Mitosis x Babylon: How They Can Provide the First Bitcoin Cross-Chain System, Technical Analysis

The cryptocurrency world has long been overdue for a secure and decentralized cross-chain infrastructure that can connect Bitcoin with more advanced smart contract networks. Despite numerous attempts to build a bridge between Bitcoin and other blockchains, there is still no truly trustless, permissionless, and censorship-resistant solution. However, the tandem of Mitosis and Babylon has the potential to change this paradigm.

Problem: Bitcoin Isolation

Bitcoin, as the largest and most reliable cryptocurrency, has colossal liquidity, but its architecture is not designed for native cross-chain interactivity. Unlike networks like Ethereum, Bitcoin does not have a built-in virtual machine (EVM), there are no standard methods for generating smart contracts, and there are no easy ways to prove the state of another chain.

Today's solutions - from wrapped BTC (WBTC) to bridges - are essentially centralized or partially trusted. This creates vulnerabilities to hacks and censorship, and goes against the core principles of decentralization.

Solution: Mitosis and Babylon symbiosis

The two projects, Mitosis and Babylon, are being developed as independent modules, but their potential is revealed in tandem:

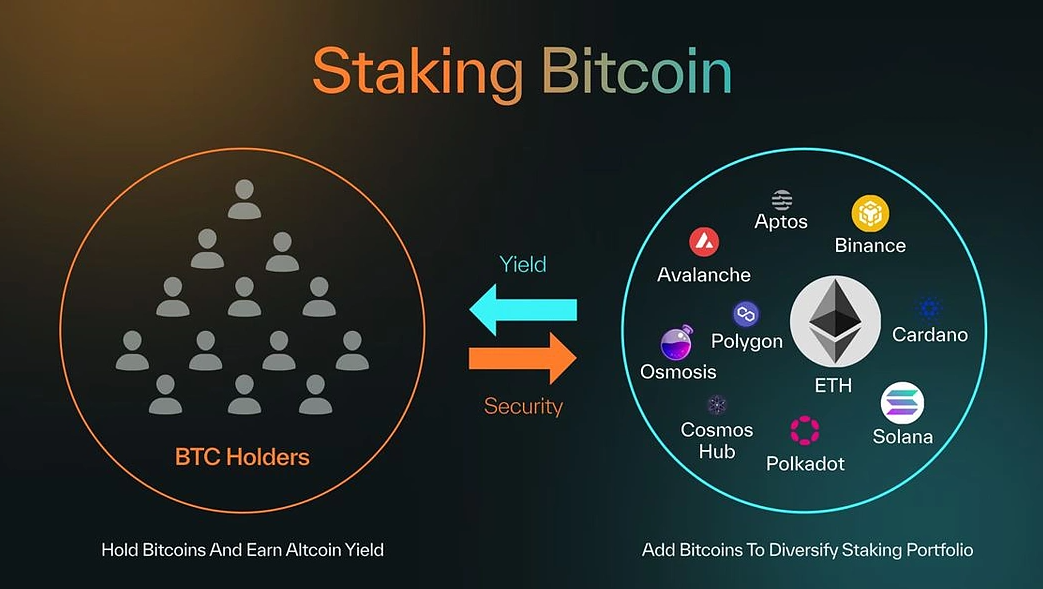

Babylon: Bitcoin-anchored security layer

Babylon provides a Bitcoin timestamping and staking layer, allowing other blockchains to apply Bitcoin’s security without having to trust intermediaries. The main principles are:

• Finality via Bitcoin: chains can transfer their state to Bitcoin through special proofs, receiving finality tied to the network with the highest hash power.

• Bitcoin-based validator slashing: validators on networks using Babylon post collateral in BTC. If they act maliciously, this collateral can be destroyed, providing a strong economic incentive to act honestly.

• Separation of consensus and execution: Babylon does not perform its own computation, but provides a consensus and security layer.

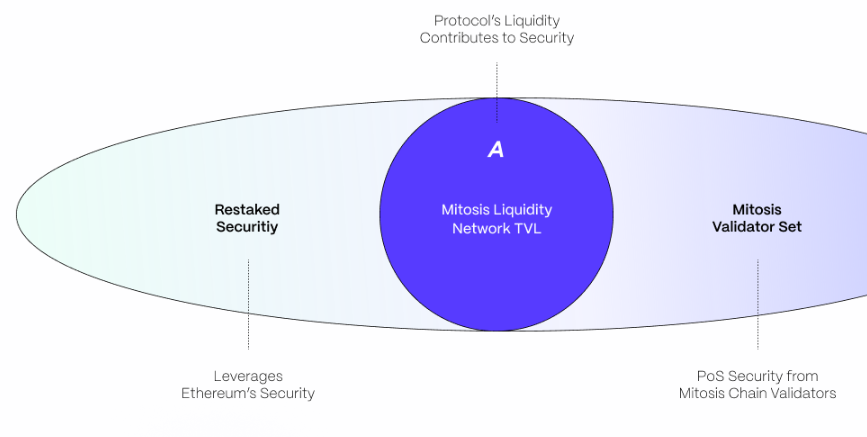

Mitosis: Cross-chain Liquidity and Execution Layer

Mitosis is an OMNI-layer protocol for cross-chain communication based on native L2 and zk-validated channels:

1. Universal liquidity via zk-channels: allows users to move assets between chains trustlessly and without the need for bridges, using zero-knowledge proofs.

2. Built-in compatibility with modular stacks: Mitosis can be used as a module in rollup ecosystems like Celestia, EigenLayer, Caldera, etc.

3. Execution via zkVM: arbitrary programs can be executed on the Mitosis network, which can then be proven and verified on another chain.

How it works: Mitosis + Babylon = trustless BTC bridges

The combination of these solutions allows for a decentralized and secure bridge between Bitcoin and other ecosystems:

Babylon provides finality and security

A network interacting with BTC can use Babylon to anchor the state and enforce slashing of validators' BTC collateral. This removes the need for centralized federations like WBTC.

Mitosis implements cross-chain execution and asset movement

Assets, including BTC or BTC derivatives, can be moved between chains via zero-knowledge proofs and Mitosis execution logic. Instead of “freezing” BTC in multisig, Mitosis creates a cryptographically verifiable wrapper that interacts with external state.

Bitcoin as a settlement layer and guarantor of validity

Since both Babylon and Mitosis can use Bitcoin as a finality layer, actions occurring in them can be independently verified and censorship-resistant.

Technical Overview: Mitosis x Babylon — Trustless Bitcoin Cross-Chain Architecture

|

Component |

Mitosis |

Babylon |

Combined Impact |

|

Primary

Function |

Cross-chain

execution and liquidity layer |

Bitcoin

timestamping and security layer |

Enables

trustless BTC movement and smart contract interoperability |

|

Security

Model |

Zero-knowledge

proof verification |

Bitcoin-based

validator staking and slashing |

Economic

and cryptographic guarantees without centralized custody |

|

Core

Technology |

zkVM,

zk-messaging, omni-layer channels |

Bitcoin

anchoring, staking layer, slashing via Bitcoin |

ZK +

Bitcoin anchoring = fully decentralized BTC interoperability |

|

BTC

Integration |

Enables

native BTC to move across chains using zk-lock contracts |

Uses

BTC for finality and validator collateral |

BTC is

both the asset and the security base |

|

Finality

Assurance |

ZK

proofs validated by target chain |

Anchoring

checkpoints in Bitcoin |

Bitcoin-level

finality for cross-chain actions |

|

Validator

Accountability |

Enforced

via ZK proof verification and message propagation |

Validators

slashable in BTC for malicious behavior |

High-stakes

validation backed by Bitcoin security |

|

Smart

Contract Support |

Customizable

zkVM for execution on any rollup or L2 |

No

execution layer; serves as consensus/finality layer |

Execution

(Mitosis) + Security (Babylon) = Full-stack dApp support |

|

Cross-Chain

Messaging |

Native

ZK-based messaging across chains |

N/A

directly, but secures state sync |

Trustless

message passing with Bitcoin-based settlement |

|

Use

Cases |

BTC in

DeFi, L2 liquidity routing, native cross-chain swaps |

Secure

L2s, timestamped checkpoints, slashing conditions |

Native

BTC in DeFi without wrappers or bridges |

|

Centralization

Risk |

Fully

decentralized with permissionless architecture |

Bitcoin-secured

consensus, no multisig or federations |

No

single point of failure, unlike WBTC/federated bridges |

|

Scalability |

ZK

rollups and recursive proofs |

Stateless,

scales with Bitcoin |

ZK tech

+ Bitcoin scale = high-throughput BTC cross-chain flows |

|

Upgradeability |

Modular,

supports plug-in apps and integrations |

Minimalist,

focused on finality and slashing logic |

Agile

application layer with stable security base |

|

Example

Workflow |

User

locks BTC → zkProof → minted token on L2 |

BTC

anchoring confirms zkProof and slashing conditions |

Seamless

trustless flow of BTC to any chain with auditability |

|

Regulatory

Benefits |

No

centralized custody = lower custodial risk |

Anchoring

to Bitcoin may be seen as more robust |

Transparent,

auditable, and user-controlled BTC flow |

|

Differentiator

from WBTC/Bridges |

No

wrapped tokens, no custodians |

No need

for third-party trust assumptions |

First

truly decentralized BTC cross-chain interoperability stack |

Use case: BTC in DeFi without wrapped tokens

Let's imagine a user wants to deposit BTC into a DeFi protocol on Ethereum L2:

1. They send BTC to a special zk-lock contract, the confirmation of which is transmitted to Mitosis zkVM.

2. Mitosis generates a lock proof and syncs it with the third-party chain via zk messaging.

3. Babylon ensures that this process is final in Bitcoin, and if there is an attempt to abuse it, validators lose their BTC collateral.

4. The user receives a “BTC-native” token on L2 and can use it without trusting a centralized custodian.

Conclusion

The Mitosis and Babylon pairing is a step toward creating a truly cross-chain system with native Bitcoin support, without wrappers, bridges, or trust in third-party intermediaries. Rather than adapting Bitcoin to other chains’ smart contract standards, these projects adapt other chains to Bitcoin’s fundamental principles: decentralization, finality, immutability.

In the coming months, these modular, zk-based, anchoring-based architectures will be the key to unleashing Bitcoin liquidity in DeFi. And perhaps for the first time, in a truly decentralized way.

Comments ()