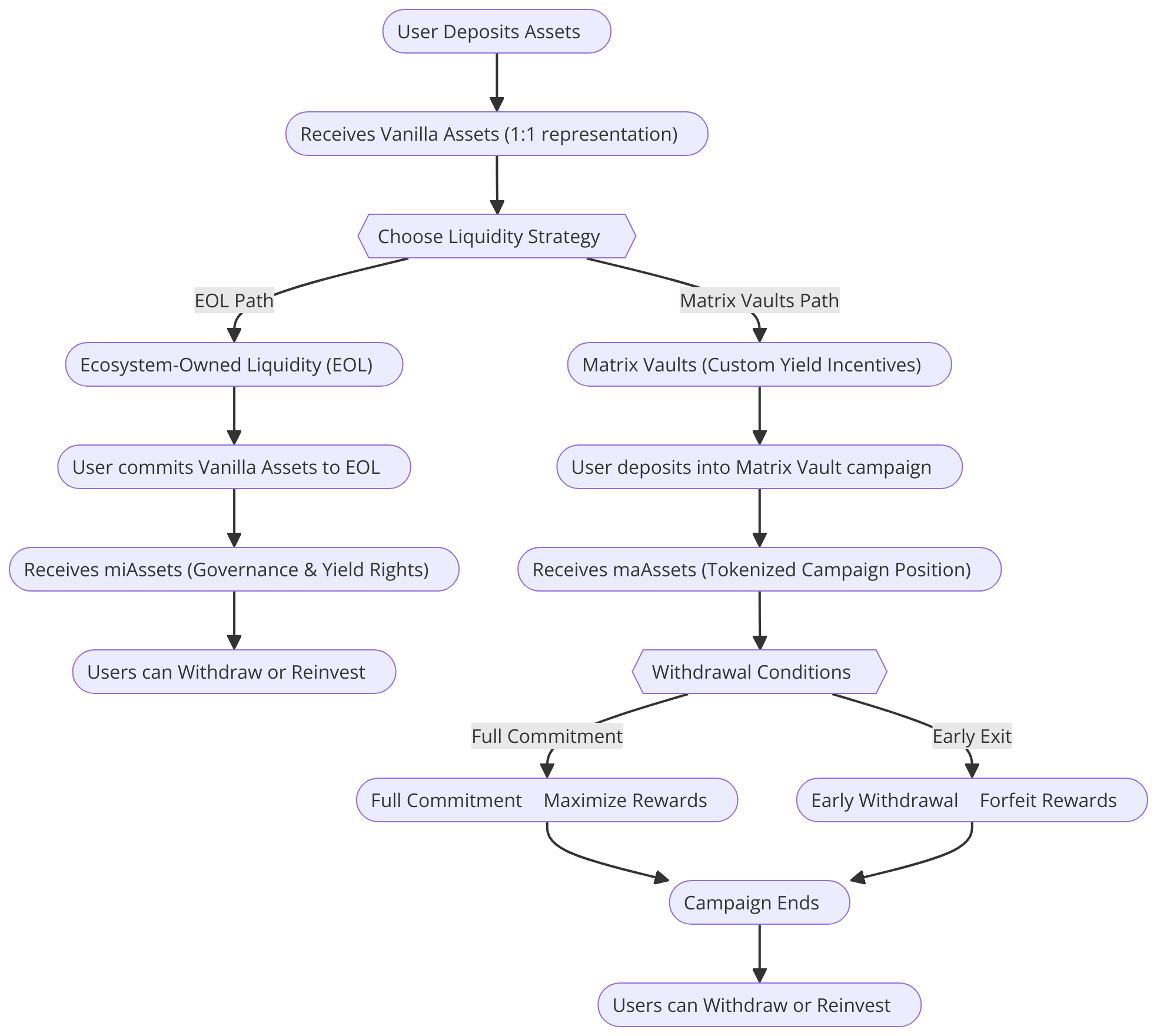

Step 1: Deposit Assets

Users deposit assets into Mitosis Vaults and receive Vanilla Assets, which are tokenised versions of their deposits backed 1:1.

Step 2: Choose a Liquidity Strategy

Users can decide how to use their Vanilla Assets:

Option 1: Ecosystem-Owned Liquidity (EOL) → Earn Yield with Governance Rights

- Users commit Vanilla Assets to EOL and receive miAssets in return.

- miAssets represent a stake in the liquidity pool and allow users to vote on liquidity strategies.

- Liquidity moves automatically to maximise returns across multiple DeFi protocols.

Option 2: Matrix Vaults → Flexible Yield & Liquidity Incentives

- Matrix Vaults offers structured liquidity campaigns. Users deposit assets and receive maAssets representing their participation in specific campaigns. Some campaigns allow early withdrawals with forfeited rewards, while others require full commitment until the end.

- Matrix Vaults are explained in detail in section 3.

Step 3: Withdraw or Reinvest

- EOL Users: Can redeem miAssets for Vanilla Assets at any time (subject to yield fluctuations).

- Matrix Vault Users: Depending on the campaign, they may withdraw early with a penalty or need to wait until completion.

📌 Key Takeaway: Mitosis ensures liquidity stays flexible and productive—offering yield opportunities while keeping capital efficient.

3. Matrix Vaults: Beyond Traditional Liquidity Mining

Solving the Mercenary Capital Problem

Matrix Vaults provide a self-reinforcing system that discourages short-term speculators and rewards long-term participants. Unlike traditional liquidity mining programs, which attract short-term profit seekers, Matrix Vaults naturally filter out mercenary capital through an innovative reward structure.

- Early withdrawals result in forfeited rewards, which are redistributed to remaining participants.

- This creates a self-reinforcing cycle where committed liquidity providers benefit from short-term participants exiting early.

- Over time, rewards compound, and the pool of stable liquidity providers grows stronger, making Matrix Vaults more predictable and efficient.

Key Benefits of Matrix Vaults

1. For Liquidity Providers (Users)

✔ No forced lockups unless specified by the campaign.

✔ Fair reward mechanisms that benefit long-term participation.

✔ Flexibility to exit early if needed, depending on the campaign.

2. For DeFi Protocols

✔ More predictable liquidity planning.

✔ Attracts well-aligned long-term participants.

✔ Reduces token sell pressure from reward distributions.

3. For the Ecosystem

✔ Better capital efficiency across DeFi.

✔ Less market impact from liquidity maturity events.

✔ Improved price discovery for liquidity value.

4. How Mitosis Compares to Other DeFi Protocols

Mitosis introduces major improvements over existing competitors like Uniswap, Curve, Balancer, and Aave. Here’s how:

🔹 Uniswap (AMM-based Liquidity)

- Limitation: Requires liquidity providers to pair assets, leading to impermanent loss.

- Mitosis Advantage: No pair-based liquidity requirement; allows single-asset deposits that move dynamically across DeFi protocols.

🔹 Curve Finance (Stablecoin Liquidity Pools)

- Limitation: Primarily optimised for stablecoins.

- Mitosis Advantage: Supports a wider range of assets and dynamic deployment across multiple DeFi protocols.

🔹 Balancer (Weighted Liquidity Pools)

- Limitation: Requires manual pool weight configurations.

- Mitosis Advantage: Uses governance-driven liquidity allocation via EOL.

🔹 Aave (Lending & Borrowing)

- Limitation: Lenders rely on borrowers to generate interest.

- Mitosis Advantage: Liquidity is actively deployed to yield-generating strategies, ensuring higher capital efficiency.

📌 Final Verdict: Unlike traditional liquidity pools that lock assets and limit usability, Mitosis ensures liquidity is always active and optimised.

5. The Future of Mitosis

Mitosis continues to advance, bringing innovations and strengthening its position as a leader in DeFi liquidity infrastructure. Here’s what’s next:

✅ Enhanced Multi-Asset Liquidity → Expanding support beyond single-asset deposits, enabling diversified liquidity pools and greater capital efficiency.

✅ Advanced Cross-Chain Connectivity → Strengthening interoperability across multiple blockchains, ensuring seamless asset mobility and deeper liquidity integration.

✅ Next-Level Governance Frameworks → Introducing more sophisticated, community-driven decision-making processes for optimal liquidity allocation.

✅ Sustainable Yield Strategies → Refining reward structures prioritising long-term engagement, reducing reliance on short-term incentives.

With these innovations, Mitosis is redefining the future of DeFi liquidity, making it more innovative, sustainable, and inclusive!

6. Risks of Using Mitosis

While Mitosis offers numerous benefits, users should be aware of the potential risks associated with participating in liquidity provisioning:

✅ Smart Contract Risk → Like all DeFi protocols, Mitosis operates through smart contracts that, if exploited, could lead to fund losses.

✅ Market Volatility → Asset prices fluctuate, impacting liquidity value and yield earnings.

✅ Impermanent Loss → Although mitigated in Mitosis, users participating in liquidity provisioning are still exposed to potential value shifts.

✅ Regulatory Uncertainty → The evolving DeFi landscape may face regulatory challenges impacting liquidity incentives and accessibility.

✅ Protocol-Specific Risks → Matrix Vault campaigns have different structures; some may impose withdrawal restrictions, so users should carefully review campaign terms before participating.

Understanding these risks is crucial for making informed decisions when engaging with Mitosis liquidity solutions.

7. Conclusion

Mitosis revolutionises DeFi liquidity by making it programmable, tradable, and cross-chain compatible. With EOL and Matrix Vaults, liquidity works for users instead of sitting idle in pools.

By ensuring fair access to high-yield opportunities, breaking down blockchain barriers, and giving users more control, Mitosis is setting a new standard for DeFi liquidity infrastructure.

💡 Want to maximise your DeFi liquidity? Mitosis is the future. 🚀

8. References

- Mitosis Litepaper: Read the full document

- Mitosis Glossary: Explore key terms

- Arts by: vahiddabiri

Comments ()