Mitosis. SyncSwap. Invest widely.

At the moment, the web3 industry is rapidly developing. Someone wants to earn money, someone wants to make this world a better place by implementing useful technologies. I have been thinking for a long time about what project could be suitable for the synergy of the Mitosis project, and it seems I have found an interesting option.

Summary:

1) Providing Liquidity in Mitosis

2) The SyncSwap and its opportunities

- The mission of SyncSwap

- The project aims

- Security

- Activity

- Proprietary token

3) Opportunities for cooperation

1) Providing Liquidity in Mitosis

Imagine that you have ETH, and you want to invest it somewhere and not move it from one place to another for greater benefit for yourself. Can you imagine it? Great, I will explain further why Mitosis is the best place for such a plan.

Mitosis is where you can provide liquidity. The liquidity goes into the Ecosystem-Owned Liquidity (EOL) storage, then the liquidity will be distributed across protocols through voting. That is, when you contribute, for example, ETH in exchange, you receive miETH and depending on how much you took out in liquidity, you will have voting power. Through voting, there is a further distribution of liquidity and thus it does not remain passive, but continues to participate in other chains helping to develop the web3 more dynamically.

Protocol approval process:

1) There is a protocol that wants to receive a part of the liquidity from EOL. It makes a detailed article about itself, about how they are going to use the liquidity, and posts it on the forum;

2) Then the community evaluates this proposal, and miAssets holders vote to include the protocol in the EOL distribution portfolio. Here;

3) After that, miAssets holders vote to distribute liquidity between the approved protocols. If you hold miETH, then you vote for the distribution of ETH. If miUSDT, then for the distribution of USDT, etc.

This way, you don’t have to worry about which chain you provided liquidity to, as the EOL system is where everything is centralized in the general storage.

2) The SyncSwap and its opportunities

1 - The mission of SyncSwap is to bring easy-to-use DeFi and the benefits of scaled Ethereum to more people and help the mass adoption of zero-knowledge technology, Ethereum, and Web3.

2 - The project aims to make a simple and easy-to-use product and I think they are doing a good job. Fast transactions, user-friendly interface and underestimated potential due to the wave of negativity towards the ZkSync chain Layer2.

3 - What about security? Low-cost DeFi to everyone with complete Ethereum security powered by zero-knowledge technology. SyncSwap has been working with Zellic for the security review of SyncSwap's future-proofing multi-pool design.

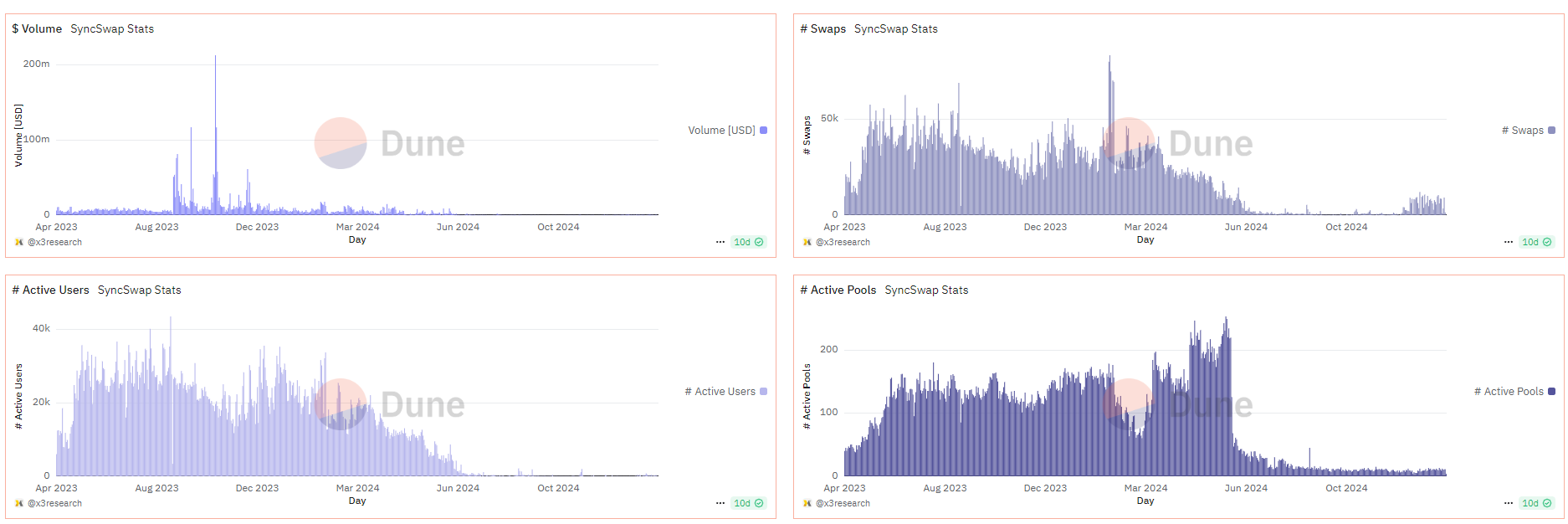

4 - Activity. Although the charts for the last months do not look as good as for the previous ones. I think they have potential because SyncSwap supports such chains as Linea, ZkSync, Scroll and Sopfon. And also the release of its own token can stimulate interest in the platform.

Despite this, the project's TVL remains stable over time, this can be seen on the defilama.

5 - Proprietary token. The project will soon have its own token

SYNC holders can convert their SYNC tokens into veSYNC tokens anytime and enjoy various benefits.

- Voting powers

- Protocol fee dividends

- Fee discount

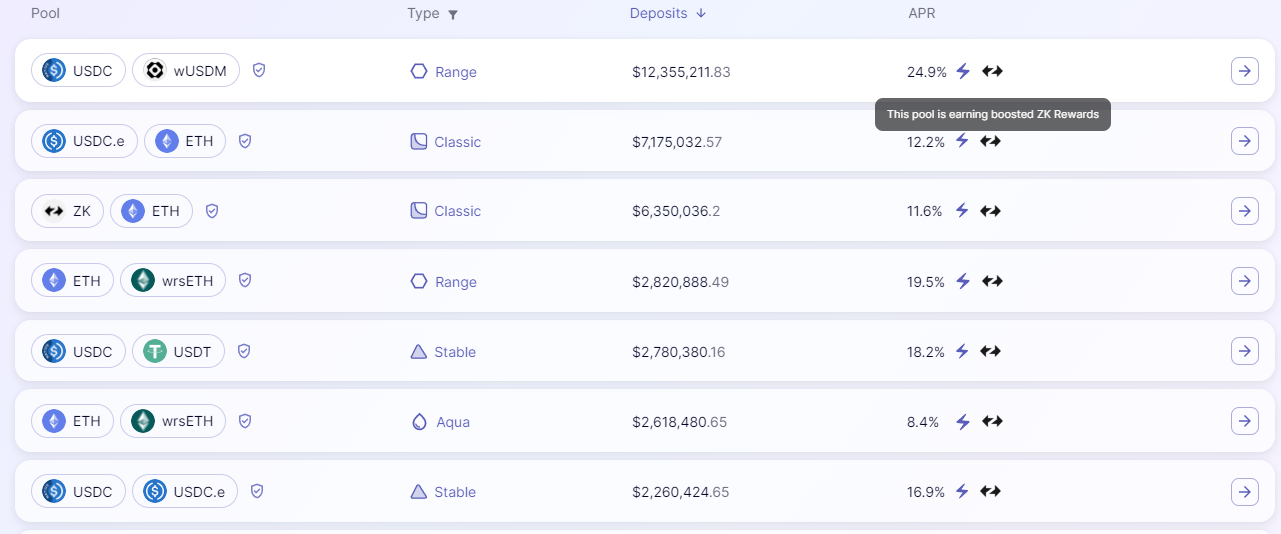

Currently, there is a campaign with token rewards from ZkSync, which provides additional income from Liquidity Provision. And there is also a high percentage of APR.

3) Opportunities for cooperation

At the moment, Mitosis does not have a ZkSync chain. Based on what was written above about the SyncSwap protocol, I think this is a good opportunity to consider cooperation.

Based on the graphs and pool sizes, SyncSwap cannot be called a popular platform at the moment, but this platform has security, a convenient and understandable interface, as well as fast transaction processing speed.

And also Smart Router helps to provide the best price, thanks to the liquidity aggregator function.

Comments ()