Mitosis VS Uniswap, Curve and Aave: How mitosis changes the game!

In the world of DeFi, giants like Uniswap, Curve, and Aave have shaped how liquidity, trading, and lending work. But a new player called Mitosis, isn’t just another protocol, it’s redefining liquidity itself.

Let’s walk through how Mitosis compares to these DeFi giants and what it brings to the table.

Quick Overview

🟢 Uniswap – Decentralized trading.

🔵 Curve – Efficient stablecoin swaps.

🟣 Aave – Borrowing & lending.

🟠 Mitosis – Programmable liquidity.

Let’s compare them and see how Mitosis changes the game.

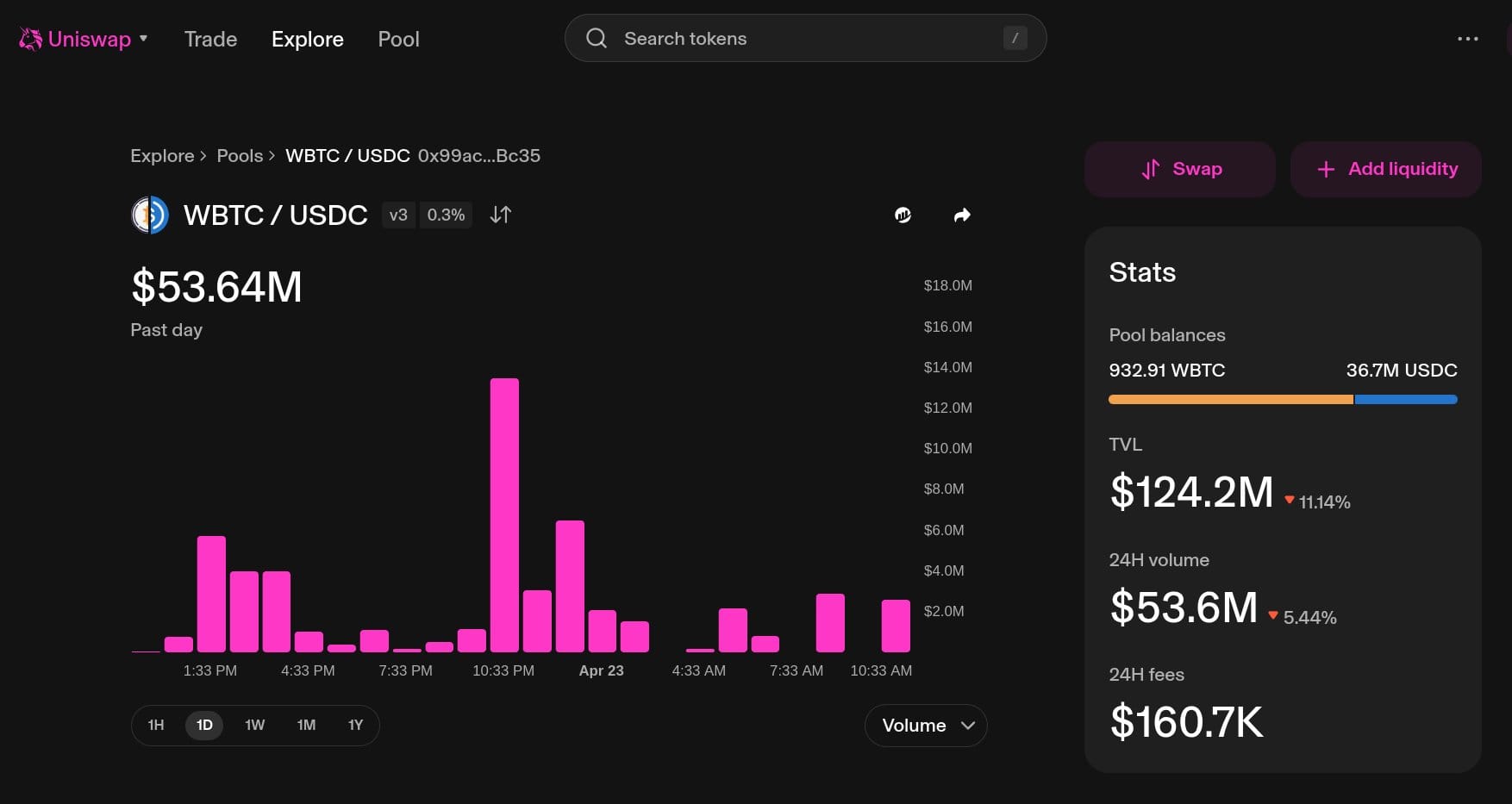

Uniswap: The DEX Giant

Uniswap is a decentralized exchange (DEX) that lets people swap one cryptocurrency for another directly from their wallet, without needing a middleman like a bank or a traditional exchange.

It uses an automated market maker (AMM) model, where users provide liquidity into pools.

Traders swap tokens through these pools, and liquidity providers (LPs) earn fees from every trade.

Instead of traditional "order books," prices are set automatically based on supply and demand inside each pool.

In short:

Uniswap lets anyone trade tokens easily, and anyone can earn fees by providing liquidity.

✅ AMM for token swap

✅ LPs earn fees from trading.

✅ Concentrated liquidity.

❌ Liquidity is locked in pools.

❌ No governance over where liquidity flows.

❌ Mercenary yield farmers can drain TVL.

Curve: The King of Stablecoin

Curve is a decentralized exchange (DEX) that’s specially built for stablecoins (like USDC, USDT, DAI) and similar assets that have close prices.

It focuses on low slippage and low fees when swapping stablecoins.

Liquidity providers (LPs) can lock their CRV tokens to boost rewards through the veCRV system.

In short:

Curve makes stablecoin trading super cheap and efficient, while rewarding long-term liquidity providers.

✅ Focuses on stablecoin trading with low slippage.

✅ Uses veCRV for gov. incentives.

✅ LPs get boosted rewards via long-term staking

❌ Liquidity is still locked in pools.

❌ Governance incentives lead to bribing wars and capital inefficiency

Aave: The DeFi Bank 🏦

Aave is a decentralized lending and borrowing platform kind of like a DeFi bank.

You can deposit your crypto into Aave to earn interest (becoming a lender).

Other users can borrow those assets by putting up collateral (like ETH or stablecoins).

Interest rates adjust automatically based on supply and demand.

Aave also introduced cool features like flash loans (borrow instantly with no collateral if repaid in one transaction).

In short:

Aave lets you earn passive income by lending, or borrow assets without trusting a bank, all on-chain.

✅ Borrowing & lending market with collateralized loans.

✅ LPs earn interest from borrowers.

✅ Supports multiple chains

❌ Liquidity fragmentation – TVL split across markets.

❌ Funds sit idle when not borrowed.

❌ No governance over liquidity allocation

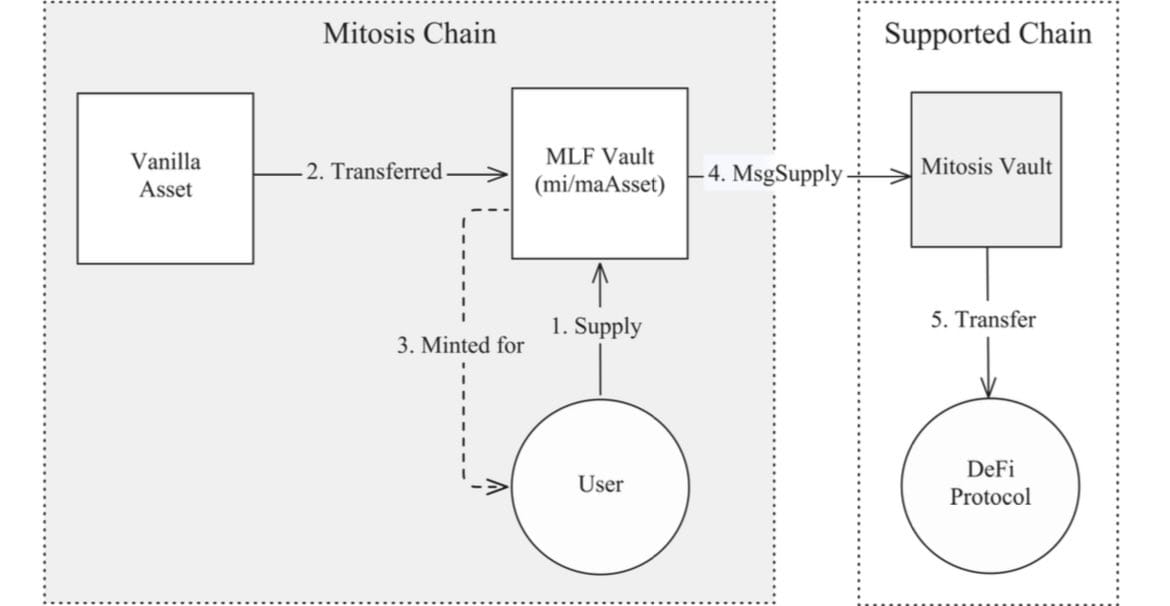

Mitosis: network of programmable liquidity

Mitosis is a cross-chain liquidity protocol but instead of locking your tokens on one chain, it replicates them across multiple blockchains at the same time.

You deposit into vaults (like weETH, ETH, rsETH, etc.).

Your liquidity gets replicated across supported chains, no bridges needed!

You can earn rewards, boost your DNA score, and vote on where liquidity flows during special events (called EOL epochs).

Mitosis also introduces miAssets and maAssets, which are tokenized versions of your liquidity positions which is tradable, collateralizable, flexible.

In short:

Mitosis lets your liquidity live on many chains at once, earn rewards, and stay programmable.

✅ Liquidity isn’t locked – it’s programmable & tradable.

✅ Ecosystem-Owned Liquidity – LPs vote on where liquidity goes.

✅ Matrix Vaults – Liquidity campaigns with structured incentives.

✅ miAssets & maAssets – LP positions become tradeable, collateralizable assets.

DeFi models compared

| Protocol | Core Function | Primary Design |

|---|---|---|

| Uniswap | AMM-based token swaps | LPs earn via swap fees |

| Curve | Stablecoin swaps with low slippage | Focused on gauge-weighted emissions |

| Aave | Lending and borrowing | Interest rate model |

| Mitosis | Cross-chain liquidity replication | Vaults, EOL epochs, DNA alignment |

Token Utility: How Value Is Distributed

| Token | Core Utility |

| UNI | Governance and protocol direction |

| CRV | Voting + emissions control |

| AAVE | Governance + risk mitigation |

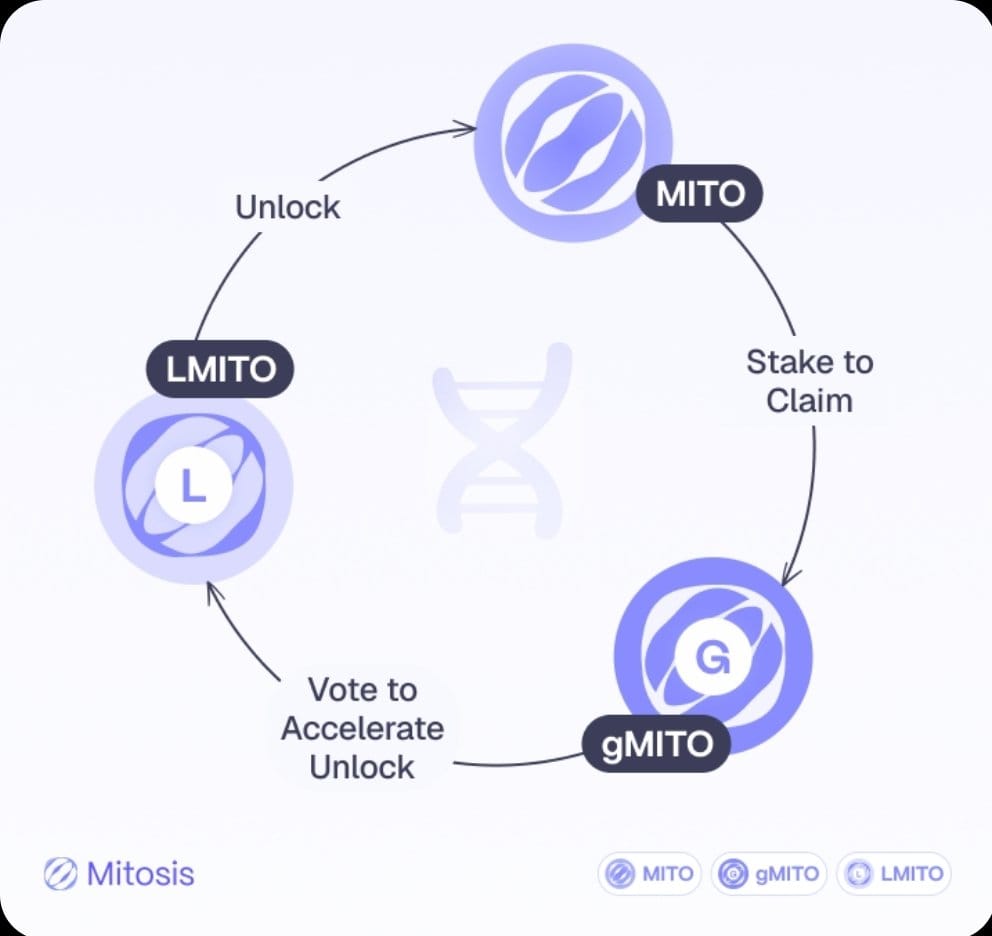

| MITO | Access to the Mitosis ecosystem (vaults, DNA, EOL) |

| gMITO | Governance token (locked MITO) |

| lMITO | Liquidity operator role token |

Mitosis’ token model adds functional diversity:

- gMITO is for governance and alignment (similar to veCRV or stAAVE).

- LMITO empowers users who actively manage liquidity

READ MORE ABOUT MITOSIS 3 TOKEN SYSTEM HERE..

Incentive Design: Yield vs. Alignment

| Protocol | Incentives |

| Uni swap | LPs earn from swap fees |

| Curve | CRV emissions via veCRV gauge voting |

| Aave | Interest rates + AAVE token incentives |

| Mitosis | EOL (Epoch of Liquidity), DNA Score, vault yield |

Mitosis innovates on incentive design. Rather than simply farming APYs, it introduces EOL epochs (where aligned behavior is rewarded) and the DNA program (which tracks user loyalty and action).

Yield in Mitosis is tied not just to capital, but to behavior.

Composability & Interoperability

Uniswap, Curve, and Aave are foundational to composable DeFi but mostly within single ecosystems.

Mitosis is designed to be composable across ecosystems, with vaults and replicated assets becoming tools that other protocols can plug into.

Imagine this:

- A vault on Mitosis lets a user deposit weETH

- That replicated liquidity is accessible to dApps on Ethereum, Arbitrum, Linea, and more

- All without bridging or fragmentation

This creates true modular liquidity. Not just L1 to L2 transfers, but seamless multichain access.

How Mitosis, Uniswap, Curve, and Aave Work Together

Uniswap lets you swap tokens easily inside a chain like Ethereum or Arbitrum.

Curve lets you swap stablecoins with almost no slippage, super efficient for stable pairs.

Aave lets you deposit your tokens to lend and borrow assets, earning interest.

But all three mostly operate separately on each chain; ETH Uniswap, Arbitrum Curve, Polygon Aave, etc.

They don’t naturally share liquidity across blockchains.

This is where Mitosis comes in:

Mitosis replicates liquidity across multiple chains at once.

It makes sure tokens can exist and move freely between different ecosystems.

Instead of locking liquidity in one place like Uniswap or Curve, Mitosis makes liquidity flexible and programmable.

So basically:

Uniswap, Curve, and Aave = powerful DeFi apps (swap, stable-swap, lend/borrow).

Mitosis = the liquidity layer underneath them that lets assets move and interact across multiple blockchains seamlessly.

Mitosis makes their jobs easier and DeFi more connected.

IN CONCLUSION:

Mitosis doesn’t aim to replace Uniswap, Curve, or Aave.

Instead, it introduces a new liquidity fabric:

Liquidity that moves between chains.

Vaults that direct liquidity where it's needed.

Incentives that reward alignment over speculation.

In doing so, Mitosis could become the invisible infrastructure that powers the next multichain generation of DeFi.

Motosis Mainnet is coming. DeFi is about to replicate.

Comments ()