MITOSIS: The programmable liquidity 【concepts and benefits】

DeFi is about giving users control over how they provide and manage liquidity in decentralized financial systems, let's look how mitosis will contribute and facilitate stable, transparent, and democratic DeFi ecosystem where liquidity is effectively deployed and valued.

Programmable liquidity in DeFi (Decentralized Finance) refers to the ability to customize, automate, and manage liquidity in decentralized markets using smart contracts and programmable rules. It allows users to dictate specific conditions under which their liquidity is provided or adjusted, offering greater flexibility and efficiency compared to traditional liquidity management methods.

MITOSIS as a programmable liquidity: it's a Programmable liquidity that allows liquidity providers to dynamically adjust their positions, strategies, and allocations in decentralized liquidity pools.

In DeFi, Mitosis can provide a more refined approach to managing liquidity by offering:

- Dynamic Liquidity Allocation: It allows liquidity to be split or distributed across different pools or assets based on pre-programmed rules, market conditions, or the user's preferences.

- Automated Position Adjustment: Users can set strategies to automatically adjust their liquidity positions to adapt to market changes, like volatility or price movements, similar to how the "cells" in DeFi pools can evolve and change over time.

- Optimized Returns: Programmable liquidity can help maximize returns for liquidity providers (LPs) by automating strategies like rebalancing positions or moving liquidity between pools to take advantage of the best opportunities.

In essence, Mitosis helps bring more sophistication to liquidity management, allowing participants to optimize their capital without needing to manually adjust positions all the time.

Evolution of liquidity in the past years

The evolution of liquidity in decentralized finance (DeFi) has been a journey of increasing sophistication, automation, and customization.

1. Early Stages: Traditional Liquidity Provision

- Centralized exchanges (CEXs) were the initial stage of liquidity management in finance. Market makers or centralized entities provided liquidity to facilitate trading, charging a spread between buy and sell orders.

- Decentralized exchanges (DEXs) emerged as an alternative, with platforms like Uniswap introducing Automated Market Makers (AMMs). Liquidity providers (LPs) began to supply liquidity to these DEXs by depositing pairs of tokens into liquidity pools. The protocol uses an algorithm to price the assets based on supply and demand, and LPs earn transaction fees in return.

- In these early stages of DeFi, liquidity provision was still somewhat static — once liquidity was added, it typically stayed in the pool unless the LP manually adjusted their position.

2. Dynamic Liquidity and AMMs

- The next step in the evolution came with the introduction of dynamic liquidity in AMMs, where liquidity providers were able to receive rewards through transaction fees. While this was an improvement over traditional methods, the LPs still had limited control over how their liquidity was used.

- For example, Uniswap v2 introduced constant product market-making (x * y = k), but LPs couldn’t programmatically control or automate their positions or adjust for factors like market volatility, slippage, or changes in token prices.

Key Concepts:

- Smart Contracts: Programmable liquidity relies on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically manage liquidity without needing intermediaries or manual intervention.

- Automated Strategies: Liquidity providers (LPs) can program liquidity strategies that automatically adjust based on predefined conditions. For example, they could set rules for when to enter or exit a pool, rebalance positions, or move liquidity between different pools to maximize yield or minimize risk.

- Customizable Liquidity: LPs can decide on different parameters, such as the amount of liquidity, types of assets to provide, and risk levels. This can also include conditional actions like withdrawing liquidity when prices hit a certain point or adding liquidity when certain market conditions are met.

- Incentives & Rewards: In many DeFi protocols, LPs are rewarded with transaction fees or governance tokens for providing liquidity. Programmable liquidity can allow LPs to better optimize these rewards by defining their own strategies for participation in liquidity pools.

How Mitosis Makes Liquidity Programmable:

- Automation via Smart Contracts:

- Mitosis allows liquidity to be automatically divided or “split” into different pools based on conditions defined by the user. This is achieved using smart contracts that monitor market conditions and adjust liquidity flows automatically.

- Dynamic Liquidity Reallocation:

- Instead of manually moving assets around, LPs can set dynamic liquidity strategies that automatically allocate funds between different liquidity pools or assets to optimize returns based on real-time market data.

- Customizable Risk Management:

- Mitosis offers programmable risk profiles, allowing LPs to control their exposure to volatility, slippage, and impermanent loss by defining conditions for when and how liquidity is used. For instance, an LP might create a strategy that adjusts exposure to certain assets depending on market trends.

- Continuous Optimization of Returns:

- By programming liquidity positions, LPs can ensure their assets are always deployed in the most profitable pools, adjusting dynamically to changing conditions in the DeFi ecosystem.

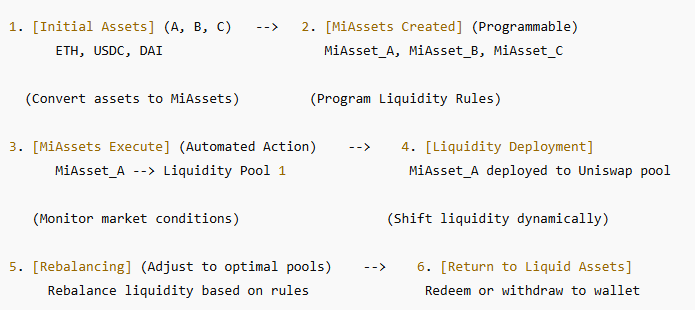

How Mi-assets are managed and converted in the mitosis system

- Initial State: Liquid Assets

- Assets (A, B, C) = You start with different assets in your wallet (e.g., ETH, USDC, or other tokens).

- These assets can be used as input liquidity to create MiAssets.

- Conversion to MiAssets:

- Step 1: MiAssets Creation

- Using a smart contract, the assets (A, B, C) are converted into MiAssets that are programmable.

- The MiAssets are now tracked and can be programmed for various DeFi activities.

- Example: Asset A (ETH) is converted into a MiAsset that will automatically adjust its liquidity position based on certain conditions (like market volatility or a specific DeFi pool’s rewards).

- Step 2: Programmable Parameters Set

- Users program rules into the MiAssets, such as:

- When liquidity should be added or removed.

- Where liquidity should be directed (e.g., a specific liquidity pool on Uniswap, Curve, etc.).

- Risk tolerance and exposure limits.

- Users program rules into the MiAssets, such as:

- Step 1: MiAssets Creation

- Execution of MiAssets (Automated Action):

- Step 3: MiAsset Monitoring

- The MiAssets continuously monitor market conditions (price changes, volume, etc.).

- They respond automatically to the programmed conditions, adjusting liquidity dynamically. For instance, liquidity might be shifted to a higher-yield pool or removed from a pool with low rewards.

- Step 4: Liquidity Conversion

- MiAssets convert into liquidity positions in various DeFi pools (e.g., a Uniswap pool or a lending platform). This could also involve splitting the MiAssets into several positions (splitting between different assets, pools, etc.).

- Example: MiAsset (ETH) is split and deployed across multiple pools for better yield optimization.

- Step 3: MiAsset Monitoring

- Rebalancing and Adjustments (if needed):

- Step 5: Rebalancing

- The smart contract automatically adjusts the MiAssets by shifting liquidity between pools based on market data or changes in rewards.

- For instance, if a pool experiences a decrease in yield, MiAssets can automatically move liquidity to a more profitable pool.

- Step 5: Rebalancing

- Conversion Back to Liquid Assets (if desired):

- Step 6: Withdrawal or Conversion

- If the LP wishes to exit or convert their assets back into liquid form, MiAssets will either:

- Redeem their liquidity positions back into original tokens (e.g., ETH, USDC).

- Convert assets back into the user’s wallet based on the conditions defined in the MiAsset strategy.

- If the LP wishes to exit or convert their assets back into liquid form, MiAssets will either:

- Step 6: Withdrawal or Conversion

Future of mitosis on mainnet;

the Mitosis ecosystem is likely to experience several key trends that will shape its growth and influence in the broader financial landscape. Here are some future trends for the Mitosis ecosystem:

1. Increased Integration with Layer 2 and Cross-Chain Solutions

- Layer 2 scalability (like Optimism, Arbitrum, zk-rollups) and cross-chain interoperability are likely to play a major role in the future of the Mitosis ecosystem. These solutions can make liquidity provision faster, cheaper, and more efficient by reducing the high transaction costs and delays currently seen on layer 1 blockchains like Ethereum.

- The ability to automate liquidity provisioning across multiple blockchains will enhance the accessibility of Mitosis. As liquidity can be spread across different ecosystems, it will open up new opportunities for LPs to maximize returns on their assets across various decentralized finance platforms, regardless of the underlying blockchain.

2. Advanced AI and Machine Learning for Optimizing Liquidity Strategies

- As the ecosystem grows, artificial intelligence (AI) and machine learning (ML) will become central tools for optimizing liquidity strategies within Mitosis. AI/ML algorithms will be able to analyze vast amounts of market data in real-time and adjust liquidity positions on behalf of LPs, further reducing manual effort and optimizing yields.

- AI could predict market trends, detect arbitrage opportunities, and dynamically adjust liquidity based on evolving market conditions. LPs could essentially deploy "smart liquidity strategies" where AI determines the best actions based on historical data and predictive models.

3. Tokenization of Mi-Assets and New Incentive Models

- As Mi-Assets become more widely adopted, the ecosystem will likely see the tokenization of these assets in new and innovative ways. This could involve creating derivative products or NFTs that represent shares in liquidity strategies or programmable assets. LPs could trade or collateralize these tokens across different platforms, creating more liquidity and further improving capital efficiency.

- Incentive models will continue to evolve. We might see more sophisticated reward structures, where LPs are incentivized not only for providing liquidity but also for customizing liquidity strategies that enhance the overall efficiency of the DeFi ecosystem. This could involve rewarding LPs with governance tokens or other platform-specific incentives.

4. Programmable Risk Management and Automated Insurance

- The future of programmable liquidity in Mitosis will involve advanced risk management tools that help LPs tailor their exposure to specific assets, pools, or market conditions. This will allow for more granular control over portfolio risk, making it easier to avoid impermanent loss, minimize volatility exposure, or protect against systemic risks.

- A possible future trend could be the development of automated insurance solutions within the Mitosis ecosystem. LPs could "program" coverage for specific risks they encounter (e.g., smart contract vulnerabilities, hacks, or extreme market volatility). This would be powered by decentralized insurance protocols, creating an extra layer of security for liquidity providers.

5. Composable DeFi Products and Ecosystem Expansion

- The composability of DeFi protocols is a key feature that will continue to drive the growth of Mitosis. As more protocols and dApps are built on top of Mitosis, liquidity can be more easily shared and allocated between different services, creating highly flexible, customizable financial products. These products could include composite DeFi portfolios, automated yield strategies, or even multi-strategy liquidity provisioning that draws from multiple DeFi protocols.

- The Mitosis ecosystem will likely evolve to integrate with more DeFi platforms, offering LPs a one-stop-shop to deploy their liquidity across various types of decentralized applications — from DEXs to lending platforms, stablecoin protocols, and beyond.

6. Governance and Decentralized Control of Liquidity

- Governance in the Mitosis ecosystem will likely become more decentralized over time. LPs will have the opportunity to influence protocol upgrades, liquidity management strategies, and even decision-making on incentive models through DAO-based governance.

- As the ecosystem matures, Mitosis could integrate with more governance frameworks that allow liquidity providers to collectively manage the rules governing liquidity strategies, risk management, and reward distribution. This could lead to more democratized control over how liquidity is managed across DeFi networks.

7. Enhanced User Experience (UX) and Simplified Liquidity Management

- The future of the Mitosis ecosystem will involve making liquidity management easier and more accessible for a wider range of users, including those with less technical expertise. The development of user-friendly interfaces and simplified liquidity management tools will help onboard more retail investors into the ecosystem.

- Pre-programmed strategies, templates, or even automated services could allow users to easily deploy their assets without needing to be experts in DeFi. This would reduce the complexity of interacting with smart contracts and enhance the appeal of programmable liquidity for both casual and experienced investors.

8. Sustainability and Energy-Efficient Liquidity Protocols

- With increasing concern over the environmental impact of blockchain networks, sustainability will become an important trend in the Mitosis ecosystem. Developers will focus on creating energy-efficient liquidity protocols that minimize the carbon footprint associated with providing liquidity on blockchain networks.

- This could involve the adoption of more eco-friendly consensus mechanisms (e.g., proof of stake, or other low-energy models), as well as the development of liquidity strategies that prioritize low-cost, low-energy usage for liquidity provision.

9. Interoperable Asset Classes and Cross-Protocol Liquidity

- The Mitosis ecosystem could evolve to support interoperable asset classes, enabling liquidity to be used across different blockchains and DeFi protocols seamlessly. This would allow LPs to deploy a variety of tokens, including wrapped tokens or synthetic assets, and enable cross-chain liquidity.

- By improving cross-protocol compatibility, liquidity providers will be able to move assets between ecosystems more fluidly, making the entire DeFi space more interconnected and efficient.

10. Real-World Asset Integration

- As DeFi continues to mature, the Mitosis ecosystem might see integration with real-world assets (RWAs). This could include tokenized versions of traditional assets like real estate, stocks, or commodities, and liquidity could be programmed to adapt to these types of assets.

- LPs could participate in both traditional finance and DeFi simultaneously, providing liquidity to tokenized real-world assets alongside crypto assets in the same strategy, creating hybrid DeFi-finance ecosystems.

Conclusion

The Mitosis ecosystem is poised for an exciting future with the development of more advanced programmable liquidity tools, automated risk management, cross-chain interoperability, and AI/ML-driven optimization. As DeFi continues to evolve, Mitosis will likely play a significant role in making liquidity provision more efficient, flexible, and accessible for a wide range of users, from casual investors to institutional participants. The trends above highlight a shift toward a more dynamic, automated, and integrated DeFi ecosystem that will continue to push the boundaries of what’s possible in decentralized finance.

Litepaper: https://docs.mitosis.org/assets/files/mitosis-litepaper-6e8de95ce2bb14f8c2d2ffc8c272b9f3.pdf

Official X: https://x.com/MitosisOrg

Comments ()