Mitosis vs. Traditional Liquidity Bridges

In the ever-evolving world of decentralized finance (DeFi), seamless liquidity management is the cornerstone of effortless cross-chain interactions. As blockchain networks grow increasingly interconnected, the demand for scalable, multi-chain solutions has never been higher. This article delves into why Mitosis, a pioneering Layer 1 blockchain powered by its Ecosystem-Owned Liquidity (EOL) model, surpasses traditional liquidity bridges in tackling the complexities of cross-chain asset transfers.

Background on Traditional Liquidity Bridges

Traditional liquidity bridges operate by facilitating asset transfers between different blockchain networks, typically through a lock-and-mint mechanism. For instance, a user might lock ETH on Ethereum and mint a wrapped version (e.g., wETH) on another chain like Arbitrum. While this enables cross-chain interactions, several limitations persist:

- High Fees: Bridging assets incur gas fees on both source and destination chains, which can be prohibitive, especially during high network congestion. For example, bridging costs can escalate during peak usage on Ethereum, as noted in industry discussions on DeFi protocols.

- Security Risks: Many bridges rely on centralized components, such as multi-signature wallets or relayers, making them vulnerable to exploits. Historical incidents, like the Ronin Bridge hack, underscore these risks, with centralized elements often being the weakest link.

- Fragmentation: Each bridge typically supports a limited set of chains, leading to a fragmented liquidity landscape. This fragmentation results in assets being siloed, reducing capital efficiency and complicating user interactions across networks.

- Complexity: Users must manage multiple bridges and wrapped tokens, which can be confusing and inefficient, particularly for retail users unfamiliar with DeFi intricacies.

These challenges highlight the need for a more streamlined, secure, and scalable solution, setting the stage for innovations like Mitosis.

Overview of Mitosis and Its EOL Model

Mitosis is an Ecosystem-Owned Liquidity (EOL) layer 1 blockchain designed to capture Total Value Locked (TVL) and attract users through community governance. Launched as a solution for the modular era of blockchain, Mitosis focuses on tokenizing liquidity positions, represented as miAssets, which can be traded, staked, or used as collateral in DeFi protocols. The EOL model is a key differentiator, enabling LPs to vote on liquidity allocation across chains, ensuring alignment with ecosystem growth. This governance-driven approach contrasts sharply with the often centralized management of traditional bridges.

As of recent updates, Mitosis has demonstrated significant growth, with over $80 million in TVL within three months of development, as reported by CoinGecko. Its partnerships with protocols like Ether.fi and Hyperlane further enhance its ecosystem, positioning it as a leader in cross-chain liquidity management.

Mitosis’s Modular Liquidity Framework: A Game-Changer

One of Mitosis’s most compelling features is its modular liquidity framework, which allows liquidity to move natively across chains without the need for traditional bridging mechanisms. Unlike traditional bridges that rely on locking and minting wrapped tokens, Mitosis enables direct access to liquidity across networks through derivative tokens (miAssets). This native movement reduces complexity and costs, offering several advantages:

- Capital Efficiency: LPs receive miAssets at a 1:1 ratio, which can be used in other DeFi applications on Ethereum L1/L2, earning additional income. For example, a user providing liquidity on Solana can instantly access it on Ethereum without bridging, as detailed in this article Cross-Chain Liquidity Management: How Mitosis Unifies DeFi Liquidity on Mitosis University.

- Reduced Fees and Slippage: By eliminating the need for wrapped tokens, Mitosis minimizes gas fees and slippage, enhancing user experience. Automated liquidity routing ensures the best execution.

- Simplified User Experience: Users no longer need to manage multiple bridges or wrapped assets, making cross-chain interactions more accessible, especially for retail users.

This framework aligns with the modular era’s emphasis on composability, allowing Mitosis to serve as a liquidity hub that connects fragmented DeFi ecosystems.

Permissionless Interoperability: Fostering Inclusivity

Interoperability is a cornerstone of multi-chain DeFi, and Mitosis excels in this area through its permissionless approach. Traditional bridges often require permissioned connections, meaning chains must be explicitly supported, which can limit scalability. Mitosis, powered by Hyperlane, allows anyone to deploy on any chain or rollup without needing approval from the core team, as highlighted in this article Modular Liquidity Expansion: Meet Mitosis. This open model offers several benefits:

- Rapid Chain Integration: New blockchain projects can connect to Mitosis quickly, fostering inclusivity and scalability. For instance, modular chains powered by Celestia can integrate seamlessly, as discussed in Gate.io Learn.

- Reduced Fragmentation: By enabling permissionless interoperability, Mitosis acts as a liquidity hub, unifying assets like TIA from Neutron and Osmosis on Ethereum L1 before L2, decreasing fragmentation, as noted in Hyperlane Blog.

- Alignment with Modular Trends: Mitosis’s approach aligns with the industry’s shift toward modularity, ensuring it can meet the high cross-chain demands of upcoming blockchains, as outlined in the article Introducing Mitosis: The Modular Liquidity Protocol.

This permissionless model contrasts with traditional bridges’ reliance on siloed, permissioned Any Message Bridge (AMB) solutions, offering a more scalable and decentralized interoperability framework.

Unifying Liquidity and Enhancing Capital Efficiency

Mitosis addresses this by acting as a liquidity hub that unifies assets across chains:

- Unified Liquidity Pools: Assets can be unified on Ethereum L1 before being available on L2, reducing fragmentation and improving capital utilization. For example, a user’s ETH on Arbitrum can be seamlessly accessed on Optimism, enhancing yield opportunities.

- Increased Yield Opportunities: By unifying liquidity, Mitosis enables LPs to chase yields across chains without manual bridging, potentially increasing returns.

- Composability of Assets: Locked assets become composable, enhancing their utility in the DeFi ecosystem, as highlighted in Gate.io Learn.

This unification not only improves capital efficiency but also enhances the overall user experience, making Mitosis a compelling choice for DeFi participants.

Security and Trust-Minimization: A Robust Approach

Security is a critical concern in cross-chain DeFi, with traditional bridges often vulnerable due to centralized components. Mitosis takes a trust-minimized approach, offering several security advantages:

- Modular Security Model: Mitosis ISM uses delegated Proof of Stake (dPoS) and plans to incorporate Ethereum restaking and mesh security, providing robust protection that scales with TVL growth, as detailed in Hyperlane Blog.

- Trust-Minimized Execution: Liquidity movements are verifiable and secure without a single point of failure, contrasting with traditional bridges that rely on centralized relayers or multi-sig systems, as noted in this article Mitosis: The Liquidity Revolution That Ends Blockchain Bridges on Mitosis University.

- Economic Security Scaling: As liquidity expands, Mitosis’s economic security increases, creating a self-reinforcing model. LPs can secure cross-chain messaging by staking miAssets, earning governance tokens.

This decentralized and scalable security model sets Mitosis apart, offering better protection against hacks and exploits compared to traditional bridges.

Efficient Cross-Chain Trading with Instant Finality

Cross-chain trading in traditional setups can be cumbersome, involving multiple steps and potential delays due to blockchain finality times. Mitosis revolutionizes this process by using derivative tokens on its chain to enable instant finality:

- Instant Finality: Lending an asset A on chain X to borrow asset B on chain Y can be completed on the Mitosis chain using derivative tokens, eliminating bridging delays, as outlined in Mitosis Blog.

- Reduced Risks: By avoiding traditional bridging methods, Mitosis reduces exposure to smart contract vulnerabilities and high fees, enhancing user safety.

- Seamless User Experience: Traders can execute cross-chain strategies without managing multiple bridges, improving efficiency and accessibility, particularly for retail users.

This efficiency in cross-chain trading positions Mitosis as a superior choice for traders seeking diversified yield opportunities in a multi-chain world.

Comparative Analysis: Mitosis vs. Traditional Bridges

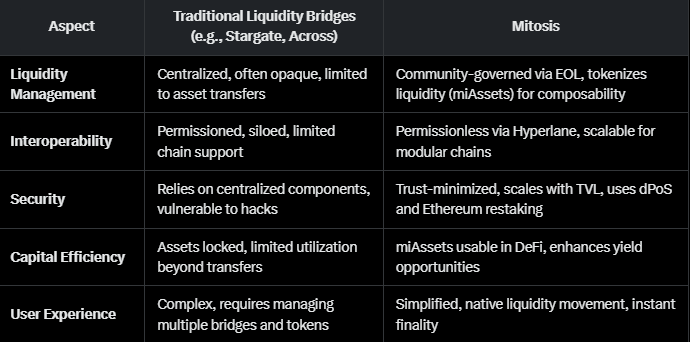

To illustrate the differences, consider the following table comparing key aspects:

This table underscores Mitosis’s advantages in addressing the limitations of traditional bridges, offering a more robust and user-friendly solution.

Conclusion

Mitosis represents a significant leap forward in DeFi liquidity management, offering a suite of features that traditional liquidity bridges cannot match. Its EOL model, modular liquidity framework, permissionless interoperability, enhanced security, and efficient cross-chain trading capabilities position it as a leader in the modular era of blockchain technology. By addressing pain points like high fees, security risks, fragmentation, and complexity, Mitosis paves the way for a more integrated and prosperous multi-chain future.

You can keep in touch with MITOSIS by following:

WEBSITE || X (Formerly Twitter) || DISCORD|| DOCS

Comments ()