Mitosis Vs. Other L1 Solutions: The Liquidity Revolution

Introduction

You found a great DeFi opportunity on another chain. But when you tried to move your funds, you ran into high fees, long wait times, and liquidity issues. Frustrating, right? The truth is, while many Layer 1 (L1) blockchains are making progress in terms of speed and scalability, most of them still struggle with liquidity fragmentation—a major roadblock for DeFi’s long-term success. That’s where Mitosis comes in. Mitosis is designed to redefine liquidity, making it more accessible, efficient, and sustainable across different blockchain networks. But what exactly makes it different from other L1s? Let’s break it down.

What Makes Mitosis Different?

1. Liquidity Comes First, Not Last

Most blockchains focus on transaction speed and security but leave liquidity to external protocols. Mitosis flips the script by making liquidity a core part of its design.

➡️ Ecosystem Liquidity (EOL): Instead of relying on external market makers, projects built on Mitosis can own and control their liquidity, ensuring long-term sustainability.

➡️ The Matrix Liquidity Model: Mitosis doesn’t just provide liquidity; it creates a self-sustaining liquidity ecosystem that continuously optimizes itself.

➡️ Seamless Cross-Chain Liquidity Routing: With Mitosis, you don’t need to depend on inefficient external bridges. Liquidity moves freely and efficiently across different chains.

2. Scalability Without the Trade-Offs

Most L1s focus on high transaction speeds, but at what cost? Many sacrifice security or decentralization to achieve scalability. Mitosis, however, takes a smarter approach:

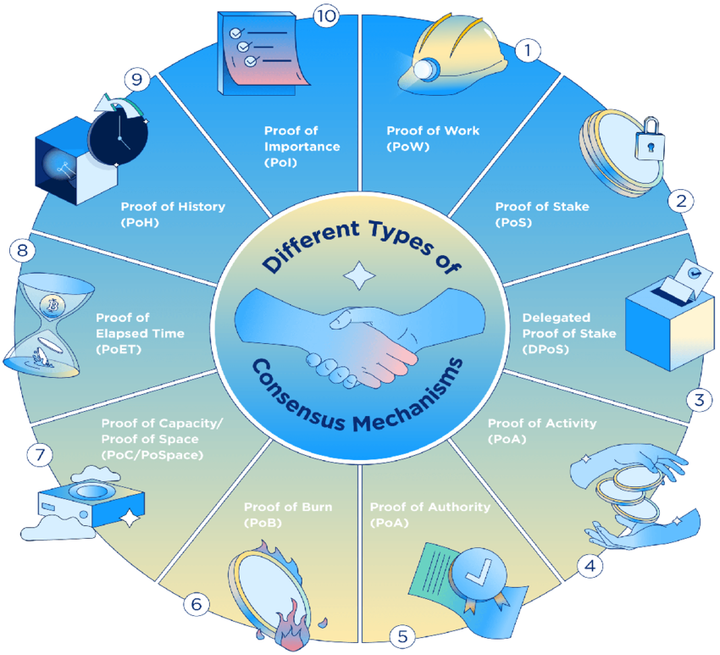

➡️ Layered Liquidity Management: Instead of clogging the main network, Mitosis handles liquidity separately, ensuring smoother transactions without congestion. ➡️ Adaptive Consensus Mechanism: Validators aren’t just rewarded for securing the network—they’re incentivized based on liquidity conditions, keeping the system efficient. ➡️ Cross-Chain Ready: Whether you’re moving assets between chains or developing a cross-chain app, Mitosis ensures seamless interoperability without the usual liquidity headaches.

3. Sustainable Economics, Not Quick Fixes

Liquidity mining, high staking rewards, and yield farming may sound great initially, but they often lead to short-term speculation rather than long-term growth. Mitosis avoids these pitfalls with a more balanced economic model:

➡️ Smart Liquidity Incentives: Instead of fixed rewards, liquidity providers earn based on real demand, reducing unnecessary token emissions.

➡️ No Short-Term Liquidity Farming Traps: Many DeFi projects struggle with mercenary capital—users who farm rewards and exit immediately. Mitosis ensures liquidity stays in the ecosystem.

➡️ Supporting Builders & Projects: If you’re a developer, Mitosis helps you access liquidity directly, making it easier to launch and grow your project without constant fundraising.

Conclusion: Why Mitosis Is a Game Changer

The blockchain world is evolving, and liquidity is becoming the most important factor in determining an L1’s success. Unlike most networks that treat liquidity as an afterthought, Mitosis puts it front and center, solving major problems that have plagued DeFi for years.

Key Takeaways:

✅ Mitosis prioritizes liquidity instead of treating it as a secondary feature.

✅ Its EOL & Matrix Model create a sustainable liquidity ecosystem, not just temporary incentives.

✅ The adaptive modular framework ensures scalability without sacrificing security.

✅ Balanced tokenomics prevent liquidity drain and promote long-term ecosystem health.

As DeFi continues to mature, liquidity efficiency will separate the winners from the rest. With its liquidity-first approach, Mitosis is shaping up to be one of the most important L1s for the future of decentralized finance.

For more updates as regards Mitosis ecosystem, check out their official sites at: Website | X | Discord | Telegram

Comments ()