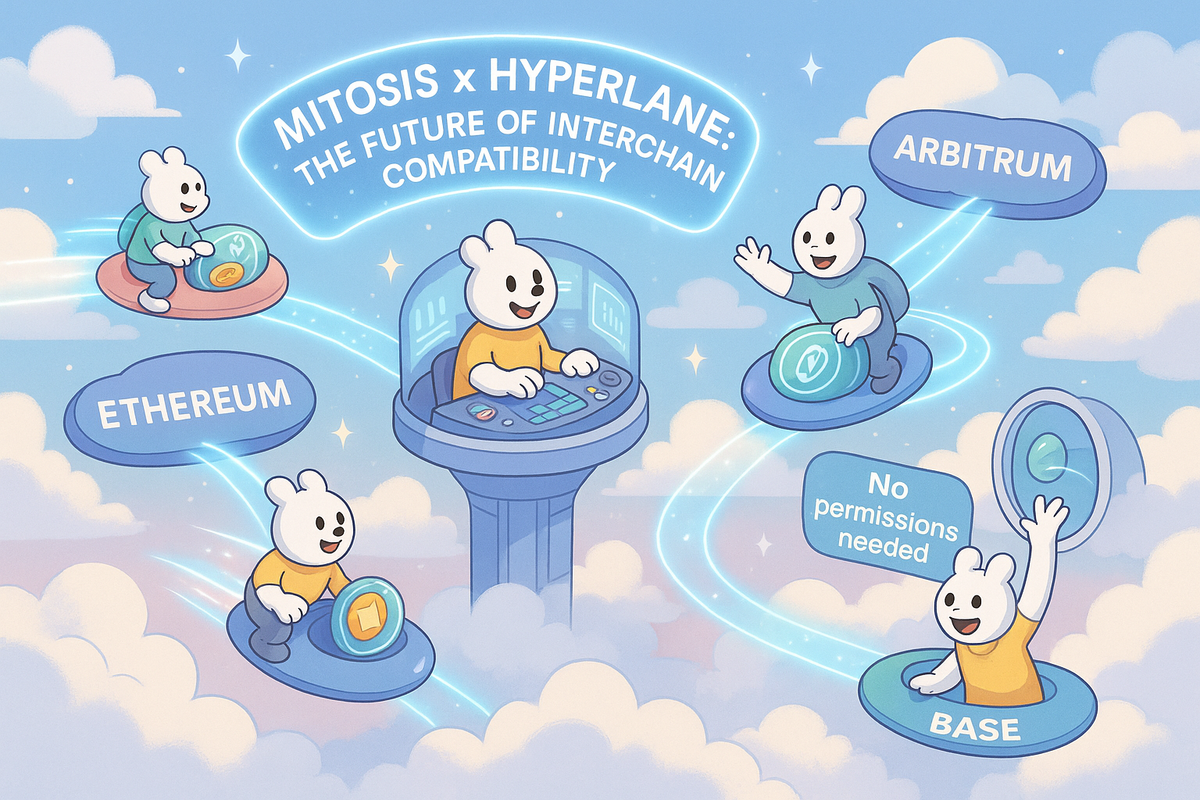

Mitosis x Hyperlane: The Future of Interchain Compatibility

Mitosis and Hyperlane: How Cross-Chain Liquidity Works Without Barriers

When I first encountered the problem of transferring assets between different blockchains, I realized it was a real headache. Each time I had to find suitable bridges, pay fees of $50–100, wait for confirmations for several hours, and worry about fund security. Over the past two years, I've seen hackers steal billions of dollars precisely through bridge vulnerabilities.

Mitosis, in partnership with Hyperlane, solves this problem in a fundamentally different way. Instead of the traditional "transfer and hope" approach, this system introduces the concept of unified liquidity. I deposit assets once and get the ability to use them on any supported network through miAssets — tokens that represent my share in the common pool.

How It Works in Practice

Imagine I have 10 ETH on Ethereum. Usually, to use them on Arbitrum or Optimism, I need to bridge — slow, expensive, risky. With Mitosis, I deposit these 10 ETH into Mitosis Vault and receive 10 miETH in a 1:1 ratio.

This miETH I can use on any supported network for trading, farming, or lending, while my original ETH remains secure in the main pool. Hyperlane acts as a communication layer that transmits information about locked assets between networks without requiring physical token movement.

Real example:

- Deposited 5 ETH into Mitosis Vault on Ethereum.

- Received 5 miETH, which I used for farming on Arbitrum at 12% APY.

- Simultaneously, part of the same assets worked in a liquidity pool on Base with 8% yield.

- Total capital efficiency increased 2.5x compared to the traditional approach.

Key Advantages

- Capital Efficiency: Assets generate yield across multiple networks

- Security: No need to trust multiple bridges; assets are protected through EigenLayer

- Speed: No bridge confirmation delays, miAssets are instantly available

- Cost: One deposit transaction instead of multiple cross-chain transfers

Technical Architecture Without Complexity

Mitosis is an EVM-compatible blockchain built on Cosmos SDK, integrated with Hyperlane. This setup allows interaction with any Hyperlane-enabled network without requiring permissions or negotiations with other blockchain teams.

Hyperlane enables permissionless interoperability — any developer can deploy it on their chain within hours. This is in contrast to LayerZero or Wormhole, which require lengthy approval processes.

Operational Flow:

- Deposit assets into Mitosis Vault on the source network

- Smart contract locks assets and generates proof-of-lock

- Hyperlane transmits the proof to the target network

- Receive miAssets on the target network

- Upon withdrawal, the process is reversed

Security Architecture Includes:

- Mitosis consensus based on Tendermint

- Restaked ETH security layer via EigenLayer

- Hyperlane's modular security (ISM)

- Economic incentives for honest validators

Ecosystem-Owned Liquidity (EOL)

Mitosis introduces a community-driven liquidity model. Instead of managing individual assets, users contribute to a common pool governed by voting.

Holding miAssets grants voting rights on how liquidity is allocated. This gives access to early-stage DeFi opportunities, institutional-grade yields, and governance over ecosystem direction.

Governance Use Cases:

- Decide how liquidity is distributed between protocols

- Choose new networks for expansion

- Set risk parameters for yield strategies

- Approve new assets for pools

At the time of writing, Mitosis has a TVL of $71.98M. It’s integrated with projects like Ether.fi ($3.2B TVL) and Symbiotic ($1.8B TVL), and planning expansions to Solana and Cosmos.

Practical Use Cases

- Cross-chain trading: Trade miETH on Arbitrum, buy miUSDC on Polygon, no bridging needed

- Cross-chain lending: Deposit ETH on Ethereum, borrow USDC on Arbitrum using miETH as collateral

- Borderless farming: Use one deposit to participate in several farming opportunities across networks

- Yield arbitrage: Instantly move capital to protocols offering higher APY

- Institutional access: Participate in high-capital strategies usually gated to large funds

Comparison With Existing Solutions

Traditional Bridges (LayerZero, Wormhole):

- Require separate transactions per transfer

- High fees ($20–100)

- Delays (10–30 minutes)

- Security risks every time

Mitosis + Hyperlane:

- Single deposit for multichain access

- Minimal fees

- Instant liquidity

- Unified security layer

Liquid Staking (Lido, Rocket Pool):

- Limited to ETH

- Ethereum-only

- Static returns

Mitosis:

- Multi-asset support

- Works across all EVM-compatible chains

- Dynamic yield optimized via governance

Security and Risk Management

Mitosis employs a multi-layered approach to security:

Level 1: Own Tendermint-based PoS consensus with 100,000 MITO minimum stake

Level 2: EigenLayer restaking using ETH to increase economic attack cost

Level 3: Hyperlane ISM for modular, multi-validator confirmation systems

Risk Management Measures:

- Limits on deposits into new protocols

- Gradual allocation increases post-audit

- Insurance via Nexus Mutual

- Auto-suspension on anomaly detection

Economic Model and Tokenomics

MITO Token Functions:

- Governance: Vote on upgrades and liquidity allocation

- Staking: Secure network and earn fee revenue

- Fees: Used for transaction costs inside Mitosis

- Incentives: Reward early adopters and LPs

Fee Model: 0.05% of operation volume, distributed to stakers and protocol treasury

Roadmap Highlights

Q3 2025:

- Solana integration via Wormhole

- BTC support via wrapped BTC

- Mobile app launch

Q4 2025:

- Cosmos IBC integration

- miNFTs support

- Institutional-grade vaults

2026:

- Launch of native DEX

- Cross-chain derivatives

- AI-optimized yield strategies

What This Means for DeFi's Future

The partnership between Mitosis and Hyperlane demonstrates a viable path toward unified DeFi. Instead of fragmented liquidity scattered across chains, a shared pool is accessible from everywhere.

For developers, this enables immediate liquidity access. For users, it simplifies DeFi interactions and opens up better yield opportunities.

This is not a revolution — it's an evolution. A natural step toward more accessible and efficient DeFi. In a few years, isolated blockchains may seem as outdated as dial-up internet.

🔗 Stay Connected with Mitosis:

- Explore the project: mitosis.org

- Follow for updates: X (formerly Twitter)

- Join the community: Discord Server

- Get announcements first: Telegram Channel

Comments ()