Mitosis Vault Liquidity Framework (VLF): Transforming Static Liquidity into Programmable Infrastructure

Mitosis is changing the game with its Vault Liquidity Framework (VLF), turning passive capital into programmable, yield-generating infrastructure. The traditional DeFi landscape suffers from static liquidity positions that generate passive yields without the flexibility to adapt to changing market conditions. VLF addresses this fundamental limitation by creating a system where your positions aren’t just deposits but modular components in an evolving DeFi engine.

In this article, you’ll discover how Mitosis revolutionizes DeFi through its Vault Liquidity Framework (VLF), transforming passive capital into programmable, yield-generating infrastructure. We’ll explore core concepts that make VLF work: the ERC-4626 compatible vault system that turns deposits into modular components, the strategy execution and merkle tree verification system that authorizes every action before execution, the automated settlement system that handles rewards fairly and transparently, and the structured reclaim process that balances user control with strategy stability.

By the end, you’ll understand how VLF transforms your positions from simple deposits into programmable building blocks for an evolving DeFi engine.

VLF Vaults: ERC-4626 Compatible Smart Infrastructure

VLF Vaults are ERC-4626 compatible smart vaults that represent claims on both the underlying principal (hub assets) and the yield generated from strategic DeFi deployments. Each vault is tailored to a specific liquidity opportunity and maintains 1:1 asset backing via the Mitosis Vault system, creating the foundation for programmable liquidity infrastructure.

Vault Architecture and Asset Properties

Each VLF Vault represents a specific liquidity opportunity for a specific hub asset, adhering to the ERC-20 standard for seamless integration while implementing the ERC-4626 interface for standardized vault interactions. The system is designed to generate yield through strategic DeFi protocol integrations and implements configurable deposit limits to manage risk, ensure controlled growth, and maintain strategy efficiency.

VLF Assets such as miAssets and maAssets (tokens representing shares in VLF Vaults) function as programmable building blocks with several key properties: they automatically accrue yield from underlying strategies, can be reclaimed for underlying hub assets through the structured reclaim process, are composable for use in other DeFi protocols, and are subject to deposit limits that prevent excessive vault growth. With Mitosis, your positions aren’t just deposits but modular components in an evolving DeFi engine.

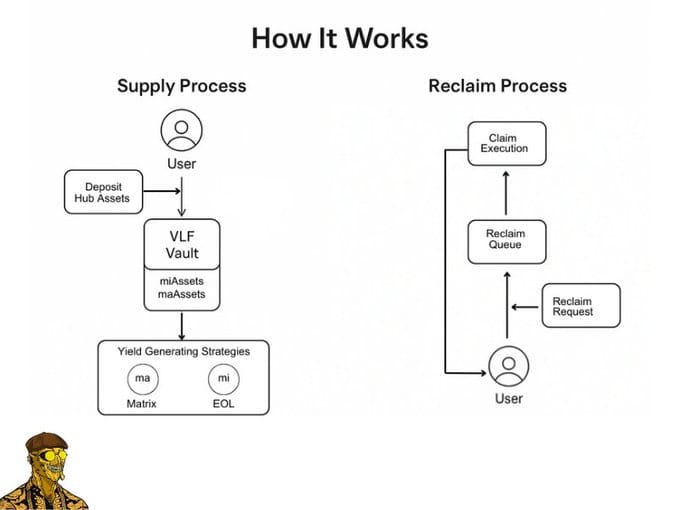

Supply Process: From Static to Programmable

The supply process transforms static deposits into dynamic, strategy-ready capital through three straightforward steps:

- First, users deposit hub assets into a VLF Vault after checking current deposit limits.

- Second, users receive VLF tokens (such as miAssets or maAssets) representing their share in the vault.

- Third, supplied capital is deployed into yield-generating strategies by strategists who analyze opportunities and determine optimal allocation across different branch chains.

Hub assets are transferred from the user to the VLF Vault, corresponding amounts of VLF assets are minted to the user, and supplied hub assets become available for strategist deployment in yield-generating strategies. The Asset Manager maintains comprehensive ledgers tracking both allocated and idle liquidity across all branch chains, enabling sophisticated liquidity management and optimization strategies that maximize yield while maintaining security and user control.

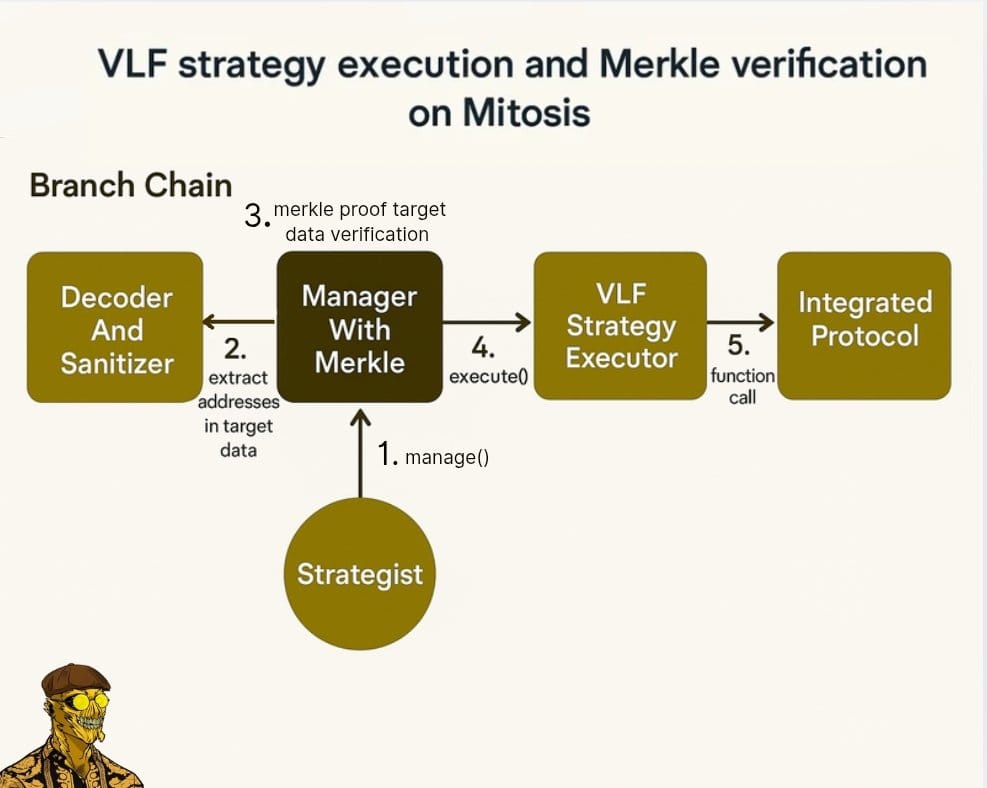

Cryptographically Verifiable Strategy Execution: Merkle tree verification system

Mitosis is transforming DeFi by making strategy execution cryptographically verifiable through its innovative security framework. Through Vault Liquidity Frameworks, strategies can only run if they match pre-approved logic stored in Merkle trees, creating a transparent, secure, and fully auditable process where Mitosis doesn't just manage liquidity but also proves every move is safe. When a strategist proposes a move, it doesn't execute immediately. Instead, the system uses a sophisticated verification process that ensures all strategy actions are pre-approved and secure. The strategist interacts with VLF Strategy Executors through the ManagerWithMerkleVerification contract's manage() function, which requires merkle proofs for each function call, protocol-specific decoders, target contract addresses, function call data, and values for each call. The cryptographic verification flow works through five distinct steps that ensure complete security and transparency.

- First, the strategist calls manage() to propose a strategy execution with specific parameters and target protocols.

- Second, the Decoder & Sanitizer extracts key data from the call, including critical parameters like addresses and function calls while filtering out non-security parameters to reduce complexity.

- Third, Merkle verification confirms the strategy matches pre-approved logic stored in the Merkle tree, performing cryptographic proof verification to ensure each function call is authorized.

- Fourth, the VLF Executor triggers execution only if the verification passes, maintaining strict security controls.

- Fifth, the strategy interacts with the target protocol to perform actions like swaps, lending, or other DeFi operations.

This decoderAndSanitizer approach provides crucial system advantages including selective parameter verification where only security-critical addresses are included in verification while non-critical parameters are filtered out, reduced merkle tree complexity by ignoring non-security parameters, and enhanced flexibility allowing strategists to adjust trading parameters without requiring new merkle tree updates. All of this happens on-chain, creating complete transparency and auditability for every strategy action.

VLF-allocated assets must interact with integrated protocols through actual VLF strategies, performed by the strategist and only possible within rules registered on-chain, ensuring assets cannot be used in unintended ways or misappropriated. The strategy execution system provides a secure, flexible framework for DeFi integrations while maintaining strict asset protection through cryptographic verification that proves every move is safe before execution.

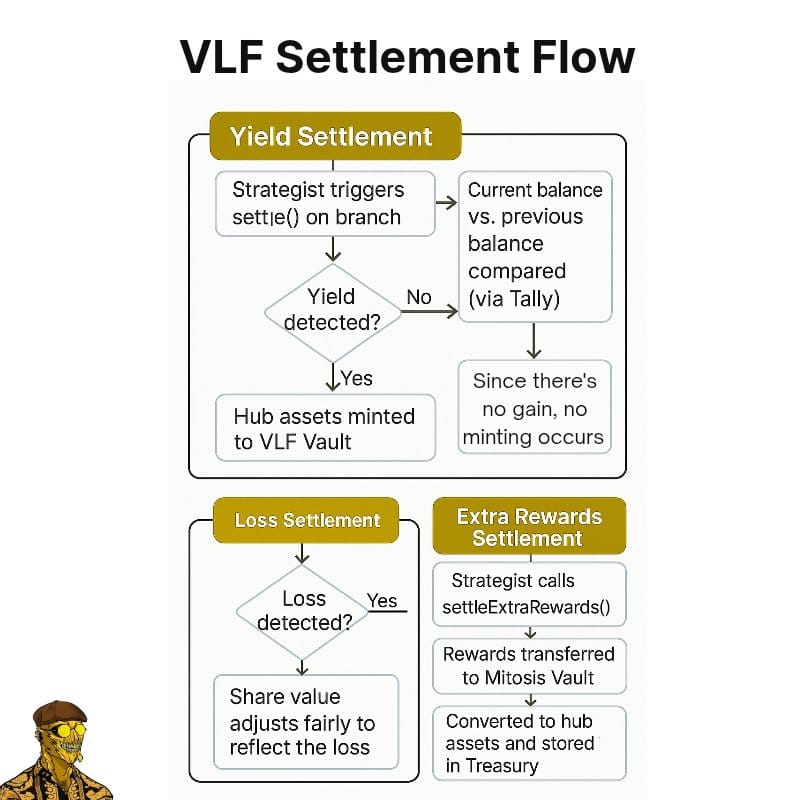

Automated Settlement System: Fair and Transparent Reward Distribution

Mitosis’s programmable liquidity means your DeFi rewards settle fairly, automatically, and on-chain through the VLF Settlement system. This sophisticated framework replaces messy, manual reward tracking with a system that settles yield, losses, and extra tokens using cryptographic verification and smart automation across three distinct settlement types.

Yield Settlement: Automatic Value Appreciation

When a strategy earns returns in the same asset (like ETH earning ETH), the strategist triggers settle() on the branch chain. The system compares the current balance (fetched via Tally) to the last recorded one, and if there’s a gain, the Asset Manager receives a message and mints equivalent hub assets to the VLF Vault, increasing users’ share values automatically.

Here’s a practical example: Previous balance shows 100 ETH, current balance shows 105 ETH, the system detects a +5 ETH yield, the system mints 5 ETH hub assets to VLF Vault, and users’ share value increases without needing to claim anything. This automatic process ensures that positive strategy performance immediately benefits all vault participants proportionally.

Loss Settlement: Proportional Risk Distribution

If the strategy loses value, the process mirrors yield settlement, except the system burns hub assets from the vault, ensuring losses are distributed proportionally to all participants. Using the same framework:

Previous balance shows 100 ETH, current balance drops to 98 ETH, the system detects -2 ETH loss, the system burns 2 ETH hub assets from VLF Vault, and share value adjusts fairly to reflect the loss. This transparent mechanism ensures that all participants share both the rewards and risks of strategy performance.

Extra Rewards Settlement: Multi-Token Reward Management

Some strategies generate rewards in other tokens (such as earning MNT from Mantle Yield Lab for cmETH LPs), which are handled through a dedicated flow. The strategist calls settleExtraRewards(), after which rewards are transferred to the Mitosis Vault, then converted to hub assets and stored in Treasury, and distributed via Merkle proof-based airdrops.

For example: Strategy earns 150 MNT tokens, tokens are sent to Mitosis Vault, 150 MNT hub assets are minted and stored, then distributed to VLF participants via Merkle claim mechanisms. All of this happens across chains using cryptographic messages, ensuring that every gain, every loss, and every extra reward is tracked and settled automatically without manual intervention.

Structured Reclaim Process: Balancing Control with Strategy Stability

Unlike traditional DeFi protocols, where withdrawals are immediate, VLF implements a sophisticated reclaim system that ensures strategy stability, yield optimization, and protection against yield farming abuse while maintaining user control. Withdrawals follow a structured, three-stage queue that balances user flexibility with the operational needs of sophisticated yield strategies.

Three-Stage Queue System

The reclaim process begins with:

- Request Initiation: where users submit a reclaim request with a specific VLF Vault, and their requested amount of VLF assets are transferred to the Reclaim Queue, placing the user’s request in the queue for processing. This initial stage establishes the user’s intent to withdraw while beginning the structured process that protects strategy integrity.

- Liquidity Reservation & Waiting Period: where idle funds are reserved and held for a minimum delay (such as 7 days). This requires both sufficient underlying hub assets to be reserved for reclaim (not allocated to VLF strategies) and a minimum waiting period to elapse for security. The liquidity reservation process involves strategist assessment of idle hub assets not currently in use for VLF, reservation of available idle liquidity for reclaim, withdrawal of reserved liquidity from VLF Vault, and movement to Reclaim Queue with corresponding VLF assets burned, and allocation lock ensuring reserved liquidity is no longer available for VLF strategies.

- Claim Execution: allows users to verify that their request is resolved (liquidity reserved plus waiting period complete) and claim against their resolved request to receive hub assets back. Once resolved, hub assets are released to the user, completing the structured withdrawal process.

Benefits of Delayed Reclaim System

This delayed reclaim system ensures strategy stability by preventing sudden liquidity withdrawals that could disrupt active strategies, yield optimization by allowing strategies to plan for liquidity needs and unwind positions optimally, and protection against yield farming abuse by blocking immediate supply-and-reclaim behavior that would harm long-term participants. The system transforms VLF from simple yield farming into a sophisticated liquidity infrastructure where participants commit to medium-term strategies in exchange for optimized yields and professional management.

Conclusion

Mitosis’s Vault Liquidity Framework represents a fundamental evolution in DeFi infrastructure, successfully transforming static liquidity positions into programmable, yield-generating components that adapt dynamically to market opportunities. Through its comprehensive approach combining ERC-4626 compatible vaults that create modular building blocks, automated settlement systems that ensure fair reward distribution, and structured reclaim processes that balance flexibility with stability, VLF creates a new paradigm where positions become programmable infrastructure rather than passive deposits.

As DeFi continues evolving toward more sophisticated yield strategies and cross-chain operations, how might VLF’s approach to programmable liquidity influence the development of next-generation DeFi protocols and reshape our understanding of what liquidity infrastructure can accomplish in decentralized finance?

Through this comprehensive framework, Mitosis creates the foundation for a more dynamic, efficient, and user-controlled DeFi ecosystem where liquidity works as programmable infrastructure, positioning VLF at the forefront of the next generation of decentralized finance innovation.

Comments ()