Mitosis X Morph: Zootosis campaign explained

OVERVIEW:

-> What are zootosis vaults

-> Why morph L2

-> Supported assests and vault structure

-> Vault mechanics

-> Two phase structure

-> Flexibility + Incentives = sustainable growth

-> Why Zootosis matters

-> Conclusion

INTRODUCTION

The DeFi space is no stranger to vaults, points, or L2 partnerships. But Zootosis Vaults, the latest launch from Mitosis on Morph L2, is more than just a typical yield farming event. It’s a carefully crafted campaign blending innovation, UX, and long-term alignment .

Let’s unpack what Zootosis is, how it works, and why it matters.

What Are Zootosis Vaults?

Zootosis Vaults are smart contracts deployed on Morph L2, allowing users to deposit assets and earn a combination of:

MITO tokens (Mitosis ecosystem reward)

Morph token allocations

Zoots points (a unified loyalty system)

maAssets (Morph) — composable receipt tokens with future utility

These vaults represent the next evolution of Mitosis’ Matrix Vaults, now enhanced through Morph’s high-performance infrastructure.

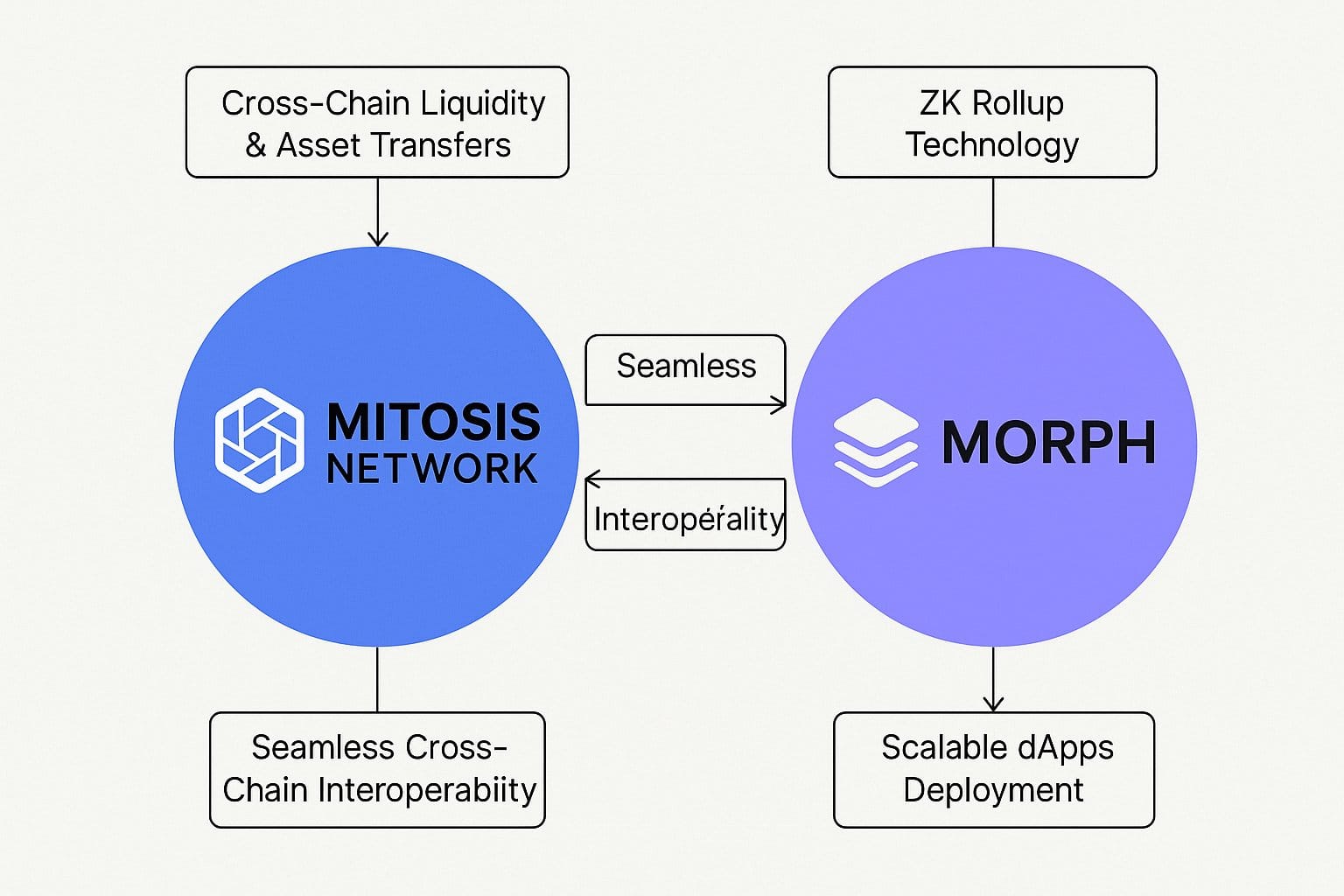

Why Morph L2?

Morph is a hybrid rollup that combines the best of Optimistic and zk-rollups. Developed by Bitget, Morph focuses on speed, decentralization, and accessibility.

Key reasons why Mitosis chose Morph:

Hybrid Scaling Model – Combines optimistic and ZK tech for fast, cheap, and secure transactions.

Decentralized Sequencer Network – Ensures fair ordering and no central point of failure.

Responsive Validity Proofs – Offers robust security with quicker finality.

Morph Pay Integration – Consumer grade onchain finance tools that support real-world use cases.

This environment is ideal for Mitosis to run smarter, more scalable vault campaigns while reaching users beyond DeFi natives.

Supported Assets & Vault Structure

Deposits are broken into three tiers with defined caps to keep APYs sustainable and fair:

Main Assets ($80M cap total | $20M per asset):

ETH (~11,120 ETH at $1800 average price)

USDT ($20M)

USDC ($20M)

WBTC (~211 BTC at $9500 average price)

Secondary Assets ($60M cap total):

LRTs: mphETH, weETH, STONE ($10M each)

BTC derivatives: LBTC, SolvBTC ($5M each)

Stablecoins: sUSDe, USDa, sbvUSD, USDS/DAI ($5M each)

Wildcard Asset ($10M):

One asset, to be revealed later in the campaign

This variety ensures that both traditional and experimental assets can participate.

Vault Mechanics: Earning Rewards

When users deposit assets:

They receive maAssets (Morph) in return

maAssets act as proof of position, and will have additional use cases soon (such as governance, collateral, and strategy access)

They immediately begin accruing a points system tracking loyalty and time-in-vault called zoots

Two-Phase Structure

The Zootosis campaign is designed to evolve through two phases:

Phase 1 – Standard Deposits & Points Accrual

Users deposit assets into vaults

Earn Zoots + MITO + Morph rewards

Liquidity periods determine how many Zoots you earn

Early withdrawal allowed, but forfeits 90% of unclaimed Zoots

Phase 2 – Strategy-Specific Supply Options

Users will be able to direct their deposits into strategy-specific vaults (like AMMs or lending markets)

maAssets become strategy-enhanced, offering:

Higher Zoots accrual

Unique reward streams

Custom risk/yield profiles

Direct interaction with Morph’s native DeFi protocols

Flexibility + Incentive = Sustainable Growth

One of the biggest challenges in DeFi is finding the balance between:

Lockups for yield stability

Flexibility for users who don’t want to be trapped

Zootosis solves this by:

Letting users withdraw anytime

Rewarding long-term participation through point multipliers

Making short-term exits less appealing without penalizing yield

It’s user-aligned liquidity without the mercenary farming.

Why Zootosis Matters

This campaign isn’t just about vaults. It’s about:

Aligning Mitosis with Morph; a high-performance L2 with consumer-level UX

Giving users programmable vaults that scale with them

Launching maAssets into broader DeFi utility

Rewarding real alignment, not just quick yield hopping

Zootosis is the blueprint for what next-gen DeFi campaigns should look like.

CONCLUSION

Mitosis is building the infrastructure for scalable, user-first liquidity. Morph is the chain bringing that UX to life. Zootosis is the first major fusion of the two and likely just the beginning.

As vaults fill and strategies expand, early users aren’t just earning rewards instead they’re helping to define what modern DeFi infrastructure should feel like.

So whether you’re in it for the yield, the points, or the future utility of maAssets, Zootosis is the campaign you don’t want to miss.

Comments ()