Mitosis: Revolutionizing DeFi Liquidity with Programmable Components.

In biology, mitosis is how cells reproduce splitting, growth, adapting. It’s nature’s way of keeping things moving, evolving, and renewing.

Now imagine that same concept applied to decentralized finance. That’s exactly what the Mitosis Protocol is doing flipping liquidity from being a locked-in, passive position into something dynamic, programmable, and alive.

Let’s be honest DeFi is powerful, but it’s far from perfect.

Right now, two big problems hold it back:

•Static Liquidity:

Once users commit their assets to a protocol, they’re often locked in. Redeploying liquidity elsewhere is difficult, reducing agility and opportunity.

•Access Inequality:

High-yield opportunities are usually reserved for institutional players and large investors via private deals undermining DeFi’s original promise of financial inclusivity.

Mitosis is here to flip the script.

What is Mitosis?

A modular interoperability layer that enables seamless asset movement across chains securely, efficiently, and without the usual drama. Mitosis changes the game by turning liquidity into a living, flexible asset that can be moved, repurposed, and directed without friction.

Here is how it works

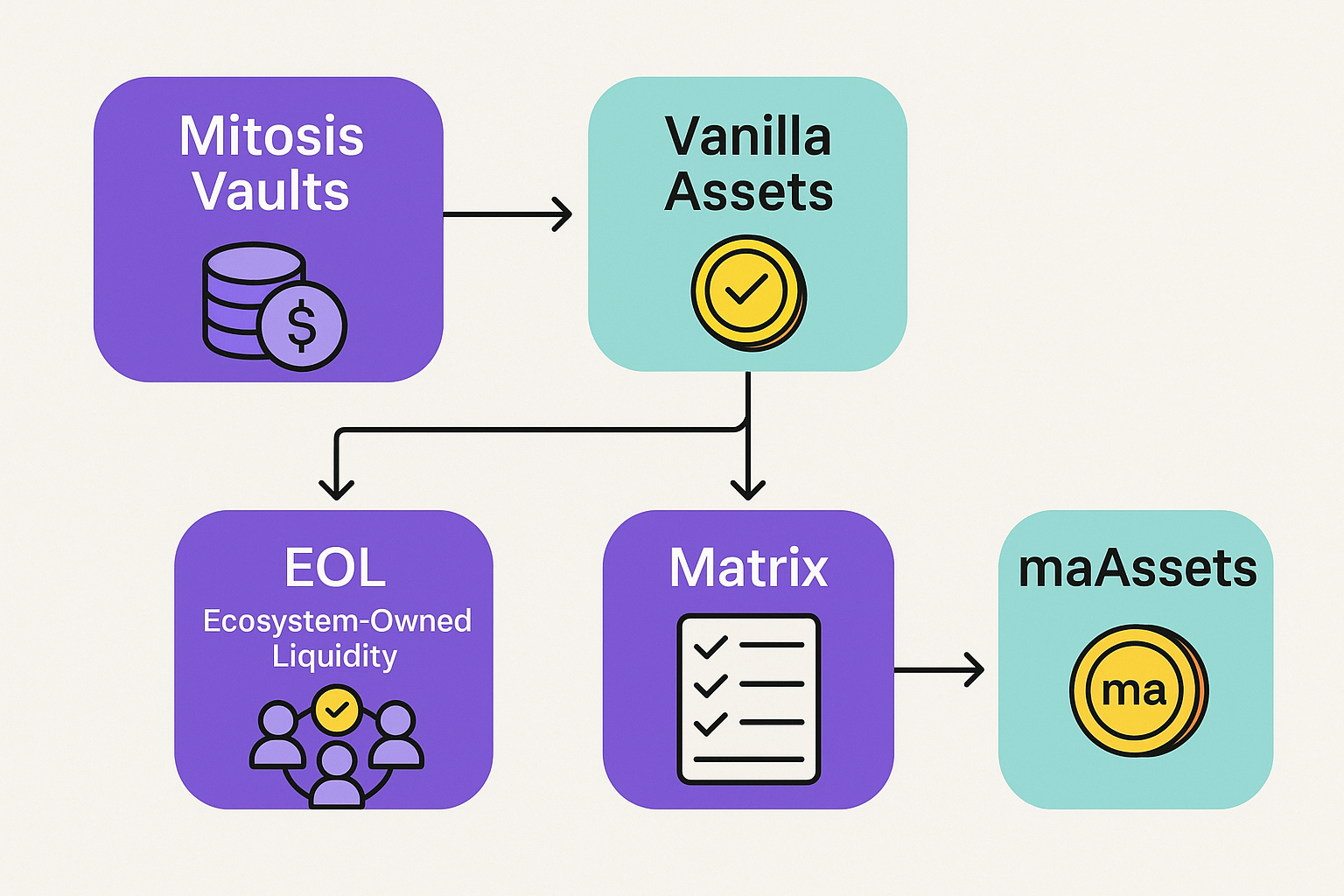

When you deposit assets into Mitosis Vaults across supported chains like (Ethereum, Arbitrum, Optimism, Base, and Polygon zkEVM)you receive Vanilla Assets on the Mitosis Chain.

These represent your deposits but come with new levels of flexibility.

Mitosis playbook:

✅ Efficient

✅Credibility

✅ Assurance With Vanilla Assets,

you can choose one of two paths:

1. EOL (Ecosystem-Owned Liquidity)

•Collective and governed by the community.

•Assets are pooled, and decisions are made via on-chain voting.

You receive miAssets, representing your share of the pool. Sounds interesting right 👀?

A practical example:

Alex deposit $1,000 worth of USDC into a Mitosis EOL Vault.

Here’s what happens:

Your USDC joins a community liquidity pool governed by Mitosis users.

How you earn:

•The strategy earns a yield

•The protocol distributes this yield back to all miUSDC holders proportionally.

Your miUSDC grows in value, and you can redeem it back for USDC + earnings when you exit.

Why it matters:

•Gives voice and power to the community.

•Reduces overreliance on centralized decision-makers.

•Builds resilience through collective ownership.

2. Matrix Vaults

• Tailored for active users.

• Participate in curated liquidity campaigns with predefined terms.

• You earn maAssets, reflecting your personal stake in each strategy.

Why it matters:

•Strategic Asset Allocation

•Clarity,Choice,Control.

Why Mitosis Deserves Your Attention

Let’s break it down. Mitosis isn’t just another DeFi project it’s a foundational shift.

Here’s what sets it apart:

1. Programmable Liquidity

Liquidity becomes a building block modular, portable, and agile. It’s no longer locked up and dead weight.

2. Real Accessibility

The protocol tears down the walls around premium opportunities. Whether you’re new to DeFi or a seasoned player, you can access high-yield campaigns without needing insider connects.

3. Multi-Chain Flow

Mitosis connects multiple ecosystems, allowing liquidity from different chains to come together on the Mitosis Chain. No silos, no fragmentation.

4. True Community Governance

EOL means power is in the hands of the people. Not teams, not VCs, not whales. Everyone gets a say.

5. Liquidity with Purpose

You’re not just staking for the sake of it. With Mitosis, your liquidity does something. It evolves. It grows. It adapts.

Final Thoughts: A Protocol That Mirrors Nature’s Wisdom

Just like in biology, Mitosis in DeFi is about regeneration and adaptability. It gives liquidity its legs back so it can move, flex, and grow with you.

This is the kind of innovation DeFi needs not just more tokens or hype, but systems that actually solve the underlying limitations we’re facing.

Mitosis isn’t just building a protocol. It’s building a movement toward a fairer, smarter, more agile DeFi world. One where growth isn’t gated and opportunity isn’t reserved for a select few.

And if you ask me that’s exactly the kind of DeFi I want to be part of.

References

1. Buterin, V. (2013). Ethereum Whitepaper: A Next-Generation Smart Contract and Decentralized Application Platform. https://ethereum.org/en/whitepaper/

2. Mitosis Protocol. (2024). Mitosis Documentation. https://docs.mitosis.xyz

3. Andreessen Horowitz (a16z). (2021). The DeFi Stack Explained. https://a16z.com/2021/04/27/defi-stack/

4. Bankless. (2023). The Liquidity Problem in DeFi and What’s Next. https://newsletter.banklesshq.com

5. Binance Academy. (2022). What Is Liquidity in DeFi? https://academy.binance.com/en/articles/what-is-liquidity-in-defi

6. Delphi Digital. (2023). Programmable Liquidity: Unlocking DeFi’s Next Wave. https://www.delphidigital.io/research

7. Web3 Foundation. (2022). Cross-Chain Interoperability and the Future of DeFi. https://web3.foundation

Comments ()